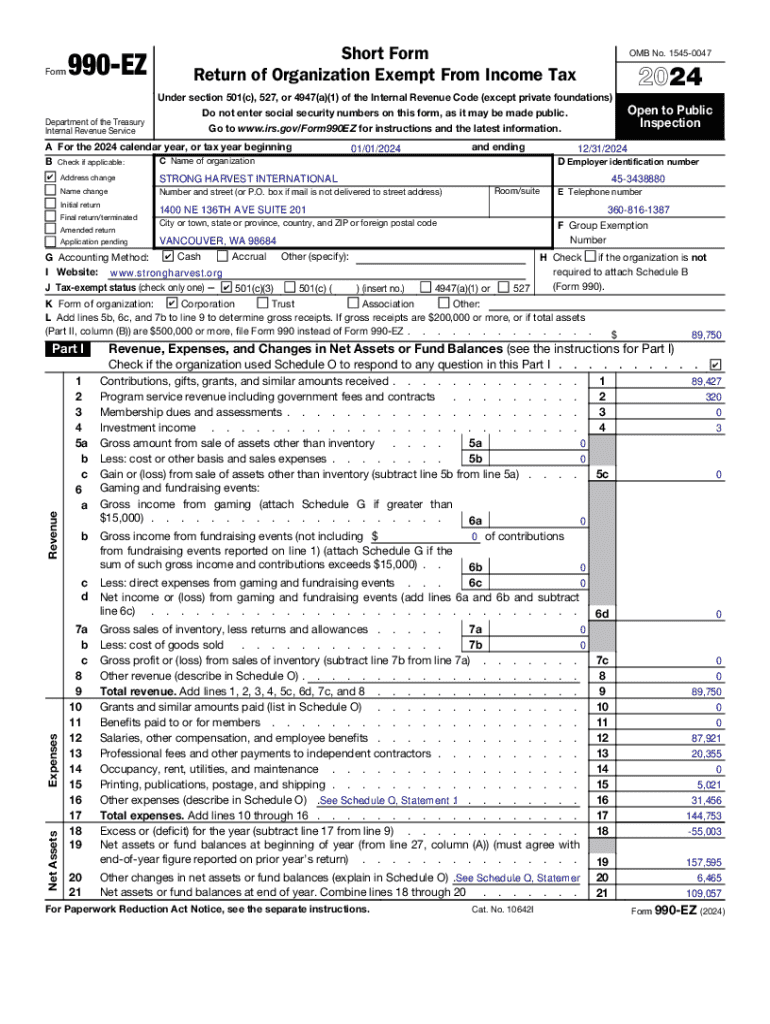

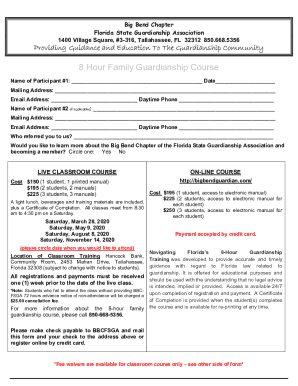

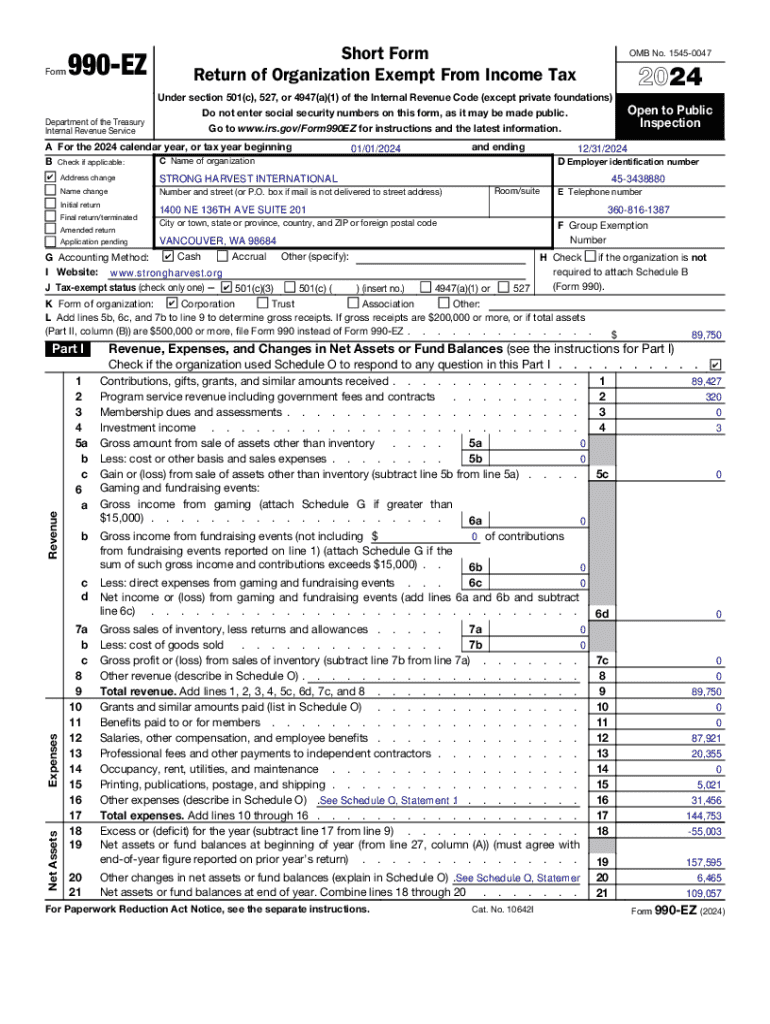

Get the free A For the 2024 calendar year, or tax year beginning

Get, Create, Make and Sign a for form 2024

How to edit a for form 2024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out a for form 2024

How to fill out a for form 2024

Who needs a for form 2024?

A comprehensive guide to the 2024 'a for' form

Understanding the 'a for' form

The 'a for' form is a critical document used primarily in various financial and regulatory contexts, addressing distinct needs across different sectors. As we move into 2024, the significance of this form has escalated, influenced by evolving regulations and the need for accuracy in data reporting. This guide aims to demystify the 'a for' form, ensuring users understand its importance and application.

Who needs to use the 'a for' form?

The 'a for' form is essential for a variety of stakeholders, including businesses, financial institutions, and individuals dealing with tax or regulatory compliance. In 2024, entities engaged in complex financial transactions or those subject to new reporting requirements will find the 'a for' form particularly relevant. Understanding who should utilize this form can help streamline compliance efforts and minimize errors.

Key features of the 2024 'a for' form

For 2024, the 'a for' form has undergone several significant updates, aimed at enhancing user experience and functionality. Notable changes include the integration of interactive features that facilitate easier data entry and more streamlined navigation through the form. These updates reflect a focus on modernizing the filing process, making it less cumbersome for users who often find traditional forms outdated.

New updates for 2024

The 2024 version of the 'a for' form introduces critical updates that users must be aware of. These changes often arise from legislative updates or feedback from user experiences in previous years. By adopting new technologies and responsive designs, the latest form helps users better manage their submissions.

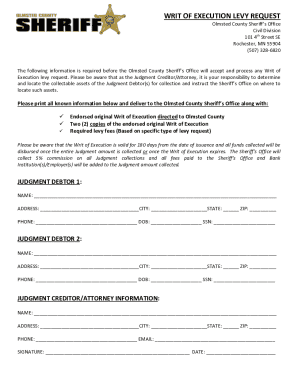

Step-by-step instructions for filling out the 'a for' form

Filling out the 'a for' form effectively requires preparation and attention to detail. Begin by gathering necessary documents, such as previous tax filings, financial records, and any relevant identification. Organizing your information can make the process smoother and reduce the likelihood of errors when entering data into the form.

Detailed walkthrough of each section

The structure of the 'a for' form is delineated into several key sections, each requiring specific information. For instance, Section 1 focuses on user information, asking for personal details such as name and contact information. Section 2 dives into financial data, where users must report revenue, expenses, and other relevant financial metrics. Lastly, Section 3 is critical for signatures and certification, ensuring that users validate the authenticity of their submissions.

Editing and customizing the 'a for' form

Once you have filled out the 'a for' form, you may need to make edits before finalizing. pdfFiller offers robust editing tools that make it easy to adjust information as needed. These tools allow users to change text, update numbers, or even shift the layout to best fit their presented data. This level of customization ensures that the form accurately reflects your circumstances before submission.

Adding digital signatures

In 2024, the inclusion of electronic signatures is vital for expediting submission processes. pdfFiller simplifies this by allowing users to add digital signatures seamlessly. By adhering to the guidelines surrounding electronic signatures, users enhance the validity and security of their submissions without the need for printing or scanning documents.

Collaborating on the 'a for' form

As teams work together on the 'a for' form, collaboration becomes key to ensuring accuracy. pdfFiller incorporates features for real-time editing, which allows multiple users to work on the form simultaneously. Leveraging these collaborative tools can help identify potential errors quickly and encourage teamwork throughout the completion process.

Submitting the 'a for' form

Understanding submission procedures for the 'a for' form is critical for timely compliance. In 2024, users should be aware of established timelines for submission to avoid penalties. Both electronic and paper submissions come with distinct advantages and disadvantages, and choosing the right method based on individual circumstances is essential.

What happens after submission?

After successfully submitting the 'a for' form, users should remain vigilant about follow-up communications. Depending on the filing context, additional documentation or clarification may be requested by authorities. By knowing what to expect post-submission, individuals can prevent unnecessary delays in processing their applications or claims.

Managing your 'a for' form after submission

Tracking the status of your 'a for' form is crucial, particularly if multiple submissions or revisions have occurred. pdfFiller provides users with tools to check their submission status, ensuring they remain informed throughout the process. Adequate management of this phase facilitates better decision-making and timely responses to any issues.

Revisions and resubmissions

After submission, there may be instances requiring users to revise their 'a for' form. pdfFiller allows for easy edits and the ability to resubmit as needed. Understanding when and how to make these changes, while being aware of respective deadlines, is crucial to remain compliant with reporting requirements.

Frequently asked questions (FAQs)

As users engage with the 'a for' form, several common issues often arise. Addressing these concerns through proactive measures can make the process smoother. Users might experience challenges around understanding specific sections or dealing with submission errors. Here, we look to categorize and provide solutions to prevalent challenges.

Expert tips for a smooth process

Navigating the 'a for' form can be challenging, but maintaining best practices can significantly ease the burden. By taking a methodical approach, users can avoid pitfalls that commonly lead to delays or complications. Best practices include thoroughly reviewing entries before submission and seeking guidance when necessary.

Additional tools and features by pdfFiller for document management

pdfFiller provides additional tools that enhance document management. Integrating the 'a for' form with other applications allows for smoother workflows. From cloud storage solutions to productivity enhancements, the platform equips users with various resources to handle documents effectively and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the a for form 2024 form on my smartphone?

How do I edit a for form 2024 on an iOS device?

How do I complete a for form 2024 on an iOS device?

What is a for form 2024?

Who is required to file a for form 2024?

How to fill out a for form 2024?

What is the purpose of a for form 2024?

What information must be reported on a for form 2024?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.