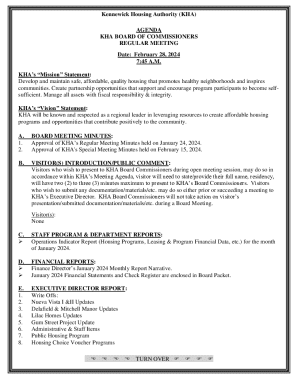

Get the free Got a strange investment offer email, legit or scam? ...

Get, Create, Make and Sign got a strange investment

Editing got a strange investment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out got a strange investment

How to fill out got a strange investment

Who needs got a strange investment?

Got a strange investment form? Here’s what you need to know

Understanding the context of your investment form

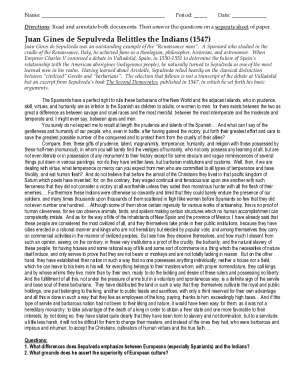

Not all investment forms are straightforward. A ‘strange’ investment form typically raises questions due to its structure, content, or associated costs. It might feature obscure terms, inconsistent details, or questionable credibility. Understanding these nuances is the first step to determining whether or not your form is legitimate.

Common characteristics of unusual investment paperwork include excessive jargon, unclear instructions, or vague terms of service. For example, if an investment opportunity promotes unrealistic returns without substantiating them with credible data, it should immediately raise a red flag. Proper scrutiny of any investment form is essential because failure to do so could lead to losing not just your investment, but personal information to potential fraudsters.

Common red flags in investment forms

When faced with a peculiar investment form, several red flags indicate you should proceed with caution. One of the most alarming signs is unusual fees and charges, which can significantly detract from your investment's returns. If the fees are not standard or not clearly defined, it's an immediate concern.

Transparency is key; if the investment opportunity lacks clarity and fails to provide detailed information about the investment's workings or its potential risks, be wary. Furthermore, missing or vague contact details can suggest that the issuer is not genuine, while confusing terms and overly complex language can intimidate consumers. Scammers often employ pressure tactics, fueling a sense of urgency that leads potential victims to make hasty decisions without proper due diligence.

Steps to analyze your investment form

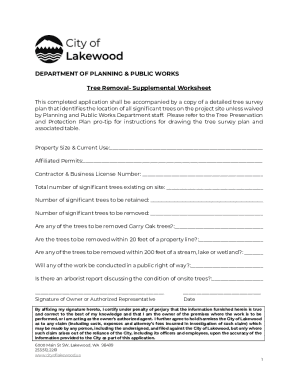

Analyzing a strange investment form requires diligence and systematic steps that enhance your understanding and judgment of the proposed opportunity. The first step is to gather relevant information. Look into the source of the investment; whether it’s through a reputable entity or a dubious third party can significantly affect your decision.

It's also critical to collect supporting documents and previous communications that may offer insight into the issuer's authenticity. Next, contacting the issuer is essential. Prepare a list of questions aimed at clarifying ambiguous details of the form. The professionalism and promptness in their responses can offer further insights into their credibility.

Consider consulting financial advisors or experts, especially if you’re uncertain at any stage. Their seasoned judgment can be invaluable. Researching the company's legitimacy by checking registration with the relevant government organizations can also prevent entanglement in fraudulent schemes. Moreover, seeking reviews, ratings, or complaints about the issuer could save you from making costly mistakes.

Using pdfFiller to manage your investment form

Document management has never been easier thanks to pdfFiller, which allows you to digitally edit and fill out investment forms seamlessly. This platform facilitates not only the completion but the secure signing of documents online, ensuring that all transactions remain confidential.

Certainly, collaborating with financial advisors becomes a breeze, as you can easily share forms and receive their inputs within the platform. Additionally, pdfFiller allows you to store and manage all your investment records in one accessible location, so you can retrieve necessary documents at any time without fuss.

What to do if you suspect fraud

If, after careful scrutiny, you suspect that your investment form may be fraudulent, it’s crucial to act promptly. Reporting fraudulent investment forms to appropriate authorities preserves not just your interests, but also protects future potential victims from falling into the same traps.

Moreover, take proactive steps to safeguard your personal information. This could include changing passwords, monitoring your financial accounts, or even consulting local authorities for guidance. Resources are available for victims of investment fraud, often through governmental websites or organizations dedicated to assisting exploited investors.

Recognizing the signs of a scam: a deeper dive

Understanding the psychological tactics employed by scam artists is essential for identifying potential fraud. Scammers exploit human emotions, often leveraging urgency and the desire for quick wealth to manipulate targets into making impulsive decisions. Case studies illustrate typical scam structures often found in suspicious investment forms, showcasing how the absence of viable business models or excessive promises leads to significant losses.

For example, in 2020, numerous investors in the United States fell victim to an investment fraud scheme that promised absurdly high returns on cryptocurrency investments, often supported by fictitious narratives and fabricated testimonials. Through these examples, it becomes increasingly clear that rigorous diligence and skepticism are necessary to discern legitimate opportunities from scams.

Forming a strategy for future investments

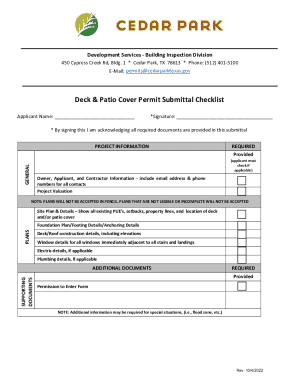

To safeguard against potential investment fraud in the future, it is vital to develop a robust strategy centered around thorough evaluation of investment forms before proceeding. Crafting a checklist can help streamline the decision-making process, encompassing essential aspects like the transparency of the issuer, historical performance, and a comparison of fees with industry standards.

Taking your time is equally crucial; allowing for deliberation helps prevent rash decisions spurred by high-pressure tactics used by scammers. By fostering a habit of analytical thinking and detailed investigation, you can enhance your confidence in making informed investment decisions that lead to fruitful outcomes.

Handling complex investment structures

Complex investment structures often come in the form of structured products or derivatives which can be challenging to navigate without proper knowledge. Understanding the risk factors involved in these intricate financial instruments is crucial in assessing any investment form.

Be diligent in reviewing disclosures that explain potential risks and rewards. Additionally, breaking down complex contracts into manageable segments can lead to better comprehension. This exercise can ensure that you are not agreeing to terms that may lead to unexpected surprises down the line.

Navigating legal protections

Investors have various legal protections against fraudulent practices, including established regulations designed to ensure fair trading and accountability within the investment sector. Understanding these laws and your rights as an investor can empower you to take action when you suspect illegitimacy in investment forms.

If faced with suspicious forms or dubious investment opportunities, learning about legal resources can serve as a critical tool for investors. Consulting regulatory bodies or seeking legal assistance in your area can yield valuable insights into how to proceed and mitigate risks associated with investments.

Preparing for future investments efficiently

To elevate your investment management process, utilizing tools such as pdfFiller can significantly improve efficiency in document processing. The ability to edit, sign, and store forms digitally creates a streamlined experience that allows you to focus more on investment opportunities rather than paperwork.

Maintaining organized investment documentation not only provides peace of mind but also facilitates easier tracking of your investments over time. Integrating structured practices into your investment diligence process ensures you make informed choices, ultimately guiding you away from the pitfalls of strange investment forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete got a strange investment online?

How do I make changes in got a strange investment?

Can I create an electronic signature for signing my got a strange investment in Gmail?

What is got a strange investment?

Who is required to file got a strange investment?

How to fill out got a strange investment?

What is the purpose of got a strange investment?

What information must be reported on got a strange investment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.