Get the free New NAIC task force urged to update RBC to avoid more ...

Get, Create, Make and Sign new naic task force

Editing new naic task force online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new naic task force

How to fill out new naic task force

Who needs new naic task force?

New NAIC Task Force Form: A Comprehensive Guide

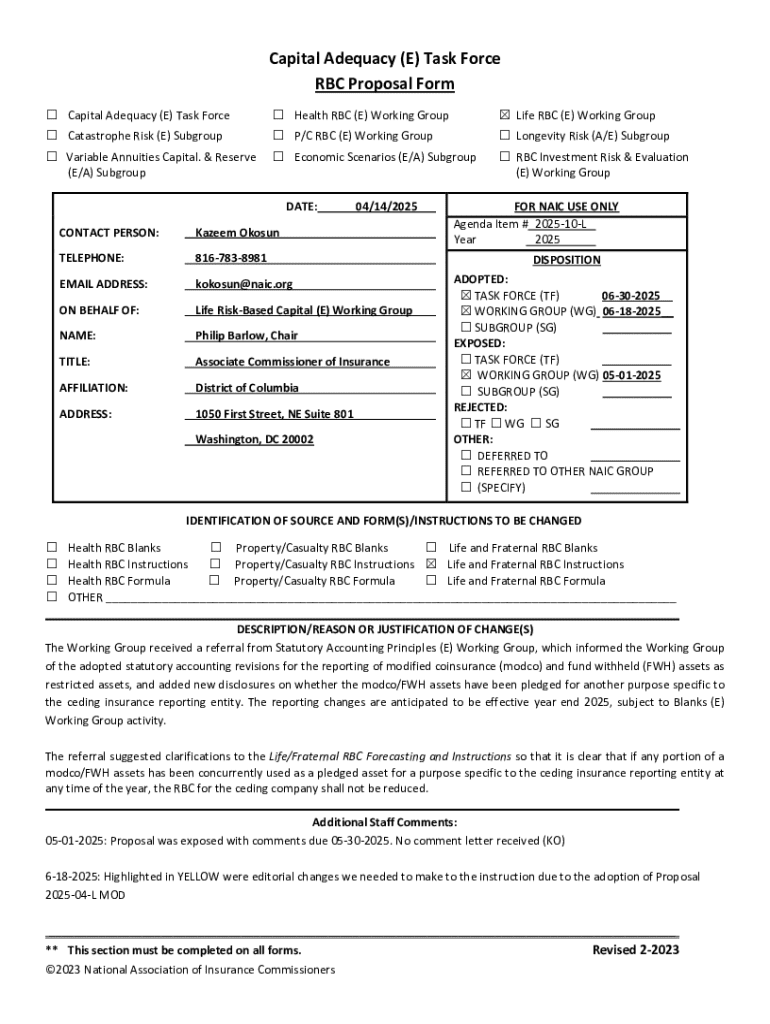

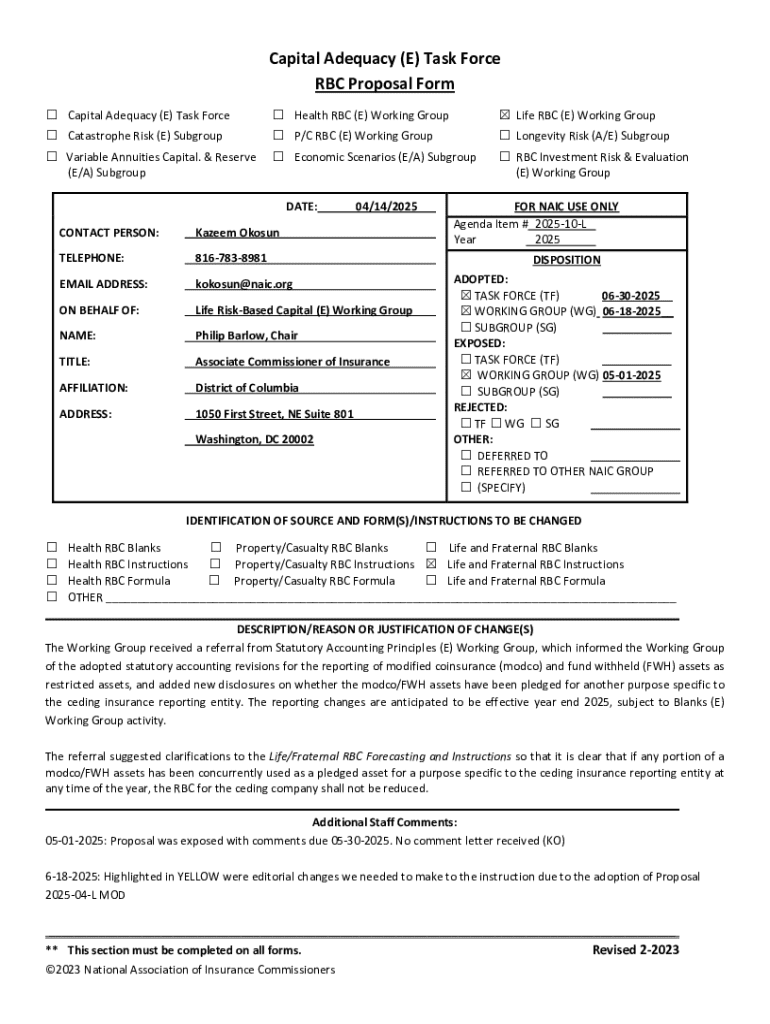

Overview of the new NAIC task force form

The new NAIC task force form is a crucial regulatory document established by the National Association of Insurance Commissioners (NAIC) to facilitate the effective reporting of information concerning the insurance industry. Its primary purpose is to standardize the submission of data regarding task forces formed to address specific issues in the insurance sector, ensuring that all stakeholders benefit from an organized, transparent process.

Within the regulatory landscape, the importance of this form cannot be overstated. It acts as a bridge between insurers and regulators, enabling smoother communication and collaboration. By aligning the interests of different regulatory bodies and insurance professionals, the form ultimately reinforces industry standards and promotes a robust framework for compliance.

The NAIC plays a pivotal role in this context, serving as a collective of state regulators that establishes consistent guidelines and rules that govern insurance practices across the United States. The new NAIC task force form reflects this commitment to harmonizing regulations while accommodating the unique needs of various insurance entities.

Key features of the new NAIC task force form

The new NAIC task force form boasts several key features designed to enhance its utility for insurance professionals. First and foremost, the form includes comprehensive fields and sections that facilitate detailed reporting of specific issues and objectives. This structured layout allows users to provide all necessary information succinctly, minimizing confusion and ensuring accuracy.

Secondly, it is designed with compliance in mind. The form adheres strictly to regulatory requirements set by the NAIC, ensuring that all submissions meet the latest standards in insurance regulation. This aspect is particularly beneficial for organizations that wish to avoid potential pitfalls during audits or compliance checks.

Additionally, the adaptability of the new NAIC task force form caters to the diverse needs of various insurance sectors. Whether dealing with life, health, property, or casualty insurance, the form allows for customization to suit different regulatory needs while maintaining a core structure essential for compliance.

Step-by-step guide to completing the new NAIC task force form

Step 1: Gathering required information

Before filling out the new NAIC task force form, it's crucial to gather all necessary documentation and data. Key documents may include previous task force reports, compliance records, and specific operational metrics related to the issues at hand. Organizing this information beforehand can streamline the entire process.

Here are a few tips for organizing your information effectively: 1. Create a checklist of all required documents to avoid missing anything. 2. Use folders or digital storage solutions to group related materials together. 3. Set timelines for collecting data to prevent last-minute rushes.

Step 2: Filling out the form

When proceeding to fill out the new NAIC task force form, it’s essential to follow the instructions for each section closely. Ensure you provide clear, detailed information in answer to the prompts. Common pitfalls to avoid include incomplete sections, misinformation, or missing signatures.

Step 3: Reviewing your submission

Before submitting the form, perform a thorough review of all entries. Utilize a checklist to confirm that every section is completed adequately. It’s also important to note any relevant deadlines for submission to ensure timely compliance.

Step 4: Submitting the form

The last step involves submitting the form. Depending on your institution's policies, you may choose between electronic submission or mailing a paper copy. Always confirm receipt of the submission to safeguard against any potential miscommunications or issues.

Interactive tools to enhance your experience

In the age of digital transformation, utilizing interactive tools can vastly improve your experience with the new NAIC task force form. For instance, real-time editing and collaboration features enable multiple team members to work simultaneously on the document, fostering a cooperative atmosphere.

Moreover, tracking changes and maintaining version history ensures that all modifications are recorded, allowing for easy backtracking if needed. This enhances accountability and clarity throughout the documentation process.

Lastly, integrated eSignature options streamline the final steps of document execution. This eliminates the need for printing, signing, and scanning, making the process not only faster but also more efficient for all parties involved.

Best practices for managing your NAIC task force form

To navigate the complexities of the new NAIC task force form effectively, consider embracing a few best practices. First, maintaining compliance with ongoing updates to the form or associated regulations is essential. Staying informed about changes from the NAIC ensures that your submissions remain relevant and accurate.

Additionally, managing your documents efficiently is crucial. Utilize cloud-based solutions that allow secure storage, easy retrieval, and backup of your records. This not only protects your data but also facilitates easier access when follow-up requests from regulatory bodies arise.

Finally, when addressing follow-up requests, maintain open communication with the regulators and provide them with any additional information promptly to facilitate a smooth process.

Common FAQs about the new NAIC task force form

As with any regulatory form, questions often arise concerning the new NAIC task force form. One of the most common inquiries is what to do if issues are encountered during the completion process. It’s advisable to have a designated point of contact within your organization to troubleshoot these problems as they arise.

Another frequently asked question involves amending a submitted form. If revisions are necessary after submission, be sure to follow the specified protocol for amendments detailed by the NAIC. Provide a clear explanation for the changes to avoid confusion.

Lastly, if you require support or clarification, contact the appropriate regulatory body or department as soon as possible. Having this line of communication established is critical for ensuring that all your inquiries are addressed swiftly.

Case studies and examples

Examining real-world applications of the new NAIC task force form provides valuable insights into its effectiveness. Various teams have successfully utilized the form to address pressing issues, such as compliance with new insurance regulations, and aligned their operations with industry best practices.

For instance, a regional insurance provider faced challenges regarding capital requirements. By forming a task force and utilizing the new NAIC task force form, they were able to systematically report their findings and collaborate with regulators. This proactive approach not only improved compliance but also led to enhanced operational efficiencies.

Lessons learned from such experiences highlight the importance of thorough documentation, open communication with regulators, and the commitment to continuous improvement in compliance strategies.

The role of pdfFiller in completing your NAIC task force form

pdfFiller stands out as an exceptional cloud-based solution for completing the new NAIC task force form. Its user-friendly interface allows individuals and teams to seamlessly edit PDFs, eSign documents, and manage files from one centralized platform. This functionality is particularly beneficial for those engaged in often complex and multifaceted insurance regulations.

Users of pdfFiller have noted significant improvements in their document management processes, citing the ease of collaboration and reduced turnaround times for submissions. Testimonials highlight the transformative power of pdfFiller in enhancing productivity and compliance within the insurance industry.

The platform’s key features, such as customizable templates, automated workflows, and secure eSignatures, make it an invaluable tool when navigating the intricacies of regulatory forms like the NAIC task force form.

Future trends and changes to watch

As the insurance landscape continuously evolves, so too will the regulatory requirements that govern it. Anticipated changes may directly impact the new NAIC task force form, necessitating ongoing adaptation from organizations. Stakeholders should remain vigilant concerning shifts in regulations and emerging standards to ensure continued compliance.

Technological advances also present opportunities for improving document management processes. As cloud-based solutions become more sophisticated, the potential for integrated monitoring and real-time compliance updates will enhance the practical applicability of forms like the NAIC task force form. Additionally, automation might further streamline the completion process, reducing manual workloads and increasing accuracy.

Build your knowledge: Related forms and templates

Understanding the new NAIC task force form is just the beginning; being aware of related forms and templates can greatly enhance your efficiency. Other relevant NAIC forms include the Annual Statement and Quarterly Statement, which provide comprehensive financial and operational data required by regulators. These forms interconnect with the task force form, often serving as supporting documentation or foundational inputs.

By familiarizing yourself with these forms, you can streamline your workflow while ensuring that all regulatory requirements are met. The interconnected nature of these documents highlights the need for effective document management strategies that can adapt to a dynamic regulatory environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in new naic task force?

How do I complete new naic task force on an iOS device?

How do I complete new naic task force on an Android device?

What is new naic task force?

Who is required to file new naic task force?

How to fill out new naic task force?

What is the purpose of new naic task force?

What information must be reported on new naic task force?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.