Get the free IRS Form 990-EZ Tutorial: Overview of the Form

Get, Create, Make and Sign irs form 990-ez tutorial

How to edit irs form 990-ez tutorial online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs form 990-ez tutorial

How to fill out irs form 990-ez tutorial

Who needs irs form 990-ez tutorial?

IRS Form 990-EZ Tutorial Form

Understanding IRS Form 990-EZ

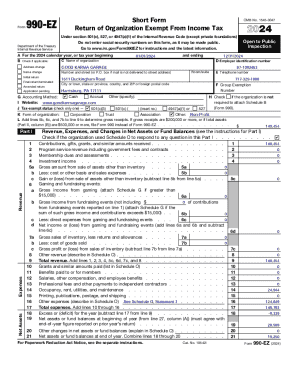

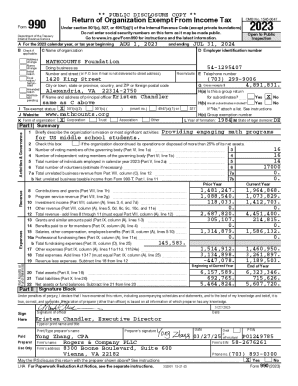

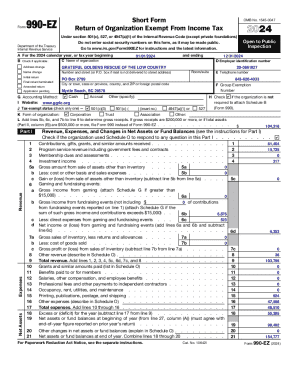

IRS Form 990-EZ is a streamlined version of the traditional Form 990, designed specifically for smaller tax-exempt organizations. The primary purpose of the form is to provide the IRS with a snapshot of an organization's financial activities, ensuring transparency and accountability. This form simplifies the reporting process for organizations with gross receipts of less than $200,000 and total assets of less than $500,000.

Organizations that are required to file Form 990-EZ include charities, educational institutions, and certain types of nonprofits. To qualify, they must meet specific financial thresholds that distinguish them from larger organizations, which file the full Form 990. Understanding the differences between Form 990-EZ and Form 990 is crucial; while both serve to report financial information, Form 990-EZ is less detailed and provides a quicker filing option tailored for smaller entities.

Preparing to fill out IRS Form 990-EZ

Before you start filling out Form 990-EZ, it is essential to gather all necessary documentation to facilitate a smooth reporting process. This includes comprehensive financial records, such as income statements, balance sheets, and any schedules that detail your organization's income and expenses. Additionally, collect information concerning board members, key operational activities, and significant transactions or changes during the tax year.

Understanding the federal and state filing requirements is also vital to ensure compliance. Different states may have specific requirements that accompany the federal form, and failing to meet these can lead to penalties. Be aware of the filing deadlines, which are typically the 15th day of the 5th month after the end of your organization's fiscal year. Late submissions can result in fines, making it crucial to adhere to the schedule.

Step-by-step instructions for completing IRS Form 990-EZ

Completing the IRS Form 990-EZ involves several sections where you'll provide key financial information about your organization.

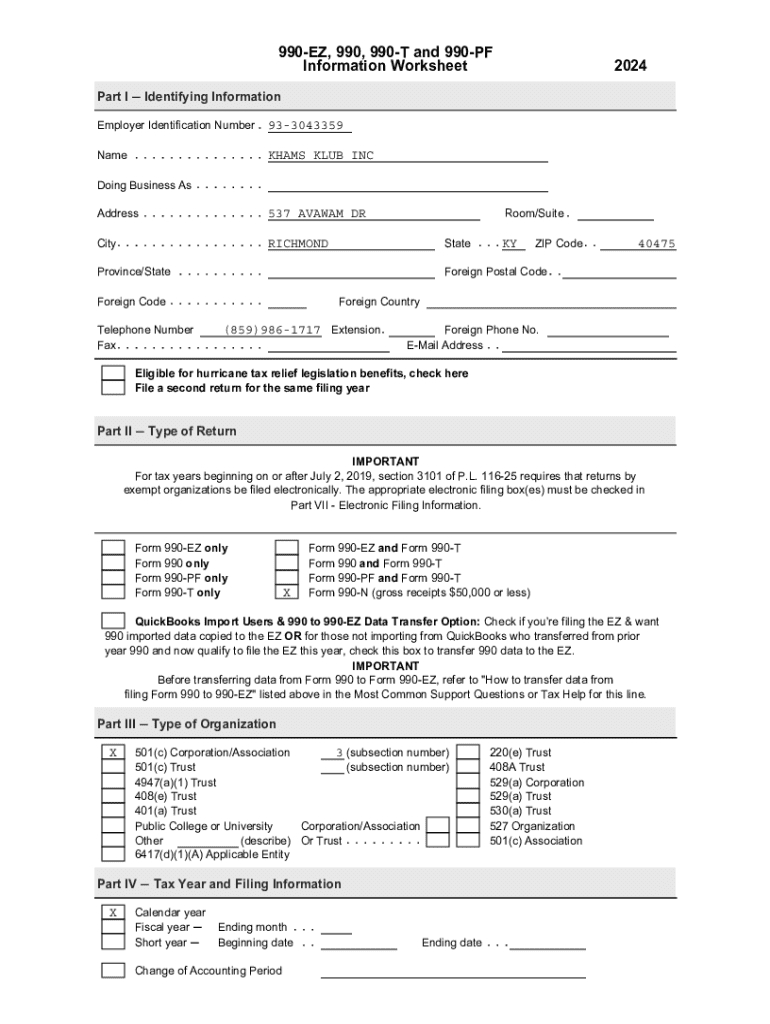

### Section A: Basic Information gives you the opportunity to enter your organization details, including its legal name, address, and the specific tax year being reported. This foundational information must be accurate, as it will appear on public records.

### Section B: Revenue, Expenses, and Changes in Net Assets requests detailed breakdowns of your total revenue sources, including contributions, grants, and program service revenue. Also, account for expenses, ensuring a clear and accurate portrayal of financial performance throughout the year.

### Section C: Balance Sheet necessitates reporting your assets and liabilities to reflect the organization's financial position at year-end. This includes cash on hand, investments, accounts receivable, and any liabilities.

### Section D: Functional Expenses categorizes and lists expenses related to your organization's programs, management, and fundraising efforts. It's crucial to classify these appropriately for transparency and clarity.

### Section E: Other Information allows you to disclose any additional comments or disclosures that might be relevant to your tax return. Make sure to use this section to clarify any unique attributes of your organization.

Understanding schedules related to IRS Form 990-EZ

When filing Form 990-EZ, you may also need to complete related schedules, which provide additional detail for certain areas of your operations. For instance, Schedule A assesses public charity status and public support. If your organization receives contributions exceeding a specific threshold, you'll need to accurately document this information.

### Schedule B requires the disclosure of contributors, including significant donors and grants. It's important to respect any anonymity requests as required.

### Schedule C addresses any political campaign and lobbying activities conducted by your organization, ensuring compliance with IRS regulations on these matters. Depending on your organization’s activities, you may need to file these schedules alongside your main form.

Common mistakes to avoid when filling out Form 990-EZ

Filling out IRS Form 990-EZ can be straightforward if common pitfalls are avoided. One frequent mistake is underreporting revenue or gross receipts, which can lead to audits or penalties. Always ensure that all sources of income are accurately reported, including grants and contributions from various stakeholders.

Another typical error involves inaccuracies in reporting expenses. Categorizing expenses incorrectly or omitting certain costs can result in discrepancies that raise red flags with the IRS. To sidestep these issues, it is best to double-check your entries and possibly engage a tax professional to assist in reviewing the document prior to submission.

How to file IRS Form 990-EZ electronically

Filing IRS Form 990-EZ electronically is becoming increasingly popular due to its convenience and efficiency. Start by selecting an authorized e-filing provider, which will guide you through the process. Simply create an account on their platform, fill in the necessary details from your organization, and submit the form directly to the IRS.

E-filing offers several advantages over traditional paper filing, including reduced processing times, immediate confirmation upon submission, and fewer chances for clerical errors. Users also benefit from built-in prompts and guidance through the e-filing systems, which can streamline the completion process.

Tips for managing your IRS Form 990-EZ filing process

Organization is key in maintaining a successful filing process for IRS Form 990-EZ. Start by establishing a filing calendar that aligns with your nonprofit’s fiscal year to track key dates and deadlines throughout the year. Regularly scheduled meetings to review financial data with your team can ensure you stay on top of any issues that may arise, allowing your organization to file on time.

Using tools such as pdfFiller can greatly simplify the document management process. This versatile platform allows you to edit PDFs seamlessly, collaborate with team members, and eSign documents all in one place. Furthermore, the cloud-based storage feature ensures your documents are accessible anytime, anywhere, providing peace of mind that your financial records are backed up and secure.

Troubleshooting post-filing queries

Once you have filed IRS Form 990-EZ, it's essential to stay alert for any communications from the IRS. In the event that your form is rejected, review the rejection notice thoroughly to identify any corrections needed. You must respond promptly, as the IRS deadlines are strict, and any delays could result in penalties.

In addition, be prepared for potential audits. Maintaining organized records throughout the year can provide the necessary documentation when requested by the IRS. Always keep backups of submitted documents and related financial files to streamline the process in case of inquiries or additional documentation requests.

Keeping track of your nonprofit’s ongoing compliance

Ongoing compliance is a vital aspect of managing any nonprofit organization. This extends beyond just filing Form 990-EZ; maintaining accurate financial records year-round ensures that you’re prepared for any required reviews or audits. Be diligent in tracking income, expenses, and operational changes as these all contribute to your overall financial health and compliance status.

Additionally, consider developing a compliance checklist that details the various requirements your organization must meet, including state-specific nonprofit filing requirements. Regular updates and reviews of this checklist will help prevent oversight and ensure that your organization remains in good standing.

Utilizing resources for assistance

Numerous resources are available to aid in the successful completion of IRS Form 990-EZ. The IRS website itself is a valuable repository of guidance and forms. Tools like webinars or consultation services provided by tax professionals can clarify complex areas of the filing process, offering personalized assistance based on your organization’s specific needs.

Moreover, pdfFiller supports continued learning and document management, providing templates and editing tools specific to 990-EZ and other forms. This platform enables users to efficiently manage their documentation, ensuring that compliance requirements are met without the tedious hassles of traditional paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute irs form 990-ez tutorial online?

How do I edit irs form 990-ez tutorial online?

How do I complete irs form 990-ez tutorial on an Android device?

What is irs form 990-ez tutorial?

Who is required to file irs form 990-ez tutorial?

How to fill out irs form 990-ez tutorial?

What is the purpose of irs form 990-ez tutorial?

What information must be reported on irs form 990-ez tutorial?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.