Get the free Emergency Loan Application - Campus Support & Intervention

Get, Create, Make and Sign emergency loan application

Editing emergency loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out emergency loan application

How to fill out emergency loan application

Who needs emergency loan application?

Navigating the Emergency Loan Application Form: A Comprehensive Guide

Understanding emergency loans

Emergency loans are specialized financial products designed to assist individuals and businesses in times of urgent need. These loans can provide quick access to funds to address unforeseen circumstances, such as medical emergencies, natural disasters, or unexpected job loss. Their importance cannot be overstated, as they serve as a lifeline for those facing immediate financial hardships.

Common scenarios requiring emergency loans include unexpected medical expenses, repairs from property damage due to a storm, or costs arising from sudden family tragedies. These instances often necessitate rapid financial support, which makes understanding the emergency loan application form crucial for obtaining timely assistance.

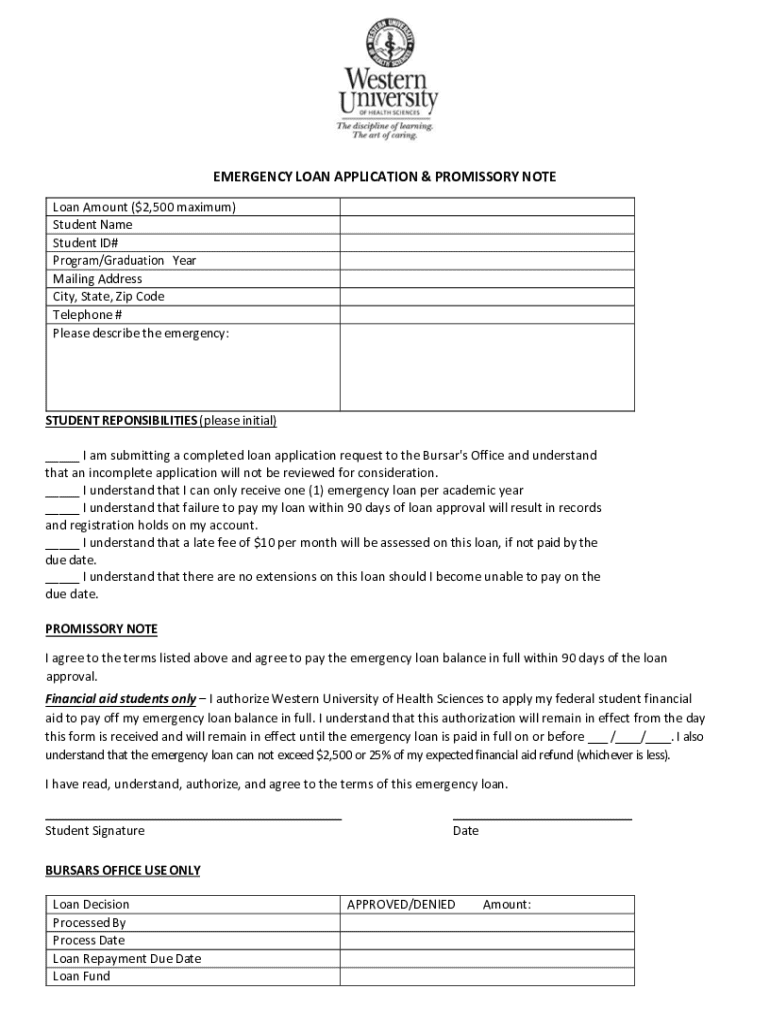

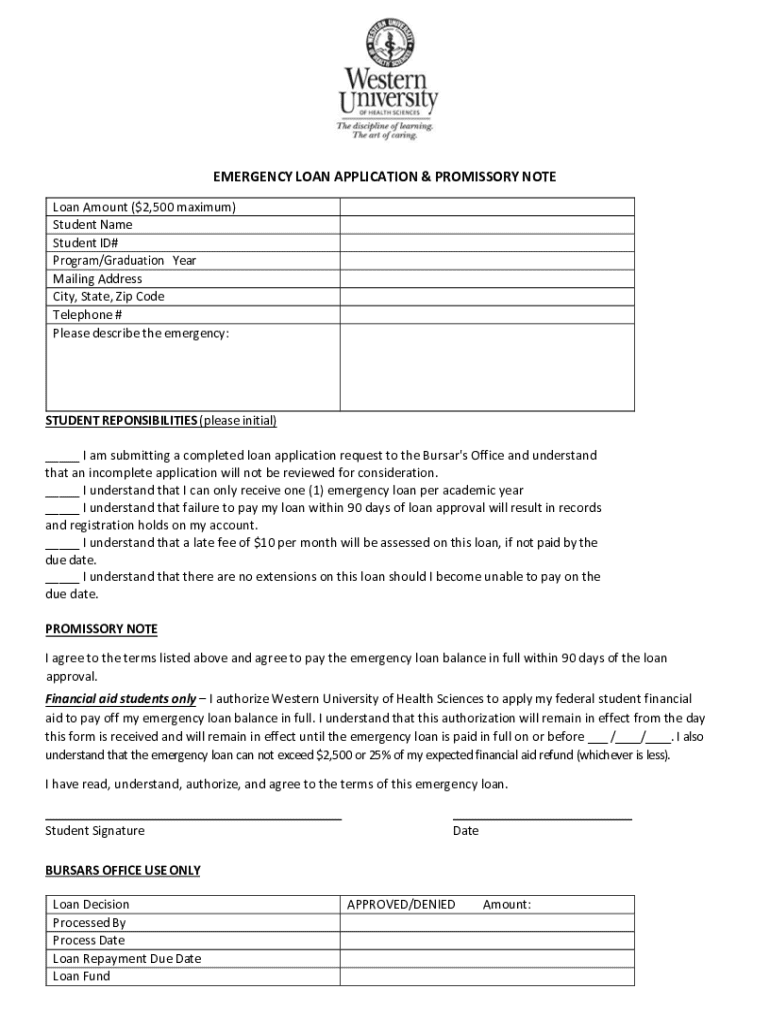

Key components of the emergency loan application form

The emergency loan application form serves as the initial step in acquiring necessary funds. This form is designed to collect essential information from applicants to assess their needs and eligibility. Understanding what information to include is fundamental for a successful application.

Completing these sections accurately will provide lenders a clearer picture of your financial situation and the urgency of your request.

Eligibility criteria for emergency loans

Eligibility for emergency loans generally includes a range of candidates. Both individuals facing sudden expenses and businesses needing immediate capital can apply. However, specific criteria can vary depending on the lender.

Commonly accepted reasons for seeking an emergency loan include medical bills, urgent home repairs, or unforeseen job loss. Required documentation for verification often includes identification, proof of income, and any relevant bills or reports that demonstrate your financial need.

Step-by-step guide to filling out the emergency loan application form

Filling out the emergency loan application form correctly can significantly affect the outcome. Here’s a step-by-step guide to ensure you provide all necessary information.

By meticulously following these steps, you enhance your chances of a successful application significantly.

Submitting the emergency loan application

Once your application form is complete, the next step is submission. Knowing where and how to submit your application is vital to ensure timely processing.

Expect processing to take anywhere from a few hours to several days, depending on the lender. After submission, keep an eye on communication from the lender for updates or requests for additional information.

Managing your emergency loan

Once you've secured your emergency loan, effective management becomes crucial. Creating a repayment plan immediately after receiving the funds can help prevent financial strain later.

Using platforms like pdfFiller, you can easily edit, sign, and collaborate on your loan documents online. This capability ensures you stay organized, especially during repayment.

Frequently asked questions (FAQs) on emergency loan applications

Navigating the emergency loan application process can raise numerous questions. Here are some common inquiries and their answers.

Interactive tools and resources available at pdfFiller

To ease the application process, pdfFiller offers a range of interactive tools and resources to assist with documentation. Users can create custom applications and utilize editing tools to fill out forms directly.

These resources can take the stress out of managing paperwork during a financial crisis.

Insights on the future of emergency loans

The landscape of emergency loans is evolving. With advances in technology, lenders are streamlining the application process, enabling faster funding options. Digital platforms are facilitating greater access to funding for those in need.

As technology continues to play a significant role, we can expect improvements in underwriting processes and the use of AI in evaluating loan applications. Such trends indicate a brighter future for those requiring assistance in times of financial hardship.

Testimonials and user experiences

Real-life stories can provide insight into the effectiveness of emergency loans. Many individuals have successfully navigated their financial crises thanks to timely assistance.

For instance, a family may have faced a significant medical expense with mounting debts. Thanks to an emergency loan, they were able to pay for surgery without endangering their family's financial stability. Such experiences underscore the critical role of emergency loans in offering relief during hardship. Platforms like pdfFiller have also simplified their paperwork process, allowing for quicker approvals and easier document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my emergency loan application in Gmail?

How do I fill out emergency loan application using my mobile device?

How do I fill out emergency loan application on an Android device?

What is emergency loan application?

Who is required to file emergency loan application?

How to fill out emergency loan application?

What is the purpose of emergency loan application?

What information must be reported on emergency loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.