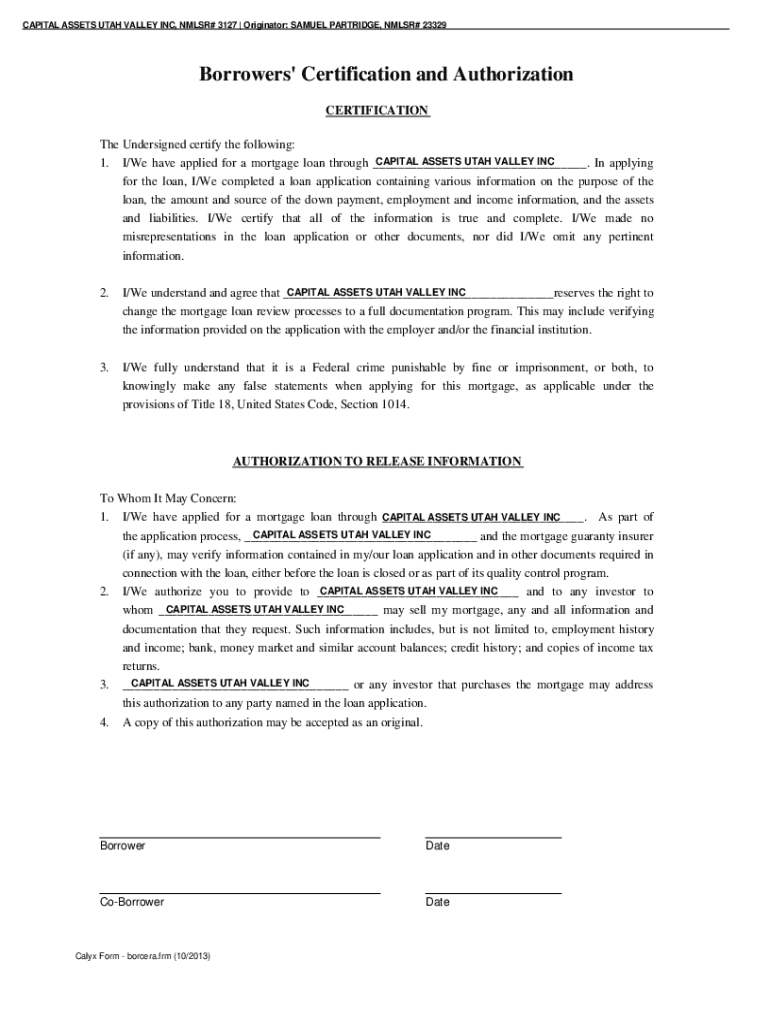

Get the free Capital Assets Utah Valley - Reviews, Photos & Phone ...

Get, Create, Make and Sign capital assets utah valley

Editing capital assets utah valley online

Uncompromising security for your PDF editing and eSignature needs

How to fill out capital assets utah valley

How to fill out capital assets utah valley

Who needs capital assets utah valley?

Capital Assets Utah Valley Form: How-to Guide

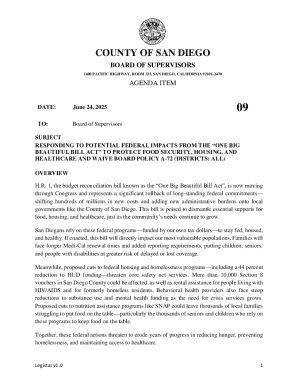

Understanding capital assets and their importance in Utah Valley

Capital assets are long-term resources that a business or organization owns, which are essential for generating revenue. These might include land, buildings, machinery, and equipment. In Utah Valley, capital assets play a crucial role in economic growth, contributing to the local economy of cities like Provo, Orem, and Lehi. Their management can significantly affect a business's financial health and operational efficiency.

Local regulations in Utah Valley impose specific requirements for capital asset reporting. It's vital to understand these stipulations to maintain compliance and ensure accurate financial reporting. Proper management of capital assets also enhances accountability, as it allows businesses to track ownership and depreciation accurately, thereby fostering trust among stakeholders in the region.

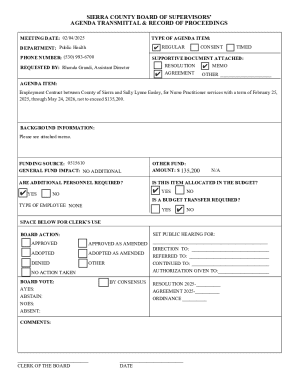

Overview of the Capital Assets Utah Valley Form

The Capital Assets Utah Valley Form serves a distinct purpose: it’s designed to document, classify, and track various capital assets held by businesses and organizations within the valley. This form is particularly essential for those seeking to maintain compliance with local regulations, facilitate audits, or assess their financial standings.

Situations that necessitate the form include annual fiscal audits, application for grants, or internal reviews of asset management. Stakeholders involved in the submission process typically include finance teams, auditors, and departmental heads who need to verify and validate the information recorded in the form.

Step-by-step guide to filling out the Capital Assets Form

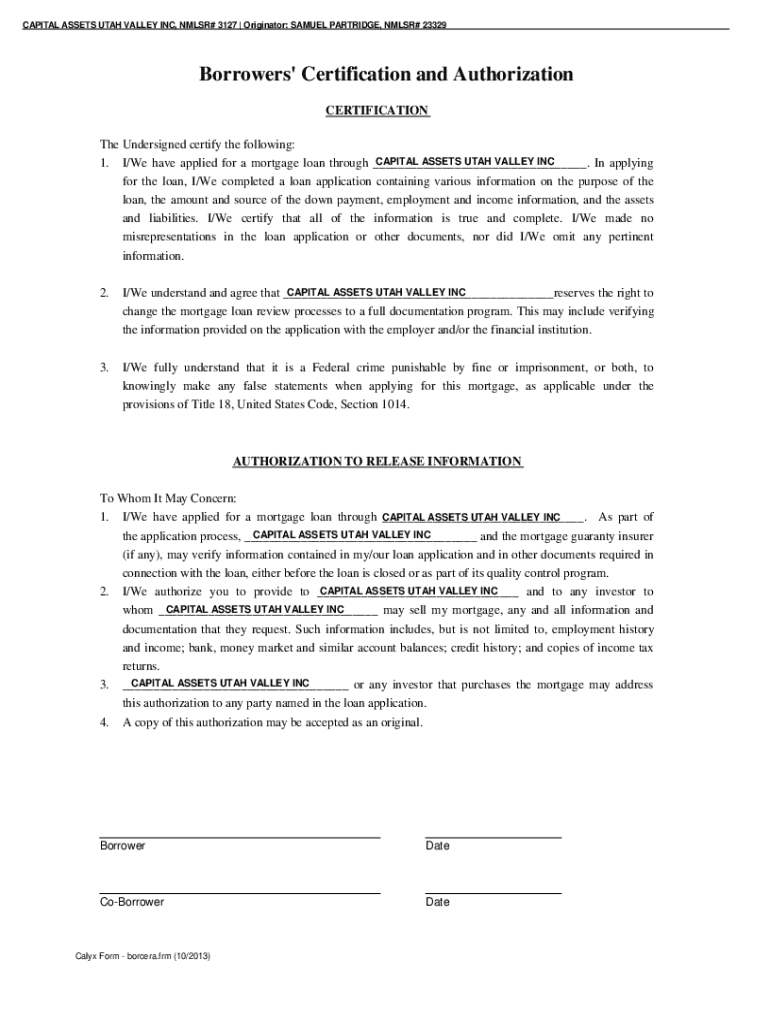

Filling out the Capital Assets Utah Valley Form requires careful attention to detail to ensure accuracy and compliance. The essential information required includes personal identification and comprehensive descriptions of each asset.

Here's how to fill out each section of the form:

Editing and customizing the Capital Assets Utah Valley Form

To enhance the usability and clarity of the Capital Assets Utah Valley Form, pdfFiller provides various editing tools. Users can easily add annotations and comments directly onto the form, which is especially helpful for collaborative efforts among finance teams based in cities like Pleasant Grove or Richmond.

Moreover, merging forms or documents can streamline the process. Here are some tips for making your document work efficiently:

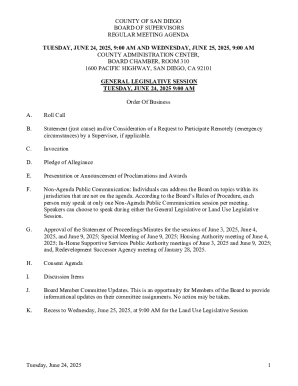

Signing and submitting the form digitally

Digital signatures have gained popularity in Utah Valley due to their efficiency and convenience. eSigning the Capital Assets Utah Valley Form is a straightforward process that offers time-saving benefits, especially for busy professionals.

The eSigning process involves the following steps:

Once signed, it’s crucial to adhere to submission guidelines, ensuring that the form is directed to the appropriate authority. Familiarize yourself with deadlines to avoid any compliance issues.

Managing and storing capital assets records securely

Organizing your capital assets documentation is vital for efficient asset management. Best practices include maintaining a clear naming convention for electronic documents and ensuring that access is restricted to authorized personnel only.

Utilizing pdfFiller for centralized access aids in seamless document management. The platform offers robust cloud storage solutions, allowing teams from areas such as SLC and Wallsburg to collaborate effectively, regardless of their physical location.

Common challenges and solutions in capital asset management

Errors in reporting are a common challenge faced by organizations handling capital assets. These can lead to significant discrepancies in financial statements and audits. To avoid such issues, thorough verification of the provided information is essential before submission.

Another challenge is dealing with missing information. Procedures for addressing incomplete data must be clearly outlined, including notification of stakeholders to obtain the necessary details promptly. Additionally, staying abreast of regulatory changes in Utah is imperative for compliance and effective asset management.

FAQs about the Capital Assets Utah Valley Form

Addressing common queries can assist users navigating the Capital Assets Utah Valley Form. Here are some frequently asked questions:

Leveraging pdfFiller for your document needs

pdfFiller stands out in the realm of document management solutions thanks to its unique features that cater specifically to the needs of business professionals in Utah Valley. Collaborative editing and real-time feedback ensure that teams can work together effectively, regardless of their locations.

Moreover, pdfFiller seamlessly integrates with other software tools, enhancing workflow connectivity for users in diverse environments. Customer testimonials highlight the platform's ability to simplify tedious documentation processes, turning struggles into efficient practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the capital assets utah valley in Chrome?

How do I fill out the capital assets utah valley form on my smartphone?

How do I fill out capital assets utah valley on an Android device?

What is capital assets utah valley?

Who is required to file capital assets utah valley?

How to fill out capital assets utah valley?

What is the purpose of capital assets utah valley?

What information must be reported on capital assets utah valley?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.