Get the free Borrowers Certification and Authorization Form - Fill Online ...

Get, Create, Make and Sign borrowers certification and authorization

Editing borrowers certification and authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out borrowers certification and authorization

How to fill out borrowers certification and authorization

Who needs borrowers certification and authorization?

Understanding Your Borrowers Certification and Authorization Form

Understanding the Borrowers Certification and Authorization Form

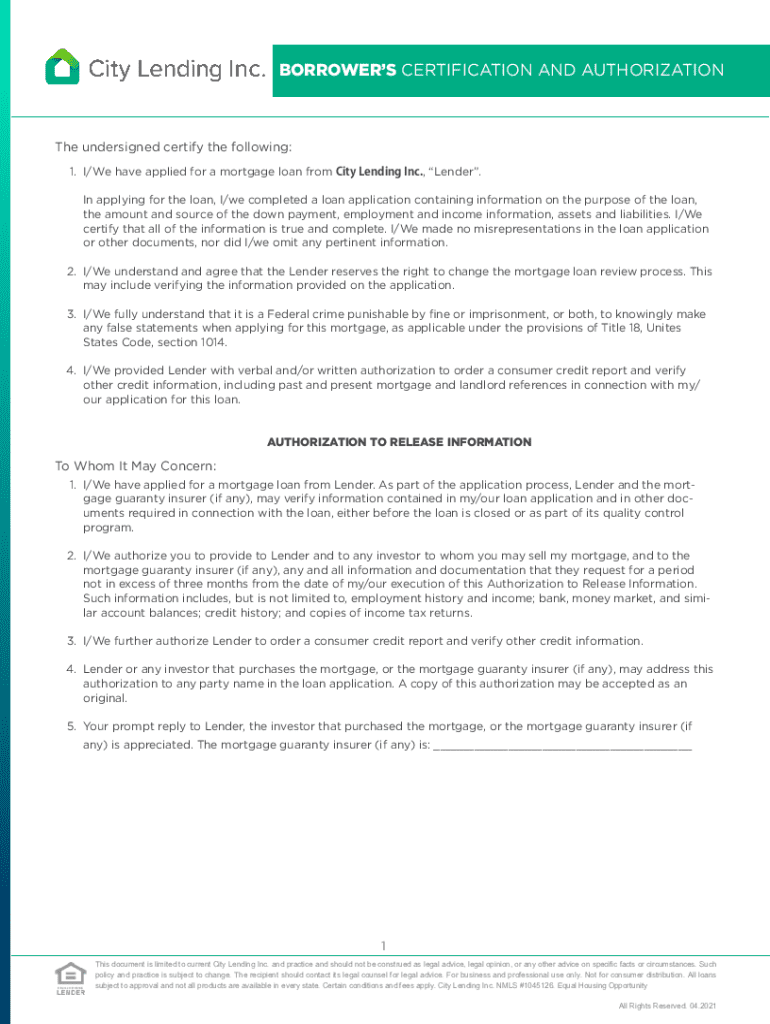

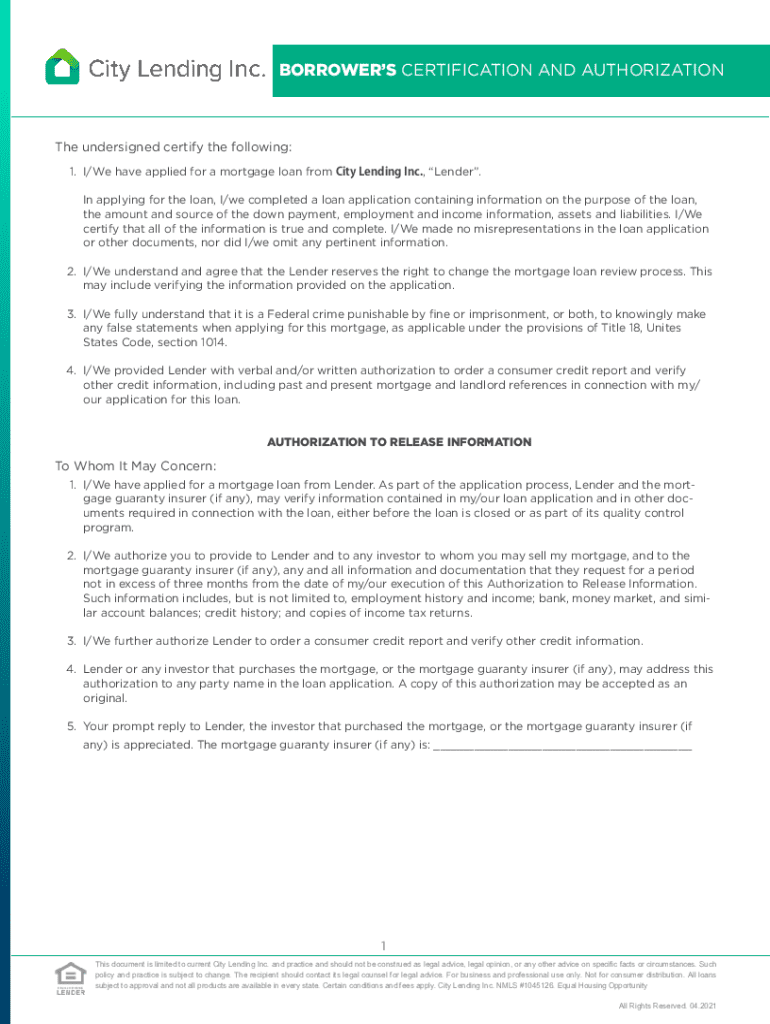

The Borrowers Certification and Authorization Form is a crucial document required during the borrowing process. Essentially, it serves as a formal declaration by potential borrowers, affirming the accuracy of their information and granting permission to lenders to access necessary financial data. This form streamlines the loan approval process, ensuring that lenders can verify the borrower's credentials quickly and with confidence.

In the world of lending, this form plays a pivotal role. It not only protects the interests of lenders by safeguarding against potential fraud but also facilitates a smoother process for borrowers by expediting background checks. With the increasing digitization of financial transactions, understanding this form is indispensable for anyone looking to secure a loan.

Key components of the form

The Borrowers Certification and Authorization Form generally includes several key sections. These typically encompass:

The significance of certification and authorization in borrowing

Certification is a term that reflects the borrower's promise regarding the accuracy of the information they provide. It's essential for lenders as it offers assurance that they're working with reliable data. This certification carries legal weight; if a borrower submits false information, they could face severe penalties, including denial of the loan or criminal charges for fraud.

Authorization, on the other hand, is the act of granting lenders the right to request and review the borrower's financial information. This is critical because it allows lenders to perform due diligence, verifying claims made by the borrower. A comprehensive review of a borrower’s financial history ensures that lenders are making informed decisions and reduces the risk of default.

Step-by-step guide on filling out the Borrowers Certification and Authorization Form

Filling out the Borrowers Certification and Authorization Form might seem daunting at first; however, with a structured approach, it can be quite manageable. Here's a step-by-step guide to assist you through the process.

Collecting required information

Before you start filling out the form, gather the necessary information to ensure a smooth completion. You will typically require:

Completing the form: Section-by-section breakdown

Breaking down the form section by section can simplify the process:

Tools and features for simplifying the form completion process

Using pdfFiller can significantly streamline the process of completing your Borrowers Certification and Authorization Form. This platform offers various resources that can make your experience more efficient and effective.

Using pdfFiller to edit your form

One of the standout features of pdfFiller is its ability to effortlessly edit PDFs. With user-friendly tools, borrowers can modify any section of the form, ensuring all information is accurate.

eSigning your Borrowers Certification and Authorization Form

The platform allows you to electronically sign your forms, which is not only convenient but also legally binding. Using pdfFiller's step-by-step guide for eSigning makes this process straightforward.

Collaboration features for teams

For teams involved in the borrowing process, pdfFiller offers collaboration features. This allows multiple users to work on the document simultaneously, enhancing efficiency and ensuring everyone is on the same page.

Common mistakes to avoid when completing your Borrowers Certification and Authorization Form

Completing the Borrowers Certification and Authorization Form correctly is crucial to avoid delays or issues in your loan application. Here are some common mistakes to avoid:

Managing your Borrowers Certification and Authorization Form after completion

Once the Borrowers Certification and Authorization Form is completed, proper management of this document is essential for security and efficiency.

Storing your document securely

Utilizing cloud storage options available through pdfFiller allows you to securely store your form while keeping it easily accessible. This protects your personal information while ensuring you can retrieve it quickly when needed.

Sharing your completed form with lenders

When it's time to share your finished form with lenders, ensure you're using secure methods. pdfFiller facilitates secure sharing options, giving you peace of mind that your data remains protected.

Tracking the status of your form

Keeping track of your Borrowers Certification and Authorization Form is simple with pdfFiller's tracking features. You can monitor responses and feedback from lenders, allowing for timely follow-ups where necessary.

FAQs about Borrowers Certification and Authorization Form

It's common to have questions about the Borrowers Certification and Authorization Form. Here are some frequently asked questions and answers:

Additional assistance for borrowers

Should you require further clarity regarding your Borrowers Certification and Authorization Form, contacting your lender is a wise choice. They're there to assist you and can explain any uncertainties about the form.

When to seek professional advice

If the process seems overwhelming or if you are unsure about specific legal terms within the form, seeking professional financial advice could be beneficial. It's crucial to have a clear understanding of your obligations and rights before proceeding.

Interactive features of the Borrowers Certification and Authorization Form

The Borrowers Certification and Authorization Form comes with various interactive features, especially when managed through pdfFiller.

Utilizing pdfFiller's interactive tools

These tools enhance user experience by allowing for easy navigation and modifications. Features like form fields, clickable checkboxes, and prompts help users complete the document with clarity and confidence.

Real-time collaboration capabilities

For teams managing loans or multiple applications, the ability to collaborate in real-time is a game-changer. This function allows for efficient teamwork and reduces the likelihood of miscommunication.

Mobile access to your documents

With pdfFiller, users can manage their Borrowers Certification and Authorization Form from anywhere, thanks to mobile access capabilities. This flexibility ensures that you can work on your document when it is convenient for you, whether at home or on the go.

Utilizing a reliable document management platform like pdfFiller not only simplifies the completion of your Borrowers Certification and Authorization Form but also enhances your efficiency in the borrowing process. Having access to editing, eSigning, collaboration tools, and mobile management capabilities is invaluable for individuals and teams alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send borrowers certification and authorization for eSignature?

How do I complete borrowers certification and authorization online?

How do I edit borrowers certification and authorization straight from my smartphone?

What is borrowers certification and authorization?

Who is required to file borrowers certification and authorization?

How to fill out borrowers certification and authorization?

What is the purpose of borrowers certification and authorization?

What information must be reported on borrowers certification and authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.