Get the free Minnesota Partnerships Forms Availability

Get, Create, Make and Sign minnesota partnerships forms availability

Editing minnesota partnerships forms availability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minnesota partnerships forms availability

How to fill out minnesota partnerships forms availability

Who needs minnesota partnerships forms availability?

Comprehensive Guide to Minnesota Partnerships Forms Availability Form

Understanding Minnesota partnerships

Partnerships in Minnesota represent a unique business structure where two or more individuals manage and operate a business together, sharing its profits and liabilities. Under Minnesota law, partnerships are governed by the Uniform Partnership Act, which outlines how these entities can be created and structured. Understanding partnerships starts with recognizing the difference between general and limited partnerships, each of which has distinct characteristics and legal implications.

General partnerships involve all partners in the decision-making processes and liability management, meaning each partner is fully responsible for debts. In contrast, limited partnerships consist of both general partners, who manage the business, and limited partners, who invest capital but do not partake in daily management. Establishing a partnership in Minnesota requires adherence to specific legal formalities, such as submitting the appropriate registration forms, drafting a partnership agreement, and registering for taxation with the Department of Revenue.

Overview of partnership forms in Minnesota

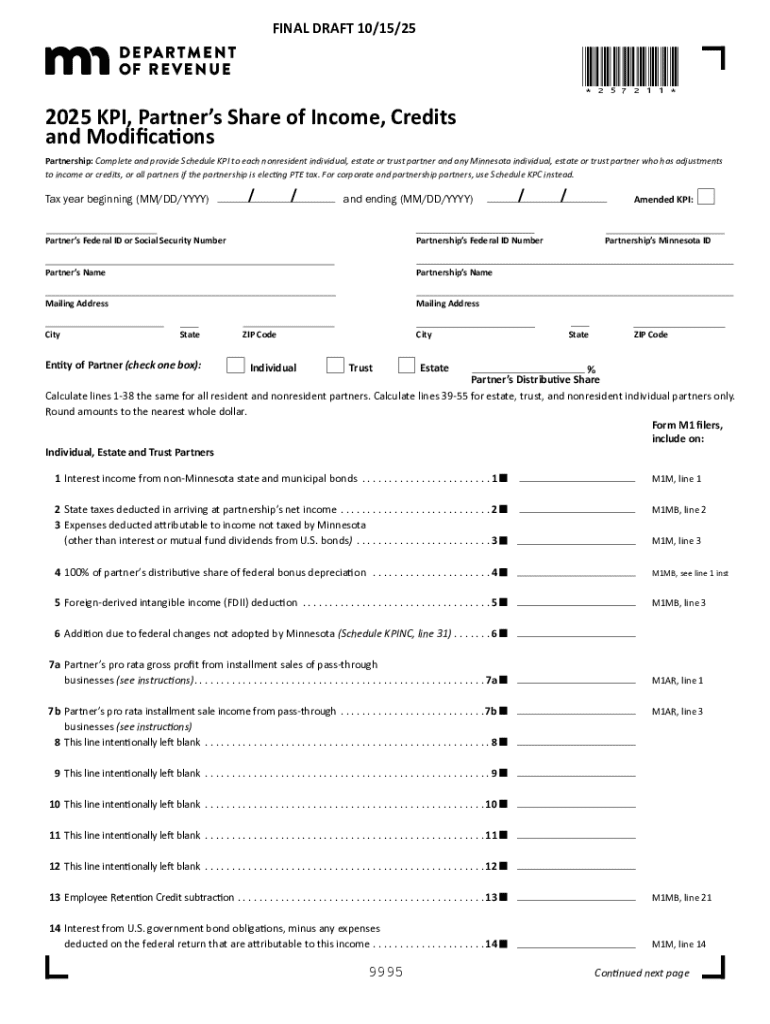

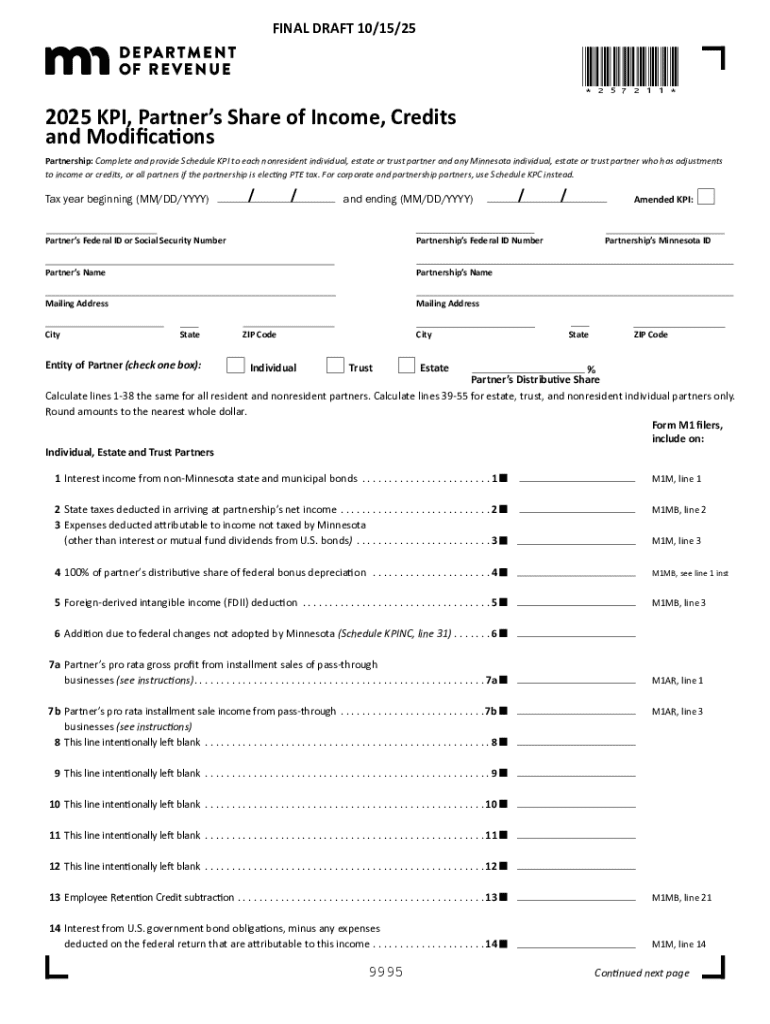

Properly completed partnership forms are crucial for regulatory compliance and legal recognition in Minnesota. Various forms are necessary to establish and maintain a partnership, each serving a specific purpose in the partnership lifecycle. Below are some common forms required for partnerships.

Accessing Minnesota partnership forms

Finding the necessary partnership forms in Minnesota is straightforward. Most forms can be accessed through the Minnesota Secretary of State’s website, which serves as a repository for various business documents. Local government offices can also provide essential forms and guidance for those who prefer in-person assistance.

Digital availability offers a great advantage, allowing you to fill out many forms online, streamlining the process significantly. Forms can often be downloaded in PDF format for printing, making it simple to prepare and submit physical copies when necessary.

Step-by-step guide to completing partnership forms

Filling out partnership forms accurately is critical to your business’s success. Before you begin, gather all necessary information, including business name, contact details of all partners, and information specific to each partner's contributions and responsibilities.

Let’s break down the major forms you'll likely encounter and the details needed to complete them.

To avoid common errors, double-check all information before submission. If uncertain, consulting a legal professional is advisable to ensure your partnership remains compliant with state laws.

Editing and managing partnership forms

Managing partnership forms is simplified with tools like pdfFiller, designed for document editing and management. This platform allows users to easily edit PDFs without the need for specialized software, ensuring that any changes needed to your forms can be made swiftly and efficiently.

You can also utilize pdfFiller’s eSigning capabilities to digitally sign partnership forms, enhancing convenience and saving time. The platform includes collaboration features, enabling multiple partners to review and contribute to documents seamlessly.

Submitting your partnership forms

Once your partnership forms are completed, it's essential to know where and how to submit them. Minnesota provides several options for submission, including online and traditional mail.

When submitting online, follow the specific instructions outlined on the Minnesota Secretary of State’s website. For mail submissions, ensure you include any required fees, which may vary based on the type of form being submitted. Understanding processing times is also crucial; typically, processing can take a few days to several weeks, depending on volume and submission method.

FAQs about Minnesota partnerships forms

Navigating the partnership forms landscape in Minnesota can lead to questions. Here are some common concerns you might encounter:

Contact support for Minnesota partnership forms

If you require further assistance regarding Minnesota partnership forms, various resources are available. The Minnesota Secretary of State’s office provides contact information for inquiries and support directly related to partnership registrations.

For users of pdfFiller, customer support options are accessible, ensuring you have the help needed to navigate document management effectively. Subscribing to receive email updates about form changes is also recommended to stay informed on any new regulations or procedures.

Staying compliant with Minnesota partnership laws

Regular compliance is crucial for maintaining your partnership's good standing in Minnesota. This includes timely updates and adherence to all filing requirements to prevent any legal ramifications.

Resources are available to keep you informed about legal changes affecting partnerships. Consistent updates on partnership tax obligations and partnership agreements can mitigate potential discrepancies. Additionally, providing documents in multiple languages, including translation disclaimers, ensures clarity for non-native speakers while promoting inclusivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get minnesota partnerships forms availability?

How do I complete minnesota partnerships forms availability online?

How do I make edits in minnesota partnerships forms availability without leaving Chrome?

What is minnesota partnerships forms availability?

Who is required to file minnesota partnerships forms availability?

How to fill out minnesota partnerships forms availability?

What is the purpose of minnesota partnerships forms availability?

What information must be reported on minnesota partnerships forms availability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.