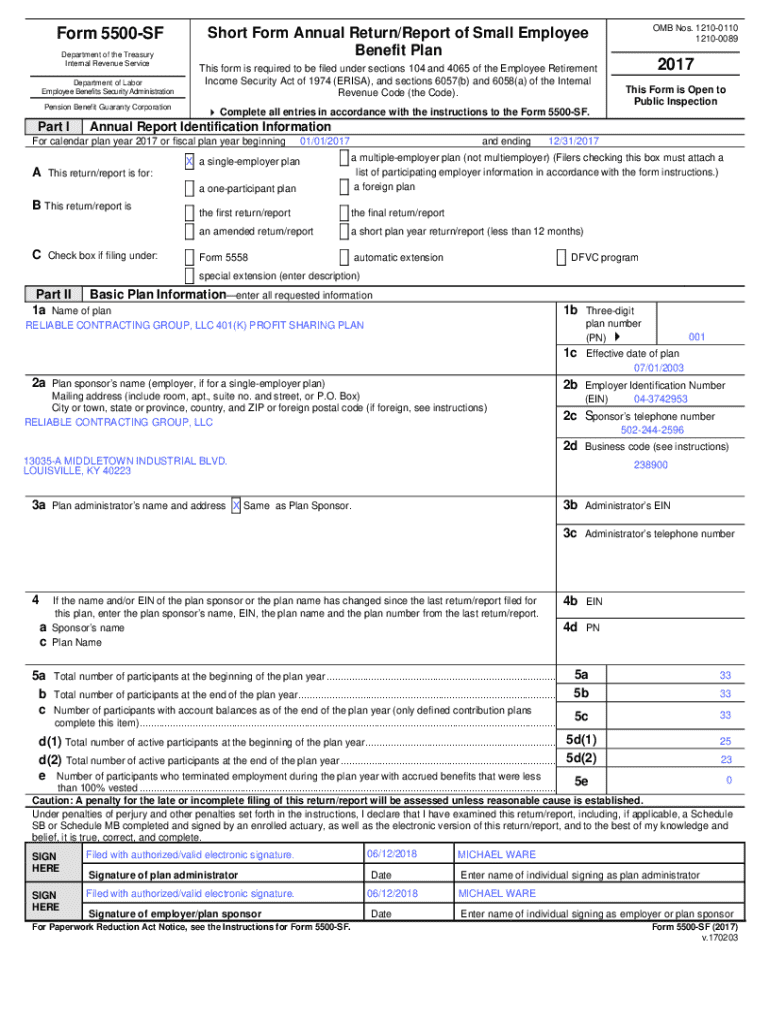

Get the free Form 5500-SF 2017

Get, Create, Make and Sign form 5500-sf 2017

Editing form 5500-sf 2017 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5500-sf 2017

How to fill out form 5500-sf 2017

Who needs form 5500-sf 2017?

Form 5500-SF 2017: A Comprehensive Guide

Understanding Form 5500-SF 2017

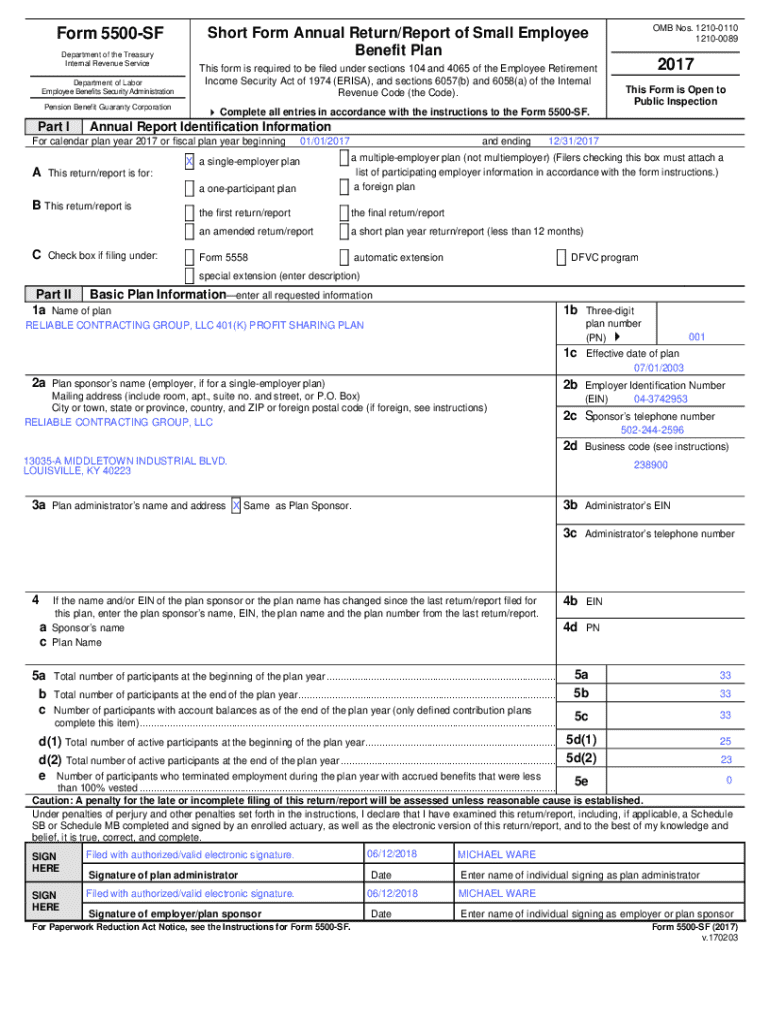

Form 5500-SF is a streamlined version of the Form 5500 used for compliance reporting by pension and health plans in the United States. The form primarily serves the purpose of providing the federal government, particularly the Department of Labor, with vital information about a plan’s financial condition, investments, and operations. By using Form 5500-SF, smaller plans can reduce their compliance burden while ensuring that they meet the necessary regulatory obligations.

The significance of Form 5500-SF lies in its role in safeguarding the interests of plan participants and beneficiaries. By ensuring that organizations report accurate and timely information, it helps maintain transparency in retirement and welfare plans, thereby promoting trust in the U.S. benefits system.

Who needs to file?

Eligibility to file Form 5500-SF is primarily dictated by the size and type of the plan. This form is primarily for smaller retirement plans, specifically those with fewer than 100 participants on the first day of the plan year. Organizations that sponsor such plans must file Form 5500-SF in lieu of the standard Form 5500. Moreover, plans that are fully insured and meet certain criteria regarding the number of participants often qualify for this simplified filing.

Key features of Form 5500-SF 2017

The structure of Form 5500-SF is designed for user-friendliness. It consists of several essential sections where filers must provide specific information. The form starts with basic plan information followed by sections detailing financial data and service provider information. This streamlined approach facilitates easier data entry and comprehension for smaller organizations.

A key difference between Form 5500 and Form 5500-SF lies in the complexity of the data requested. Form 5500 requires comprehensive reporting, while Form 5500-SF focuses on the essential elements necessary for compliance without overwhelming smaller plan sponsors with extraneous details.

Filing requirements for Form 5500-SF 2017

Organizations must adhere to specific deadlines when filing Form 5500-SF. The standard filing deadline is the last day of the seventh month following the end of the plan year. For example, if a plan year ends on December 31, the deadline for filing would be July 31 of the following year.

In addition to understanding the deadlines, it is imperative to recognize the importance of electronic filing for Form 5500-SF. The Department of Labor mandates electronic submission through the EFAST2 system. Filers need to register for an electronic filing account and prepare to submit their completed forms through designated e-filing platforms.

Step-by-step instructions to fill out Form 5500-SF 2017

Before beginning to fill out Form 5500-SF, it is essential to prepare by gathering the necessary documentation. Required financial records include a summary of the plan’s assets, liabilities, and any additional information that determines the plan’s financial health. Furthermore, details from service providers, such as custodians and any insurance companies involved, must be categorized and reported.

As you dive into the filling process, it’s recommended to follow a section-by-section guide for accuracy. Pay close attention to the basic plan information and ensure correct naming and identification of the plan. In the financial section, use reliable data to represent the plan’s current status accurately. Avoid common pitfalls, such as misreporting participant counts or neglecting to update details that may have changed since the last filing.

Utilizing pdfFiller for effortless form completion

pdfFiller enhances the form completion experience for Form 5500-SF filers. This platform provides an intuitive interface for editing PDFs, allowing users to easily enter information, modify fields, and navigate through the form in a user-friendly manner. The features available within pdfFiller, such as eSigning capabilities and collaborative tools, empower teams to work on submissions jointly, regardless of their locations.

Additionally, pdfFiller’s cloud access ensures that users can manage their forms from anywhere. This functionality is particularly valuable for organizations with remote teams, as it enables them to seamlessly contribute to document preparation and filing, ensuring every stakeholder’s input is included.

Interactive tools for Form management

Accessing the pdfFiller platform opens up a suite of features tailored specifically for managing Form 5500-SF. Users can utilize templates pre-formatted to meet compliance standards, which minimizes errors during data entry. Interactive elements allow filers to click through sections and save their progress, ensuring that every detail is accounted for before submission.

Collaborative options available on pdfFiller make it easier for teams to manage their submissions. By enabling multiple users to provide input and feedback on the form, organizations can enhance the accuracy of their filings and reduce the chances of mistakes that could lead to non-compliance.

Troubleshooting and FAQs

During the filing process, organizations may encounter common issues such as missing information, incorrect entries, or confusion regarding eligibility for filing. Knowing how to rectify such mistakes is vital to ensuring timely compliance. Should you find that you've made an error, promptly file an amended Form 5500-SF to correct any inaccuracies as soon as possible.

Frequently asked questions often revolve around misunderstandings regarding eligible plan types and what to do if the filing deadline has been missed. Plans may be exempt from filing under specific conditions, and it’s crucial to understand the factors that determine such exemptions. For those who miss deadlines, options may exist to request an extension or to file an appeal.

Additional information and assistance

Should assistance be required during the filing process, support is available through multiple channels. The Department of Labor offers contact information for inquiries related to Form 5500-SF. In addition, various helplines and online resources can provide guidance, particularly as they relate to specific cases or unique scenarios faced by specific organizations.

For more complex cases, engaging a professional or expert in benefits compliance may be warranted. Their insights can be invaluable in navigating intricate filing requirements, especially for larger organizations or those with particular situations that fall outside typical standards.

Understanding the importance of compliance

Compliance with Form 5500-SF filing requirements is critical. Organizations that fail to file on time or provide accurate information may face penalties imposed by the Department of Labor. These penalties can result in financial repercussions and negatively affect the reputation of the organization, impacting participant trust.

On the flip side, timely and accurate filing fosters a conducive environment for plan participants and beneficiaries. It underscores the organization's commitment to transparency and responsible management of employee benefits, ultimately benefiting the organization by promoting trust and accountability.

pdfFiller advantages for document management

pdfFiller provides comprehensive document creation solutions, allowing users to seamlessly create, edit, sign, and manage documents all in one platform. With its advanced editing capabilities, users can easily tailor their Form 5500-SF filings to ensure they meet compliance standards.

Moreover, the significance of cloud access cannot be overstated in today's work environment. Users can manage their Form 5500-SF from any location with internet access, ensuring that all relevant stakeholders can contribute to the document irrespective of their geographic constraints. This flexibility is crucial for teams that rely on collaborations across different time zones.

Closing remarks on empowering your document management

Utilizing a robust document service like pdfFiller empowers users to take control of their Form 5500-SF filings with confidence. The platform's comprehensive features streamline the editing, signing, and submitting process, ensuring that users can approach compliance with ease.

By leveraging tools designed for efficiency and user-friendliness, organizations can navigate the complexities of the Form 5500-SF with assurance. This not only helps in meeting regulatory requirements but also enhances the overall experience for everyone involved in the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 5500-sf 2017 in Gmail?

How do I make edits in form 5500-sf 2017 without leaving Chrome?

How do I complete form 5500-sf 2017 on an iOS device?

What is form 5500-sf 2017?

Who is required to file form 5500-sf 2017?

How to fill out form 5500-sf 2017?

What is the purpose of form 5500-sf 2017?

What information must be reported on form 5500-sf 2017?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.