Get the free FR-500 - Washington, DC - DC Office of Tax and Revenue

Get, Create, Make and Sign fr-500 - washington dc

How to edit fr-500 - washington dc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fr-500 - washington dc

How to fill out fr-500 - washington dc

Who needs fr-500 - washington dc?

Complete Guide to the FR-500 - Washington Form

Understanding the FR-500 form

The FR-500 form is a crucial document for businesses operating in Washington DC. This form serves as the application for a Business Franchise Tax and is essential for compliance with local tax laws. By filing this form, businesses ensure they are meeting their obligations under the District of Columbia’s taxation regulations, which helps maintain the integrity of revenue collection within the jurisdiction.

The importance of the FR-500 cannot be overstated. It not only initiates the tax process but also allows businesses to obtain a tax identification number (TIN) if they do not already have one. This identification is crucial for all subsequent interactions with the district’s tax office and when filing future tax returns.

Who needs to file the FR-500?

In Washington DC, all entities conducting business are required to file the FR-500, regardless of their size or business structure. This includes sole proprietors, partnerships, corporations, and limited liability companies (LLCs). If these businesses generate revenue, they must ensure compliance by submitting the FR-500 form to avoid penalties.

Benefits of completing the FR-500

Filing the FR-500 is essential for legal compliance, but it also provides several benefits that contribute to smoother business operations. Firstly, it helps taxpayers avoid penalties associated with late filings or non-compliance. By adhering to local tax regulations, businesses can focus on growth rather than administrative conflicts.

Additionally, having an approved FR-500 can facilitate business transactions, partnerships, and even access to financing. Financial institutions may require proof of compliance with local tax laws before processing loans or credit applications. Thus, the FR-500 is not just a form; it's a gateway to legitimacy and professionalism in the business community.

Key components of the FR-500

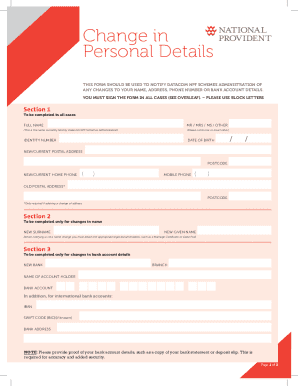

The FR-500 form comprises several key components that require thorough attention. At its core, businesses must provide personal information, including the name, address, and type of business entity. Additionally, financial details such as estimated revenue and tax identification must be accurately reported.

This information is pivotal because it dictates tax classifications, which affect the overall tax burden and liabilities. Understanding these classifications is essential for business owners, as they directly impact how much tax is owed to the District of Columbia. For instance, businesses might be classified as C Corporations, S Corporations, or LLCs, each subject to different tax rates.

Understanding tax classification

Tax classification determines the applicable tax treatment for your business. Each classification comes with specific obligations and rates, which are fundamental to preparing accurate tax returns. For example, a C Corporation is taxed independently from its owners, while an LLC passes its profits or losses directly to its members.

Preparing to complete the FR-500

Before filing the FR-500, it is crucial to gather all necessary documents to streamline the process. This includes relevant business registration documents, previous tax returns if applicable, and documentation of revenue estimates for the upcoming tax period. Organizing this information can significantly reduce the chances of errors during completion.

Having everything in one place makes the form completion process smoother. Consider using a checklist that includes all required documents and pertinent financial data. This will ensure that you have not overlooked any critical aspect of your filing, thereby enhancing compliance.

Choosing the right resources

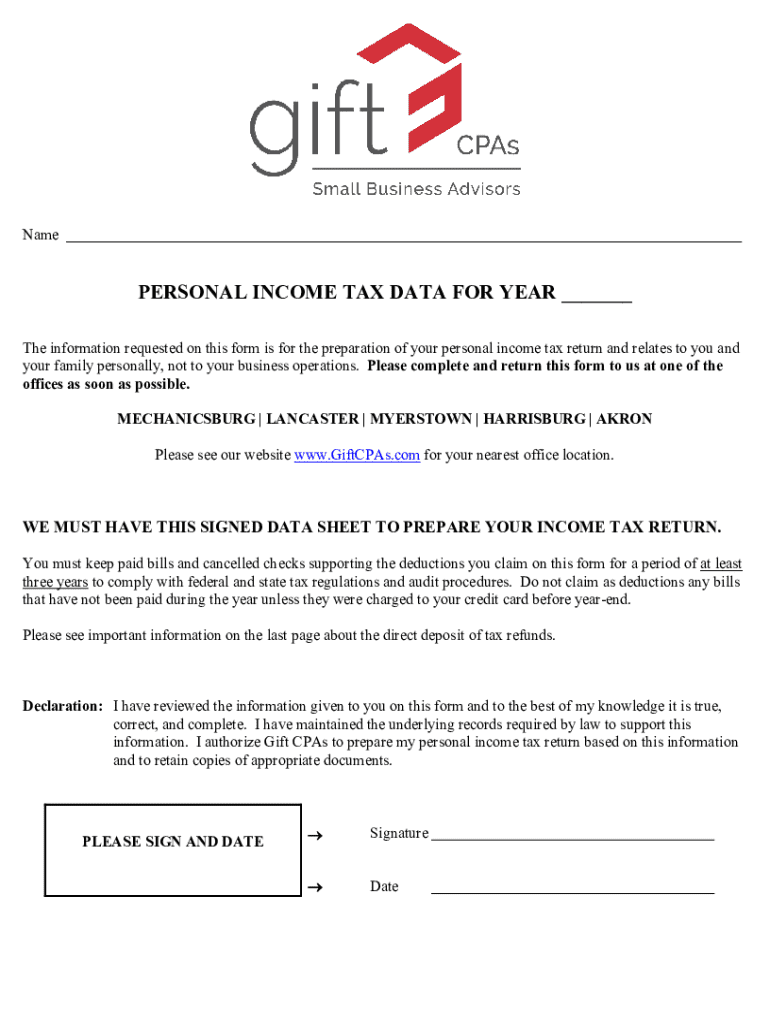

Utilizing tools for accessing and completing the FR-500 can significantly ease the workload. pdfFiller offers an intuitive platform for filling out, signing, and managing documents online. It allows users to edit PDF files seamlessly, e-sign documents directly, and collaborate with team members or accounting professionals as needed.

The user-friendly interface of pdfFiller eliminates many common issues associated with form completion, such as formatting errors or lost paperwork. With support for cloud storage, businesses can also safely store their tax documents and access them whenever needed.

Step-by-step instructions for completing the FR-500

Accessing the FR-500 form is the initial step in this process. You can find it on the District of Columbia's Office of Tax and Revenue website. Additionally, pdfFiller allows users to access the form online, facilitating faster completion.

When filling out the form, each section requires careful attention. Begin by entering your personal and business information accurately. Follow this with the revenue estimates and tax identification details. Ensure to review each field meticulously before proceeding to the next section. Common pitfalls include misreporting revenue figures or omitting key identification numbers, both of which can result in delays or penalties.

Reviewing your submission

After completing the FR-500, take the time to review your submission thoroughly. A checklist can be particularly useful in verifying that all information provided is correct, ensuring that you have met the filing requirements of the District of Columbia. Accurate filings protect against audits and potential penalties down the line, adding a layer of security to your operations.

Submitting the FR-500

Once you have completed and reviewed the FR-500, submitting the form is the next step. Businesses have several submission options: online, via mail, or in person. For convenience, submitting online through pdfFiller is often recommended as it can expedite processing times.

To submit online via pdfFiller, ensure you have completed all necessary fields. The platform provides step-by-step guidance on finalizing the form and securely transmitting it to the district’s tax office. This ability to submit directly from a cloud platform further reduces the risk of submission errors or lost mail.

Tracking your submission

After submission, tracking the status of your FR-500 is vital. The District of Columbia offers online resources to check the status of your filing, which can provide peace of mind. Keeping proof of submission, whether digital or physical, is also important should any questions arise concerning your filing.

Maintaining compliance after filing

Once the FR-500 has been submitted, the journey does not end there. Depending on the information provided, businesses may receive feedback from the tax office requiring additional documentation or clarification. Understanding the timelines for processing is crucial; keeping an eye on notification timelines can help businesses maintain compliance.

Moreover, staying informed about filing deadlines is essential. Businesses should mark their calendars for renewal dates to avoid issues with ongoing compliance. Taxpayers should also regularly review any updates to regulations or filing requirements, as the district may change laws that impact tax obligations.

Filing deadlines and renewals

Within Washington DC, specific deadlines must be complied with to ensure that businesses remain in good standing. These schedules are often dictated by the type of business and its revenue thresholds. Businesses should establish a compliance calendar that includes renewal deadlines, estimated tax payments, and important quarterly submission dates.

Frequently asked questions (FAQs) about the FR-500

As with many regulatory requirements, questions often arise regarding the FR-500 form. Common queries focus on who needs to file, how to correct mistakes, and the consequences of failing to comply by deadline. Addressing these concerns is critical for taxpayers to fully understand their obligations and rights.

Many taxpayers also seek advice on navigating issues such as filing extensions or what to do if additional taxes are owed. The District of Columbia’s customer service office can serve as a valuable resource for these inquiries, providing direct assistance and links to additional information.

Troubleshooting common issues

Filing errors can happen, but knowing how to address them can save time and money. If discrepancies are discovered post-filing, taxpayers should promptly contact the District's customer service office for guidance. Professionals with expertise in local tax regulations can also provide insights, especially when dealing with complicated situations.

Utilizing pdfFiller for your document management needs

pdfFiller stands out as a comprehensive tool in managing the FR-500 filing process and other documentation challenges. With features that allow for easy document editing, electronic signatures, and team collaboration, pdfFiller enhances the filing experience. There’s no need for cumbersome paperwork or multiple platforms, as everything is accessible in one cloud-based location.

The convenience of pdfFiller extends beyond filling out forms. Users can manage tax documents year-round, keeping track of essential deadlines and submissions efficiently. The platform evolves with the needs of the business, offering support resources and features that continue to adapt to regulatory changes.

Getting started with pdfFiller

Starting with pdfFiller is simple. New users just need to create an account, which can be done quickly through the website. Once registered, users will find an easy setup process that guides them through the initial stages, helping them become familiar with the many features available.

Resources for support, including tutorials and customer service, are readily available to answer questions and resolve issues. By utilizing pdfFiller, businesses can streamline their document management processes and focus more on growth and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit fr-500 - washington dc online?

Can I sign the fr-500 - washington dc electronically in Chrome?

How do I fill out fr-500 - washington dc using my mobile device?

What is fr-500 - washington dc?

Who is required to file fr-500 - washington dc?

How to fill out fr-500 - washington dc?

What is the purpose of fr-500 - washington dc?

What information must be reported on fr-500 - washington dc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.