Get the free NEW Skip-A-Payment Application

Get, Create, Make and Sign new skip-a-payment application

Editing new skip-a-payment application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new skip-a-payment application

How to fill out new skip-a-payment application

Who needs new skip-a-payment application?

New skip-a-payment application form: A comprehensive guide

Understanding the skip-a-payment option

The skip-a-payment option allows borrowers to temporarily postpone a scheduled loan or credit payment without incurring late fees or negatively impacting their credit score. This feature can be a lifeline for individuals experiencing unforeseen financial challenges, such as medical emergencies, job loss, or significant repairs at home. Understanding the nuances of this option is crucial for effectively managing one's finances.

Common scenarios where skipping a payment might be beneficial include seasonal income fluctuations, unexpected expenses, or when faced with higher-than-expected bills. By utilizing this option wisely, borrowers can ease their financial burden, providing them some breathing room in their budget.

Eligibility criteria for skipping a payment

Not everyone qualifies for the skip-a-payment option. Typically, eligibility can vary between individual borrowers and institutional policies. Most lenders require a consistent payment history indicating the borrower’s reliability before granting this opportunity. It's essential to familiarize oneself with specific eligibility criteria set forth by the lending institution.

Applicants need to demonstrate a legitimate reason for requesting to skip a payment. Documentation may include income statements, proof of hardship, or other financial records that validate their current situation. Additionally, some lenders may require a minimum payment history, ensuring that the borrower has adequately been managing payments prior to the request.

How the skip-a-payment application process works

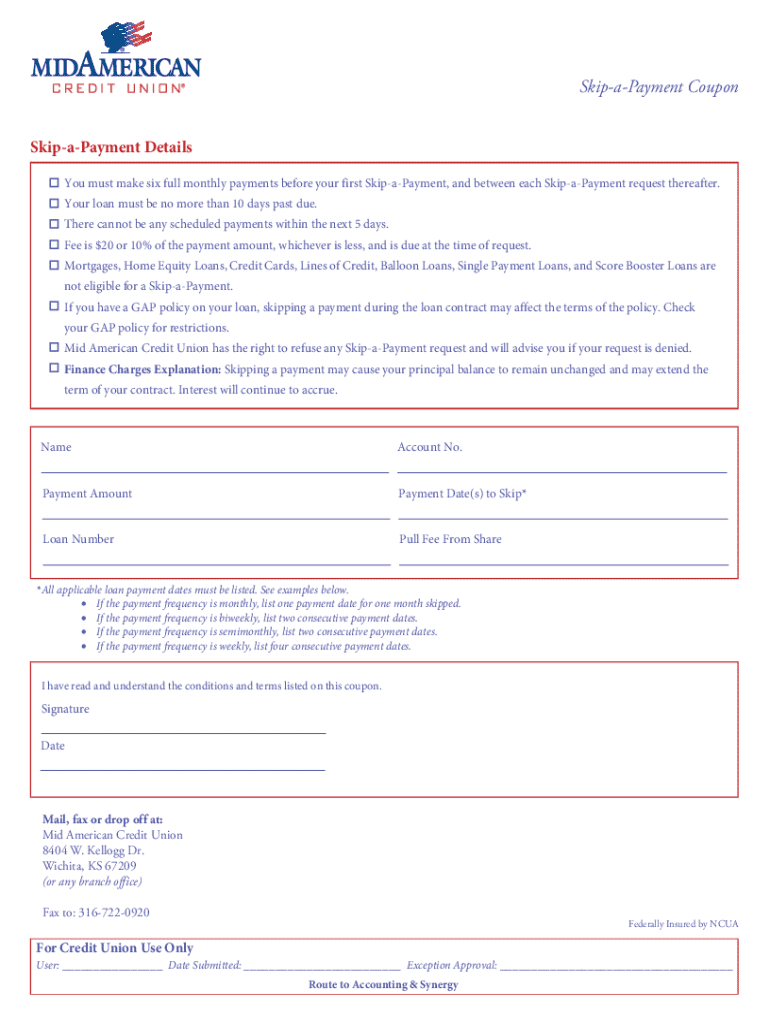

The process of applying for a skip-a-payment is straightforward. First, borrowers can access the skip-a-payment application form through the lender’s website, which is compatible with pdfFiller, enabling easy completion and submission. Once the application form is open, it’s crucial to fill out all required fields accurately, including personal and financial information.

Submitting supporting documentation is an integral part of successfully completing the application process. Once everything is submitted, it's essential to review the terms and conditions that accompany the application to understand the implications of skipping a payment, including any fees, interest implications, or potential future payment adjustments.

Filling out the skip-a-payment application form

Understanding the structure of the skip-a-payment application form is vital for a successful submission. The form typically includes several sections such as personal details, loan information, and consent statements. Each section is designed to gather specific information necessary for the lender to process your request efficiently.

Each part of the application form should be completed with precision. When entering personal details, ensure that names, addresses, and contact information are current to avoid any communication issues. The loan information section will ask for details like your loan number and outstanding balance, which must be accurate to prevent delays in processing your application.

Managing your skip-a-payment request

Once the skip-a-payment application has been submitted, applicants can expect typical processing times varying from a few days to a week, depending on the lender’s policies and workload. Most lenders communicate the status of the request via email or phone calls, keeping applicants informed throughout the process.

The potential outcomes of the application can range from immediate approval to a request for additional documentation. Reasons for denial may include insufficient payment history or not meeting the eligibility criteria set forth by the lender. It's essential to respond to any follow-up requests promptly to ensure the best chance of approval.

Using the pdfFiller platform for document management

pdfFiller offers a user-friendly cloud-based solution for managing your skip-a-payment application form. With the ability to access and edit documents from anywhere, this platform enhances convenience significantly. It also provides comprehensive editing capabilities that streamline the process of filling out forms, making it easier than ever to manage important financial documents.

To effectively use pdfFiller, the process begins by uploading the application form directly onto the platform. Users can then edit and prepare their documents for submission. The eSigning process is straightforward, allowing users to sign documents electronically before saving and tracking changes seamlessly. This level of organization can be invaluable during the application process.

Frequently asked questions about skip-a-payment forms

Many borrowers have common concerns regarding the skip-a-payment application process. Typical inquiries include how often one can skip a payment, and whether skipping a payment impacts the loan's interest accrual. Understanding these elements can help borrowers make informed decisions about whether to utilize this feature effectively.

Expert insights suggest that maintaining clear communication with your lender is crucial. This ensures that you have a strong understanding of your options and can plan strategically for your financial future. Being informed about best practices rather than just going through the motions can lead to better outcomes throughout the application process.

Real-life success stories

Hearing from individuals who have utilized the skip-a-payment feature can provide valuable perspectives and encouragement. Testimonials often highlight how this financial option allowed borrowers to navigate through difficult times and regain stability. Some families have reported avoiding potential crises thanks to the timely application of this feature.

Case studies detail real scenarios where individuals overcoming financial adversity used the skip-a-payment option strategically. These narratives can serve as motivation for those hesitant about applying or unsure if this option aligns with their financial strategies set forth through pdfFiller.

Staying informed about your loan and payment options

Tracking loan status and payment options is essential for individuals looking to manage their finances effectively. Employing tools that offer regular updates on loan status, such as those available through pdfFiller, allows borrowers to stay ahead of payment schedules and upcoming obligations.

Additionally, being proactive in updating your payment plans, whether it’s another skip-a-payment request or restructuring your repayment options, is crucial. Having a clear understanding of ongoing financial challenges and choices ensures that borrowers can make informed decisions for sustainable financial wellbeing.

Accessing support and resources

For individuals seeking assistance throughout the skip-a-payment application process, accessing support is invaluable. Most lenders provide contact information for customer service teams, offering personalized help when needed. Many institutions now offer live chat options on their websites, ensuring immediate support for applicants.

Community forums or help sections on lender websites can also be beneficial. Engaging with others who have navigated similar challenges allows borrowers to share experiences and gain insights, fostering an appealing layer of community support in financial matters.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my new skip-a-payment application directly from Gmail?

How can I modify new skip-a-payment application without leaving Google Drive?

Can I edit new skip-a-payment application on an Android device?

What is new skip-a-payment application?

Who is required to file new skip-a-payment application?

How to fill out new skip-a-payment application?

What is the purpose of new skip-a-payment application?

What information must be reported on new skip-a-payment application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.