Get the free Self-Insurance Forms - LEO

Get, Create, Make and Sign self-insurance forms - leo

How to edit self-insurance forms - leo online

Uncompromising security for your PDF editing and eSignature needs

How to fill out self-insurance forms - leo

How to fill out self-insurance forms - leo

Who needs self-insurance forms - leo?

Self-Insurance Forms - Leo Form: A Comprehensive Guide

Understanding self-insurance and its relevance

Self-insurance is a risk management strategy wherein an individual or organization retains financial responsibility for specific risks rather than transferring this risk to a traditional insurance company. This approach can lead to greater control over potential liabilities and can be particularly beneficial for businesses looking to manage their expenses efficiently.

The benefits of self-insurance are substantial. First, there's the aspect of cost savings, as avoiding premiums often results in significant savings over time. Second, self-insurance allows for increased flexibility, allowing individuals and enterprises to create customized policies that better fit their unique circumstances. Lastly, self-insurance plays a crucial role in risk management by enabling organizations to establish comprehensive risk mitigation strategies tailored to their operational needs.

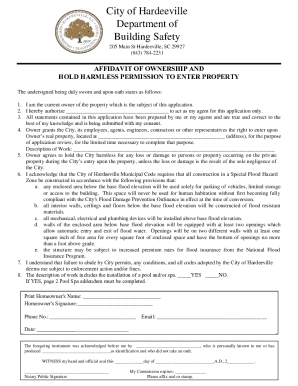

Self-insurance forms are critical to documenting this process. Various types exist, including individual self-insurance applications for personal health insurance, property insurance, and workers' compensation. Proper documentation ensures that all necessary details are logged and can facilitate smoother claims processing. Employers and individuals alike benefit from understanding and utilizing self-insurance forms correctly.

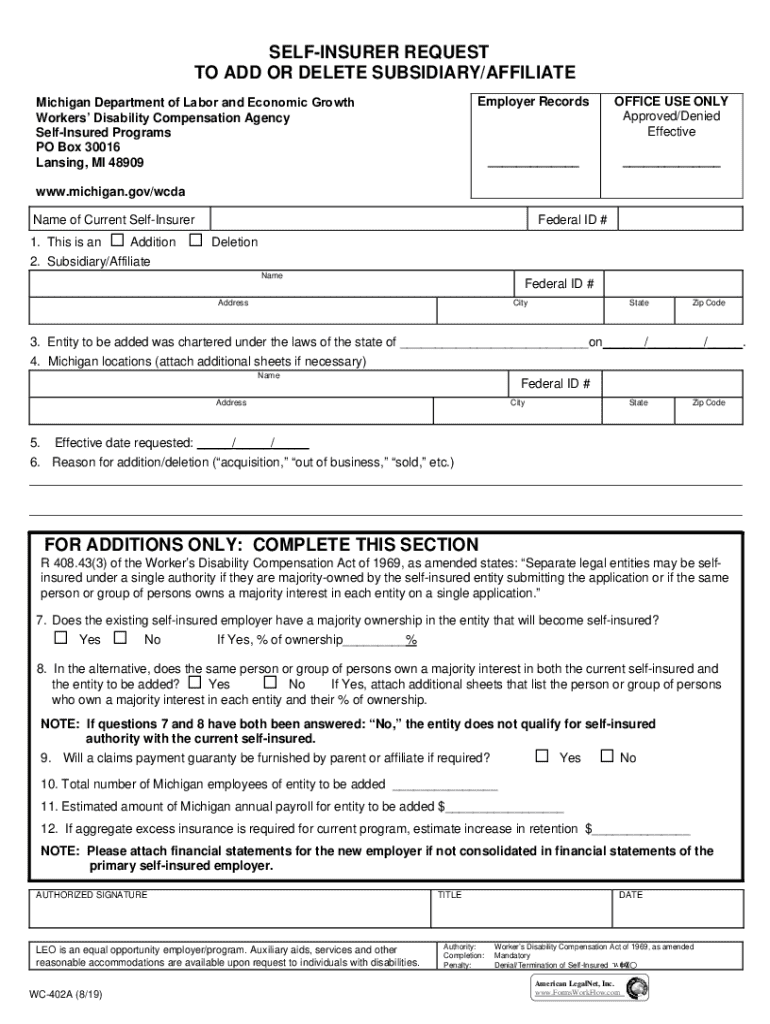

The Leo Form: An overview

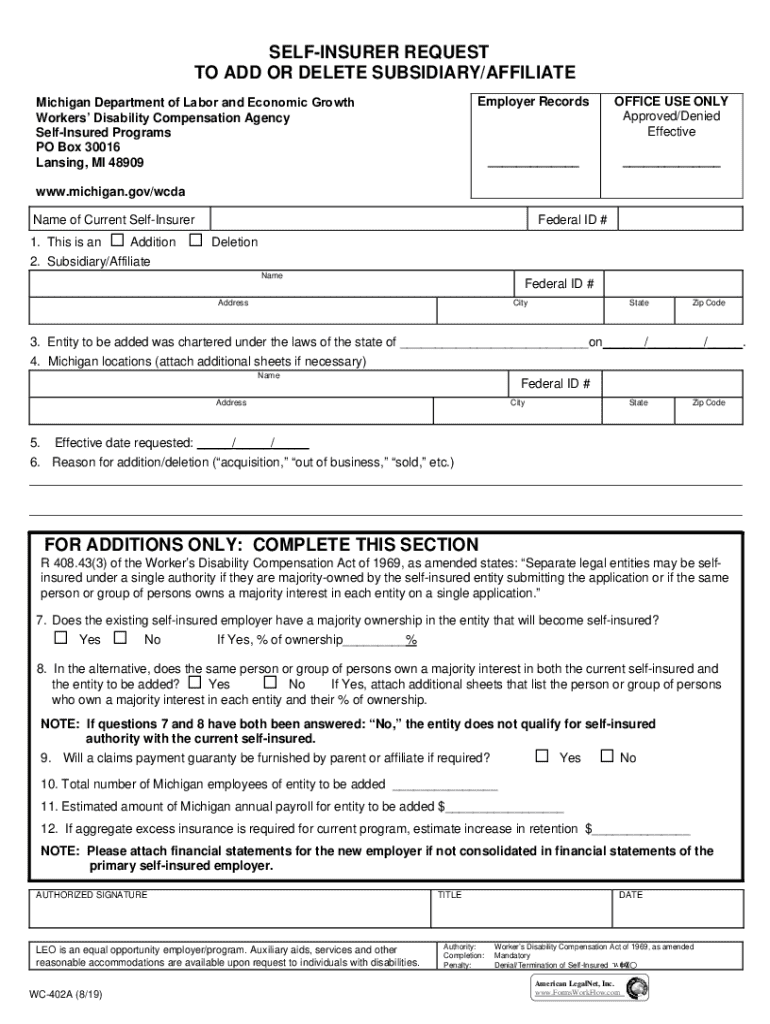

The Leo Form is a specific self-insurance form designed to streamline the self-insurance process, gathering essential information about the individual or entity seeking to self-insure. This form plays a vital role in both the approval process and ongoing management of self-insurance policies.

Its primary purpose is to assess eligibility for self-insurance, ensuring that applicants meet specific criteria for coverage. Common scenarios for utilizing the Leo Form include personal health coverage for freelancers or property insurance for small business owners managing significant operational risks. With features aimed at improving user experience, the Leo Form is a valuable tool for navigating the complexities of self-insurance.

Unique aspects of the Leo Form include its interactive elements, which guide users through the completion process, and customizable sections that allow applicants to tailor their form submission to specific needs. This design enhances user engagement and minimizes errors during form filling.

How to fill out the Leo Form

Filling out the Leo Form requires careful preparation and organization. The first step involves gathering necessary information, including personal details such as name, address, and contact information. Furthermore, applicants should compile any relevant insurance history and financial documents that highlight their capability to manage self-insured risks effectively.

Next comes the actual completion of the Leo Form. It is essential to follow a section-by-section guide provided within the form, ensuring accuracy at each step. Users are encouraged to double-check all entered information, as inaccuracies may lead to delays in processing or denial of coverage.

Additionally, effective self-insurance management requires ongoing practices. Regular reviews of self-insurance policies, tracking of claims, and maintaining organized records are critical to ensuring seamless operations and avoiding lapses in coverage.

Editing and customizing your Leo Form

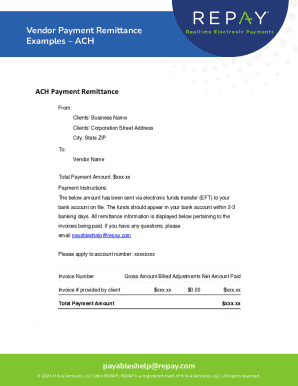

Editing the Leo Form can be easily accomplished using tools like pdfFiller. Users can upload the form directly onto the platform, which provides a suite of editing tools catering to a variety of document needs. With pdfFiller's intuitive interface, individuals can modify text, add notes, or make other necessary adjustments effortlessly.

Additionally, users can sign the form electronically. The eSignature process within pdfFiller is secure and straightforward, allowing for rapid collaboration with team members or stakeholders, ensuring that everyone is involved in the review process. Comments and feedback can also be added directly on the form to facilitate communication.

Managing your self-insurance forms with pdfFiller

pdfFiller provides a cloud-based document management system that makes accessing documents from any device convenient, thus catering to the needs of users across various locations. With built-in security measures, users can be assured that their sensitive data is safeguarded while they navigate the complexities of self-insurance documentation.

Collaboration features further enhance the user experience. Users can invite team members to review documents, track changes, and receive updates in real time. This capability is particularly beneficial in workplaces requiring efficient communication and shared responsibility regarding self-insurance forms.

Common mistakes to avoid when using the Leo Form

Navigating the Leo Form successfully requires attention to detail and awareness of potential pitfalls. A common mistake includes submitting incomplete information which can lead to processing delays or even rejection of your application. It's vital to ensure that every required section is thoroughly completed and verified before submission.

Another frequent error involves misunderstanding the eligibility criteria for self-insurance. Applicants should familiarize themselves with the requirements to avoid confusion and unnecessary rework. Lastly, users should not hesitate to utilize available resources, whether they are customer support, informative blogs, or community forums—these can provide essential guidance and encourage a smoother form-filling experience.

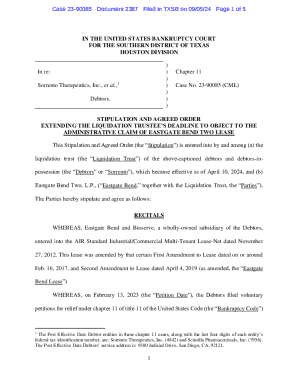

Frequently asked questions about the Leo Form

Several inquiries commonly arise concerning the Leo Form. One popular question revolves around eligibility: who qualifies for self-insurance using the Leo Form? Generally, individuals or organizations that can demonstrate adequate financial stability and risk management capabilities are eligible. Familiarizing oneself with specific requirements is essential.

Another frequent concern involves mistakes made on the Leo Form. If errors occur, applicants should contact customer support to understand the best correction processes; sometimes, minor adjustments can be made, while in other instances, a new submission may be necessary. Users should also seek guidance from online resources or forums if they find themselves unsure about completing the form correctly.

Success stories from users of the Leo Form

Numerous users have successfully leveraged the Leo Form for their self-insurance needs, experiencing positive outcomes. Individual case studies highlight how freelancers have used the form to secure essential health insurance, thus safeguarding their livelihood while managing healthcare expenses effectively.

Furthermore, teams have shared testimonials regarding their experiences using pdfFiller to manage the Leo Form, emphasizing how the platform enhanced their overall efficiency. The seamless collaboration and editing features proved instrumental in streamlining their documentation processes, ensuring critical deadlines were met.

Troubleshooting common issues

Users may sometimes encounter technical issues while working with the Leo Form. If problems arise, the first step is to ensure that the document is uploaded correctly and that full compatibility with pdfFiller has been achieved. Refreshing the page or attempting to access the form from a different browser can often solve minor glitches.

For persistent issues, accessing help and support is crucial. pdfFiller offers robust customer support, equipped to assist users with any challenges related to the Leo Form and self-insurance processes. Resources available online include troubleshooting guides, tutorials, and community support forums, offering a wealth of information to help navigate potential difficulties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in self-insurance forms - leo?

Can I create an electronic signature for signing my self-insurance forms - leo in Gmail?

How can I fill out self-insurance forms - leo on an iOS device?

What is self-insurance forms - leo?

Who is required to file self-insurance forms - leo?

How to fill out self-insurance forms - leo?

What is the purpose of self-insurance forms - leo?

What information must be reported on self-insurance forms - leo?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.