Get the free Form 1094-B / 1095-B - CFS Tax Software, Inc. - TaxTools

Get, Create, Make and Sign form 1094-b 1095-b

How to edit form 1094-b 1095-b online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1094-b 1095-b

How to fill out form 1094-b 1095-b

Who needs form 1094-b 1095-b?

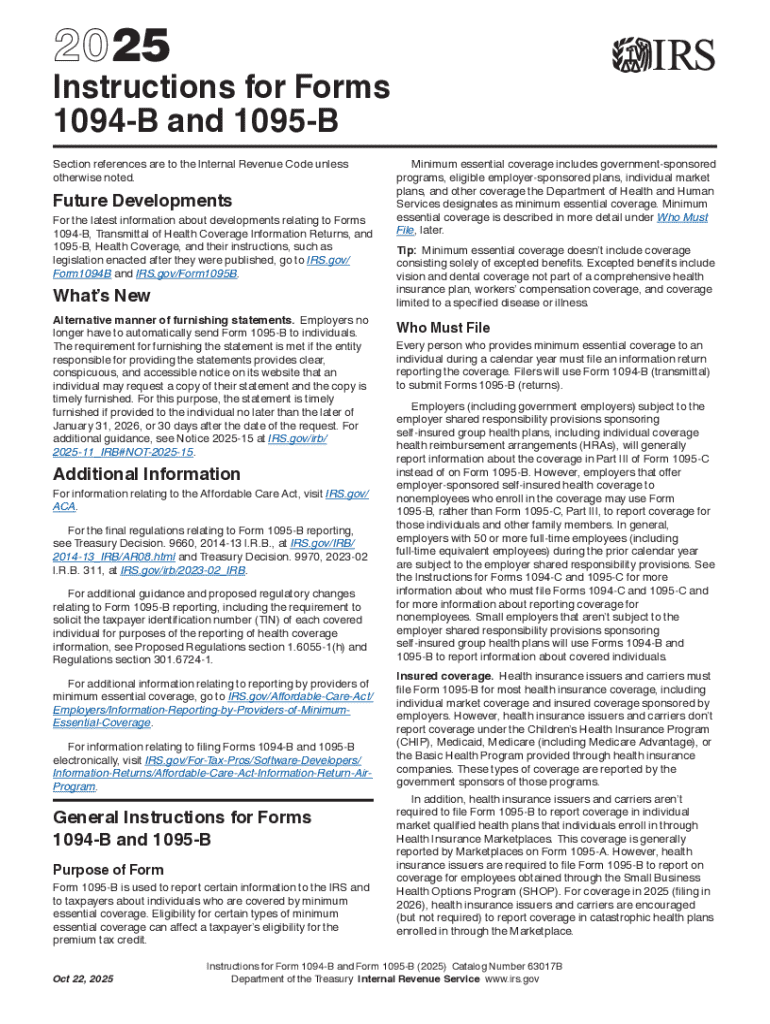

Form 1094-B and 1095-B Guide

Understanding Form 1094-B and 1095-B

Form 1094-B and Form 1095-B are crucial documents in the landscape of healthcare coverage reporting. They play vital roles in the tracking and communication of health insurance provisions among insurers, employers, and the IRS. Specifically, Form 1094-B serves as a transmittal form that summarizes the data provided in multiple 1095-B forms, which document the specific health coverage provided to individuals.

The importance of these forms cannot be overstated. Compliance with the Affordable Care Act (ACA) mandates the accurate reporting of health coverage, ensuring that individuals have the healthcare protections to which they are entitled. Failure to report accurately can lead to tax penalties for both individuals and organizations, making understanding and completing these forms correctly critical.

Key differences between Form 1094-B and Form 1095-B

Form 1094-B functions primarily as a summary or transmittal form. It includes information about the reporting entity, such as employer details or insurer information, and serves to summarize the data contained within the accompanying 1095-B forms. In contrast, Form 1095-B provides detailed individual-level information, including data on the months in which the health coverage was provided and identification of individuals covered.

To highlight their distinctions further, consider this side-by-side comparison: Form 1094-B is solely designed for summary reporting of coverage data, while Form 1095-B offers comprehensive insights per individual, making it essential for tax compliance and individual notices.

Comprehensive breakdown of Form 1094-B

Form 1094-B is structured with multiple sections, each requiring specific data entries. The key parts of this form include the reporting entity's information, the total number of 1095-B forms that are being submitted, and the signature line for the authorized representative. Filling it out accurately ensures that the IRS receives all necessary information to associate the individual coverage records accurately.

When filling out Form 1094-B, follow these steps: Identify the reporting entity with its accurate information; provide coverage data summarizing each individual covered; fill in the transmittal fields, ensuring accuracy; and conduct a final review to verify all entries before submission. This methodical approach minimizes errors and enhances compliance.

Detailed overview of Form 1095-B

Form 1095-B consists of several sections that meticulously document the health coverage of individuals. It includes fields for the individual's name, Social Security number, the months they were covered under the health plan, and policyholder details. The accuracy of this information is crucial for reporting purposes, as it serves as verification for insurance coverage during tax time.

When completing Form 1095-B, ensure accuracy in individual details and coverage information. Indicating coverage months precisely is essential, along with adherence to ACA requirements which may have implications for mandates and penalties. Lastly, be mindful of submission timing and methods, as filing deadlines are strictly enforced, typically aligning with the tax season.

Common mistakes to avoid when filling out forms 1094-B and 1095-B

Several common errors can undermine the accuracy and effectiveness of Form 1094-B and Form 1095-B submissions. These mistakes include providing incomplete information, incorrectly identifying individuals, and misreporting coverage months. Each of these mistakes can lead to significant issues with IRS compliance and potential penalties.

To foster accurate reporting, double-check all entries and ensure that all individual details correlate with official documents. Regular audits of the forms and avoiding last-minute submissions can help significantly reduce errors. Internal training for staff who handle these forms can also enhance compliance and minimize mistakes.

Tools and resources for managing forms 1094-B and 1095-B

Leveraging advanced tools like pdfFiller can greatly simplify the preparation of Forms 1094-B and 1095-B. This platform is designed to streamline the document creation process, allowing users to fill, edit, and sign forms seamlessly from any location. It provides robust features that accommodate healthcare compliance and reporting needs.

Access to additional guidance and FAQs on the pdfFiller platform ensures users can clarify their understanding and obligations regarding these forms. This integrated approach not only aids in filling out forms but also empowers organizations to stay compliant with ever-evolving healthcare regulations.

Changes and updates for the 2024 tax year

As tax year 2024 approaches, certain updates and changes in form requirements may apply. Staying informed on these modifications is essential for effective and compliant reporting. Regulatory bodies frequently publish updates that can affect how forms should be filled out, and understanding these changes can help mitigate risks associated with compliance.

Being proactive about these changes enables organizations to adapt efficiently. Regular training sessions for staff on new compliance requirements can enhance overall preparedness and accuracy in the completion of Forms 1094-B and 1095-B.

Conclusion

Navigating the complexities of Forms 1094-B and 1095-B need not be daunting. By leveraging a resourceful platform like pdfFiller, individuals and teams can efficiently manage these documents from a cloud-based solution, ensuring accuracy and compliance in their reporting efforts. Emphasizing careful attention to detail and utilizing advanced tools will streamline the process, making it simpler to maintain compliance in healthcare documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 1094-b 1095-b straight from my smartphone?

How do I complete form 1094-b 1095-b on an iOS device?

How do I fill out form 1094-b 1095-b on an Android device?

What is form 1094-b 1095-b?

Who is required to file form 1094-b 1095-b?

How to fill out form 1094-b 1095-b?

What is the purpose of form 1094-b 1095-b?

What information must be reported on form 1094-b 1095-b?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.