Get the free White v. Equifax Information Services, LLC et alD. Nevada

Get, Create, Make and Sign white v equifax information

How to edit white v equifax information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out white v equifax information

How to fill out white v equifax information

Who needs white v equifax information?

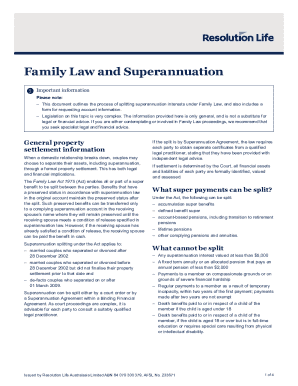

Comprehensive Guide to the White . Equifax Information Form

Overview of White . Equifax

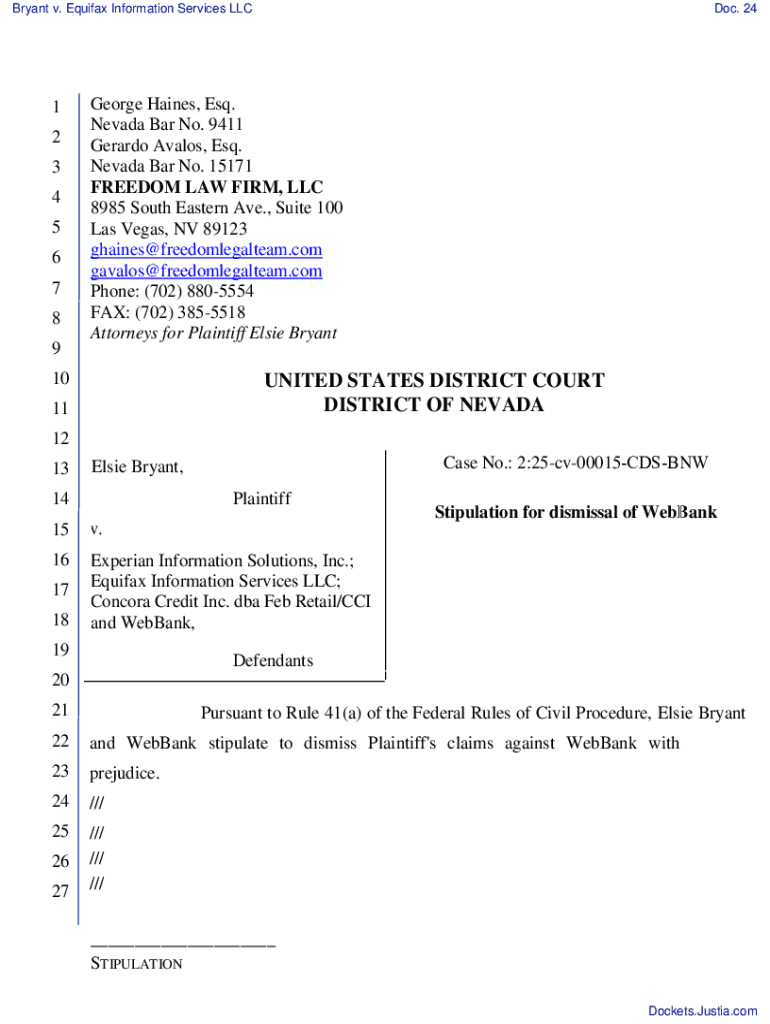

The White v. Equifax case is a significant legal battle that underscores critical issues in consumer rights and credit reporting. This case primarily revolves around allegations against Equifax, one of the largest credit reporting agencies, concerning the mishandling of personal data. As a consumer, understanding this case is fundamental, as it directly impacts how credit information is reported and the rights that consumers hold in safeguarding their financial identity.

Key facts of the lawsuit show that consumers’ personal information was allegedly compromised, raising questions about corporate responsibility in safeguarding sensitive data. The implications for consumers cannot be overstated; a victory for plaintiffs could set a precedent that enhances consumer privacy rights and fosters more accountability within the credit reporting industry.

Understanding the Information Form

The White v. Equifax information form plays a crucial role in the legal proceedings of the case. Its primary purpose is to gather detailed information from individuals who were impacted, essentially documenting their experiences related to Equifax's data handling practices.

This information is vital for the court to assess the extent of harm caused and to ensure that affected consumers receive appropriate remedies. By filling out the form accurately, individuals actively assert their rights as consumers and contribute to the collective pursuit of justice.

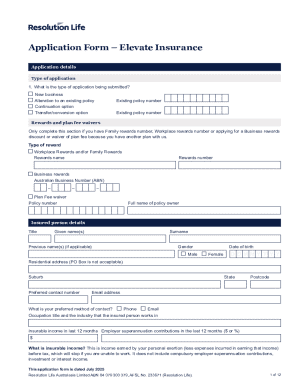

Accessing the White . Equifax Information Form

Locating the White v. Equifax information form is straightforward, with several official channels available for access. The form is typically hosted on legal websites and resources dedicated to the case, ensuring clarity and accessibility.

Utilizing pdfFiller allows users to download or edit the form directly in the cloud, facilitating a hassle-free user experience.

Compatibility of formats

When handling the White v. Equifax information form, it's essential to consider the format for best results. Generally, the form will be available in PDF format, which is favored for its universality and ease of use.

However, if users need to edit or fill in details, choosing a compatible file type is crucial. PDF documents are widely accepted for submission, making it the ideal choice. While there are alternative formats such as DOCX and TXT, they often lose the form's layout and essential features.

Step-by-step guide to completing the form

Completing the White v. Equifax information form accurately is key to ensuring your submission is effective. Each section of the form must be approached with careful attention to detail.

Ensure all details are accurately filled out to avoid processing delays. Common mistakes include typographical errors or missing sections, which can hinder the form's acceptance.

Tips for accurate data entry

Providing accurate contact information on the White v. Equifax information form is crucial for effective communication. Inaccuracies can lead to delays or a lack of response from the court. To minimize mistakes, consider these tips.

Adhering to these strategies promotes accuracy, significantly enhancing the likelihood of a smooth submission process.

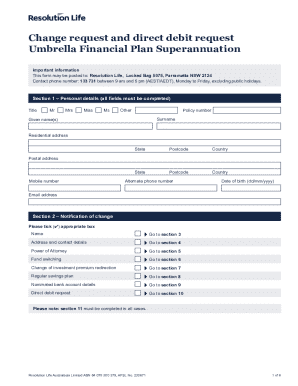

Interactive tools for managing your form

pdfFiller offers a variety of interactive tools that simplify the process of managing your White v. Equifax information form. Its editing functions allow users to make necessary revisions quickly.

These tools enhance communication, making it easy to work collaboratively with stakeholders involved in the submission process.

Signing and sharing the form

Once you have completed the White v. Equifax information form, signing it is the next critical step. pdfFiller offers a secure eSigning feature, which simplifies this process.

These features streamline the process, allowing for efficient communication and collaboration throughout the case.

Submitting the White . Equifax Information Form

Filing the White v. Equifax information form correctly is essential for ensuring that your input is considered in the ongoing legal proceedings. Generally, submissions can be made electronically or via mail, depending on the court’s requirements.

Timely and correct submissions not only enhance your role as a claimant but also contribute significantly to the collective case against Equifax.

Tracking your submission

After submitting the White v. Equifax information form, tracking its status is vital for peace of mind and to assess the potential outcome. Monitoring your submission ensures there are no unforeseen delays.

These actions ensure that you remain informed throughout the process, allowing you to follow up as necessary.

Frequently asked questions (FAQs)

Engaging with the White v. Equifax information form may lead to several questions regarding its purpose and the legal terminology involved. Understanding these facets is essential for effective participation.

These common concerns can be clarified further through legal resources available at pdfFiller and by engaging with legal professionals who specialize in consumer rights.

Support resources available

Several support resources are available for individuals facing challenges while completing the White v. Equifax information form. From online forums to direct legal assistance, the options are extensive.

Using these resources can empower individuals to navigate the complexities of legal documentation with confidence.

Case impact and future implications

The outcome of the White v. Equifax case has far-reaching effects on consumer rights across the board. A ruling in favor of the plaintiffs could prompt shifts in how credit reporting agencies operate and interact with consumers.

These potential changes highlight the importance of staying informed and engaged in discussions around consumer rights.

Staying informed on legal updates

Continuous engagement with ongoing developments in the White v. Equifax case and related issues is crucial for consumers. By staying updated, individuals can adapt to shifting legal contexts and protect their interests.

Being proactive in these areas not only keeps individuals informed but also encourages community involvement in advocating for better legal standards.

Leveraging pdfFiller for document management

pdfFiller provides an innovative cloud-based platform designed to simplify document management. The benefits of using pdfFiller for completing the White v. Equifax information form are numerous.

Choosing pdfFiller streamlines the entire process, from document creation to management, empowering individuals and teams to operate efficiently.

Success stories with pdfFiller

Many users have found success by leveraging pdfFiller’s capabilities for managing legal documents. Testimonials highlight improved workflows and greater control over the documentation process.

These success stories provide insight into how leveraging pdfFiller can benefit anyone managing forms like the White v. Equifax information form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my white v equifax information in Gmail?

How do I make changes in white v equifax information?

Can I create an electronic signature for the white v equifax information in Chrome?

What is white v equifax information?

Who is required to file white v equifax information?

How to fill out white v equifax information?

What is the purpose of white v equifax information?

What information must be reported on white v equifax information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.