Get the Free Recurring ACH Payment Authorization Form - eForms

Get, Create, Make and Sign recurring ach payment authorization

Editing recurring ach payment authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out recurring ach payment authorization

How to fill out recurring ach payment authorization

Who needs recurring ach payment authorization?

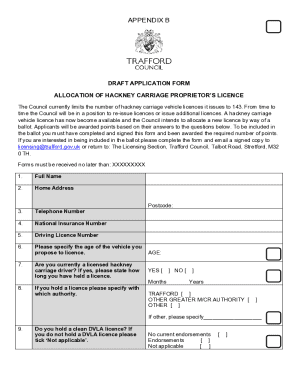

A comprehensive guide to the recurring ACH payment authorization form

Overview of recurring ACH payments

Recurring ACH payments represent a seamless payment solution allowing both businesses and individuals to automate withdrawals from a bank account on a predetermined schedule. ACH, or Automated Clearing House, payments facilitate electronic transfers, making them a preferred choice for recurring transactions such as subscriptions, utilities, and loans.

For businesses, the ability to set up recurring payments decreases administrative overhead and helps maintain cash flow predictability. Individuals benefit from this payment method by reducing the potential for late payments, ensuring timely bill settlement, and aiding in personal budgeting.

Common use cases for recurring ACH payments include rent payments, monthly subscription services (like music or streaming), insurance premiums, and loan repayments. Each of these scenarios illustrates how automation simplifies financial management for both parties involved.

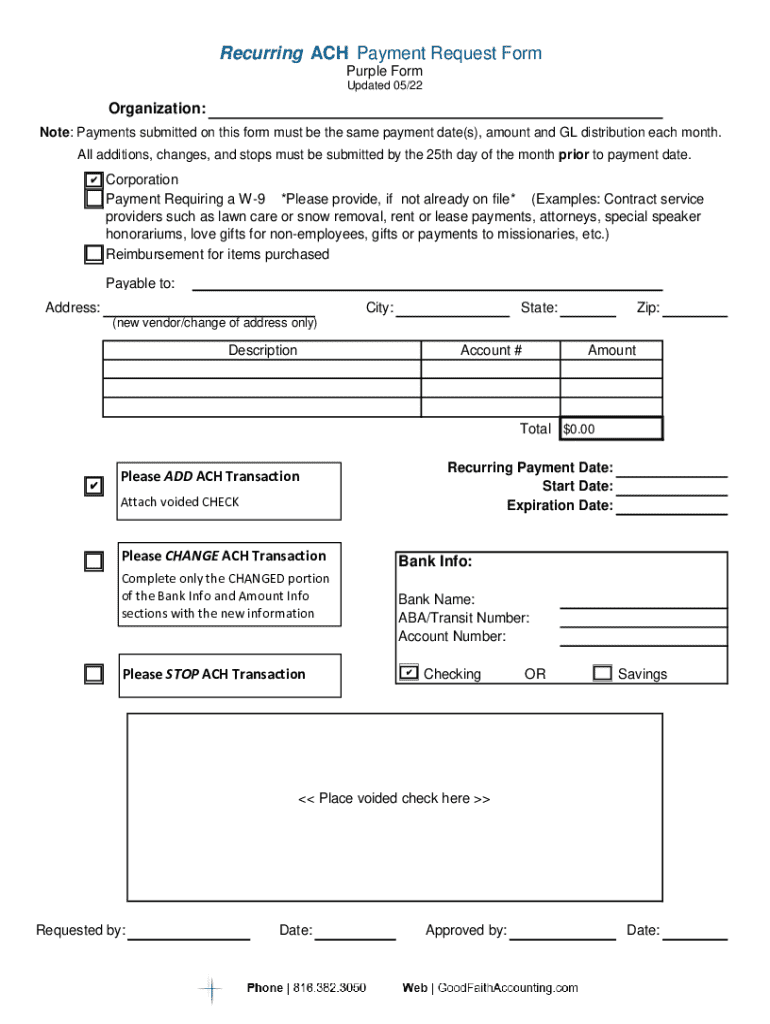

Understanding the recurring ACH payment authorization form

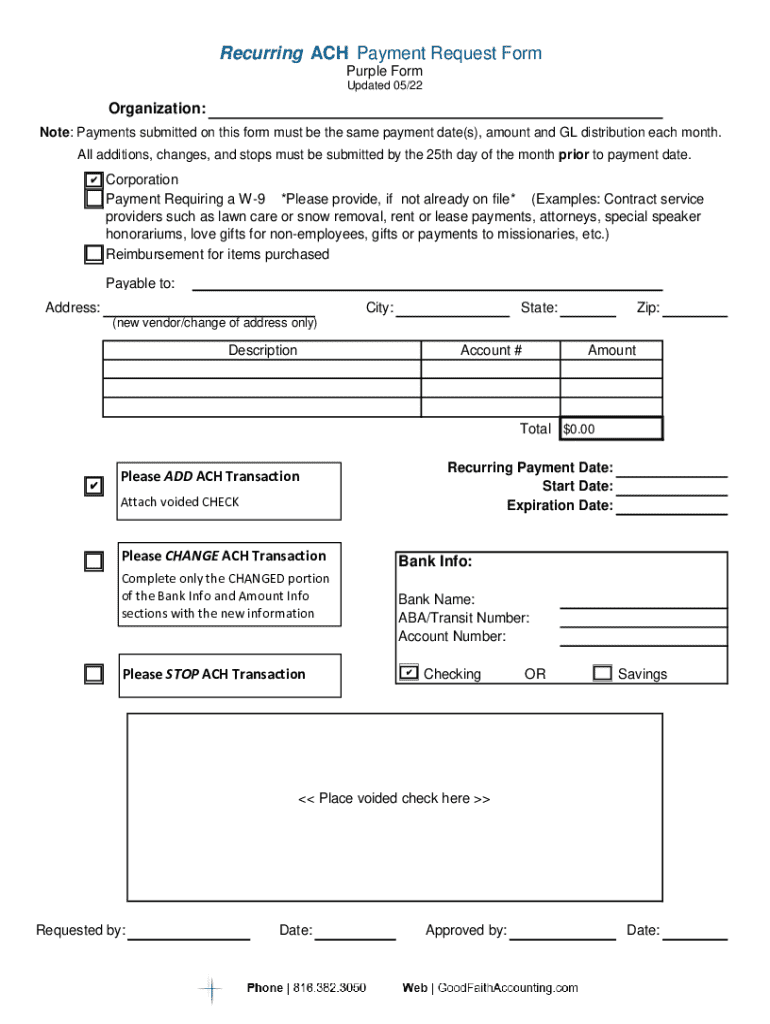

The recurring ACH payment authorization form is a critical document granting permission to a company to withdraw funds from a customer’s bank account at regular intervals. This form signifies the customer's consent, outlining specific details related to the payment structure and frequency.

Key components of this form typically include the payer’s information (such as customer name and street address), payment details (amount and withdrawal schedule), and an authorization statement that ensures legality and clarity between all parties. It’s crucial to understand that using this form involves legal considerations, such as compliance with the NACHA operating rules, to ensure equitable treatment of consumer rights.

How to fill out the recurring ACH payment authorization form

Filling out the recurring ACH payment authorization form is a straightforward process when you follow systematic steps. Here’s a step-by-step guide to ensure accuracy and clarity:

Double-checking all details is critical in ensuring accuracy in your form completion to avoid future discrepancies and payment issues.

Editing and customizing your ACH payment authorization form

When using pdfFiller's tools for document editing, you can customize your ACH payment authorization form creatively. This includes adding fields for personalized information and adjusting payment frequencies or amounts, ensuring that the document reflects your specific needs.

Digital document management offers numerous benefits. It allows for easy storage, retrieval, and sharing, thereby improving organization. Additionally, modifications can be made in real-time, facilitating quick adaptations for changing payment structures or terms which is particularly beneficial for businesses that routinely update their offerings.

Signing the recurring ACH payment authorization form

The signing process of the recurring ACH payment authorization form can be done electronically, using pdfFiller’s eSignature options. Electronic signatures are legally accepted, provided they meet stipulated regulations, such as the eSign Act in the United States. This flexibility allows for quick processing, especially compared to traditional signing methods which can delay transactions.

Best practices for securing signatures include using reputable eSignature platforms, ensuring document integrity, and maintaining logs that highlight when and how the signature was obtained, safeguarding both parties involved.

Submitting the form: what you need to know

Once the recurring ACH payment authorization form is completed and signed, it’s ready for submission. Common submission methods include direct submission to the bank which often requires physical delivery, or submission via email, fax, or physical mail to the vendor or service provider managing the withdrawals.

To ensure timely processing of your authorization, verify the preferred submission method of the receiving party and confirm that they have received the document, which often involves follow-up communication.

Managing your recurring ACH payments

After your recurring ACH payment authorization is established, it’s essential to monitor payments and keep track of transactions to maintain awareness of your financial status. Regular reviews of bank statements can help in catching discrepancies early.

If you need to adjust or revoke the authorization, it’s essential to know how to update your payment information or cancel altogether. To update, you can submit a new authorization form. To cancel, typically you will need to provide a written request or complete the cancellation form if the company requires it, making sure to do so in advance to avoid unwanted charges.

Troubleshooting common issues

Occasionally, issues with authorization processing can arise. This might include delays in payment or discrepancies in payment schedules. When such issues occur, it's important to reach out to your financial institution or service provider quickly to resolve them efficiently.

Steps to resolve payment disputes typically include providing documentation, such as bank statements showcasing unauthorized transactions, and having a dialogue with the financial institution for possible remedies or refunds.

Frequently asked questions (FAQ)

A common query concerning recurring ACH payment authorization is the processing time for ACH payments. Generally, ACH payments can take one to two business days to process, depending on the bank's processing schedule and the specifics of the transaction.

Another frequent question involves changing the payment amount after submitting the form. While possible, this often requires filling out a new authorization form reflecting updated payment terms.

Additionally, some users are concerned about what happens if they forget to cancel a recurring payment. The result is an unwanted withdrawal that might affect budgeting for that month; hence, ensuring reminders to review and manage payments to avoid such situations is essential.

Explore more with pdfFiller

For continued support with financial transactions, pdfFiller offers a variety of templates specifically designed for situations requiring document management. Utilizing pdfFiller’s comprehensive platform empowers users to effortlessly edit PDFs, eSign contracts, collaborate with teams, and manage all document needs from a single, cloud-based solution.

Accessing support and learning resources directly from pdfFiller enhances user experience, ensuring that you are equipped with the tools required to navigate documentation efficiently and effectively for various financial operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit recurring ach payment authorization online?

Can I create an electronic signature for the recurring ach payment authorization in Chrome?

How do I fill out recurring ach payment authorization using my mobile device?

What is recurring ach payment authorization?

Who is required to file recurring ach payment authorization?

How to fill out recurring ach payment authorization?

What is the purpose of recurring ach payment authorization?

What information must be reported on recurring ach payment authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.