Get the free Monthly-Debt-Update-website.knit - Joint Economic Committee

Get, Create, Make and Sign monthly-debt-update-websiteknit - joint economic

Editing monthly-debt-update-websiteknit - joint economic online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly-debt-update-websiteknit - joint economic

How to fill out monthly-debt-update-websiteknit - joint economic

Who needs monthly-debt-update-websiteknit - joint economic?

Monthly Debt Update: Managing Your Financial Future with the Joint Economic Form

Understanding monthly debt updates

Monthly debt updates are systematic reviews of an individual's or a business's current debt obligations and payment statuses. They provide an organized assessment for tracking overall financial health. Keeping track of monthly debt is critical as it allows individuals and businesses to make informed decisions, allocate resources effectively, and develop strategies to pay down obligations. In the context of national economics, the Joint Economic Form provides essential insights about collective debt trends, shaping how individuals manage their own financial responsibilities.

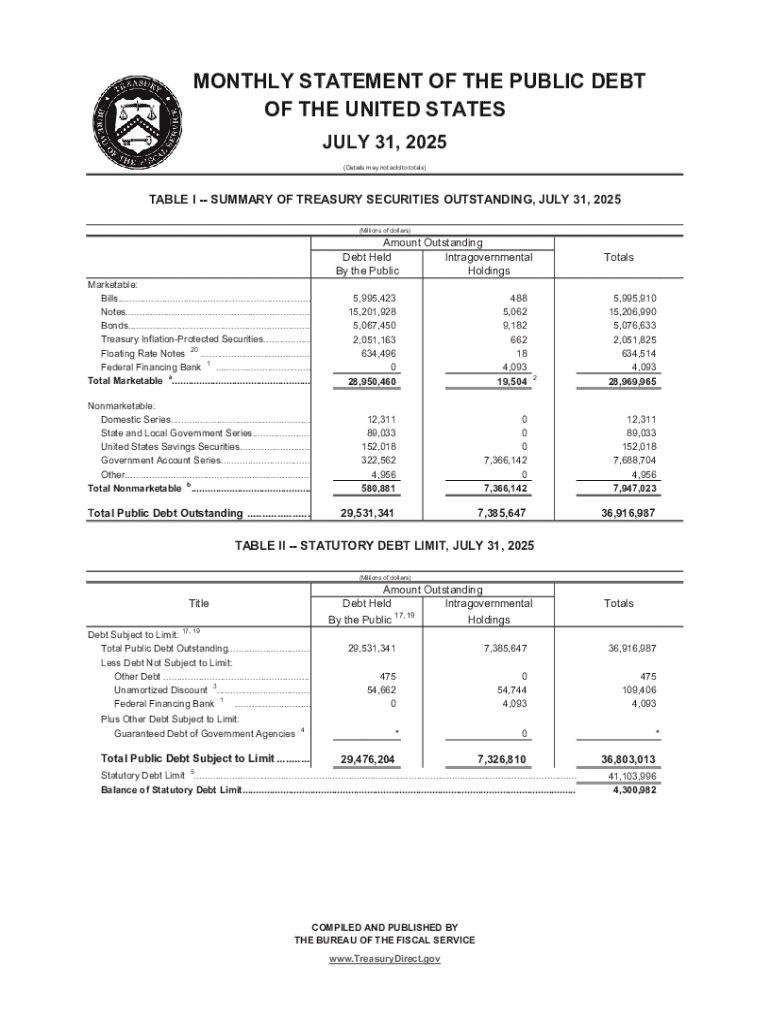

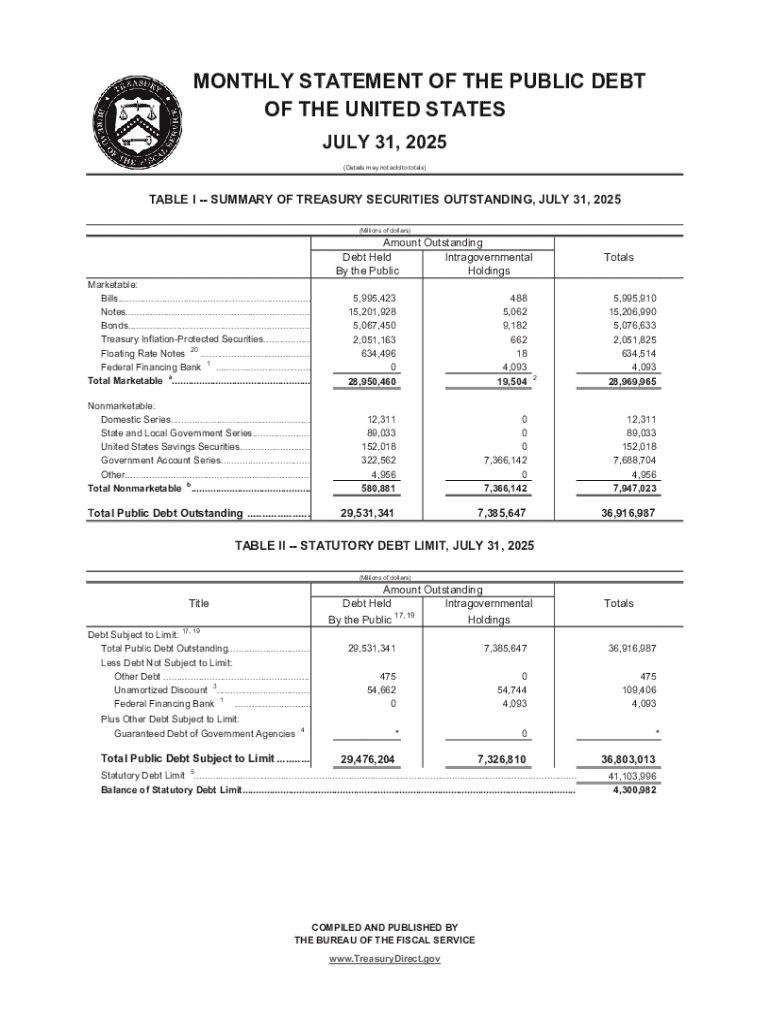

Current state of national debt

The growth of the national debt has been a subject of concern among economists and financial analysts. Recent statistics indicate that the U.S. national debt has exceeded $31 trillion, driven by factors such as increased government spending, economic stimulus measures, and tax cuts. Interest rates play a significant role in influencing the long-term repercussions of this debt, with current rates hovering around 4-5%, substantially higher compared to the historical lows seen back in 2021.

The composition of the U.S. debt is equally critical to understand. A clear breakdown reveals that approximately 78% of the debt is public, held by a mix of foreign governments, institutional investors, and individual Americans. Meanwhile, the remaining portion is intra-governmental debt, which accounts for loans between various U.S. government entities. Major holders of U.S. debt include China, Japan, and domestic federal reserve banks.

Utilizing interactive tools for debt management

pdfFiller's interactive tools are designed to simplify debt management, offering features that allow users to track and manage monthly debts effectively. These tools enable easy document creation, editing, and collaboration, reinforcing efficient practices for financial tracking. The benefits of utilizing a cloud-based platform include access from anywhere and seamless integration among team members, which is especially valuable for businesses.

To use pdfFiller for your monthly debt updates, follow this step-by-step guide. Start by creating a new document tailored for debt tracking using the platform's template features. Next, edit and customize your document to reflect specific categories of your monthly obligations, such as credit cards, loans, and other debts. After completing your edits, utilize the secure signing feature to finalize your updates before sharing with relevant stakeholders.

Best practices for filling out joint economic forms

Completing the Joint Economic Form requires careful attention to detail. Specific sections focus on total debt amounts, ratios, and the classification of different types of debt. It is critical to avoid common mistakes, such as misreporting amounts or mixing up personal and business debts, which can lead to inaccuracies in financial reporting.

Collaborating with others is streamlined using pdfFiller, where features such as comments and real-time editing facilitate better communication. Users can easily share documents for input, feedback, and final approval, ensuring all members are aligned on financial strategies and reporting. This collaborative approach significantly enhances the accuracy and reliability of the data submitted on the Joint Economic Form.

Upcoming releases and updates relevant to debt management

Recently, notable changes in government policy regarding economic aid have been introduced that will significantly impact monthly debt tracking. For example, new tax incentives may alter how individuals and businesses approach their debt repayment strategies. Additionally, pdfFiller continuously innovates its offerings, with upcoming features that assist in tracking and reporting financial obligations more efficiently.

Stay informed about forthcoming webinars and training sessions aimed at effectively managing debt. These educational initiatives are designed to help both individuals and businesses strategize in light of new debt data, equipping them to navigate the evolving economic landscape.

Expert insights and tips for effective debt management

Financial experts emphasize the importance of implementing proactive strategies to manage increasing debt levels. Regular reviews of monthly finances and debt updates can unveil insights that guide decision-making. The incorporation of debt updates into broader financial strategies allows individuals and businesses to remain agile amidst shifting economic conditions, making it imperative to adjust planning based on the latest data.

Key recommendations include categorizing debt into priority levels, negotiating with lenders when feasible, and leveraging interactive tools like pdfFiller to maintain accurate records. These practices not only streamline financial operations but also empower better financial decision-making over time.

Real-life applications of monthly debt updates

Real-life case studies exemplify the successful management of debt through diligent reporting and monitoring. Several businesses have reported improved cash flow and reduced liabilities by adhering to scheduled updates and assessments of monthly debts. Moreover, individuals who leverage tools for timely debt updates often find themselves making more informed financial decisions, which leads to more sustainable personal finance management.

The role of technology in financial health cannot be overlooked. By utilizing cloud-based solutions like pdfFiller, users gain insights into their financial standings that help mitigate risks associated with debt. This kind of proactive debt management fosters a culture of accountability and transparency, both at the individual and organizational levels.

Frequently asked questions about monthly debt updates

Individuals often have queries regarding how to optimally manage their debt updates. Common questions include best practices for reporting discrepancies, proper categorization of various debt instruments, and how best to utilize tools like pdfFiller for monthly updates. Furthermore, users may seek troubleshooting tips for any challenges encountered while utilizing the platform.

Clarifications on financial terms commonly used in debt discussions are also significant. Ensuring that users feel well-informed about interest rates, debt-to-income ratios, and other crucial metrics enhances their confidence in managing their financial obligations effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in monthly-debt-update-websiteknit - joint economic without leaving Chrome?

How do I fill out the monthly-debt-update-websiteknit - joint economic form on my smartphone?

How can I fill out monthly-debt-update-websiteknit - joint economic on an iOS device?

What is monthly-debt-update-websiteknit - joint economic?

Who is required to file monthly-debt-update-websiteknit - joint economic?

How to fill out monthly-debt-update-websiteknit - joint economic?

What is the purpose of monthly-debt-update-websiteknit - joint economic?

What information must be reported on monthly-debt-update-websiteknit - joint economic?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.