Get the free Federal Verification - Office of Scholarships & Financial Aid - financialaid uor...

Get, Create, Make and Sign federal verification - office

How to edit federal verification - office online

Uncompromising security for your PDF editing and eSignature needs

How to fill out federal verification - office

How to fill out federal verification - office

Who needs federal verification - office?

Understanding the Federal Verification - Office Form: A Comprehensive Guide

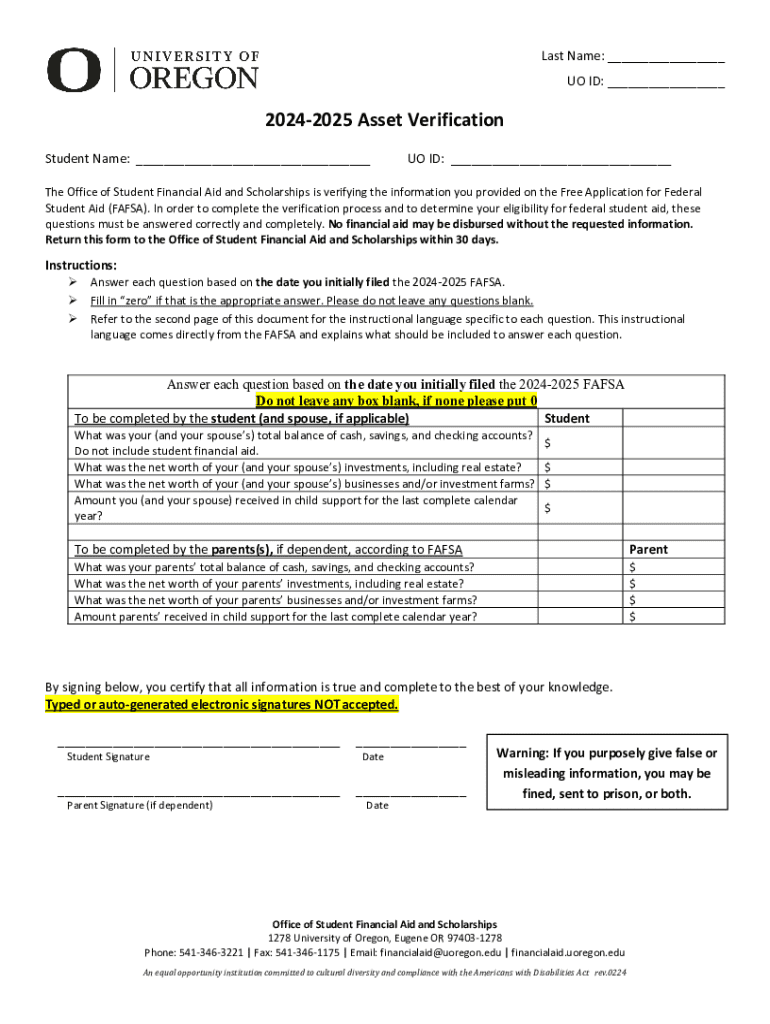

Overview of federal verification

Federal verification is a crucial process managed by the Department of Education aimed at ensuring the accuracy of information provided by students in their financial aid applications. This verification process plays a significant role in ensuring that federal funds, including Title IV aid, are distributed fairly and to those who truly qualify. It safeguards the integrity of federal financial aid programs by verifying the data submitted by students against federal and state records.

The key objectives of federal verification include validating key financial data such as income and household size, preventing fraud, and ensuring compliance with federal regulations. These efforts are particularly important in the financial aid landscape, where thousands of students depend on federal funds to cover rising tuition costs.

Students applying for federal aid are primarily affected by federal verification. This process is triggered when the FAFSA application—necessary for securing financial aid—faces a discrepancy, or if the Department of Education selects it for verification. Beyond students, educational institutions and financial aid offices must also navigate this process diligently to assist applicants effectively.

The federal verification process

Undertaking federal verification can seem daunting, but breaking it down into manageable steps simplifies the process. Below is a step-by-step guide to completing federal verification.

For each step, careful attention to detail is crucial to avoid delays. Institutions often have a timeline for processing verification, so staying organized is key.

Types of federal verification forms

Different forms are associated with the verification process, each serving a specific purpose. The most common forms include the FAFSA verification form, which requires students to confirm the accuracy of their reported financial details, and the IRS verification of non-filing, utilized for individuals who did not file an income tax return.

In addition, there are requests for verification of income and family size that may arise during the process. Each of these forms is essential for ensuring that the financial aid awarded aligns with federal guidelines and accurately reflects a student's financial situation.

Understanding verification items

Verification items are critical elements that the Department of Education checks for accuracy. Some key items include Adjusted Gross Income (AGI), family size documentation, and other supporting information necessary to complete verification.

Documentation for each of these verification items varies but typically requires proof of income, tax returns, and possibly evidence of current family size. Acceptable documentation may include recent pay stubs, bank statements, or proof of public assistance.

Common issues and solutions

As with any bureaucratic process, issues may arise during federal verification. Frequently, applicants encounter challenges due to missing documentation or the submission of inaccurate information. This often leads to frustration and delays in receiving financial aid.

To navigate these challenges, it's important to have a clear understanding of how to amend your verification submission. If changes are necessary, contacting the financial aid office promptly is crucial. They can guide you through correcting errors and provide alternative solutions to potential problems.

Special considerations

While most students must complete the verification process, some individuals may qualify for exclusions. For instance, students who have been selected as 'dislocated workers' or who have a dependency status change might bypass traditional verification requirements. It’s essential to understand the criteria for these exclusions, as they can significantly expedite financial aid processes.

Moreover, life circumstances frequently change and can impact verification. Changes in income or familial status can necessitate adjustments in the verification process. Keeping records of these changes and notifying the financial aid office can ensure that your aid aligns with your current situation.

Verification for subsidized and unsubsidized student financial assistance

Understanding the distinctions between types of financial assistance is critical when undergoing federal verification. Subsidized loans typically require demonstrated financial need, while unsubsidized loans do not. However, both types require verification to ensure eligibility for funding.

Students aiming to maximize their eligibility for aid should assess their financial situations, collect necessary documentation, and be proactive in their applications. Utilizing online resources, including pdfFiller, can streamline the process of completing verification forms and managing documentation effectively.

Policies and procedures regarding federal verification

Each educational institution has its own policies regarding federal verification. It's important for students to understand how long their institution retains verification records, as well as the timeline for completing the verification process. Typically, institutions will inform students of the expected timeframes for processing submissions, which can vary based on the number of applications received.

Upon completion of verification, students can expect clear communication from their institution regarding their financial aid packages. Often, institutions will outline the next steps and provide updated financial aid awards.

Professional help for complex cases

While many students can navigate the verification process independently, there are instances where professional assistance becomes necessary. Financial aid advisors can play a pivotal role, especially in complex cases involving unusual financial circumstances or significant discrepancies in documentation.

Resources such as pdfFiller can significantly aid in the documentation process. This platform allows users to edit PDFs, eSign, collaborate on forms, and securely manage files. It is an invaluable tool for team-based document preparation and can alleviate much of the stress associated with managing verification paperwork.

Preparing for future verifications

Preparing for future verifications involves establishing best practices for document management. Keeping records organized and up-to-date can streamline the verification process considerably. Students should familiarize themselves with the specific documents they will need for verification, making collecting this information easier each year.

Utilizing platforms like pdfFiller for ongoing document management ensures that students can store and access important files securely in the cloud. Additionally, setting reminders for annual updates will help maintain accurate and ready documentation for future federal verifications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in federal verification - office?

How do I edit federal verification - office straight from my smartphone?

How can I fill out federal verification - office on an iOS device?

What is federal verification - office?

Who is required to file federal verification - office?

How to fill out federal verification - office?

What is the purpose of federal verification - office?

What information must be reported on federal verification - office?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.