Get the free Generic Credit Card Authorization Form - Fill Online, Printable ...

Get, Create, Make and Sign generic credit card authorization

Editing generic credit card authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out generic credit card authorization

How to fill out generic credit card authorization

Who needs generic credit card authorization?

Understanding and Utilizing Generic Credit Card Authorization Forms

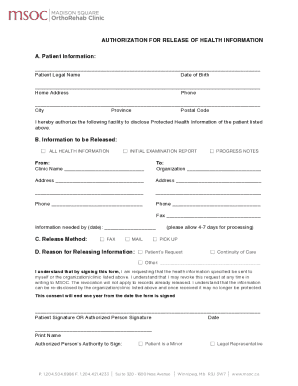

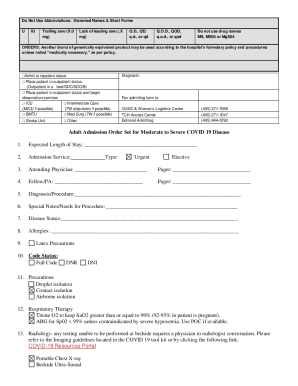

Understanding credit card authorization forms

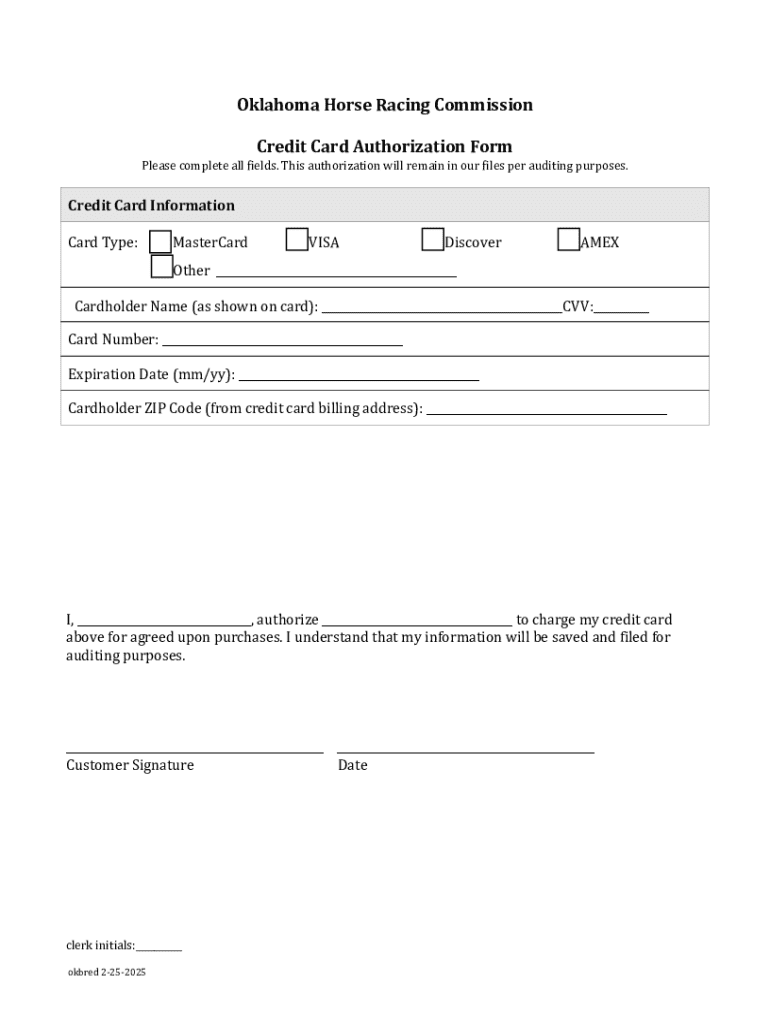

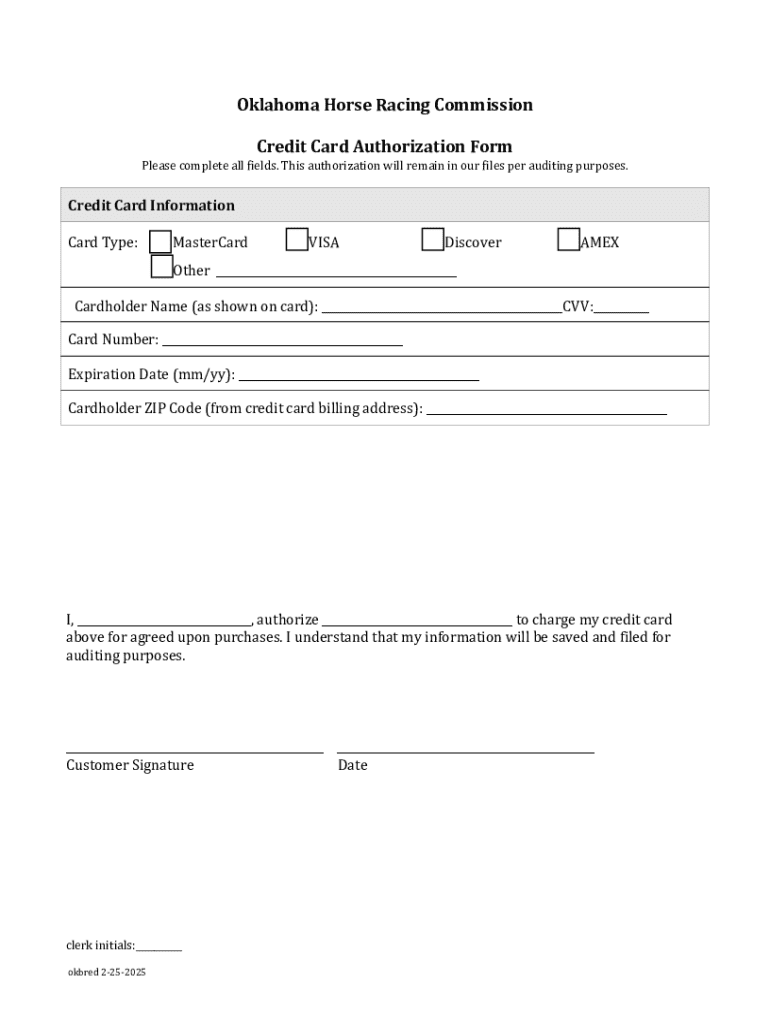

A generic credit card authorization form is a document that allows a merchant or service provider to charge a customer's credit card for goods or services. This form is crucial for facilitating safe transactions, ensuring that payments are executed with the consent and knowledge of the cardholder. Without a credit card authorization form, merchants operate at a considerably higher risk of losses due to chargebacks and fraud.

The importance of credit card authorization forms in business transactions cannot be overstated. They serve as a safeguard against unauthorized use of credit cards and provide record-keeping benefits for both parties involved. Merchants, service providers, and consumers are the main users of these forms, each benefiting from structured and legitimate payment processes.

Purpose and benefits of credit card authorization forms

Credit card authorization forms offer multiple benefits that enhance the transaction experience for merchants and consumers alike. Firstly, they protect merchants from fraudulent transactions by ensuring that charges on credit cards are authorized by the actual cardholders. This layer of security is paramount in reducing incidences of fraud that can occur in the card-not-present transactions traditionally common in online retail.

Secondly, credit card authorization forms streamline payment processes. With the essential information collected upfront, businesses can quickly process transactions without additional delay. By documenting customer consent for charges, these forms also serve as a legal record, offering legal protection if disputes arise later. Finally, they significantly reduce the risks associated with chargebacks, allowing businesses to manage their finances effectively.

Essential components of a credit card authorization form

A well-structured credit card authorization form must contain several mandatory components to ensure its effectiveness and legality. Key elements include:

By ensuring these components are present and clearly defined, businesses can create forms that not only meet legal requirements but also instill confidence in their customers.

How to create a credit card authorization form with pdfFiller

pdfFiller provides a seamless way to create and manage generic credit card authorization forms. Here’s a step-by-step guide to help you through the process:

Editable and interactive features offered by pdfFiller

Utilizing pdfFiller's platform for your credit card authorization form not only enables you to create documents but also provides a suite of interactive features. These include real-time collaboration tools for teams, which allow multiple staff members to work together effectively. eSignature integration ensures that the authorization process is both legitimate and legally binding, removing the need for physical signatures and speeding up the transaction times.

Moreover, pdfFiller's cloud-based accessibility means you can edit your documents from anywhere, whether you’re in a café or at the office. The document management capabilities enable storage, searching, and retrieval functions, ensuring that your authorization forms are organized and easy to access whenever required.

FAQs about credit card authorization forms

1. **What if a customer revokes their authorization?** In such cases, businesses must cease any further charging on the card and formally document the revocation.

2. **How does a chargeback work with an authorization form?** If a customer disputes a charge, they can request a chargeback through their card issuer, leading to an investigation into the validity of the authorization.

3. **Are there legal requirements for these forms?** Yes, businesses must ensure that their forms comply with consumer protection laws and payment card industry standards.

4. **Can a digital signature be used?** Absolutely, digital signatures are permitted and often preferred for their convenience and security.

Best practices for using credit card authorization forms

To ensure that credit card authorization forms are effective and protect your business, consider implementing the following best practices. First, prioritize security and compliance by ensuring that your forms comply with both local and international regulations regarding data privacy.

Regularly review the content of your forms, keeping them updated to reflect any changes in your policies or regulations. More importantly, educate your customers on the significance of these authorizations; a well-informed customer is more likely to engage in a smooth transaction process, leading to fewer disputes.

Downloadable templates and additional resources

Access a variety of templates tailored to different business needs, including refund authorization or ACH authorization forms. These resources provide flexibility and efficiency in managing financial transactions.

Additionally, you can find guides on payment processing best practices, helping you optimize your business strategies in the payments landscape.

Testimonials and user experiences

Many businesses that use pdfFiller for their document management solutions report increased efficiency from streamlined processes. Case studies reveal that companies have successfully reduced their transaction disputes and improved customer satisfaction by using well-crafted credit card authorization forms.

User feedback indicates that pdfFiller’s platform not only simplifies form creation but enriches the overall transaction experience, ensuring that both merchants and consumers can engage with confidence.

Engage with pdfFiller community

Subscribing to updates and engaging with the pdfFiller community provides users with insights into new features and templates that can enhance their document management strategies. Joining discussions on payment processing trends can benefit your team, ensuring you stay informed about industry shifts and compliance updates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in generic credit card authorization without leaving Chrome?

How do I edit generic credit card authorization on an iOS device?

How do I edit generic credit card authorization on an Android device?

What is generic credit card authorization?

Who is required to file generic credit card authorization?

How to fill out generic credit card authorization?

What is the purpose of generic credit card authorization?

What information must be reported on generic credit card authorization?

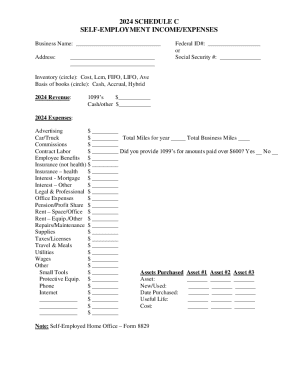

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.