Get the free New Jersey Mechanics Lien Guide and FAQs

Get, Create, Make and Sign new jersey mechanics lien

How to edit new jersey mechanics lien online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new jersey mechanics lien

How to fill out new jersey mechanics lien

Who needs new jersey mechanics lien?

Understanding and Utilizing the New Jersey Mechanics Lien Form

Understanding mechanics liens in New Jersey

A mechanics lien is a legal claim against a property, which serves as a security interest in the property for unpaid work or materials provided during a construction project. In New Jersey, these liens are a critical tool for contractors and subcontractors who wish to ensure they get paid for their services. They not only protect the interests of those who provide labor and materials but also help maintain fairness in the construction industry.

The purpose of a mechanics lien in construction is primarily to enforce payment obligations. When a contractor or subcontractor completes work or provides materials on a project, they can file a lien if they haven’t received payment. This claim is recorded against the property, effectively preventing the owner from selling or refinancing until the debt is settled, thus incentivizing timely payments.

Who can file a mechanics lien? In New Jersey, any contractor, subcontractor, or supplier who provides labor or materials for the improvement of a property has the right to file a mechanics lien. This includes general contractors, subcontractors, materials suppliers, and other professionals. However, understanding the specifics of the law is essential to ensure compliance with the legal framework governing these liens.

Key aspects of New Jersey mechanics lien laws

New Jersey mechanics lien statutes outline the process and requirements for filing a lien. The statutes detail the rights and obligations of all parties involved, providing a legal framework that aims to balance the interests of unpaid contractors and property owners. The most critical aspect of filing a lien is adhering to timelines. Failure to adhere to statutory deadlines can result in the inability to enforce a lien, making punctuality paramount in this process.

Understanding the rights and responsibilities of contractors, subcontractors, and property owners is also vital. Contractors are entitled to file a lien if they aren't paid, while property owners have the right to dispute a lien if they believe it was filed incorrectly or unjustly. This balance between rights helps maintain order in construction projects while protecting everyone involved.

Step-by-step guide to filing a New Jersey mechanics lien

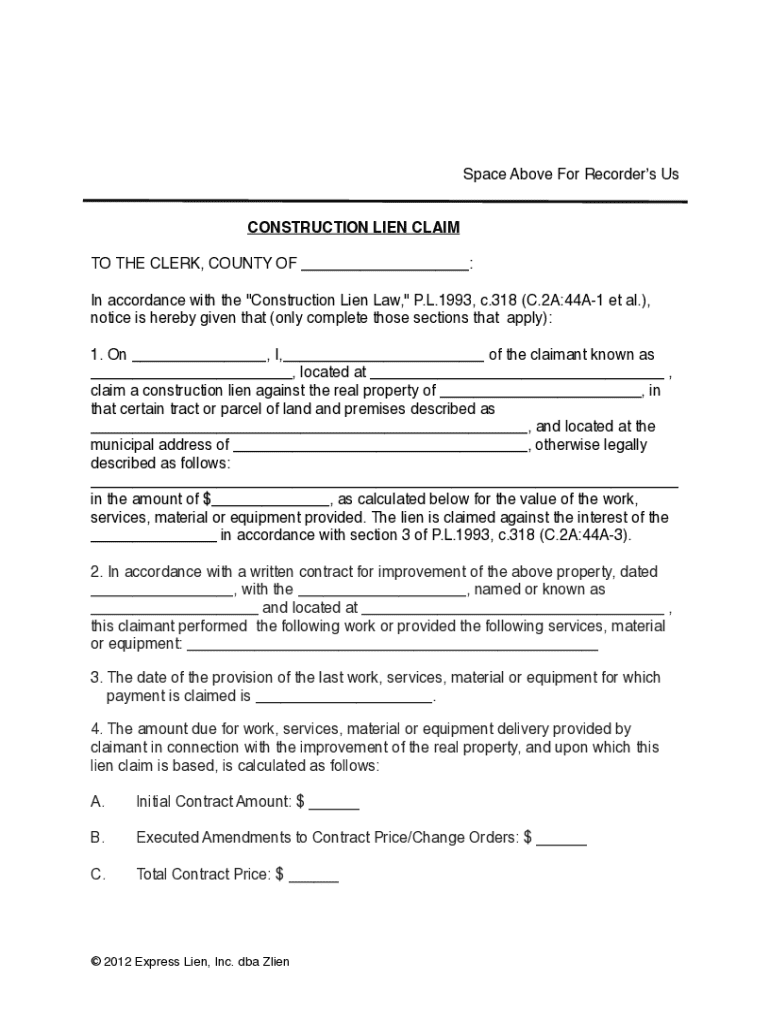

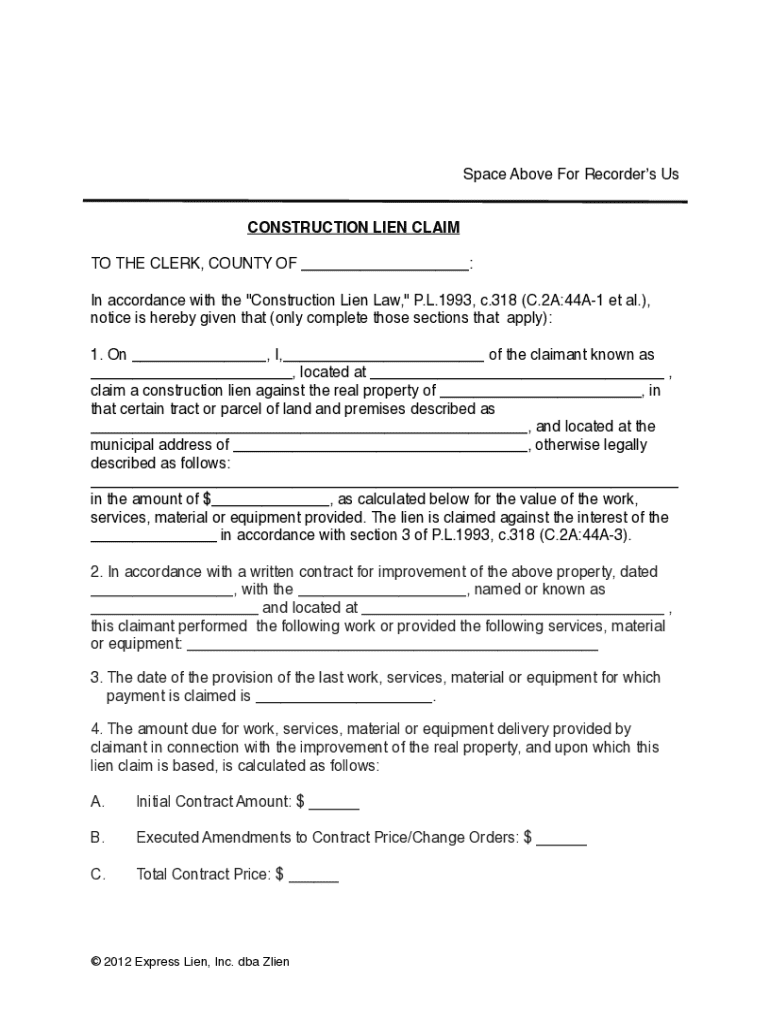

Filing a mechanics lien in New Jersey involves several crucial steps. First, you must gather all necessary information, which includes the legal description of the property along with details of the project and the involved parties. This step is vital, as accurate information will facilitate a smooth filing process.

Next, complete the New Jersey mechanics lien form. Ensure that all sections of the form are filled accurately. Common mistakes include failing to sign, providing incorrect information, or not including necessary attachments. It’s crucial to double-check all details for accuracy to prevent rejection of your lien.

After completing the form, the next step is to sign and notarize the document. New Jersey has specific requirements for notarization, including proper acknowledgment of signatures. Ensure that the proper parties sign the document to avoid any issues later.

Finally, file the lien with the county clerk’s office. Make sure to check the submission procedure, filing fees, and payment methods. Being aware of potential challenges in filing can help you navigate the process more effectively, ensuring that your lien is valid.

After filing: managing your mechanics lien

Once you have filed your mechanics lien, it's crucial to track its status actively. Follow up with the county clerk's office to ensure the lien is recorded properly. If there are disputes about the lien, having organized records and documentation will be key to resolving them efficiently. Clear communication with property owners and general contractors is essential, as misunderstandings can often lead to disputes over payment.

In the event of disputes escalating, prepare for potential legal proceedings. Familiarize yourself with the legal process surrounding mechanics liens in New Jersey to effectively advocate for your rights. Seeking advice from legal professionals, particularly those well-versed in construction law, can provide you with crucial support during challenging times.

Related forms important to mechanics liens

Several related forms are vital when dealing with mechanics liens in New Jersey. Firstly, the New Jersey Notice of Intent to Lien serves as a preliminary notification to property owners before filing a lien. This form is beneficial as it often encourages prompt payment, thereby preventing the need for further action.

Secondly, the New Jersey Lien Release Form is essential for documenting the release of a lien once payment has been received. This form clears the property’s title and ensures that no further claims are pending against it. Additionally, it is useful to be aware of comparative forms in other states to understand how mechanics liens function elsewhere, enhancing your overall knowledge of construction law.

Tools for creating and managing mechanics liens

Utilizing tools like pdfFiller can significantly simplify the process of creating and managing mechanics liens. This document creation platform streamlines the entire procedure, making it easy to fill out and edit the New Jersey mechanics lien form efficiently. The platform is designed for individuals and teams to access from anywhere, ensuring you can manage documents whenever needed.

One of the key benefits of using pdfFiller is its remarkable features, which include eSigning, collaboration options, and cloud-based access. The ability to collaborate with team members or property owners in real time enhances communication and reduces misunderstandings. Users can easily fill out necessary forms, ensuring accuracy and compliance with New Jersey’s filing requirements.

Furthermore, many users often have questions about how to navigate the mechanics lien process through such platforms. pdfFiller provides FAQs that guide users in filling out forms correctly, ensuring a smoother experience overall. From format issues to how to best organize your documentation, you'll find valuable insights right at your fingertips.

Legal considerations and compliance

Filing a mechanics lien comes with significant legal implications. Understanding these implications is essential for all parties involved. Recent changes in New Jersey lien laws can affect how liens are filed and executed, highlighting the necessity for staying updated on legal standards applicable to your situation.

It's often wise to seek legal advice when filing a mechanics lien, especially if you encounter disputes or complexities in the process. An attorney specializing in construction law can provide insight into whether or not you have a valid claim, what potential complications may arise, and the best strategies for pursuing a lien effectively.

Best practices for a successful mechanics lien filing

Documentation is paramount in the mechanics lien process. Ensure that you keep thorough records of all communications, contracts, and agreements made with property owners and general contractors. Having organized documentation acts as a safeguard in case of disputes and is invaluable for substantiating your claims.

Additionally, maintaining effective communication with property owners and contractors is critical. Regular follow-ups can help prevent misunderstandings regarding payments and will establish a professional rapport that may encourage prompt payment. By being proactive, you not only protect your interests but also promote a more collaborative work environment.

Common questions about New Jersey mechanics liens

One frequently asked question is, 'How long does a mechanics lien last?' In New Jersey, a mechanics lien typically remains in effect for a period of one year from the date of filing. However, one can also initiate legal action to enforce the lien within that time frame, which may extend its effectiveness if certain actions are taken.

Another question is: 'What happens if a lien is disputed?' If a lien is contested, it may lead to legal proceedings where parties involved present their case. Finally, individuals often inquire whether a mechanics lien can be removed. Yes, once payment has been received or the parties reach an agreement, you can file a lien release form to clear the property’s title.

Utilizing pdfFiller for future documentation needs

pdfFiller not only aids in creating mechanics liens but also serves as a versatile tool for various document needs. From contracts to affidavits and other legal documents, the platform’s array of templates ensures that users can find exactly what they need. The cloud-based nature of pdfFiller means that documents can be accessed and modified on-the-go, providing incredible flexibility.

Exploring additional templates and forms relevant to construction and legal processes can further streamline your operations. With pdfFiller, you can create, edit, and manage all your documentation needs from one comprehensive platform, ensuring that you remain organized while navigating the intricacies of the construction industry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the new jersey mechanics lien in Chrome?

Can I edit new jersey mechanics lien on an iOS device?

How can I fill out new jersey mechanics lien on an iOS device?

What is New Jersey mechanics lien?

Who is required to file New Jersey mechanics lien?

How to fill out New Jersey mechanics lien?

What is the purpose of New Jersey mechanics lien?

What information must be reported on New Jersey mechanics lien?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.