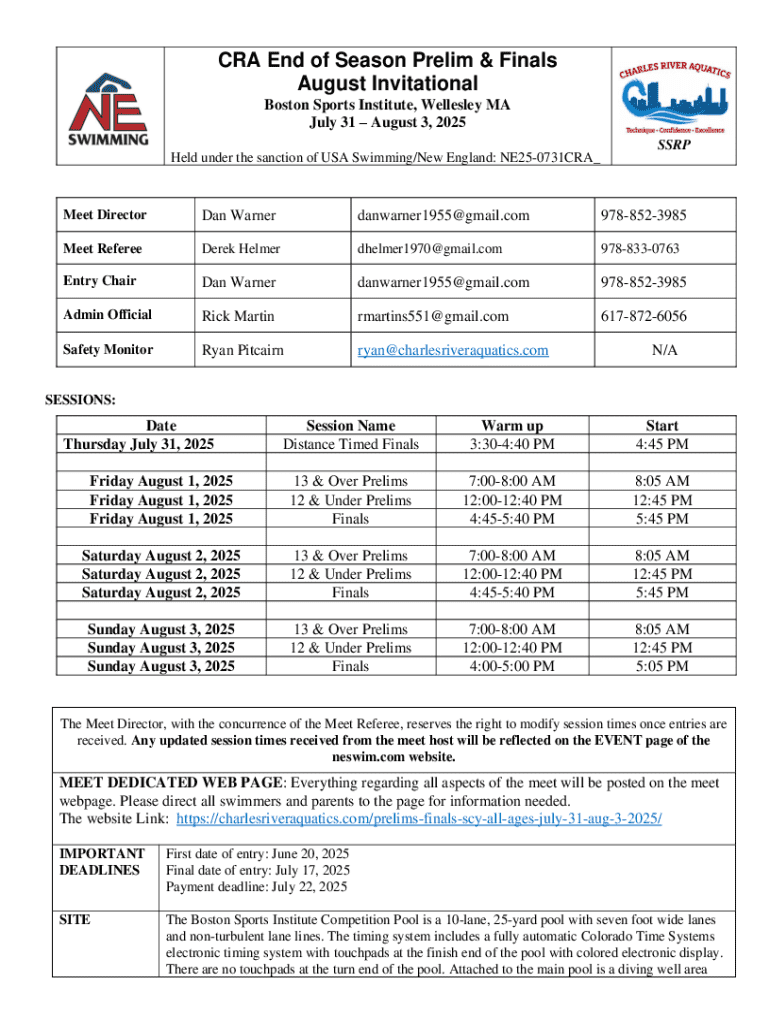

Get the free CRA End of Season Prelim & Finals August Invitational - Boston ...

Get, Create, Make and Sign cra end of season

Editing cra end of season online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cra end of season

How to fill out cra end of season

Who needs cra end of season?

CRA End of Season Form - A Comprehensive How-to Guide

Understanding the CRA End of Season Form

The CRA End of Season Form is an essential document for businesses operating in Canada, summarizing their financial activities for the year. This form, reflecting income, expenses, and applicable deductions, serves as a basis for tax assessments. It is crucial for maintaining compliance with the Canada Revenue Agency (CRA).

Accurate completion of this form is vital to avoid unnecessary audits and ensure that business owners pay the correct amount of tax. Many misconceptions exist around the form, particularly regarding what qualifies as taxable income or deductible expenses. Clarifying these points early in the process can prevent confusion and errors.

Preparing to complete your CRA End of Season Form

Preparing for the completion of the CRA End of Season Form involves gathering vital information and documentation. Businesses should compile all financial documents, including income statements, receipts for business expenses, and tax deductibles, ensuring nothing is overlooked. Each document contributes to a holistic view of the business's financial health.

Utilizing various data sources is crucial for accurate reporting. Bank statements, previous tax returns, and accounting software can assist in compiling correct values. Preparation tips include maintaining organized digital or physical files throughout the year to facilitate a seamless reporting process. The less time spent collating information at tax season, the less stressful the experience becomes.

Step-by-step instructions for filling out the CRA End of Season Form

Filling out the CRA End of Season Form can seem daunting, but breaking it down into sections simplifies the process significantly. Here's a detailed step-by-step guide:

Section 1: Basic information

Start by entering your business details. This includes your business name, address, and contact information. Ensure that you select the correct tax year to avoid discrepancies in your filing.

Section 2: Income reporting

In this section, you should report all sources of income your business has received. Various income types, such as sales revenue, investment income, and grants, must be included. To calculate total income, sum these amounts accurately, and make sure to report specific income areas as required.

Section 3: Expense documentation

Identifying deductible expenses is crucial for reducing taxable income. Common deductions include utilities, salaries, and office supplies. Organizing receipts by category will facilitate easy access and reference when filling out this section.

Section 4: Credits and deductions

Many credits are available to businesses, and eligibility criteria can vary. It's essential to explore which credits apply specifically to your business operations and to properly complete this section of the form.

Section 5: Final review and submission

Before submission, double-check all entries for accuracy. This includes verifying calculations and ensuring all required fields are appropriately filled. After thoroughly reviewing, sign and submit the form electronically where applicable. Maintaining a record of submitted forms is crucial for future reference and potential audits.

Editing and managing your CRA End of Season Form

Once the CRA End of Season Form is completed, changes may still be necessary. If you need to edit the form post-completion, it’s important to know how to make necessary modifications without losing original data. Platforms like pdfFiller offer features that simplify these edits.

With pdfFiller, users can access version control, allowing them to keep track of all changes made to the document, ensuring previous versions remain available if needed. Collaboration is also possible, as team members can comment and provide inputs, fostering a streamlined editing process. E-signing features are convenient as they allow quick signing for further approval or submission.

Interactive tools available on pdfFiller

pdfFiller provides users with an assortment of interactive features that can significantly enhance the experience of filling out the CRA End of Season Form. These tools include effective templates that can be customized to meet specific business requirements.

By utilizing the available customization options, businesses can adapt forms to better fit their specific needs. This ensures that all relevant information is captured efficiently, aligning with organizational or industry-specific requirements.

Case studies: Successful use of CRA End of Season Form

Many businesses have successfully navigated the complexities of the CRA End of Season Form by adopting best practices. For instance, a small local business streamlined their tax reporting process by maintaining a real-time digital accounting system throughout the year, ensuring all financial transactions were easily accessible during form completion.

Another case involved a mid-sized company that implemented team collaborations through pdfFiller for the CRA End of Season Form. By sharing the document among finance team members, they were able to input data and attach supporting documentation directly in the cloud, which significantly increased their efficiency and reduced submission errors.

FAQ: Common questions about the CRA End of Season Form

As businesses prepare to submit their CRA End of Season Form, several common questions arise. For instance, what to do if issues are encountered while completing the form? First, reach out to the CRA for guidance, or consult accounting professionals who can assist in resolving discrepancies.

Another frequent inquiry involves how to amend a submitted form. If errors are found post-submission, it’s essential to file an amendment promptly, including a note explaining the changes. Key dates and deadlines also play a significant role in ensuring compliance, as timely submissions prevent penalties and interest charges.

Maximizing your experience with pdfFiller

Utilizing a cloud-based document solution like pdfFiller can significantly enhance your experience with the CRA End of Season Form. Compared to traditional methods, pdfFiller provides features and functionalities that enable seamless document creation, editing, submission, and management.

Transitioning from manual paperwork to an efficient digital workflow can save time and reduce stress. User testimonials highlight not just ease of use but also improved accuracy thanks to the platform's supportive tools, such as auto-filling fields based on previous data.

Engaging with the pdfFiller community

Engaging with the pdfFiller community offers valuable opportunities for users. Forums and support channels provide answers to common concerns, enabling collaboration among users seeking tips or troubleshooting advice. Users can also share their success stories, inspiring others who face challenges.

Additionally, pdfFiller hosts webinars and workshops that cover essential skills in document management and editing. These events empower users to maximize their tools and streamline their document processes effectively, enhancing their overall experience with the platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get cra end of season?

How do I complete cra end of season online?

How do I fill out cra end of season using my mobile device?

What is cra end of season?

Who is required to file cra end of season?

How to fill out cra end of season?

What is the purpose of cra end of season?

What information must be reported on cra end of season?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.