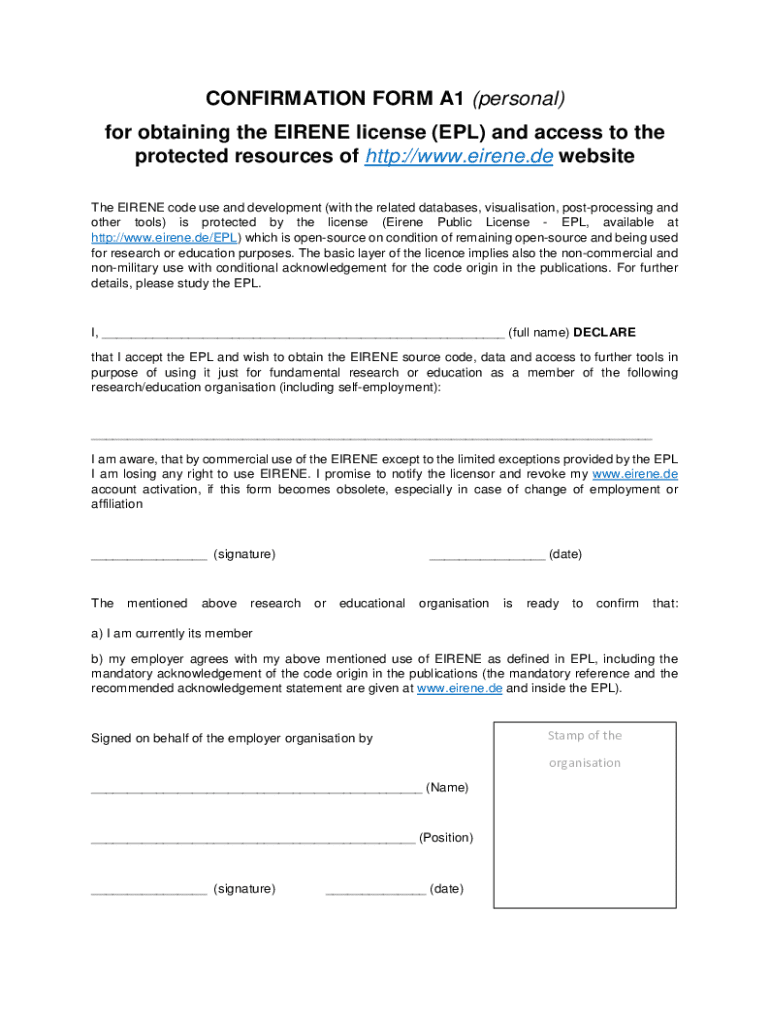

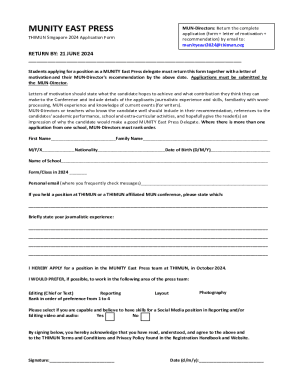

Get the free CONFIRMATION FORM A1 (personal) for obtaining the EIRENE ...

Get, Create, Make and Sign confirmation form a1 personal

Editing confirmation form a1 personal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out confirmation form a1 personal

How to fill out confirmation form a1 personal

Who needs confirmation form a1 personal?

Understanding and Managing Your Confirmation Form A1 Personal Form

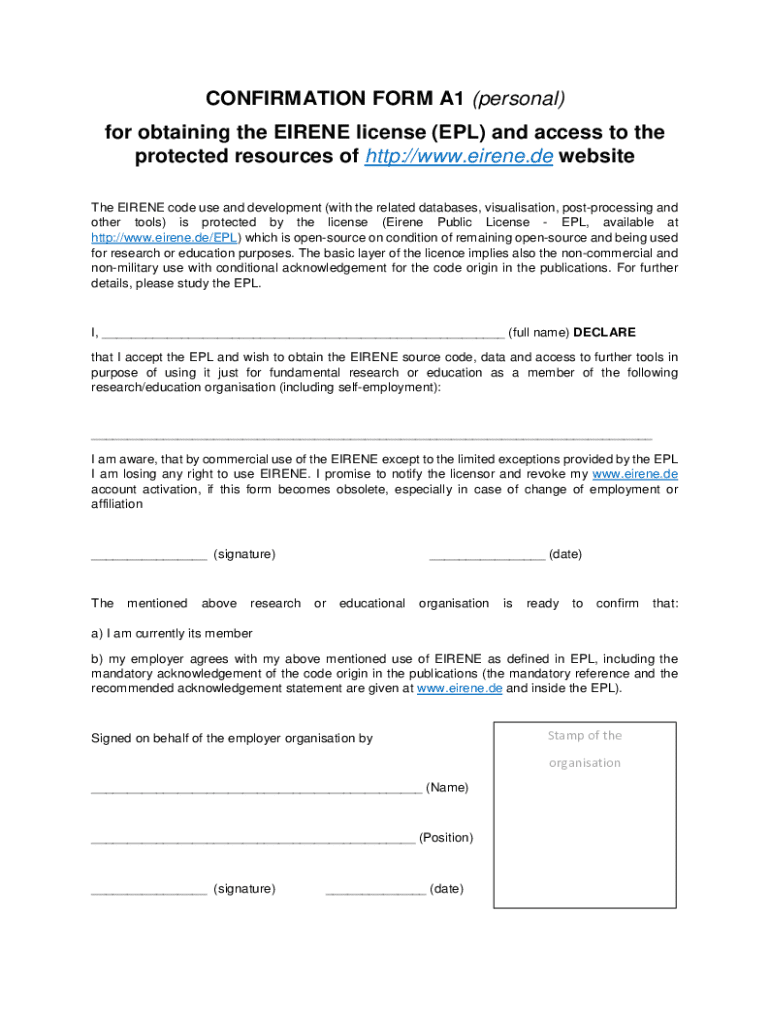

Understanding the A1 personal form

The A1 Personal Form, often referred to simply as the A1 Form, is a crucial document used predominantly in the European Union. Its primary purpose is to confirm that an individual's social security contributions are paid in one particular country while they might be temporarily working in another. This form plays a vital role in ensuring that the authenticity and legitimacy of social security coverage is maintained, serving as a certificate for the holder while abroad.

In personal and professional contexts, obtaining the A1 Form can streamline the process of employment across different EU nations. It acts as a verification tool confirming that individuals are not required to pay social security contributions in multiple countries, thus avoiding double liabilities. The importance of the A1 Form cannot be overstated, as it ensures compliance with social security legislation and protects individuals' rights.

Navigating the A1 form: key sections explained

When diving into the A1 Personal Form, understanding its structure is vital for accurate completion. The form typically consists of several key sections, including personal information, employment details, and social security identification. Each section is designed to capture relevant data that offers insight into your employment status and social security circumstances.

For those planning to fill out this form, the required data fields typically include full name, address, contact details, and particulars about your employer. Additionally, you must provide your social security ID, which is pivotal for verifying your contributions. It’s advisable to gather all related documents before starting to fill out the A1 Form to enhance efficiency and reduce the chances of errors.

Step-by-step instructions for filling out the A1 form

Before diving into the form, having a pre-fill checklist can significantly ease the process. Ensure that you have gathered necessary information and documents, which usually include your personal identification details and social security number. Being organized will help streamline the filling process and avoid common mistakes.

Starting with your personal information, input your full name, current address, and contact details into their respective fields. Next, move on to the employment section where you'll need to provide accurate information about your employer and your role within the company. Don’t overlook the additional fields as some, though less common, may impact your application if left blank or inaccurately filled.

Once you’ve completed the A1 form, review it for accuracy before submitting. Consider whether you’ll submit it online or offline, as both methods are valid depending on your situation. If choosing the online route, ensure you're using secure and reliable platforms for submission.

Editing and making changes to your A1 form

Mistakes happen, and if you’ve filled out your A1 Personal Form and need to make revisions, there are straightforward ways to do this. First, determine what changes are necessary and whether they are significant enough to warrant a complete resubmission. Usually, minor amendments can be corrected easily without needing to start from scratch.

When considering resubmission, be aware of the implications. For example, it may affect the verification of your social security contributions or your employment eligibility in another country. Always check applicable deadlines for resubmission to avoid issues.

Signing and managing your A1 form

Signing your A1 Personal Form can be accomplished through various methods, one of which is electronic signing. Electronic signatures provide convenience and can often expedite the process substantially. Tools like pdfFiller offer an intuitive platform to eSign documents electronically with just a few clicks.

Once signed, managing your A1 Form is equally crucial. Utilizing services such as pdfFiller allows you to track the processing status of your document. You’ll receive notifications about any updates or additional requirements, ensuring that you stay informed every step of the way.

Troubleshooting common issues with the A1 form

While filling out the A1 Personal Form is generally straightforward, certain common issues can arise. Mistakes often occur in details like misspelled names or incorrect social security numbers. Such small errors can lead to significant delays in verification and processing, so double-checking your entries is critical.

If you encounter challenges that you can't resolve, utilizing support services such as those offered by pdfFiller can be advantageous. Customer support can assist with understanding submission processes, correcting errors, or providing additional resources necessary to ensure your A1 Form's acceptance and processing.

Leveraging pdfFiller for your A1 form needs

Choosing pdfFiller for managing your A1 Form brings alongside several benefits. The platform is designed for seamless document editing, signing, and collaboration. Furthermore, pdfFiller empowers users to maintain all their document needs in one cloud-based solution, providing access anytime and anywhere.

One of pdfFiller's unique features is its versatility; it isn't limited to just the A1 forms. Users can easily switch between different document types and forms while retaining consistent quality and user-friendly experience. The integration of various tools simplifies the document management process beyond just filling out forms.

User experience: testimonials and success stories

User experiences highlight the efficiency and convenience that pdfFiller provides. Many individuals and teams have turned to this platform to simplify their document management tasks, relying on its ease of use and integration capabilities. Case studies reveal how pdfFiller has reduced the time and effort required to manage documents like the A1 Form, resulting in smoother workflow and compliance with social security legislation.

Feedback indicates that users appreciate the clear interface and robust support options available through pdfFiller. This level of support has proven essential for those navigating complex documentation processes, ensuring that users maintain compliance while achieving their document management goals efficiently.

Future trends in document management and A1 forms

The future of document management, particularly with forms like the A1 Personal Form, points toward increasing digitization and streamlined processes. As technology evolves, the trend towards digital submissions over paper ones is likely to continue, promoting efficiency and ease of access for users.

Predictions indicate that the A1 Form and similar documents may undergo updates, such as improvements in the formats and requirements for submission. This not only reflects evolving social security legislation across the EU but also caters to the need for greater authenticity and validity in the document verification process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in confirmation form a1 personal?

Can I sign the confirmation form a1 personal electronically in Chrome?

How do I fill out the confirmation form a1 personal form on my smartphone?

What is confirmation form a1 personal?

Who is required to file confirmation form a1 personal?

How to fill out confirmation form a1 personal?

What is the purpose of confirmation form a1 personal?

What information must be reported on confirmation form a1 personal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.