Get the free nebraska form 13 - fill online, printable, fillable, blank ...

Get, Create, Make and Sign nebraska form 13

How to edit nebraska form 13 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska form 13

How to fill out nebraska form 13

Who needs nebraska form 13?

Nebraska Form 13: Comprehensive Guide to Use and Management

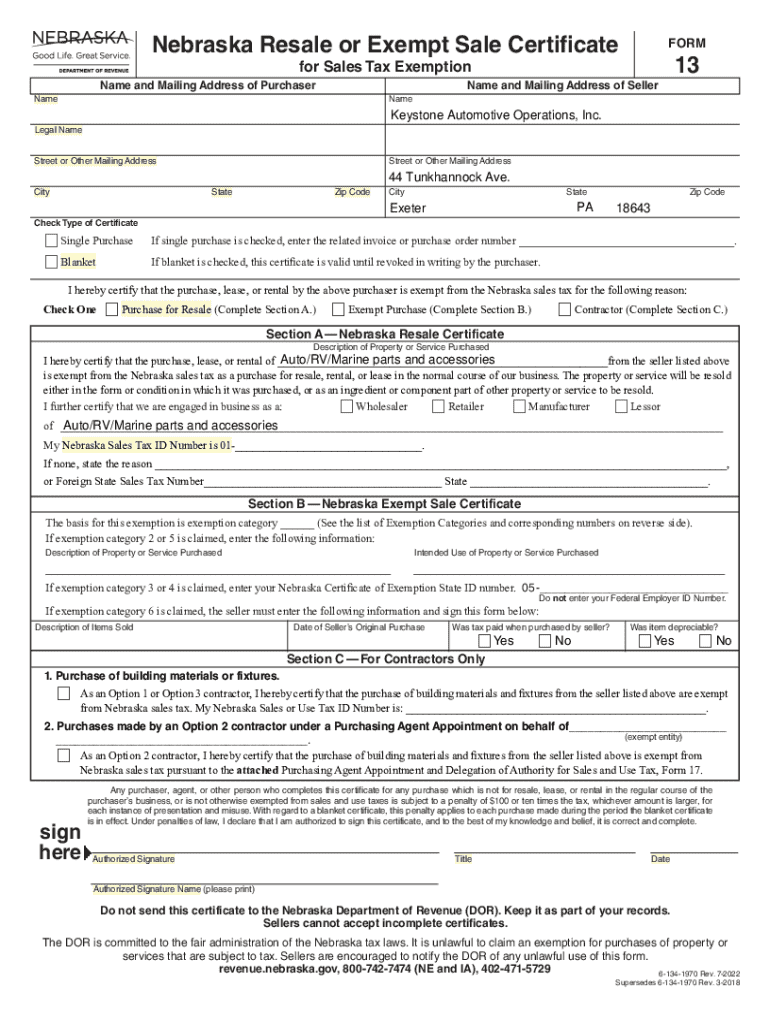

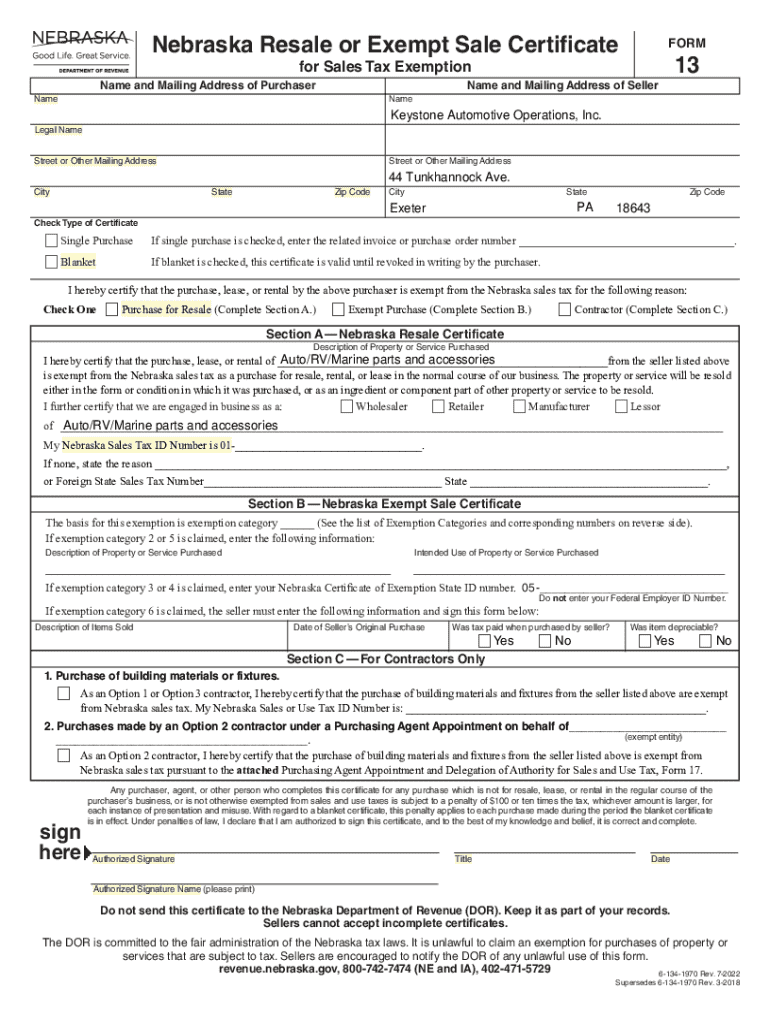

Overview of the Nebraska Form 13

Nebraska Form 13 is a vital document utilized primarily for tax purposes. It serves as a key form in the Nebraska Department of Revenue portfolio, typically required during the filing of individual income tax returns. This form is used to report income, calculate tax liabilities, and claim credits or refunds. Understanding its purpose ensures that users comply with state tax laws effectively.

Individuals who are required to report specific financial information to the Nebraska Department of Revenue should use Form 13. This includes residents, part-year residents, and non-residents who earn income in Nebraska. Accurate completion of the form is paramount, as it can significantly impact tax obligations, eligibility for tax credits, and potential refunds.

Completing Form 13 accurately is critical because any errors could lead to missed deductions, overpayments, or even audits. Furthermore, maintaining meticulous records aligned with the information on Form 13 aids in possible future reviews by tax authorities.

Key features of the Nebraska Form 13

The Nebraska Form 13 incorporates various interactive elements that enhance the user experience. Using an online platform like pdfFiller allows for real-time updates and on-the-go access. These features streamline the data entry process, making it easier for users to complete their forms efficiently.

Specific details required on Form 13 include personal identification, income sources, tax credits, and financial information. Users will also need to provide their Social Security number, taxpayer ID, and relevant tax documents supporting their claims. Recognizing common scenarios for the use of this form, such as filing as a non-resident or claiming certain deductions, can facilitate a smoother experience.

Step-by-step instructions for filling out the Nebraska Form 13

Filling out the Nebraska Form 13 requires careful attention to detail. Here’s a structured approach to ensure you're completing it accurately.

Common errors to avoid when completing Form 13

Even a small mistake on the Nebraska Form 13 can have significant consequences. Many users tend to overlook basic details, miscalculate their claims, or forget to include required attachments. Common errors include incorrect Social Security numbers, misreported income, and failure to sign the form.

The resulting consequences of such errors can range from delayed refunds to additional tax liabilities or penalties. Fortunately, pdfFiller offers features that can help identify these discrepancies before submission, allowing for timely corrections and fostering a more seamless filing experience.

Tips for managing and storing your Form 13

Effective management and storage of your Nebraska Form 13 is essential for organized record-keeping. Digitally organizing paperwork reduces the physical clutter and ensures easier access to documents when needed.

Utilizing pdfFiller’s cloud storage capabilities allows users to save their forms securely. Best practices for keeping documents secure include using strong passwords, regularly updating files, and ensuring multiple backups to prevent data loss.

Frequently asked questions (FAQs) about Nebraska Form 13

Navigating the complexities of Nebraska Form 13 can raise many questions. A few frequently asked questions include:

Case studies: Successful usage of Nebraska Form 13

Real-life examples illustrate how Nebraska Form 13 has been instrumental in various financial scenarios. An individual who reported their freelance income solely via Form 13 was able to secure a sizable tax refund by properly documenting their expenses and relevant deductions.

Testimonials indicate that users appreciate the ease of using pdfFiller for Form 13, emphasizing the simplicity of the interface and the efficiency of electronic filing.

Additional resources for Nebraska Form 13 users

Many resources are available to assist with the completion and management of the Nebraska Form 13. These include informative links to the Nebraska state government resources, user guides, and instructional videos offered through the pdfFiller platform.

For further support, consider utilizing the comprehensive help sections on pdfFiller, where users can find strategies for efficient document management related to Form 13.

Related forms and documents

In conjunction with Nebraska Form 13, users may need to navigate other related forms such as the Nebraska Individual Income Tax Return or the associated schedules for deductions. Understanding the relationship between these forms can help streamline your filing process.

Utilizing pdfFiller offers an excellent pathway for managing multiple forms efficiently. Their platform allows seamless filling and submission of interconnected documents, enhancing overall productivity.

Navigating pdfFiller tools for Form 13

pdfFiller provides an array of features tailored specifically for users handling Nebraska Form 13. The platform’s editing tools simplify document creations and modifications, while its e-signature capabilities enhance credibility and legal compliance.

User feedback highlights the impressive efficiency of pdfFiller's toolsets for managing Form 13. Many report increased productivity due to the centralized management of forms and the ease of collaboration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete nebraska form 13 online?

Can I create an electronic signature for signing my nebraska form 13 in Gmail?

Can I edit nebraska form 13 on an Android device?

What is nebraska form 13?

Who is required to file nebraska form 13?

How to fill out nebraska form 13?

What is the purpose of nebraska form 13?

What information must be reported on nebraska form 13?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.