Get the free How do automatic payments from a bank account work?

Get, Create, Make and Sign how do automatic payments

How to edit how do automatic payments online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how do automatic payments

How to fill out how do automatic payments

Who needs how do automatic payments?

How do automatic payments work? A how-to guide

Understanding automatic payments

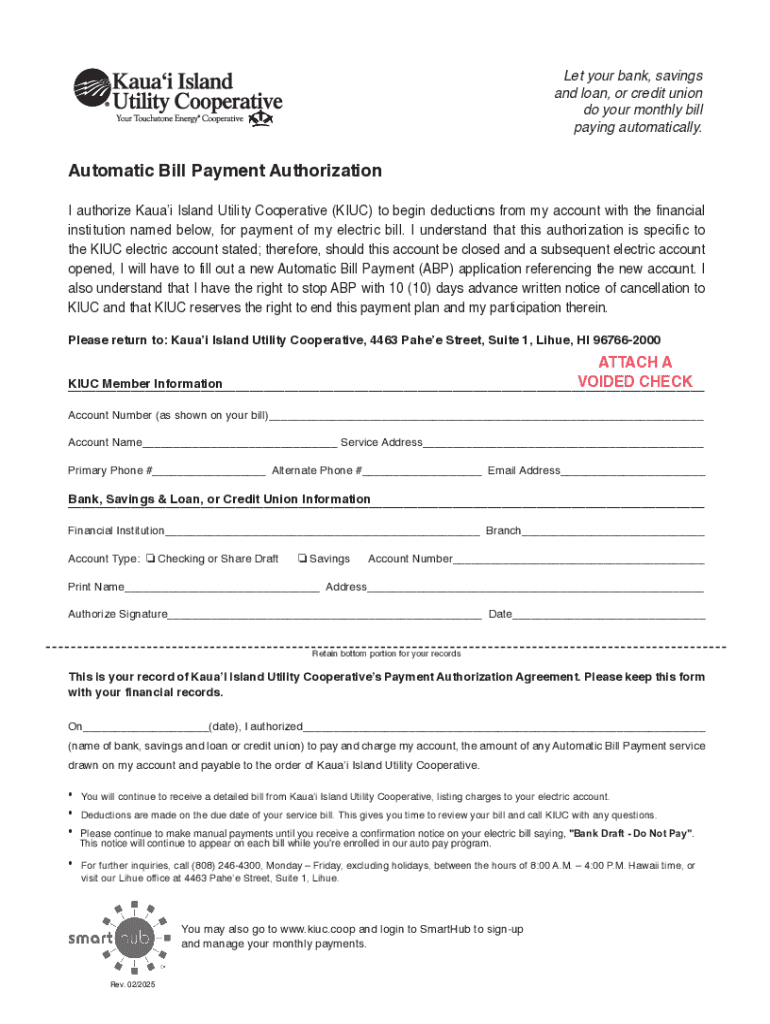

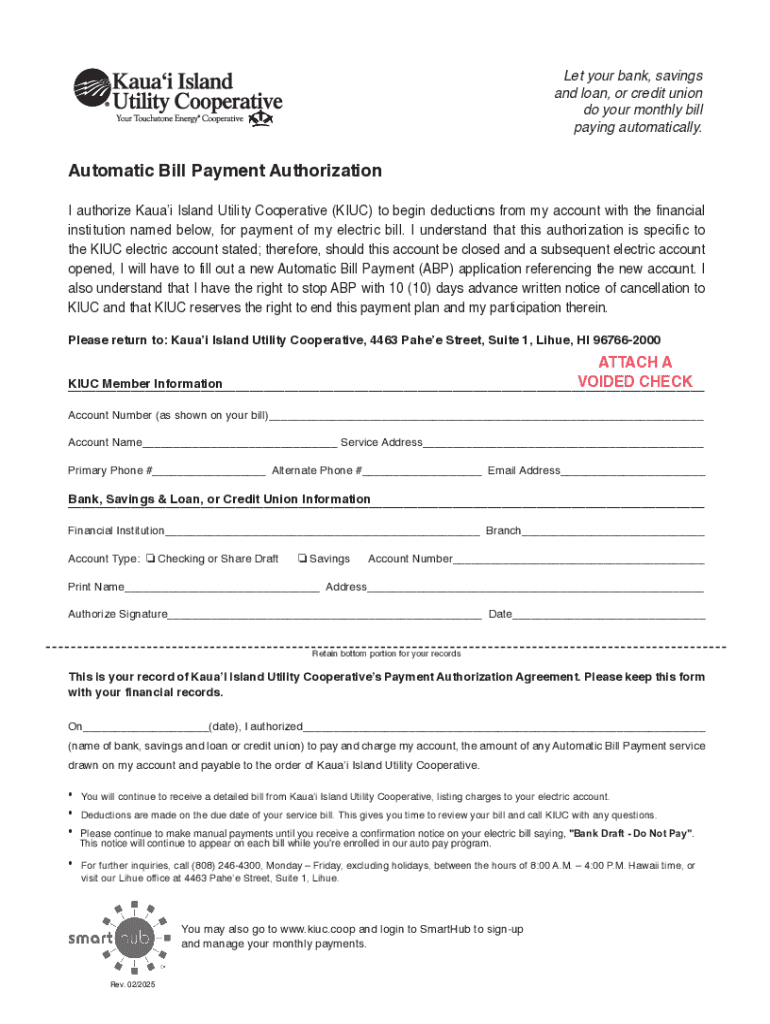

Automatic payments are transactions that are pre-arranged and processed on a scheduled basis, allowing consumers to pay for goods or services without manually initiating each payment. This method is commonly used for recurring expenses such as utilities, subscriptions, and loan repayments. By understanding how automatic payments function, you can take full advantage of this streamlined payment method.

Unlike traditional payment methods that require users to enter payment details each time a transaction occurs, automatic payments simplify the process by linking your preferred payment method—such as credit cards or bank accounts—with the billing system of the service provider. This reduces the chances of late payments, which are often accompanied by late fees, enhancing your financial reliability.

The mechanics of automatic payments involve a few critical steps: linking your bank account or payment method, establishing a recurring schedule, and specifying the payment amounts. These transactions are typically processed automatically on the due date without any further input necessary from you, making it a hassle-free way to manage finances.

The benefits of using automatic payments

Utilizing automatic payments offers several significant advantages. Primarily, these payments save time by eliminating the need to manually pay bills each month. This automated approach ensures that payments are made promptly, thereby reducing late fees and protecting your credit score. For busy individuals and teams alike, this convenience is invaluable.

Furthermore, automatic payments streamline bill management. By consolidating payments into scheduled transactions, you can easily predict your monthly expenses, aiding in budgeting. Proper budgeting leads to better financial forecasting, allowing you to reinvest time saved into other important aspects of life or business.

Enhanced security is another notable benefit. Transactions processed through trusted platforms often come with built-in encryption and fraud protection measures, ensuring that your information remains secure during payments. This makes automatic payments an attractive option for individuals looking to safeguard their financial data.

Setting up automatic payments

Setting up automatic payments is a straightforward process that involves several steps. By following this step-by-step guide, you can efficiently establish your automated payment system and enjoy the ensuing benefits.

To ensure smooth transactions, consider keeping sufficient funds available in your account to cover scheduled payments. Additionally, regularly monitoring your account statements can help you catch any potential discrepancies before they become issues.

Managing automatic payments effectively

Once set up, managing your automatic payments becomes crucial for maintaining a healthy financial status. Start by tracking and organizing all your automatic payments, which can be done using a simple spreadsheet or financial app. This organization allows you to see all upcoming transactions and predict any cash flow changes.

Over time, you may find that adjustments are necessary. Whether it's changing your payment method or modifying payment amounts, regular updates are key to maintaining control over your finances. Additionally, if circumstances change, you might need to pause or cancel automatic payments. Understanding when to consider cancellation or modifications can save you money and eliminate unnecessary fees.

Common issues and troubleshooting

Despite their numerous benefits, automatic payments can sometimes encounter issues. Payment failures often arise due to insufficient funds, expired credit cards, or changes in billing details. To resolve these issues swiftly, maintain up-to-date payment information and always confirm that you have enough funds in your account before each transaction date.

Unauthorized transactions can also be a concern. Protecting yourself is essential; regularly review bank statements for unexpected charges and consider establishing alerts for transactions. If you notice unfamiliar activity, contact your financial institution immediately. Lastly, be aware of potential service conflicts or changes in terms that could lead to inconsistent payment processing.

Legal protections for automatic payments

Consumers have federal protections concerning automatic payments, primarily governed by the Electronic Fund Transfer Act (EFTA). This act ensures that you have rights regarding unauthorized payments, which can be pivotal when disputes arise. Familiarizing yourself with these rights can empower you as a consumer.

In the unfortunate event that you encounter issues, it is essential to document all communications with service providers and your financial institution. Being informed about your rights and responsibilities enables you to take effective action should any disputes occur. Always keep records of your payment agreements, as they may be required if you need to dispute a transaction.

Staying informed about your automatic payments

To effectively manage automatic payments, it’s crucial to stay informed about all transactions. Regularly reviewing your bank statements and notifications can quickly reveal discrepancies or unauthorized transactions. Tools such as those offered by pdfFiller allow users to easily keep track of, edit, and manage documents related to these financial transactions.

Additionally, always ensure that your contact information is up to date with service providers. This ensures that you receive necessary alerts about upcoming payments and any changes within your service agreements, enhancing your ability to manage your account efficiently.

Additional insights and resources

For those wishing to dive deeper into automatic payments, further reading on financial management through these systems is readily available. Many resources discuss tips for effectively managing bills and how to leverage payment technology to streamline financial processes. Staying updated on best practices in payment technologies can provide valuable insights into optimizing your automatic payment arrangements.

By utilizing tools offered by pdfFiller, you can streamline your document management process, ensuring that you're not only on top of your automatic payments but also empowered to navigate your financial options effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute how do automatic payments online?

How do I edit how do automatic payments in Chrome?

How do I fill out how do automatic payments on an Android device?

What is how do automatic payments?

Who is required to file how do automatic payments?

How to fill out how do automatic payments?

What is the purpose of how do automatic payments?

What information must be reported on how do automatic payments?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.