Get the free How to Email Tax Forms for Printing When Printer Is ...

Get, Create, Make and Sign how to email tax

Editing how to email tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how to email tax

How to fill out how to email tax

Who needs how to email tax?

How to Email a Tax Form: A Comprehensive Guide

Understanding tax forms and their importance

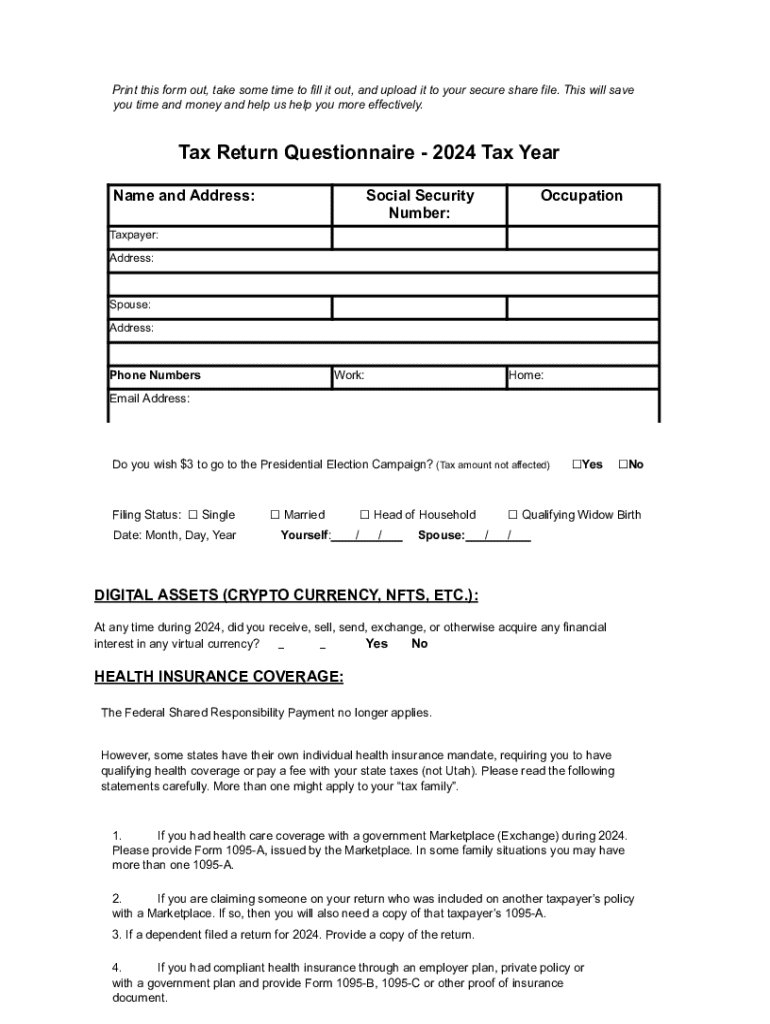

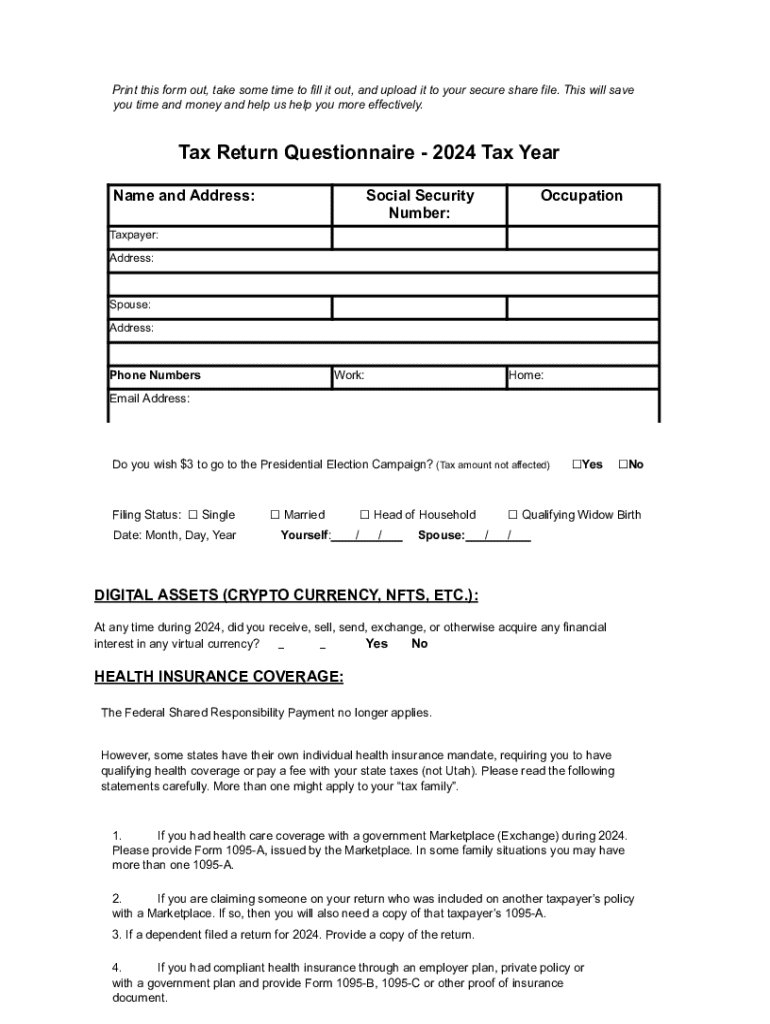

Tax forms serve as essential documents for individuals and businesses to report their annual earnings, claim deductions, and calculate their tax liability. Common forms include the 1040 for individual income tax returns, the W-2 for wage and salary reporting, and the 1099 series for various types of income. Given the complexity of tax law and the critical nature of these documents, understanding how to properly handle, fill out, and submit them is vital.

Emailing tax forms can often be a more practical solution than traditional mailing. Digital communication saves time and allows for quicker responses, especially during tax season when mail transit times can be unpredictable and delays can be costly. However, when dealing with sensitive information, such as Social Security numbers and financial data, security must be a priority.

Ensuring that your method of transmission is secure is paramount. Utilize encryption and password protection to safeguard sensitive information when emailing tax forms. By understanding the importance of these practices, individuals can avoid potential identity theft or unauthorized access to their private financial data.

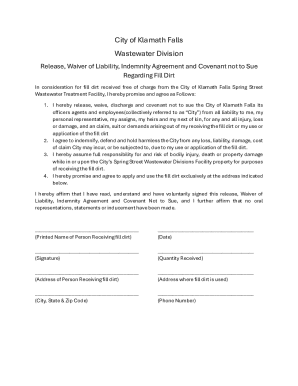

Preparing your tax form for email

**Step 1:** Complete the tax form. Before sending, ensure all required fields are filled out accurately. Mistakes in your tax return can lead to delays, fines, or even audits. It’s beneficial to have someone else review your form for clarity and accuracy before submission.

**Step 2:** Convert to PDF format, if necessary. PDF files are universally accepted and maintain formatting across different devices. Using a tool like pdfFiller allows you to create and edit PDFs easily, ensuring your tax forms are presented professionally.

**Step 3:** Secure your document. Utilize pdfFiller's password protection feature to ensure that only intended recipients can view your tax form. Additionally, consider redacting sensitive information that isn’t necessary for the recipient to process your forms, which adds an extra layer of security.

Crafting your email

**Step 4:** Composing the email is crucial. When emailing tax forms, make sure to include a clear and concise subject line, such as "2023 Tax Form Submission - [Your Name]." In the body of the email, provide context and any necessary instructions or explanations about the information being sent.

**Step 5:** Attaching the tax form PDF should be done carefully. Verify attachment size and format, as some email servers may reject large files or certain types of documents. Consider compressing images or files that are too large to ensure they transmit correctly.

Sending tax forms securely

**Step 6:** Double-check recipients to ensure you are sending to the correct email addresses. A small error in typing can mean your sensitive tax information ends up in the wrong hands.

**Step 7:** Review your email thoroughly before hitting send. Look for common pitfalls, such as typos in email addresses or incomplete information inside the email body. Attention to detail can prevent future complications.

Following up on your submission

**Step 8:** Confirming receipt of your tax form can save you trouble down the road. It's best practice to send a follow-up email asking for confirmation, especially if you haven't received a response within a few days.

**Step 9:** Keeping a record of your submission is essential for future reference. Store a copy of both the email and the tax form in a secure location. This documentation can serve as proof should there be any discrepancies later on.

Tips for successful emailing of tax forms

To avoid common mistakes, always verify that your attachments are correct and that your email is addressed to the appropriate recipient. Using tracking features within your email can help you know when the recipient opens your message.

When additional security is needed, consider using digital signatures to authenticate your identity. This practice not only adds a layer of protection but also illustrates professionalism in your correspondence.

Special considerations for teams

Collaborating on tax forms within teams can be streamlined using pdfFiller’s collaboration features. Team members can access and edit documents collectively, ensuring everyone is on the same page. This approach enhances efficiency, especially when multiple stakeholders are involved in tax preparation.

Managing access and permissions is also crucial. In a team setting, ensure that only those who need to view or edit the forms have the necessary rights, protecting sensitive data from unnecessary exposure.

Troubleshooting common issues

If your recipient cannot open the attachment, first ensure that the file format is compatible. If issues persist, sending the document through different channels, like a cloud storage link, can resolve these problems.

In case you don't receive a confirmation, follow up politely after a few days. This not only reinforces the importance of the document sent but also keeps the lines of communication open.

Advanced features of pdfFiller for tax documentation

pdfFiller offers advanced features that can streamline the tax documentation process. Templates for various tax forms can save time and ensure that all necessary fields are included. The integration with other tools and platforms allows for a seamless workflow between document creation, editing, and submission.

Additionally, tracking changes and versions within pdfFiller helps to maintain a clear record of all edits made to the documents, making it easier to reference changes in the future. This is vital for maintaining accurate records and ensuring that you always refer to the most up-to-date version of your tax forms.

Conclusion on effective tax form emailing

Effectively emailing tax forms involves preparation, clear communication, and proper security measures. By following the outlined steps and utilizing tools like pdfFiller, individuals and teams can navigate the complexities of tax form submissions more easily.

Implementing these strategies not only enhances security but also leads to a hassle-free experience in managing tax documentation. With pdfFiller, users can confidently create, edit, and submit their tax forms in a user-friendly, secure environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit how to email tax from Google Drive?

How can I send how to email tax for eSignature?

Can I create an eSignature for the how to email tax in Gmail?

What is how to email tax?

Who is required to file how to email tax?

How to fill out how to email tax?

What is the purpose of how to email tax?

What information must be reported on how to email tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.