Get the free Exempt Organizations Update archive

Get, Create, Make and Sign exempt organizations update archive

How to edit exempt organizations update archive online

Uncompromising security for your PDF editing and eSignature needs

How to fill out exempt organizations update archive

How to fill out exempt organizations update archive

Who needs exempt organizations update archive?

Comprehensive Guide to the Exempt Organizations Update Archive Form

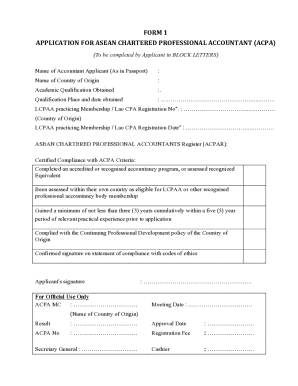

Understanding the exempt organizations update archive form

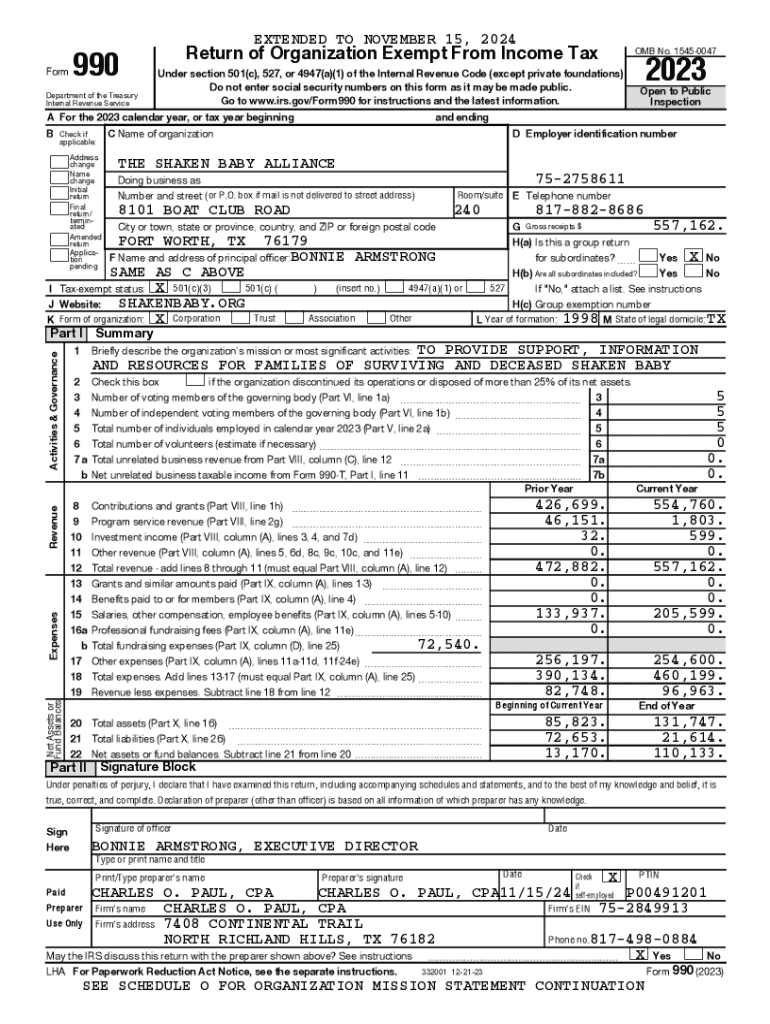

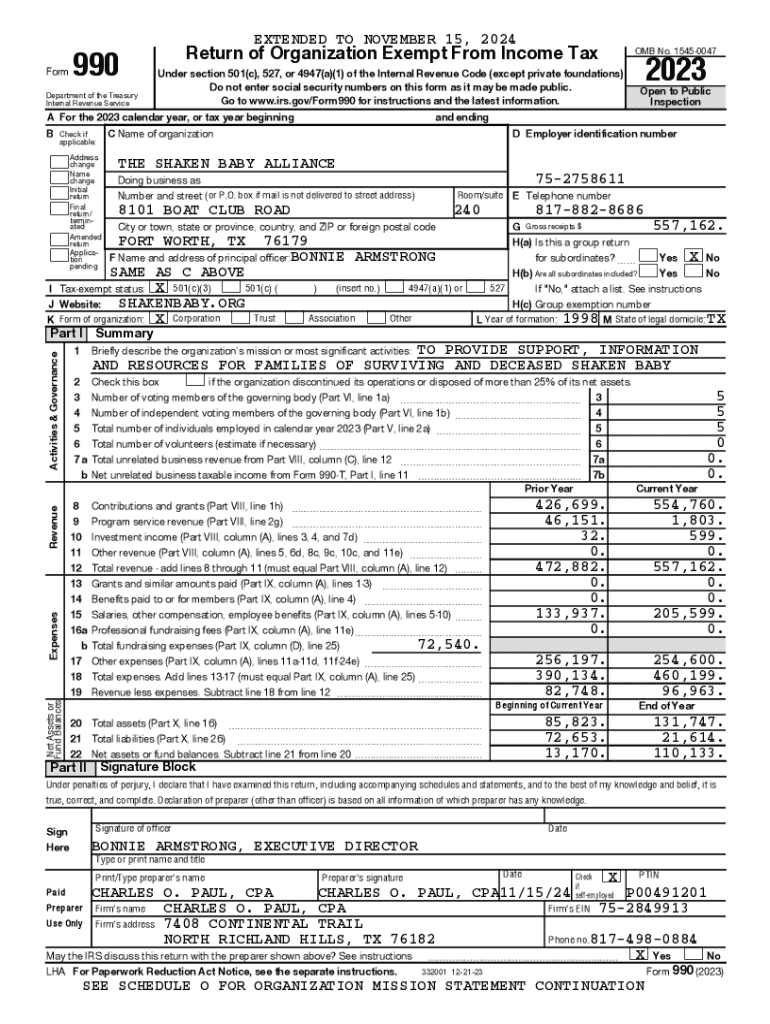

The exempt organizations update archive form is a pivotal document for nonprofits and other tax-exempt entities. Its primary purpose is to enable these organizations to update their essential information with the Internal Revenue Service (IRS), ensuring that their records are accurate and current. This form is not merely bureaucratic; it's critical for maintaining compliance with federal regulations, thereby allowing organizations to continue enjoying their tax-exempt status.

Understanding the significance of the exempt organizations update archive form lies in recognizing its role in the nonprofit sector. For many organizations, timely updates can prevent lapses in tax exemption, facilitate grant applications, and ensure transparency with donors. This is particularly important in today's digital age, where accurate and up-to-date information can influence operational continuity and reputation.

Key features of the exempt organizations update archive form

The exempt organizations update archive form contains several key features designed to capture essential data about an organization. It typically includes sections that outline organizational details, financial data, and update mechanisms that allow for real-time adjustments. An accurate and comprehensive form is vital; errors or omissions can lead to compliance issues and subsequent penalties.

Accuracy in filling out this form cannot be overstated. Incorrect or incomplete information can jeopardize an organization's tax-exempt status. Thus, attention to detail is essential in every aspect of the exempt organizations update archive form.

Preparing to fill out the form

Before diving into the exempt organizations update archive form, one must gather the necessary documentation. It’s important to assemble past financial records, organizational structure information, and any other supporting documentation that pertains to your updates. This preparation will streamline the process and ensure that all required data is readily available.

Additionally, organizing your data can further facilitate the completion of the form. Common pitfalls to avoid include failing to record recent updates or overlooking minor changes. Documenting these changes as they occur will keep your information accurate and compliant, saving time when it comes to submitting the exempt organizations update archive form.

Step-by-step instructions for completing the form

Completing the exempt organizations update archive form involves a methodical approach to ensure accuracy and compliance. Here’s a step-by-step guide to help you through the process.

Managing your submitted forms

After submitting the exempt organizations update archive form, it’s crucial to manage your submission effectively. You can track your submission status through the IRS online portal, ensuring you remain informed about any updates or queries post-submission. Understanding the response timelines will help you stay proactive, responding to any needed changes quickly.

Using pdfFiller for efficient form management

pdfFiller is an excellent resource for managing the exempt organizations update archive form. With a range of features designed to enhance your document experience, it empowers organizations to fill out, edit, eSign, and collaborate on important forms from a single, cloud-based platform.

Frequently asked questions (FAQs)

Participants often have questions as they navigate the exempt organizations update archive form. Below are some common inquiries that arise during the process.

Case studies: Successful form management

Examining case studies of organizations that have excelled in compliance can provide valuable insights into best practices. Effective management of the exempt organizations update archive form leads to streamlined operations and maintains your nonprofit's integrity in funding and operational execution.

In contrast, instances where organizations faced issues due to inefficient form submissions underscore the importance of thoroughness. Simple mistakes, such as clerical errors or lack of documentation, can be remedied by establishing a robust system for record-keeping and form submission.

Advanced topics and considerations

For more seasoned nonprofit managers, understanding how the exempt organizations update archive form integrates with other IRS forms is crucial. Knowledge of state-specific regulations is equally important, as these can impact local compliance and operational legitimacy.

Staying ahead of future changes in nonprofit reporting also enhances an organization's adaptability. Periodic updates from the IRS can impact how forms are completed and affect various reporting mechanisms, making it essential for organizations to keep abreast of these developments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in exempt organizations update archive?

Can I create an eSignature for the exempt organizations update archive in Gmail?

How do I edit exempt organizations update archive on an Android device?

What is exempt organizations update archive?

Who is required to file exempt organizations update archive?

How to fill out exempt organizations update archive?

What is the purpose of exempt organizations update archive?

What information must be reported on exempt organizations update archive?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.