Get the free This Electronic Fund Transfer Agreement and Disclosure is ...

Get, Create, Make and Sign this electronic fund transfer

How to edit this electronic fund transfer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out this electronic fund transfer

How to fill out this electronic fund transfer

Who needs this electronic fund transfer?

This electronic fund transfer form: A comprehensive guide

Overview of electronic fund transfers

Electronic Fund Transfers (EFT) have revolutionized the way we handle financial transactions. This method allows individuals and businesses to transfer funds electronically rather than through paper checks or cash. EFT encompasses various types of transactions, including direct deposits, withdrawals, and bill payments, making it a versatile tool in today's economy. The significance of EFT lies in its efficiency; transferring funds electronically saves time and reduces the risks associated with handling cash.

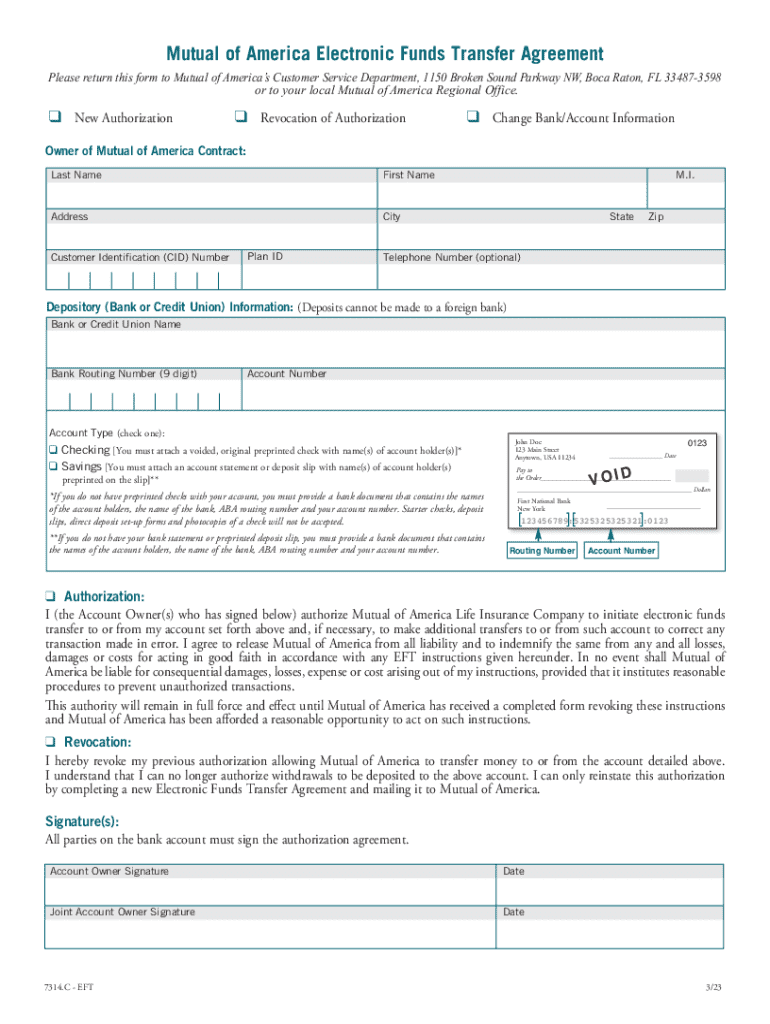

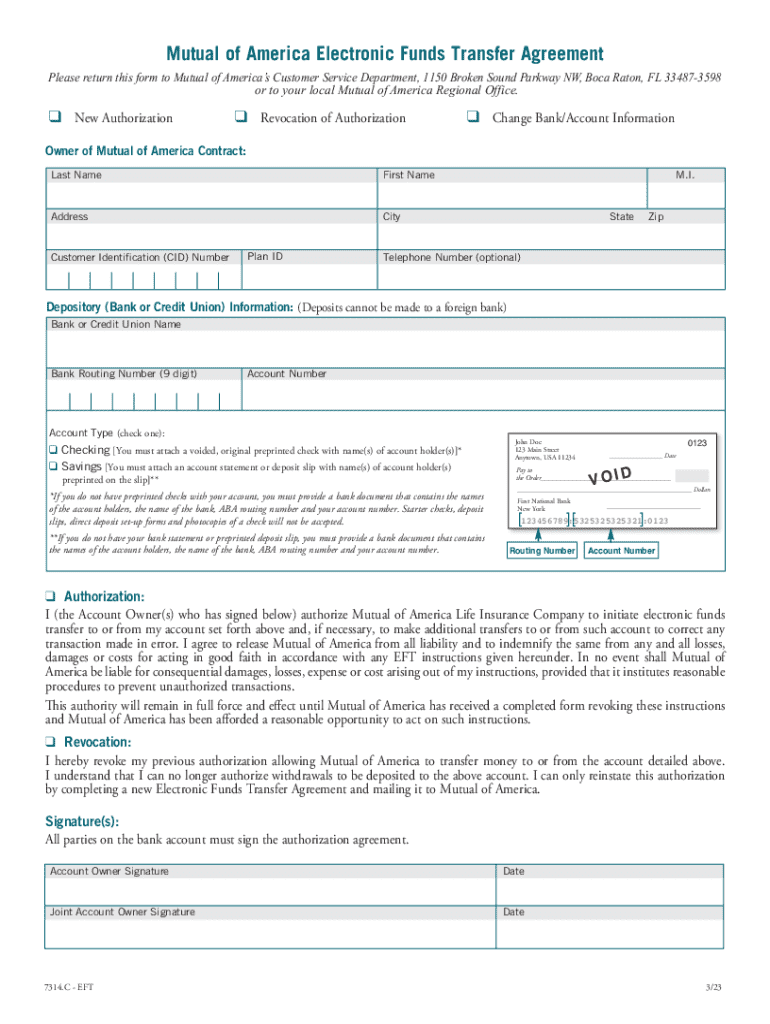

Understanding the electronic fund transfer form

The primary purpose of this electronic fund transfer form is to facilitate seamless payments between individuals and entities while ensuring transaction security. This form is essential for various financial activities, including direct deposits, bill payments, and inter-account transfers. By completing this form, users are able to authorize their financial institution to process these transactions on their behalf.

Different types of transactions covered by these forms include:

Key components of the electronic fund transfer form

Known for its simplicity, the electronic fund transfer form comprises several essential fields that must be accurately filled out. These include personal information, such as the sender's name, address, and account number, along with details necessary for processing the transaction, like financial institution information and transaction specifics.

Essential fields on the form span a few key areas:

Additional optional fields can enhance the form's utility. For instance, authorization signatures provide a record of consent while extra instructions can clarify the transaction intent.

Step-by-step instructions for completing the form

Completing the electronic fund transfer form requires careful attention to detail. Here’s a systematic guide to help ensure precision:

Editing and managing your electronic fund transfer form

Managing your electronic fund transfer form can be accomplished easily with pdfFiller. Users can access the form through the platform, where various editing tools are available. Highlighting, annotating, and commenting features allow for effective collaboration and clarification on transaction aspects.

Once you've made the necessary changes, several saving and sharing options are available. You can download your form for offline use, print a hard copy, or share it via email or direct link, allowing for seamless collaboration.

Signing the electronic fund transfer form

The validity of the electronic fund transfer form hinges on electronic signatures, which are recognized by law and ensure the security and legitimacy of the transaction. Utilizing pdfFiller for eSigning is straightforward: select the eSign option, then follow prompts to add your signature securely.

Legal considerations surrounding electronic signatures are significant. They must meet specific criteria set out in laws such as the ESIGN Act and UETA, ensuring they are accepted in various jurisdictions across the United States.

Frequently asked questions (FAQ)

Consumers often express concerns when using online EFT forms. One major concern is the security of personal information, given the sensitive nature of financial details. pdfFiller employs robust security measures, including encryption, to protect user data during transmission and storage.

Additional common queries include the ability to revise or cancel electronic transfers. Users should be aware of their financial institution's policies on making changes after submission, as there may be time frames within which alterations are permissible.

Compliance and best practices

Adhering to regulatory requirements is crucial when dealing with electronic fund transfers. User's must familiarize themselves with guidelines set forth by the National Automated Clearing House Association (NACHA) and other entities governing EFT processes, ensuring their transactions are compliant.

Best practices help safeguard personal information during transfers and include:

Additional tools and resources on pdfFiller

Beyond the electronic fund transfer form, pdfFiller offers an extensive range of document templates that cater to various financial needs. Interactive tools for tracking and managing these financial documents can enhance users' experience and organization.

The community forum on pdfFiller allows users to exchange insights and tips, making it a valuable resource for optimizing financial document management.

Testimonials and user experiences

Users of the electronic fund transfer form often share success stories about their experiences. Many find that utilizing pdfFiller for financial document management enhances their workflow, allowing for better organization and efficiency.

For example, a small business owner used pdfFiller to automate employee expense reimbursements through direct deposits, remarking that it saved her significant time and reduced paperwork. Such success stories highlight the practical benefits of embracing electronic fund transfer forms as part of a broader solution for financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute this electronic fund transfer online?

How do I edit this electronic fund transfer online?

Can I create an electronic signature for signing my this electronic fund transfer in Gmail?

What is this electronic fund transfer?

Who is required to file this electronic fund transfer?

How to fill out this electronic fund transfer?

What is the purpose of this electronic fund transfer?

What information must be reported on this electronic fund transfer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.