Get the free MUN-Directors: Return the complete - thehague thimun

Get, Create, Make and Sign mun-directors return form complete

Editing mun-directors return form complete online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mun-directors return form complete

How to fill out mun-directors return form complete

Who needs mun-directors return form complete?

Understanding and Completing the Mun-Directors Return Form: A Comprehensive Guide

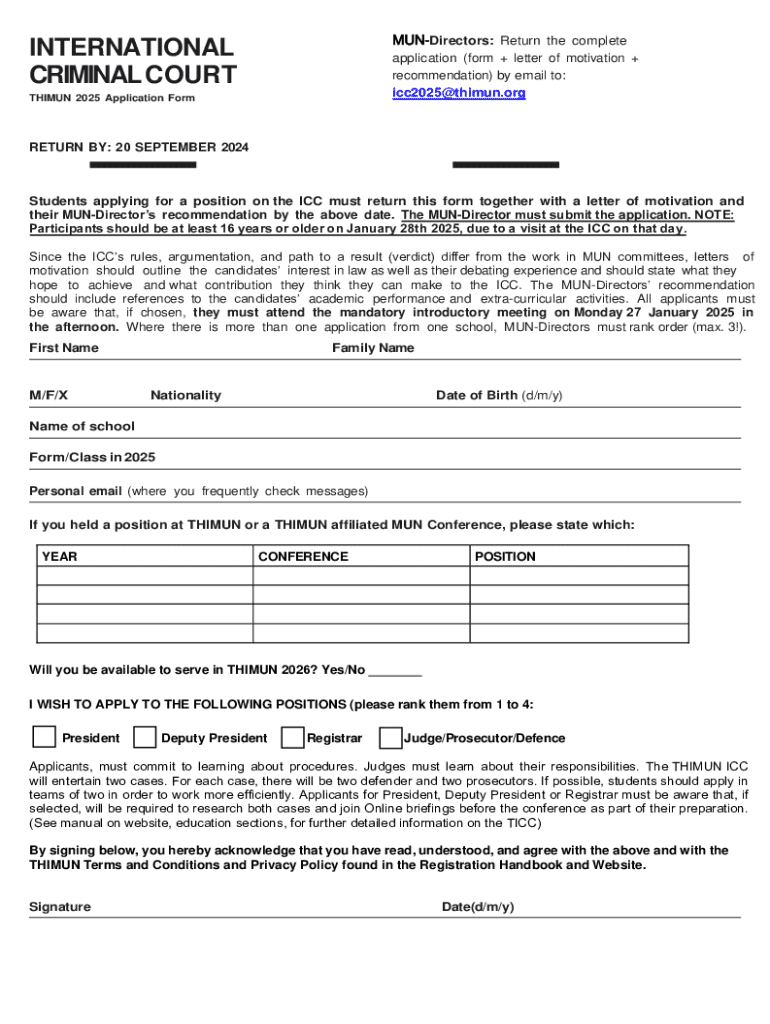

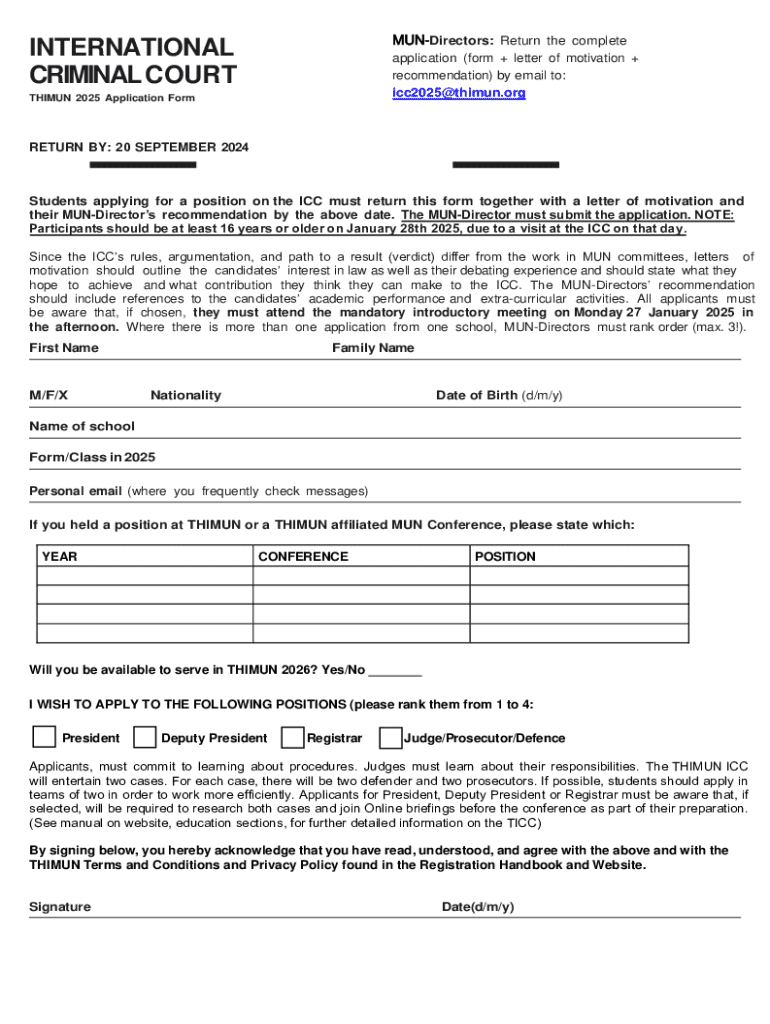

Understanding the mun-directors return form

The mun-directors return form is a crucial document for individuals and organizations involved in managing municipal operations. This form serves to report financial activities to ensure compliance with income tax regulations. The primary purpose is to summarize income and expenses, allowing for correct tax returns and accountability in financial reporting.

Typically, any business, nonprofit organization, or government entity operating within specified jurisdictions must complete this form. Understanding who needs to fill out this form is vital for ensuring that correct parties submit accurate information to avoid penalties.

Key terms such as 'net income,' 'deductions,' and 'tax credits' are fundamental when navigating the mun-directors return form. Familiarizing yourself with these concepts will assist in accurate reporting and compliance.

Preparing to fill out the mun-directors return form

Before diving into the mun-directors return form, gather essential documents and information. Start by ensuring that you have suitable identification, like a government-issued ID, which is necessary for verifying your identity during the submission process.

In addition to identification, collecting financial records is vital. You will need a summary of your income, any invoices related to your operations, and previous tax returns for reference. This information provides context for your current income tax return and may help substantiate your claims when reporting deductions.

Common pitfalls include overlooking required fields, misreporting income, or failing to provide supporting documentation. Ensuring you have all necessary information organized will streamline the process and reduce errors.

Step-by-step instructions to complete the form

1. Accessing the form

To start, locate the mun-directors return form. This form can typically be found on the official taxation authority's website or through pdfFiller, which offers both online access and the option to download the form for offline completion. Utilizing an online platform can facilitate easier editing and ensure you have the latest version of the form.

2. Filling out personal information

Begin by inputting your personal details, including your name, address, and contact information. It's essential to provide accurate and complete information, as discrepancies can lead to delays in processing or tax penalties.

3. Reporting income and expenses

When detailing your financial situation, categorize your income carefully. This could include various streams of revenue generated by your organization or business. Document expenses incurred in your operations accurately, noting common deductions like operating costs or salaries.

An effective format involves breaking down all income and expenses into clear categories. You might find it helpful to maintain a consistent structure, making it easy to track your financial information at a glance.

4. Understanding tax obligations

Once your income and expenses are documented, it’s time to understand your tax obligations. Familiarize yourself with the applicable tax rates for your province, such as Newfoundland, as they can vary widely based on location and the nature of your business activities.

Calculating total taxes owed or potential refunds involves a straightforward deduction of your total expenses from your total income, with applicable tax rates applied to the resultant figure. Don’t hesitate to consult with a tax professional to ensure accuracy in this area.

5. Finalizing your submission

Before submitting the form, double-check for any errors or inconsistencies. Make sure all required fields are completed accurately. If you are using pdfFiller, you can electronically sign and date the form, which greatly simplifies the submission.

Ensure that you are aware of submission deadlines to avoid potential late fees; timing is paramount in successfully navigating the tax return process.

Editing and managing your mun-directors return form

pdfFiller serves as an excellent tool for managing your mun-directors return form. The platform allows for straightforward editing, enabling you to update fields as necessary. When using the PDF editor, you can also add comments or notes for your records, which is particularly useful for clarifying any complex entries.

Signing and securing your document

The eSign features available on pdfFiller provide a secure way to finalize your document. Best practices for document security include ensuring your information is accessible only to authorized individuals and using encrypted channels whenever sharing sensitive documents.

Collaborating with team members

If multiple individuals need to contribute to the completion of the mun-directors return form, consider sharing the document via pdfFiller. You can invite collaborators, allowing for real-time input and dialogue, which can lead to a more comprehensive and accurate submission.

Tracking changes and managing versions

pdfFiller makes it simple to access previous versions of your document, enhancing your ability to keep track of changes made by different collaborators. The comparison tools allow you to review edits and feedback, streamlining the approval process.

Frequently asked questions about the mun-directors return form

Mistakes happen, and it can be concerning. If you discover an error after submission, you may need to amend your return, depending on the nature of the mistake. Consulting with a tax expert can provide direct guidance on the best steps to take.

If you need a copy of your submitted form, this can usually be obtained through your local tax authority's online portal. Additionally, community forums and user groups may offer insights on where to locate such documentation.

Confirmation of submissions is vital. If you don’t receive a confirmation, it's advisable to check your spam folder. If there's no record of confirmation, consider revisiting the tax authority's site or reaching out to customer support.

Accessing support and additional help

For those experiencing difficulties with the mun-directors return form, pdfFiller provides robust customer support options. Engaging with the help and FAQ section on the pdfFiller website can also yield valuable insights and solutions to common issues.

Additionally, community forums and user groups can serve as excellent resources. These platforms often have collective wisdom on various challenges, providing practical, user-driven solutions.

Leveraging pdfFiller for document management

Utilizing pdfFiller for the mun-directors return form offers numerous features designed to facilitate document creation and management. The platform's cloud-based structure means you can access your documents from anywhere, enhancing workflow efficiency.

Significantly enhance your document workflows by employing pdfFiller's collaborative tools. When managing multiple forms or documents, these features not only save time but also help ensure the accuracy and integrity of your submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mun-directors return form complete from Google Drive?

How can I send mun-directors return form complete for eSignature?

How do I edit mun-directors return form complete in Chrome?

What is mun-directors return form complete?

Who is required to file mun-directors return form complete?

How to fill out mun-directors return form complete?

What is the purpose of mun-directors return form complete?

What information must be reported on mun-directors return form complete?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.