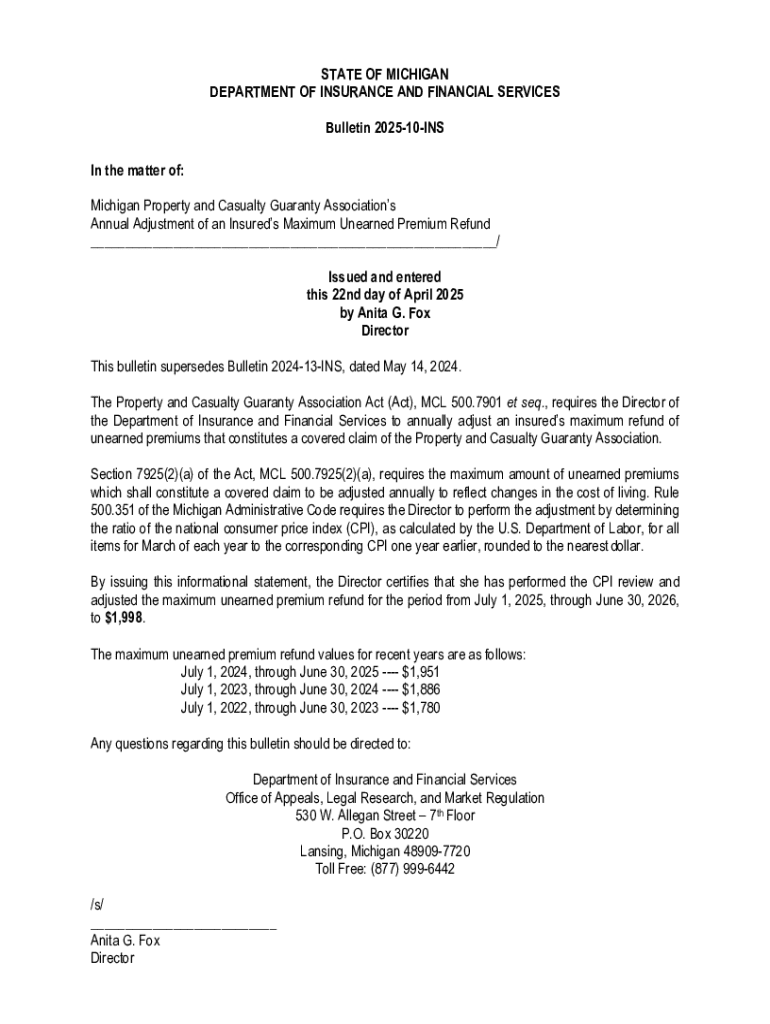

Get the free Michigan Property and Casualty Guaranty Association's ...

Get, Create, Make and Sign michigan property and casualty

How to edit michigan property and casualty online

Uncompromising security for your PDF editing and eSignature needs

How to fill out michigan property and casualty

How to fill out michigan property and casualty

Who needs michigan property and casualty?

Michigan Property and Casualty Form: A Comprehensive Guide

Overview of Michigan Property and Casualty Forms

Property and casualty insurance plays a vital role in protecting Michigan residents from potential financial losses. This type of insurance not only covers property damage from various perils like fire and theft but also safeguards against liability claims stemming from accidents or injuries caused to others. Understanding the Michigan property and casualty form is the first step toward securing the right coverage.

The importance of submitting accurate forms cannot be overstated; improper submissions can lead to coverage denials or personal liability in case of claims. Therefore, knowing key insurance terminology, such as premium—referring to the payment made for your coverage—deductible—how much you'd pay out-of-pocket before coverage kicks in—and coverage types is essential for effective form completion.

Navigating the Michigan Property and Casualty Form

Michigan offers various property and casualty forms to cater to different needs, including personal property commercial forms and personal auto forms. Each of these forms serves a specific purpose and target demographic, from homeowners to business owners and drivers.

Comparing different forms available is crucial for making an informed choice about your insurance needs. For example, if you're a homeowner, you might opt for a personal property form, while a vehicle owner would require a personal auto form. Knowing which form suits your requirements helps in ensuring adequate coverage at the best possible rates.

Preparing to Fill Out Your Michigan Property and Casualty Form

Before diving into the completion of your Michigan property and casualty form, compiling necessary documents is vital to streamline the process. A well-prepared document checklist can significantly enhance your efficiency and accuracy. Key items to gather include identification documents, such as your driver's license or state ID, previous insurance records that provide details on your coverage history, and property details for property-specific forms, including addresses, values, and descriptions of your possessions.

Step-by-step guide to filling out the form

Filling out the Michigan property and casualty form can seem overwhelming, but breaking it down into manageable steps facilitates clarity. Start by accessing the form via pdfFiller, where you can easily download and access the PDF version. Make sure to save the document to your device for further editing.

Once you have the form, it's crucial to enter your personal information correctly. Cross-check all entries for accuracy, as errors can complicate your application process significantly. Furthermore, understanding the various coverage options available is integral. Explore each type of coverage offered—like liability, collision, and comprehensive coverage for auto forms, and dwelling, personal property, and liability coverage for property forms—to determine optimal selections for your needs.

Calculating premiums

One of the most critical aspects of completing your Michigan property and casualty form involves calculating your premiums accurately. Utilizing an interactive premium calculation tool can simplify this process, providing quick estimations based on the information you've entered. Ensure to assess your needs realistically, considering factors such as historical claims data, types of coverage desired, and any applicable discounts for bundling policies with the same insurance company.

Finally, before you submit the form, make sure you review all information entered. Take advantage of pdfFiller's editing features for clarity and correction, ensuring details are correct across all lines of the form, including Line 6, Line 7, and Line 8 for any specific disclosures or details required by your insurer.

Signing and submitting the Michigan property and casualty form

After verifying and completing your Michigan property and casualty form, the next step is e-signing the document. Thanks to pdfFiller’s eSignature feature, you can sign your form electronically, which not only speeds up the process but also meets legal standards for electronic documentation.

Following the signature step, proceed to submit the form. Various submission methods are available, including online submission through your insurer’s portal, mailing a printed copy, or delivering it in person at a local office. Don't forget to keep track of your submission status, ensuring everything is progressing smoothly.

Common mistakes to avoid when filing

When filing the Michigan property and casualty form, it’s crucial to avoid common pitfalls that can lead to delays or denials. A frequent mistake is misunderstanding coverage options; not fully grasping what each coverage type entails can lead to inadequate protection. Failing to include required documents can also stall the application process significantly, so ensure nothing is left out.

Additionally, be diligent about double-checking for errors within your form. Simple mistakes—like typos in your personal information or incorrect premium calculations—can create issues later on when you need your coverage to activate. Taking your time here will pay off in the long run.

FAQs about Michigan property and casualty forms

Processing times for applications can vary by insurer, but many companies aim to resolve straightforward submissions within a few business days. If you submit a form with mistakes, your insurer will typically flag the errors, necessitating you to revise and resubmit. To prevent disruptions in coverage, always check your policy details regularly and understand how to make updates after submission.

Tools and resources available on pdfFiller

pdfFiller offers a wealth of document management features that can streamline the insurance form process. From editing capabilities that allow you to make instant changes to your form, to additional templates related to Michigan insurance forms, the platform enhances your user experience further.

Utilizing collaboration tools also allows teams to work together seamlessly on document efforts, ensuring that everyone involved can contribute input and reviews effectively. This collaborative feature effectively manages your essential documents in one place, thereby simplifying the overall process.

Testimonials and success stories

Many users have benefitted from leveraging pdfFiller for their Michigan property and casualty forms. Testimonials reveal that joys include the ease of document management, the efficiency of eSigning, and the capability of capturing and tracking submissions. Real experiences illustrate that pdfFiller not only saves time but also reduces stress associated with managing insurance forms.

Success stories showcase users who have transformed a traditionally daunting paperwork process into a streamlined task, allowing them to focus on more pressing matters than insurance management.

The importance of keeping your insurance information updated

Monitoring and regularly reviewing your property and casualty coverage is essential for maintaining the adequacy of your policy. Changes in life circumstances—such as buying a new home, changing vehicles, or significant personal shifts—can all impact your coverage requirements. Using pdfFiller for ongoing management of your insurance documents can ease this process, enabling you to update details quickly and efficiently.

Preventing lapses in coverage and ensuring you’re never underinsured again comes from being proactive with your insurance review. Continuously utilizing the tools at pdfFiller allows responsive management of your property and casualty forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get michigan property and casualty?

How do I edit michigan property and casualty online?

How do I make edits in michigan property and casualty without leaving Chrome?

What is michigan property and casualty?

Who is required to file michigan property and casualty?

How to fill out michigan property and casualty?

What is the purpose of michigan property and casualty?

What information must be reported on michigan property and casualty?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.