Get the free Form 990-EZ (2024)

Get, Create, Make and Sign form 990-ez 2024

Editing form 990-ez 2024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-ez 2024

How to fill out form 990-ez 2024

Who needs form 990-ez 2024?

Form 990-EZ 2024 Form: A Comprehensive How-to Guide

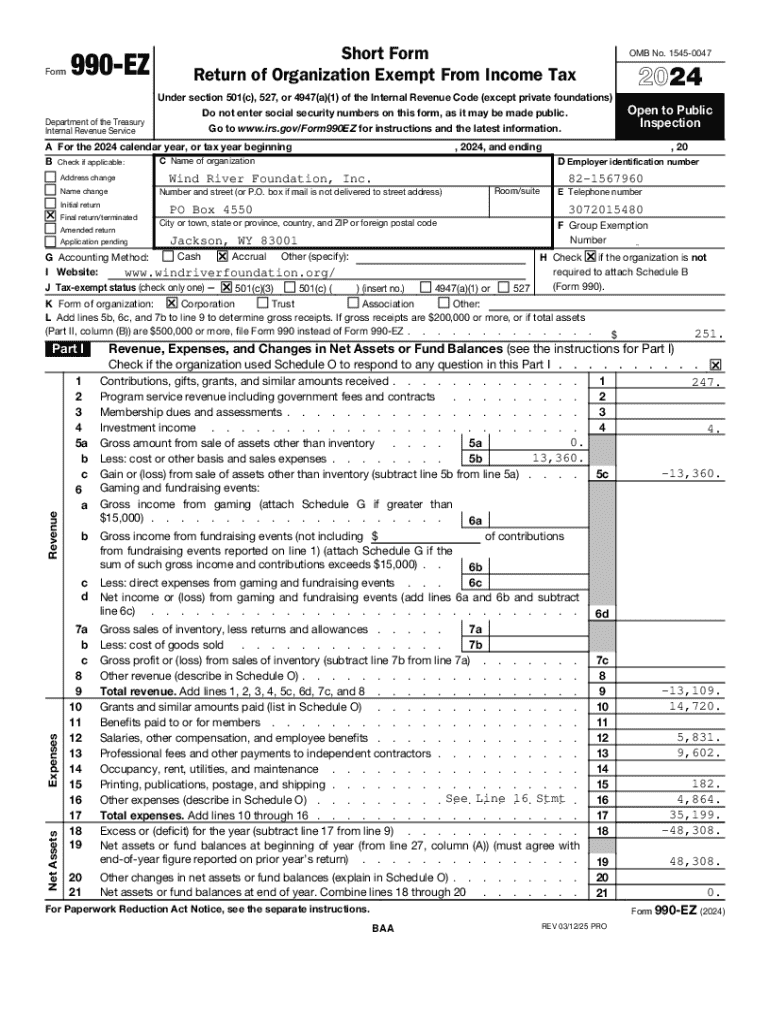

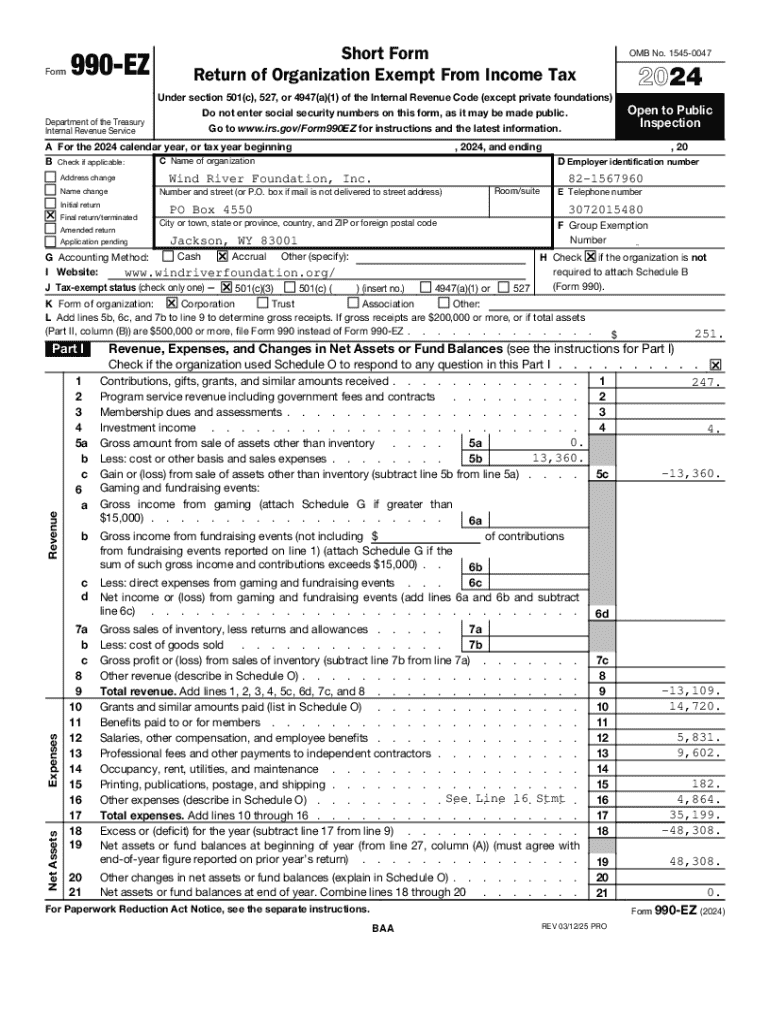

Overview of form 990-ez for 2024

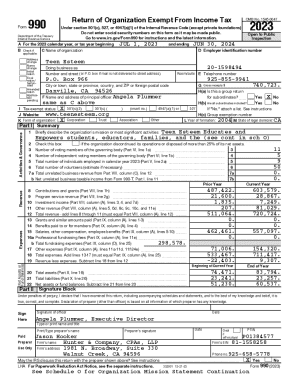

The Form 990-EZ serves as a vital instrument for tax-exempt organizations to report their financial information to the IRS. This short form is specifically designed for smaller organizations, combining efficiency with essential transparency. It provides a simplified structure for capturing information about annual revenue, expenses, and operational outcomes—formulating a comprehensive overview of the organization's financial health.

Organizations qualifying to file Form 990-EZ typically report gross receipts greater than $50,000 but less than $200,000 and have total assets below $500,000. Understanding who needs to file helps ensure compliance with IRS regulations and maintains the organization's tax-exempt status.

The 2024 version introduces important adjustments aimed at improving clarity and reflecting evolving financial environments. These modifications enhance reporting precision and facilitate better insights into organizational operations.

Essential preparation steps before filling out form 990-ez

Before diving into the completion of Form 990-EZ, it’s crucial to gather all necessary documentation. This preparatory stage ensures your submissions are thorough and reduces the likelihood of errors that could result in compliance issues. Key documents you'll need include:

Moreover, understanding your eligibility for Form 990-EZ is paramount. Common mistakes companies make include assuming eligibility based solely on organizational size without considering total assets or revenue. Therefore, ensure clear calculations of your gross receipts before proceeding.

Step-by-step instructions for completing form 990-ez

Completing Form 990-EZ entails various sections that detail the financial aspects and impact of your organization. Starting with Part I, which focuses on revenue, expenses, and changes in net assets, it's essential to provide a detailed breakdown of each line item:

In Part II, you'll need to compile a balance sheet. Clearly outline your organization’s assets and liabilities, ensuring to include current and long-term items for an accurate financial report.

Part III asks about your program service accomplishments—essentially narrating your organization's story. Use compelling examples of outputs and outcomes, clearly linking how they align with your stated mission.

In Parts IV and V, provide a list of officers, directors, and key employees, emphasizing transparency concerning compensation. Accuracy here is crucial, as any inconsistencies could lead to inquiries regarding your organization’s tax-exempt status.

Filing deadlines and important dates for 2024

For 2024, the IRS has established specific deadlines for submitting Form 990-EZ. Organizations must file the form by the 15th day of the 5th month after the end of their fiscal year, for most organizations operating on a calendar year, that translates to May 15.

Failing to meet these deadlines could impose penalties, including the loss of tax-exempt status. Additionally, late filings may attract scrutiny from the IRS, resulting in audits or further inquiries. Therefore, maintaining a calendar of critical tax filing dates is a best practice for all organizations.

Understanding electronic filing of form 990-ez

Electronic filing (e-filing) for Form 990-EZ offers numerous advantages, including faster processing times and confirmation of receipt from the IRS. Organizations can swiftly submit their completed forms, reducing paperwork burdens while enhancing accuracy.

If you decide to e-file, here's a step-by-step guide to streamline the process:

Common issues, such as technical errors or incorrect validations, can arise during e-filing. Having a reliable platform like pdfFiller helps mitigate these challenges by providing real-time feedback.

Post-filing considerations and best practices

Post-filing, it's vital to maintain organized records of your submission. Effective record-keeping not only assists with future filings but also builds a sound basis should the IRS request clarification or conduct an audit.

If you discover an error in your filed form, promptly file an amended return with explanations for the changes. Correcting mistakes swiftly demonstrates good faith to the IRS and helps maintain your organization's credibility.

If the IRS initiates an inquiry or audit, respond promptly and thoroughly. Having a solid record of all filings and related documents will equip your organization to handle the process more effectively.

PdfFiller: your partner in filling out form 990-ez

PdfFiller is a powerful tool that assists organizations in the comprehensive filing of Form 990-EZ. The platform allows users to edit PDFs, e-sign documents, and collaborate seamlessly in real time, streamlining the entire completion process.

With interactive tools for data entry and validation, pdfFiller ensures all fields are filled out accurately and that no crucial information is overlooked. This significantly minimizes the risk of errors and omissions.

The platform also includes collaboration features, making it easier for team-based filing efforts, especially beneficial for larger organizations needing input from various stakeholders.

FAQs on form 990-ez for 2024

As organizations prepare for their filings, several common questions arise. Here are some frequent concerns that may need addressing:

Addressing these concerns early in the process can prevent complications or delays in your filing efforts.

Tips for future planning and compliance

To ensure ongoing compliance and ease future filing of Form 990-EZ, organizations should prioritize year-round record-keeping. Maintaining current financial statements, minutes from board meetings, and documentation of fundraising activities will make the filing process significantly more manageable.

Staying informed about potential changes to nonprofit tax regulations is also essential. Active engagement with industry associations or platforms offering regular updates—like pdfFiller—will keep leaders alerted to shifts that might affect their operations.

Interactive resources available through pdfFiller

PdfFiller also offers a variety of interactive resources, including templates and fillable forms that streamline the preparation of Form 990-EZ while ensuring compliance with IRS standards.

Furthermore, users can leverage eSigning features for quick approval from necessary stakeholders, significantly accelerating the process of form submission. PdfFiller also hosts tutorials and webinars designed to teach users the best practices for document management, helping organizations optimize their operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 990-ez 2024 from Google Drive?

How do I complete form 990-ez 2024 online?

How do I make changes in form 990-ez 2024?

What is form 990-ez 2024?

Who is required to file form 990-ez 2024?

How to fill out form 990-ez 2024?

What is the purpose of form 990-ez 2024?

What information must be reported on form 990-ez 2024?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.