Get the free Credit Card Payment Authorization - Release of Certificate ...

Get, Create, Make and Sign credit card payment authorization

Editing credit card payment authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card payment authorization

How to fill out credit card payment authorization

Who needs credit card payment authorization?

Credit Card Payment Authorization Form: A How-to Guide

Understanding credit card payment authorization forms

A credit card payment authorization form is a crucial document used in various commercial transactions, serving primarily to secure payment from a customer. This form essentially allows a merchant to charge a customer's credit card and verifies that the cardholder authorizes the transaction. The importance of these forms cannot be overstated, especially in preventing fraudulent charges and maintaining transaction security.

By properly using a credit card authorization form, merchants can not only secure payments but also significantly reduce the potential for chargebacks. Chargebacks occur when customers dispute a charge, which can result in financial loss and an increased risk profile for businesses. Therefore, having customers fill out this authorization form is essential for creating a clear record of acceptance.

How do credit card payment authorization forms work?

The authorization process begins when a customer submits their credit card information via the authorization form. The merchant then sends this information to their payment processor or bank for verification. Once approved, the funds are temporarily set aside for the transaction, ensuring that the amount can be captured later. This streamlined process facilitates secure transactions and provides a clear trail for all parties involved.

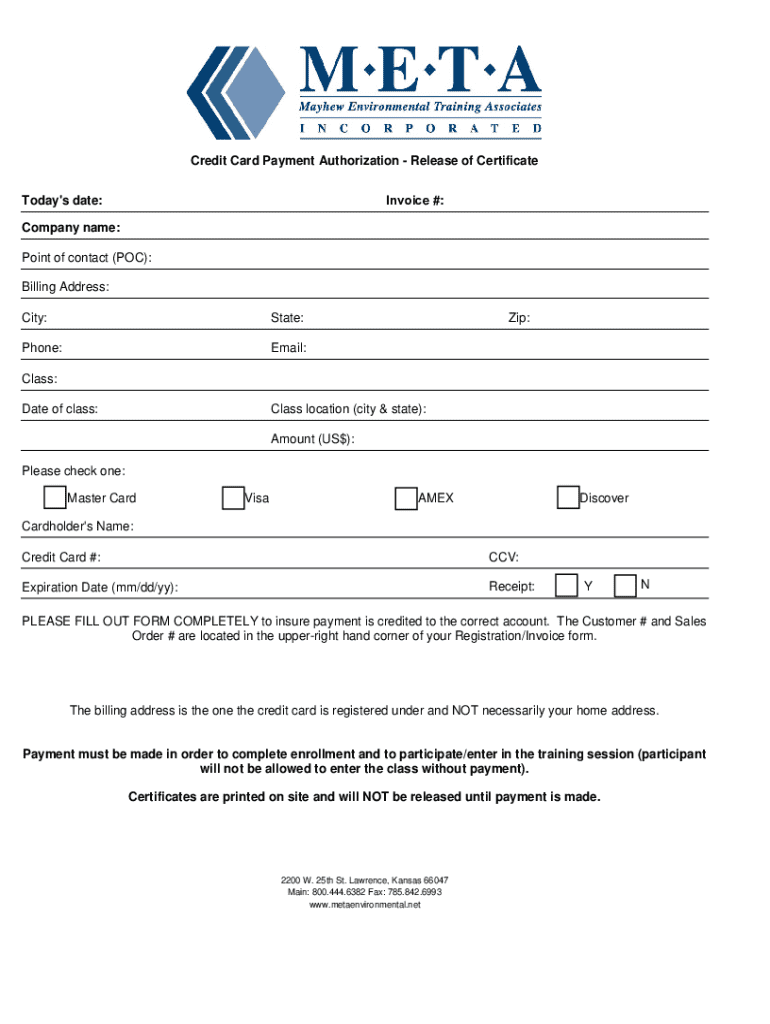

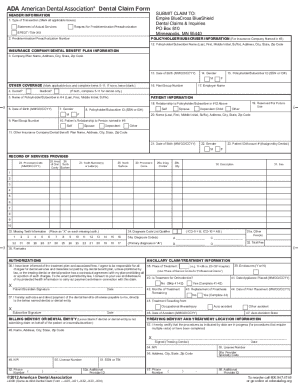

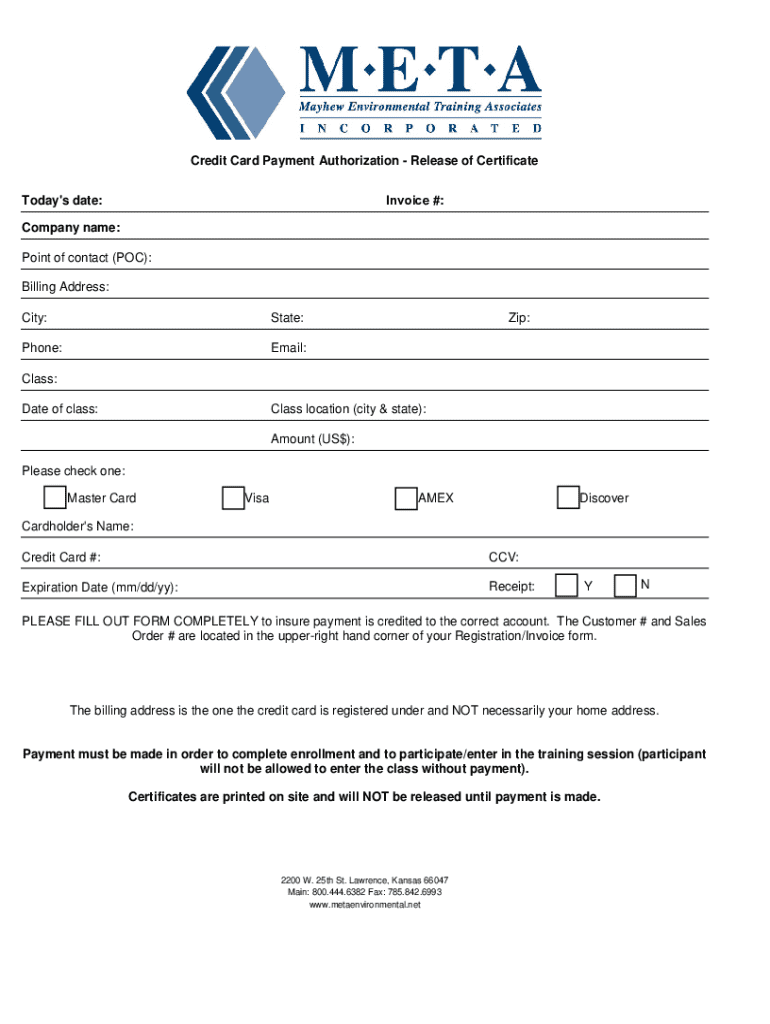

Essential components of a credit card payment authorization form

The key to an effective credit card payment authorization form lies in its components. Essential fields must be included to ensure that all necessary information is collected for processing payments efficiently. This begins with the cardholder's details, including their name and billing address, which verifies their identity and the card's legitimacy.

Further, the form should capture specific credit card information like the card number, expiration date, and CVV code. Finally, transaction details such as the total amount and a short description of the purchase are critical. Collectively, these elements create a robust framework that supports secure transactions.

Benefits of using credit card payment authorization forms

Implementing a credit card payment authorization form offers thriving businesses several significant benefits, notably in chargeback prevention. For businesses that regularly process credit card transactions, chargeback abuse can severely affect their bottom line. By requiring customers to authorize their charges in writing, companies create an essential defense against baseless disputes.

Moreover, this form plays a vital role in streamlining payment processes. With clear guidelines on the authorization process, both merchants and customers are less likely to face disputes related to payments. As a result, businesses can experience an enhanced efficiency in payment processing, allowing them to focus more on serving customers and less on resolving payment issues.

Creating your credit card payment authorization form

Designing an effective credit card payment authorization form is straightforward if you follow a structured approach. First, identify your specific needs based on the transaction types you'll be handling. Customizing the form to reflect your business operations and customer interactions ensures better alignment with your service model.

Next, decide whether to choose a pre-made template that fits your requirements or to create a custom form from scratch. When drafting the form, input all necessary fields ensuring each section is clearly labeled. This clarity will ultimately enhance user experience and reduce the likelihood of errors.

Editing and customizing your template in pdfFiller

pdfFiller offers a user-friendly platform to create and modify your credit card payment authorization form seamlessly. You can create an account easily or log in if you already have one. Upon accessing pdfFiller, you'll find an extensive array of form templates, including options specifically tailored for payment authorizations.

Using the editing tools provided, you can add or remove fields, adjust layouts, and customize your form’s design to align with your brand. After finalizing your design, pdfFiller allows you to save and export your document in various formats, ensuring adaptability across different platforms.

Ensuring security and compliance

Security is paramount when dealing with sensitive financial information. Credit card payment authorization forms must incorporate strict data protection measures, including encryption and secure storage of the captured payment information. It is crucial as businesses can face severe penalties for not adhering to these standards.

Moreover, compliance with the Payment Card Industry Data Security Standard (PCI DSS) is mandatory for all businesses that process credit card transactions. Reviewing these regulations ensures that your use of payment authorization forms not only meets legal requirements but also builds trust with your customers, thus enhancing your business reputation.

Common FAQs about credit card payment authorization forms

Understanding common questions surrounding credit card payment authorization forms can help clarify their use. Often, users wonder what happens if a transaction is unauthorized. If the customer disputes a charge, it's necessary to have the signed authorization form to support your case with the payment processor, which can mitigate financial loss.

Another frequent question arises concerning how long these authorization forms should be retained. Generally, it's recommended to keep them for at least three years, allowing ample time for any disputes or issues related to payments. Users frequently inquire about the legality of using electronic signatures on their forms, which is allowed as long as they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN).

Real-life applications and scenarios

Credit card payment authorization forms have widespread use across various commercial sectors. E-commerce platforms, for example, rely heavily on these forms to authorize transactions online, securing payments while minimizing the risk of fraud. Additionally, service industries, including restaurants and hospitality businesses, often require deposits or guarantee charges, making these forms an invaluable tool in their operational processes.

Case studies reflect successful implementations of payment authorization forms leading to better transaction integrity. Users of pdfFiller have reported enhanced customer trust due to their transparent payment processes, combined with a noticeable decrease in chargebacks. By effectively utilizing these forms, businesses can thus foster stronger relationships with their customers while also enhancing their revenue streams.

Accessing templates and additional resources

Users looking to access credit card payment authorization forms can easily download pre-made templates from pdfFiller. The platform features a user-friendly interface, providing a straightforward step-by-step guide to help you find and utilize the templates effectively. Individual customization options are also available, allowing you to adapt these forms to fit your specific business needs.

To achieve optimal results, consider leveraging some customization tips, such as ensuring that the layout aligns with your brand's aesthetic and configuring essential fields for maximum clarity. The interactive features of pdfFiller enhance the document management experience, making it an efficient solution for tracking and managing various documents.

Engaging with pdfFiller

pdfFiller is designed as an all-in-one document management solution that empowers users to create, edit, and manage their credit card payment authorization forms seamlessly. The cloud-based nature of this platform allows you to access your documents from any location, ensuring flexibility and convenience for individual users and teams alike.

To stay updated with features and enhancements, consider subscribing for updates directly from pdfFiller. The proactive customer support team is available to assist users, ensuring that any questions or concerns regarding the platform can be addressed quickly and effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit card payment authorization?

How do I make edits in credit card payment authorization without leaving Chrome?

Can I create an electronic signature for the credit card payment authorization in Chrome?

What is credit card payment authorization?

Who is required to file credit card payment authorization?

How to fill out credit card payment authorization?

What is the purpose of credit card payment authorization?

What information must be reported on credit card payment authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.