Get the free Instructions for Form 8868, Application for Extension of Time ...

Get, Create, Make and Sign instructions for form 8868

How to edit instructions for form 8868 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 8868

How to fill out instructions for form 8868

Who needs instructions for form 8868?

Instructions for Form 8868: A Comprehensive Guide

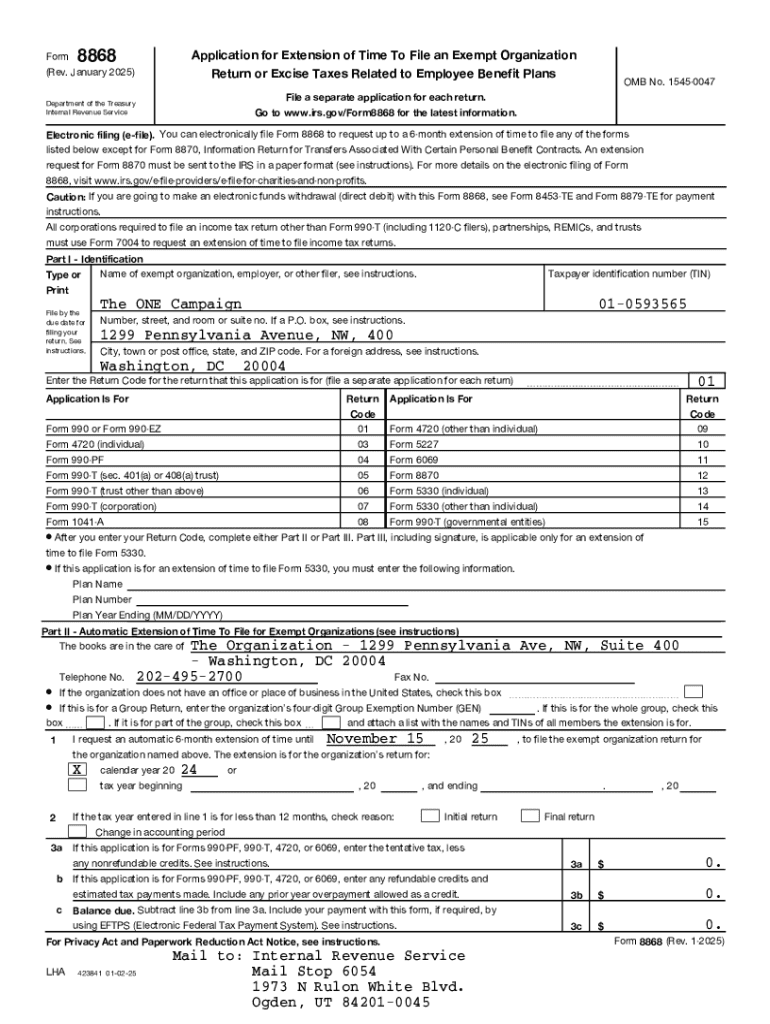

Comprehensive overview of Form 8868

Form 8868 is an essential IRS document used by nonprofit organizations, including charities and other exempt entities, to apply for an automatic extension of time for filing their annual return. By understanding this form, organizations can ensure compliance with IRS regulations while availing themselves of an extension when necessary.

The purpose of filing for an extension is significant as it affords organizations additional time to gather and submit their financial information accurately, avoiding potential penalties associated with late filings. This is particularly important for nonprofits that may need extra time to ensure all relevant data is correctly reported.

Recognizing key terminology such as 'tax return', 'extension', and 'nonprofit organization' is vital for navigating the complexities of the tax landscape, ensuring accurate submissions and compliance with the Internal Revenue Service.

Understanding the filing requirements

Before filing Form 8868, organizations should confirm their eligibility. Generally, any tax-exempt organization seeking to delay the filing of their tax return may apply. However, it’s essential to understand the necessary documentation and information required to complete the form accurately.

Key documents include prior year tax returns, current year financial statements, and any specific IRS notices received by the organization concerning filing requirements. Common reasons for needing an extension may include staff shortages, the need for additional time to ensure data accuracy, or unforeseen circumstances that delay the preparation of financial records.

When to file Form 8868

Filing deadlines are pivotal when it comes to Form 8868. Organizations must submit their extension request no later than their original due date to avoid penalties. Typically, the deadline overlaps with the filing due date of the organization’s annual tax return. For many nonprofits, this is usually March 15 or May 15, depending on their fiscal year.

It’s crucial to time your extension request correctly. Filing too close to the due date may complicate submission processes. The consequences of failing to file or filing late can be severe, causing the organization to incur penalties, risking the loss of tax-exempt status, and creating reporting issues in future tax years.

Navigating the IRS Form 8868: Step-by-step instructions

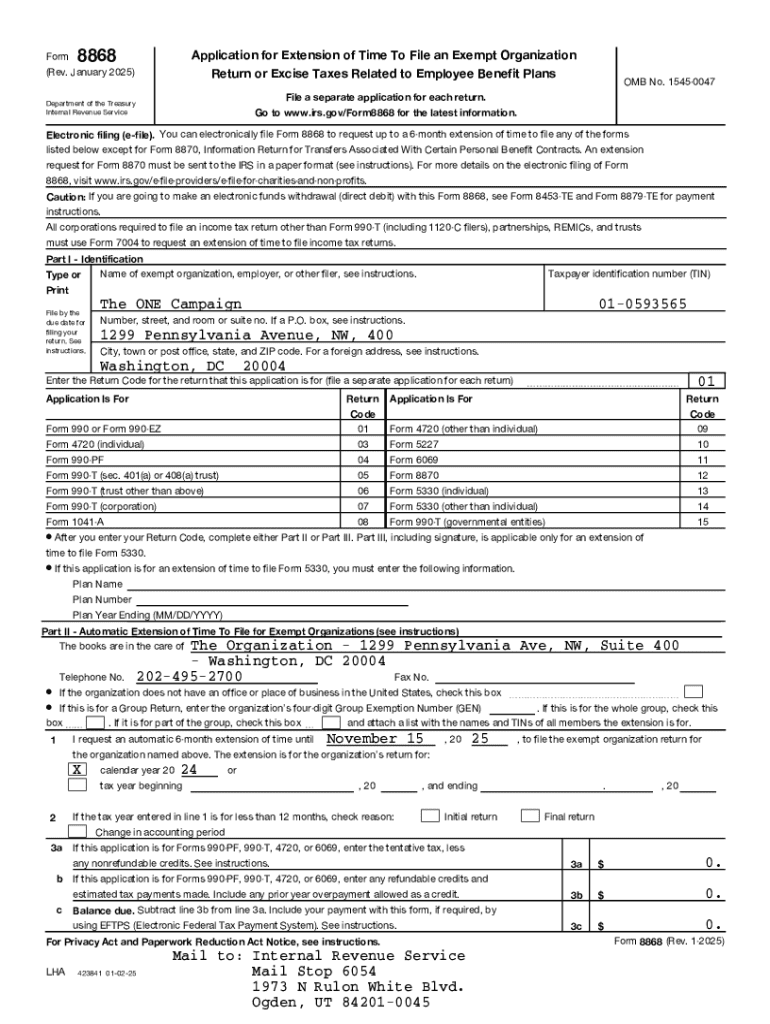

Navigating Form 8868 requires a section-by-section breakdown to ensure accurate completion. Part I requires detailed information about the organization requesting the extension, including the name, address, and Employer Identification Number (EIN).

In Part II, the organization must sign to verify the information provided. It’s crucial to ensure that all provided information is accurate as errors can lead to delays or denials of extension requests.

To avoid common mistakes, remember to double-check for completeness, ensure the EIN is correct, and verify that the signature belongs to an authorized individual within the organization.

Filling out Form 8868: Interactive tools

Utilizing online tools like pdfFiller can simplify the filling process for Form 8868. Through pdfFiller, users can easily fill, edit, and electronically sign the form, streamlining the process compared to traditional methods.

pdfFiller's interactive capabilities not only make it user-friendly but also allow users to save and store documents securely in the cloud, ensuring easy access from anywhere. This flexibility is especially beneficial for teams working collaboratively on the document.

Submitting Form 8868

Submitting Form 8868 can be done in various ways depending on the organization’s comfort level. E-filing is often the fastest and most secure option, allowing organizations to receive immediate confirmation of submission. Alternatively, for those preferring traditional methods, paper filing is available.

Organizations should be aware of any associated fees with certain submission methods and the various payment options available. Confirming receipt of your Form 8868 is crucial to ensure that the IRS acknowledges your extension request.

Post-submission steps

Once Form 8868 has been submitted, organizations should understand the expected processing time, which can vary depending on the volume of requests the IRS receives. Typically, the IRS communicates the approval status or any potential issues within a few weeks.

In case your request for an extension is denied, it’s crucial to review the reasons provided by the IRS. Following up promptly with any required documentation or clarifications can help resolve issues in a timely manner. Additionally, keeping accurate records and correspondence with the IRS is essential for long-term compliance.

Frequently asked questions (FAQs)

Filing Form 8868 may lead to various concerns and questions. Commonly asked questions include what filing methods are acceptable and if there are specific conditions under which an organization must file. It is essential to clarify these aspects upfront to streamline the process.

Furthermore, organizations might wonder about the possibility of amending or changing their extension request after submission. Understanding these elements helps organizations to navigate the process more effectively and reduces the likelihood of complications down the road.

Contact information and support

For assistance regarding Form 8868, organizations can reach out to the IRS directly. The IRS provides specific contact numbers and resources tailored for nonprofit organizations to handle queries effectively. pdfFiller also offers robust support through their platform, allowing users to access help guides, chat support, and community forums.

Leveraging external support resources, such as tax professionals or local community organizations, can also be beneficial in navigating the complexities of tax law. Engaging in community forums may help organizations connect with others facing similar challenges, fostering a sense of support and sharing.

Expert tips for a successful extension request

When submitting Form 8868, consider best practices to enhance the chances of a successful extension request. Ensuring that the form is completely filled out and aligned with IRS guidelines is crucial. Utilizing tools like pdfFiller can aid in proper document management, reducing errors and improving efficiency.

Implementing document organization strategies, such as creating a checklist for required documents and deadlines, can help ensure that nothing is overlooked during the preparation. Accordingly, these diligent practices can facilitate a smoother process and enhance overall accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute instructions for form 8868 online?

How do I edit instructions for form 8868 online?

Can I edit instructions for form 8868 on an iOS device?

What is instructions for form 8868?

Who is required to file instructions for form 8868?

How to fill out instructions for form 8868?

What is the purpose of instructions for form 8868?

What information must be reported on instructions for form 8868?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.