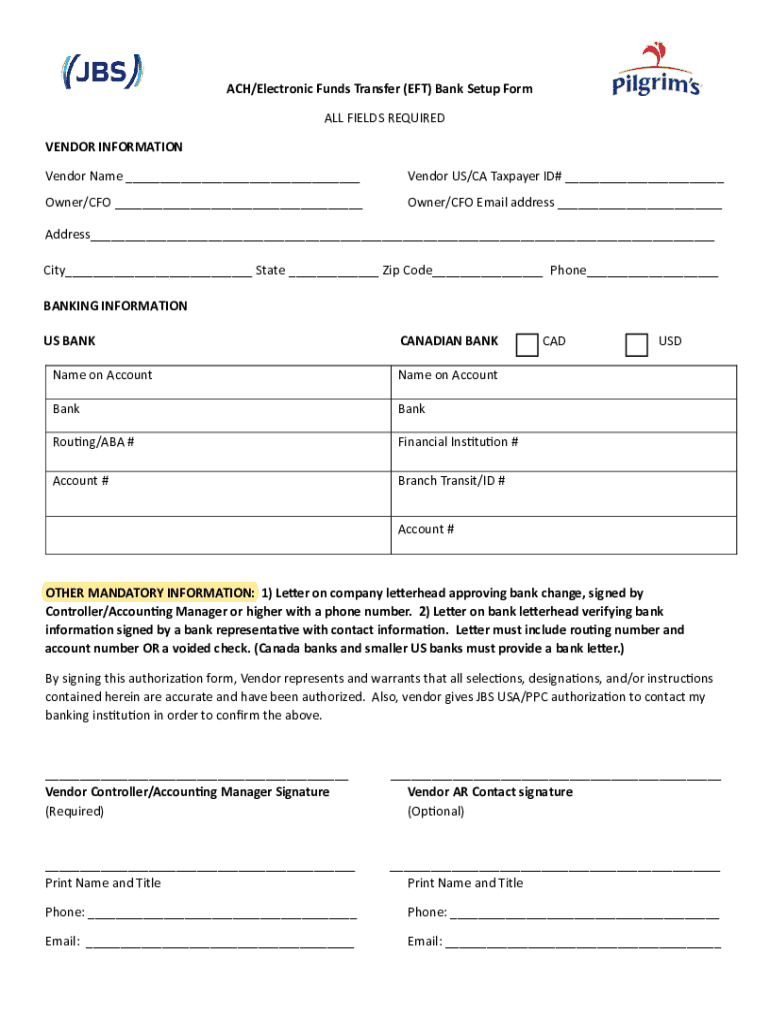

Get the free ACH/Electronic Funds Transfer (EFT) Bank Setup Form

Get, Create, Make and Sign achelectronic funds transfer eft

How to edit achelectronic funds transfer eft online

Uncompromising security for your PDF editing and eSignature needs

How to fill out achelectronic funds transfer eft

How to fill out achelectronic funds transfer eft

Who needs achelectronic funds transfer eft?

Understanding the Electronic Funds Transfer (EFT) Form: A Comprehensive Guide

Understanding electronic funds transfers (EFT)

An electronic funds transfer (EFT) is a digital payment method that allows individuals and businesses to transfer money between accounts without the need for physical checks or cash. This process is facilitated through automated clearing house (ACH) networks, making it a popular choice for transactions that require efficiency and security.

Common use cases for EFTs include payroll processing, where employers directly deposit salaries into employees' bank accounts; bill payments, allowing consumers to pay utility bills electronically; and business transactions, facilitating seamless payment between corporations.

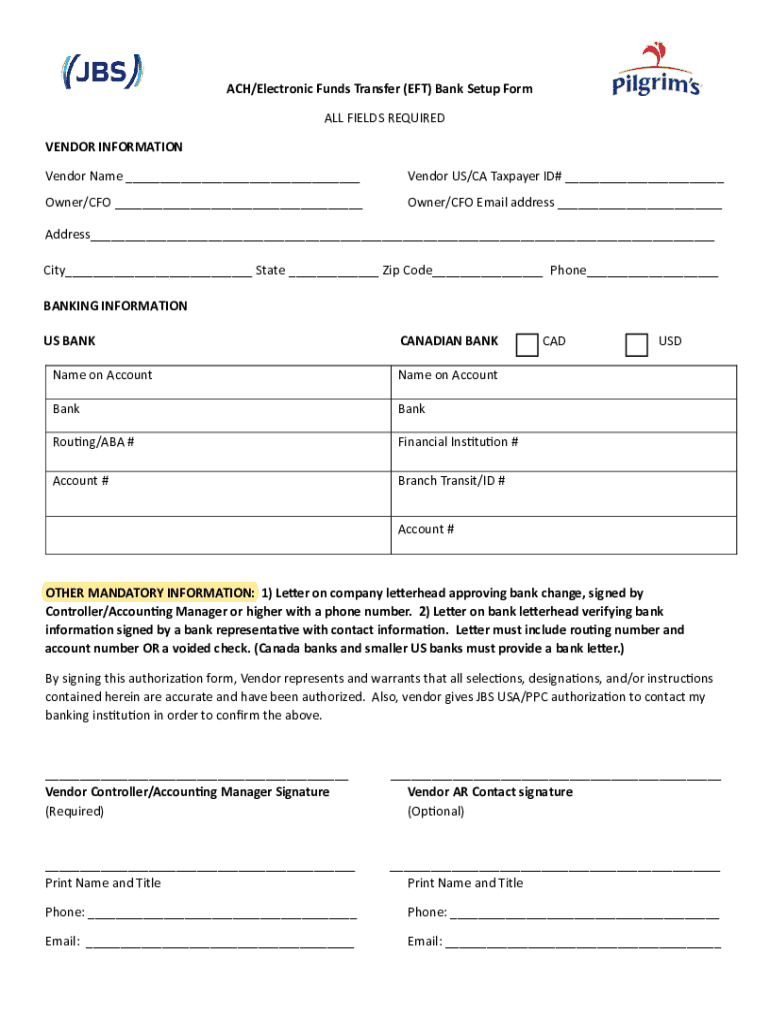

Introduction to the EFT form

The EFT form is a critical document for anyone looking to set up or manage electronic funds transfers. Its primary purpose is to authorize the transfer of funds from one bank account to another, ensuring that there is a clear record of transactions and agreements between parties.

Individuals and businesses alike must fill out an EFT form whenever they intend to initiate electronic payments. It's crucial for anyone who regularly receives payments or makes payments electronically to complete this form correctly, as inaccuracies can lead to delays or financial discrepancies.

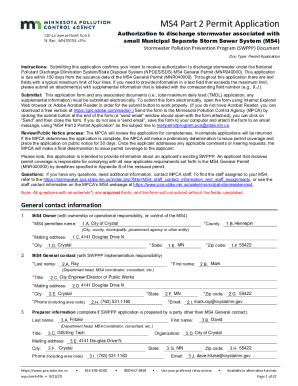

Step-by-step guide to filling out the EFT form

Completing the EFT form involves several critical pieces of information. Accurately entering this data is essential for ensuring that the transfer occurs smoothly. Start by gathering all necessary details, which typically include your personal or business information and banking details.

Detailed guide on each section

Editing and managing your EFT form

Once the EFT form is completed, you may find the need to edit or manage the document later. This can be necessary if banking details change or if a mistake is found after submission. Utilizing tools available, such as pdfFiller’s editing features, can simplify this process significantly.

It is essential to ensure compliance with financial regulations when making edits. This includes safeguarding all personal and financial data to prevent potential fraud. Best practices for document management include organizing files efficiently and keeping track of version changes to avoid confusion or miscommunication.

Signing your EFT form

Signing the EFT form is a vital step toward validating the document and instituting the transfer process. The eSigning process can be completed through various platforms, including pdfFiller, providing a fast and user-friendly experience for both parties involved.

Submitting the EFT form

After completing and signing your EFT form, the next phase is submission. Knowing where and how to submit the form is crucial to ensure the prompt processing of your request. Different organizations may have specific submission processes, generally involving either direct mailing or electronic uploads.

Discontinuing or modifying an EFT arrangement

There may come a time when discontinuing or modifying your EFT arrangement is necessary. Common reasons for changes can include switching bank accounts, needing to update payment methods, or changing the frequency of transactions.

FAQs related to EFT forms

Even with clear guidance, questions often arise regarding the EFT form and its usage. One of the most common queries is concerning mistakes made during form completion and how to rectify them appropriately.

Additional tools and resources

Utilizing interactive tools like those available on pdfFiller can facilitate a smooth EFT process. These tools offer customizable templates compatible with various financial documentation needs, including EFT forms.

Contact information for support

For any issues regarding the EFT form or electronic funds transfers, users of pdfFiller have access to a broad range of support options. Customer support can be reached through multiple channels, each designed to address inquiries quickly and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit achelectronic funds transfer eft from Google Drive?

Where do I find achelectronic funds transfer eft?

How do I make edits in achelectronic funds transfer eft without leaving Chrome?

What is achelectronic funds transfer eft?

Who is required to file achelectronic funds transfer eft?

How to fill out achelectronic funds transfer eft?

What is the purpose of achelectronic funds transfer eft?

What information must be reported on achelectronic funds transfer eft?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.