Get the free Hospitality Tax Information Form

Get, Create, Make and Sign hospitality tax information form

Editing hospitality tax information form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hospitality tax information form

How to fill out hospitality tax information form

Who needs hospitality tax information form?

Navigating the Hospitality Tax Information Form

Understanding hospitality tax

Hospitality tax is a specialized tax levied on businesses that provide accommodations, food, and beverages to consumers. Its primary purpose is to collect revenue for local and state governments, influencing the overall economic landscape of the service industry. This tax affects both business operators and consumers; for example, businesses need to account for these taxes in their pricing structures, while consumers may encounter an increase in service costs.

Complying with hospitality tax regulations is critical for businesses operating within this sector. These statutory obligations require accurate reporting and timely payments to avoid penalties. Non-compliance can result in hefty fines, legal repercussions, and damage to a business's reputation.

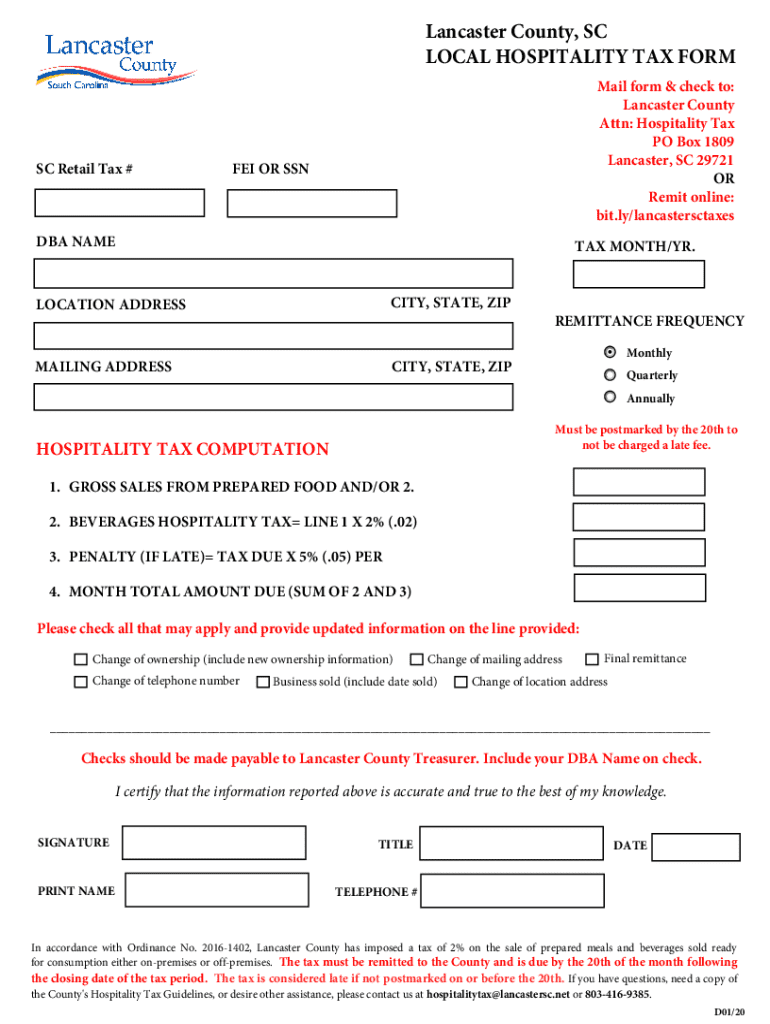

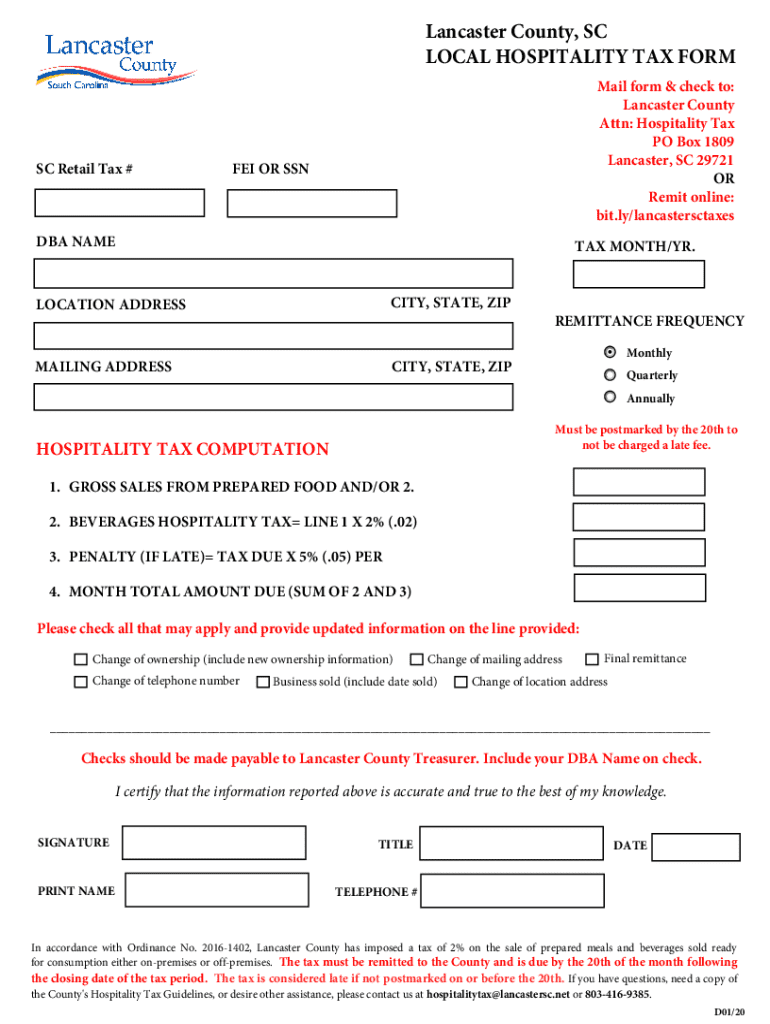

Key components of the hospitality tax information form

The hospitality tax information form is designed for businesses engaged in delivering hospitality services. It includes sections that delineate who needs to use it, the timing for submissions, and the underlying reasons for its necessity. Business owners should be aware that filing this form is not optional; it is a mandated step in maintaining compliance with tax regulations.

When filling out the form, several pieces of information are required, including personal identification details, business registration numbers, and specifics about revenue generated from hospitality services. Additionally, documentation, such as receipts and sales records, must accompany the form to substantiate reported figures.

Step-by-step guide to filling out the hospitality tax information form

Before diving in to fill out the hospitality tax information form, gather all necessary documents and data. This may include your business license, payment vouchers, receipts, and bank statements indicating hospitality-related transactions. Familiarizing yourself with common terminology such as gross receipts, deductions, and exemptions used in the form will streamline the process.

Detailed instructions for each section of the form

Tips for analyzing and reviewing your completed form

Before submitting your hospitality tax information form, undertake a self-review. This includes checking all calculations for accuracy, ensuring that all required sections are complete, and confirming that you have signed the form. A checklist can simplify this process.

Common mistakes often include mathematical errors, incorrect personal information, and failing to attach necessary documentation. Being diligent can prevent delays in processing or penalties from tax authorities.

Submitting the hospitality tax information form

There are several methods for submitting the completed hospitality tax information form. Many jurisdictions allow online submission, making the process efficient and timely. For example, pdfFiller enables users to submit forms digitally, ensuring security and ease of tracking.

After submission, understanding what follows is essential. Processing times can vary, so tracking your submission allows you to confirm receipt and anticipate any requests for additional information or notices of assessment.

Managing your hospitality tax documents with pdfFiller

In the realm of hospitality tax management, pdfFiller offers a cloud-based solution that significantly enhances document organization. By digitizing your forms, you ensure accessibility while facilitating easy edits and document management from any device.

Additionally, pdfFiller’s e-signing feature allows users to securely sign documents, streamlining the collaboration process amongst team members or clients. This eliminates the need for physical copies and expedites turnaround times.

FAQs about the hospitality tax information form

As with any tax-related matter, questions are bound to arise regarding the hospitality tax information form. Here are some commonly asked inquiries:

Contacting tax authorities

Should you require assistance, knowing when and how to contact tax authorities can be invaluable. Most tax offices provide direct contact information on their websites. When reaching out, prepare your questions in advance to facilitate clear and effective communication.

When communicating with tax representatives, be concise but detailed. Include necessary identifiers such as your business name and tax identification number to expedite your inquiry.

Additional considerations for hospitality tax compliance

To maintain compliance, staying updated on changes to hospitality tax regulations is crucial. This may involve subscribing to newsletters, attending local tax seminars, or participating in webinars that cover updates in hospitality tax law.

Leveraging pdfFiller for ongoing document management

To simplify future filings, pdfFiller can streamline the process for hospitality tax forms. The platform's features foster efficiency, allowing users to create and manage future documents with ease.

Moreover, pdfFiller provides interactive tools that facilitate document creation and editing. These features equip users to adapt templates quickly to fit their specific needs, ensuring that each filing is executed flawlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in hospitality tax information form?

How do I make edits in hospitality tax information form without leaving Chrome?

Can I sign the hospitality tax information form electronically in Chrome?

What is hospitality tax information form?

Who is required to file hospitality tax information form?

How to fill out hospitality tax information form?

What is the purpose of hospitality tax information form?

What information must be reported on hospitality tax information form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.