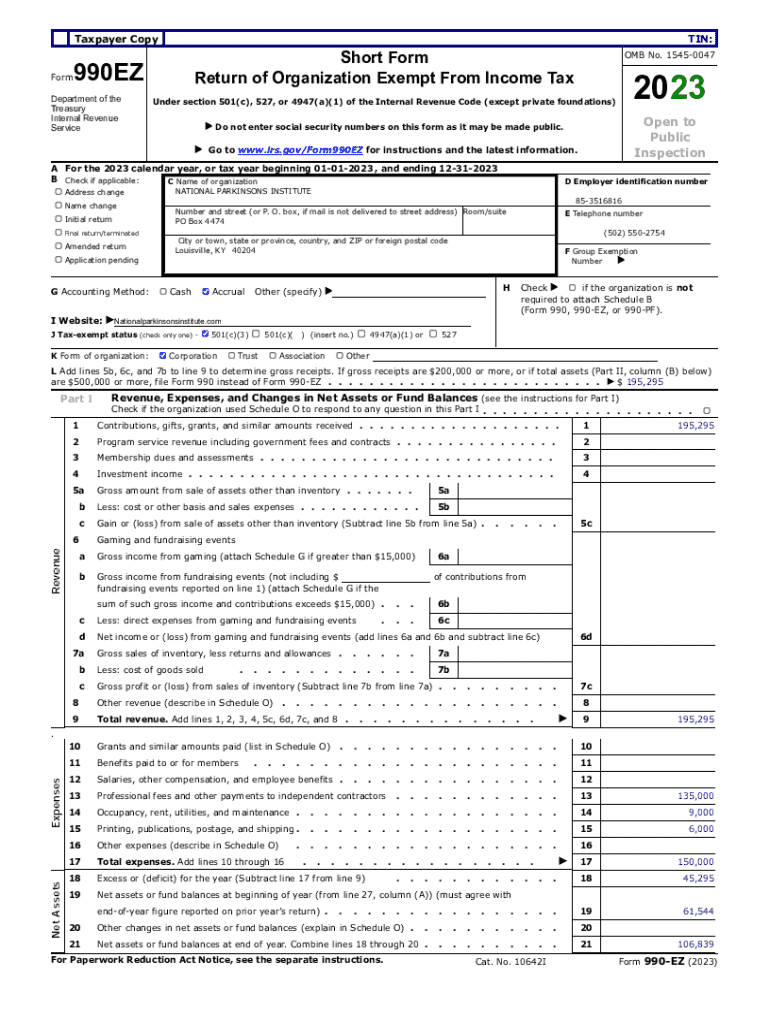

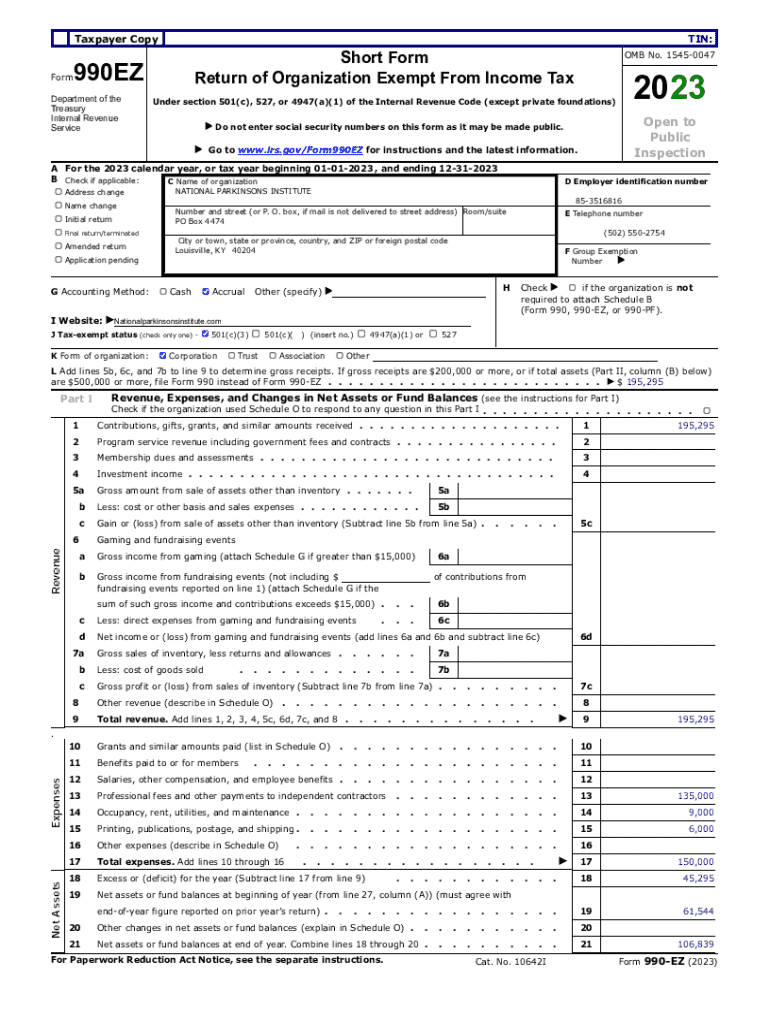

Get the free A For the 2023 calendar year, or tax year beginning 01-01-2023 , and ending 12-31-2023

Get, Create, Make and Sign a for form 2023

Editing a for form 2023 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out a for form 2023

How to fill out a for form 2023

Who needs a for form 2023?

A comprehensive guide to filling out the 2023 Form

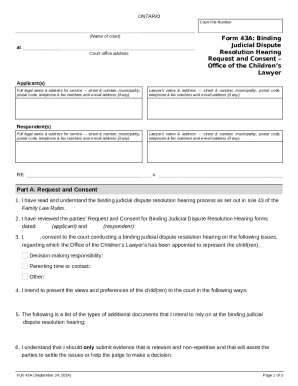

Understanding the 2023 Form

The 2023 Form serves as a critical document for individuals and teams navigating various administrative processes, particularly those related to tax filings and compliance with local regulations. This form encompasses essential data collection, ensuring that users report accurate information to remain in good standing. Its importance is underscored by the potential penalties for incorrect submissions and the ease with which accurate data can facilitate smooth transactions with government bodies.

Designed to be user-friendly, the 2023 Form includes interactive elements that enhance the overall filling experience, allowing individuals to complete it efficiently. Understanding the sections and fields within the form is vital for any user aiming to avoid common pitfalls associated with form submissions.

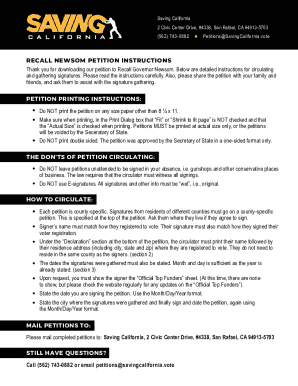

Where to find the 2023 Form

Finding the 2023 Form is straightforward and can typically be done through official government websites or authorized service providers. These sources ensure that you have the latest and most accurate version of the form, crucial for complying with any legal updates or structural changes.

Additionally, you can access templates of the 2023 Form through pdfFiller. Just follow these steps to find it:

Step-by-step instructions for filling out the 2023 Form

Before diving into the actual filling process, gathering all necessary information is crucial. Users should have ready access to financial documents, previous tax returns, and any other relevant data that would be helpful in accurately completing the form.

Here’s a detailed breakdown on filling out specific sections of the form:

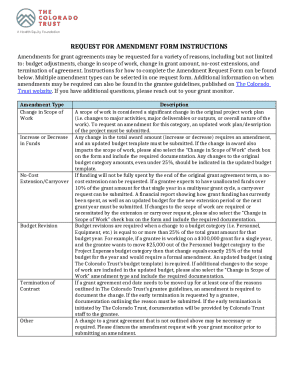

Editing the 2023 Form

Mistakes can happen when filling out a form, and that's where pdfFiller’s editing tools come into play. This platform offers various features that allow you to edit text, add images, or even import additional documents as needed. These functionalities can help streamline your workflow significantly.

If you encounter an error while completing the form, pdfFiller makes corrections straightforward. Simply navigate to the section with the mistake, edit the text, and confirm the changes were saved.

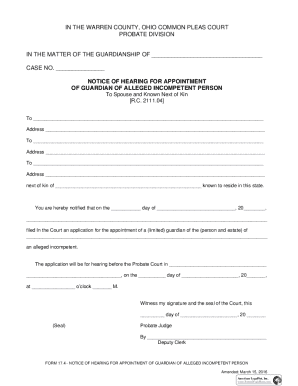

Signing the 2023 Form

Once the 2023 Form is filled out accurately, signing it is the next step. With pdfFiller, there are multiple eSignature options available that comply with legal standards. This ensures that your signature is not only valid but also secure.

To add an electronic signature using pdfFiller, follow these steps:

Submitting the 2023 Form

Submitting the completed 2023 Form can be done through various methods. Whether you opt for online submission or prefer to send a physical copy via mail, it's essential to know the correct procedures.

Also, keep an eye on important deadlines associated with the submission to avoid late penalties. Key dates typically include the filing deadline and any extensions you may need to apply for.

Managing your 2023 Form

Using pdfFiller, you have several options for managing your 2023 Form efficiently. For instance, you can save your progress at any time and store documents securely within the platform.

Additionally, if you need collaboration assistance, pdfFiller allows for document sharing among team members or advisors. Utilize these features to gather feedback or make necessary adjustments before final submission.

Troubleshooting common issues

When filling out the 2023 Form, users may encounter common issues that can be easily resolved. From data entry errors to formatting problems, understanding these issues can save time.

If technical difficulties arise while using pdfFiller, don't hesitate to access their customer support for quick assistance. Their team is equipped to address a range of troubleshooting issues to enhance your experience.

Enhancing your experience with pdfFiller

pdfFiller is not just a platform for completing forms; it offers interactive tools that significantly enhance your experience. Use features like auto-fill, templates, and eSignatures to streamline your entire document management process.

By harnessing these features, individuals and teams can enhance their productivity and ensure that they manage their documents with confidence.

FAQ section specific to the 2023 Form

Frequently asked questions often revolve around the specifics of completing and submitting the 2023 Form. Users typically seek clarity on common topics such as submission deadlines, required documents, and potential penalties for inaccuracies.

Addressing these questions not only helps users navigate their responsibilities but also alleviates some of the stress associated with form submissions.

User testimonials and case studies

Users have reported significant improvements in their document management processes after utilizing pdfFiller alongside the 2023 Form. Success stories range from individuals successfully filing their taxes without errors to organizations dramatically reducing the time spent on document turnarounds.

These real-life examples offer encouragement for new users looking to leverage pdfFiller for their 2023 Form submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in a for form 2023?

Can I create an electronic signature for the a for form 2023 in Chrome?

How do I edit a for form 2023 on an Android device?

What is a for form 2023?

Who is required to file a for form 2023?

How to fill out a for form 2023?

What is the purpose of a for form 2023?

What information must be reported on a for form 2023?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.