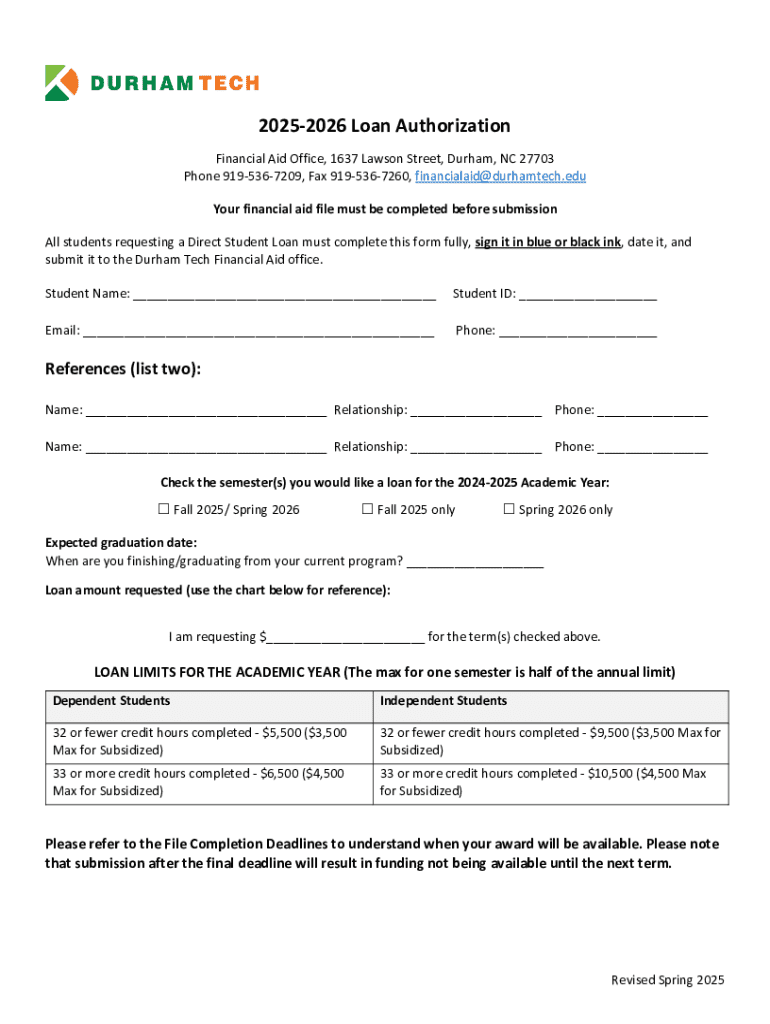

Get the free 2025-2026 Loan Authorization

Get, Create, Make and Sign 2025-2026 loan authorization

Editing 2025-2026 loan authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-2026 loan authorization

How to fill out 2025-2026 loan authorization

Who needs 2025-2026 loan authorization?

Comprehensive Guide to the 2 Loan Authorization Form

Overview of the 2 loan authorization form

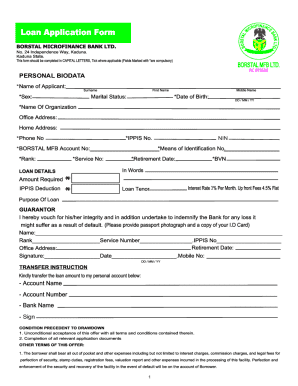

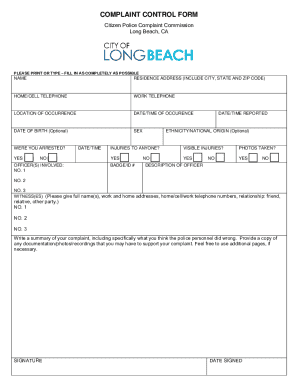

The 2 loan authorization form is a crucial document for individuals and businesses seeking financial assistance. It serves as a formal request to lenders, ensuring that all necessary information is provided to assess the applicant's eligibility. This form streamlines the loan application process, reducing delays and enhancing transparency. The importance of this form cannot be overstated, as it often determines whether an applicant can obtain the funding they need.

Key elements included in the form typically encompass personal information, financial details, and loan specifics. Providing accurate and complete data is essential, as any discrepancies can hinder approval. Additionally, understanding the various sections of the form can help applicants prepare their documentation efficiently, enabling them to navigate the loan process with confidence.

Eligibility requirements for loan authorization

Eligibility for the 2 loan authorization form often varies by lender but generally includes basic criteria such as age, residency, and creditworthiness. Typically, applicants must be at least 18 years of age and reside in the country where they are applying for the loan. Additionally, a satisfactory credit score is usually essential to qualify for most loans, influencing the terms that lenders are willing to offer.

For those seeking to apply for two loans simultaneously, specific requirements may come into play. Lenders might require a closer examination of financial stability and repayment capability. Common misconceptions include the belief that a poor credit score disqualifies applicants outright; in reality, many lenders provide options for those with less-than-stellar credit under certain conditions. Understanding these nuances can empower applicants to take informed steps toward securing their loans.

Step-by-step instructions for filling out the form

Accessing the form

To begin the process, you need to access the 2 loan authorization form. This form can typically be found online through lender websites or platforms like pdfFiller. The convenience of accessing forms digitally means that you can fill them out anywhere at any time, streamlining the process significantly.

You can download or print the form directly from pdfFiller’s library, providing both options to users depending on their preference for digital versus physical documents. Ensure you have the latest version to incorporate any recent updates to eligibility or lending criteria.

Sections of the form explained

The form is typically divided into three main sections: Personal Information, Financial Information, and Loan Details. Under Personal Information, ensure you provide your full name, address, and contact details. This information is critical as it establishes your identity with the lender.

In the Financial Information section, you're required to disclose your income, debts, and assets. Providing accurate figures is essential because they determine your repayment capacity. Lastly, when detailing Loan Details, clearly state the amount you are requesting and the specific purpose of the loan, whether it's for education, home improvement, or a business venture.

Tips for accurate completion

To enhance your chances of success, avoid common pitfalls such as submitting incomplete forms or miscalculating financial figures. Accuracy and clarity in your responses are vital; double-check your entries to ensure they align with supporting documentation. Additionally, be prepared to provide further evidence of your claims if requested by the lender.

Editing and customizing your loan authorization form

Once you have completed the 2 loan authorization form, you may want to refine its presentation or add additional relevant information. Utilizing pdfFiller’s tools, you can easily edit PDFs, add comments, or include attachments that elaborate on your financial situation or purpose for the loan.

Collaboration tools are also available, enabling you to share the form with team members or stakeholders for review before final submission. This collaborative approach ensures that all important aspects are captured and enhances the quality of your submission.

eSigning the 2 loan authorization form

The eSignature is a critical component of the loan application process, as it confirms your agreement to the terms outlined in the authorization form. This digital signature is not only convenient but also legally binding, ensuring that your application is processed promptly.

Using pdfFiller, you can sign the document electronically with just a few clicks. This not only saves time but also reduces the need for physical documentation. Ensure your eSignature complies with current legal standards to avoid any complications during the loan processing phase.

Submitting the loan authorization form

Once your 2 loan authorization form is completed and signed, it’s time to submit it. You have several submission methods available, including online portals, email, or traditional mail. The method chosen can affect processing times, so consider the lender’s preferred submission channel.

For effective submission practices, ensure that all required documents are included alongside your form. After submission, tracking your application status is wise. Many lenders provide online tools to monitor the progress and response times associated with your application.

Managing your loan status and information

Following the submission of your 2 loan authorization form, you may want to check the status of your loan application regularly. Most lenders will offer updates via email or through their online platform, giving you timely information on your application’s progress.

In case your circumstances change—such as a change in income or financial obligations—updating the lender with new information is critical. This proactive approach can stave off potential issues that may arise due to discrepancies in what you reported earlier.

Frequently asked questions (FAQs)

As applicants navigate the 2 loan authorization form process, several common concerns arise. One frequent question is about expected response timelines: typically, lenders will communicate their decision within a few weeks, depending on their workload and the complexity of your application.

Another concern often revolves around what to do if your application is denied. In such cases, many lenders provide feedback on why the loan was not approved, allowing applicants to address those issues for future applications. Engaging directly with lender representatives can also yield answers that may help clarify any confusion.

Interactive tools and resources

To assist you further in the loan process, pdfFiller provides access to various interactive tools. These include loan calculators that help you estimate potential monthly payments and total interest costs, tailored according to the amount requested and repayment terms.

In addition to calculators, users can find templates for related forms that may be necessary during the loan management process, enhancing the overall user experience and ensuring you have all the necessary documentation in one place.

Contact information for further assistance

For any further inquiries or assistance with the 2 loan authorization form, pdfFiller’s customer support team is readily available. You can reach out through their online chat, email, or dedicated support phone line to get your questions answered comprehensively.

Additionally, joining community forums can offer insights from other users who have gone through the loan process. Engaging with these forums allows for shared experiences and tips, enhancing your understanding and preparation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in 2025-2026 loan authorization without leaving Chrome?

Can I create an eSignature for the 2025-2026 loan authorization in Gmail?

How do I fill out the 2025-2026 loan authorization form on my smartphone?

What is 2025-2026 loan authorization?

Who is required to file 2025-2026 loan authorization?

How to fill out 2025-2026 loan authorization?

What is the purpose of 2025-2026 loan authorization?

What information must be reported on 2025-2026 loan authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.