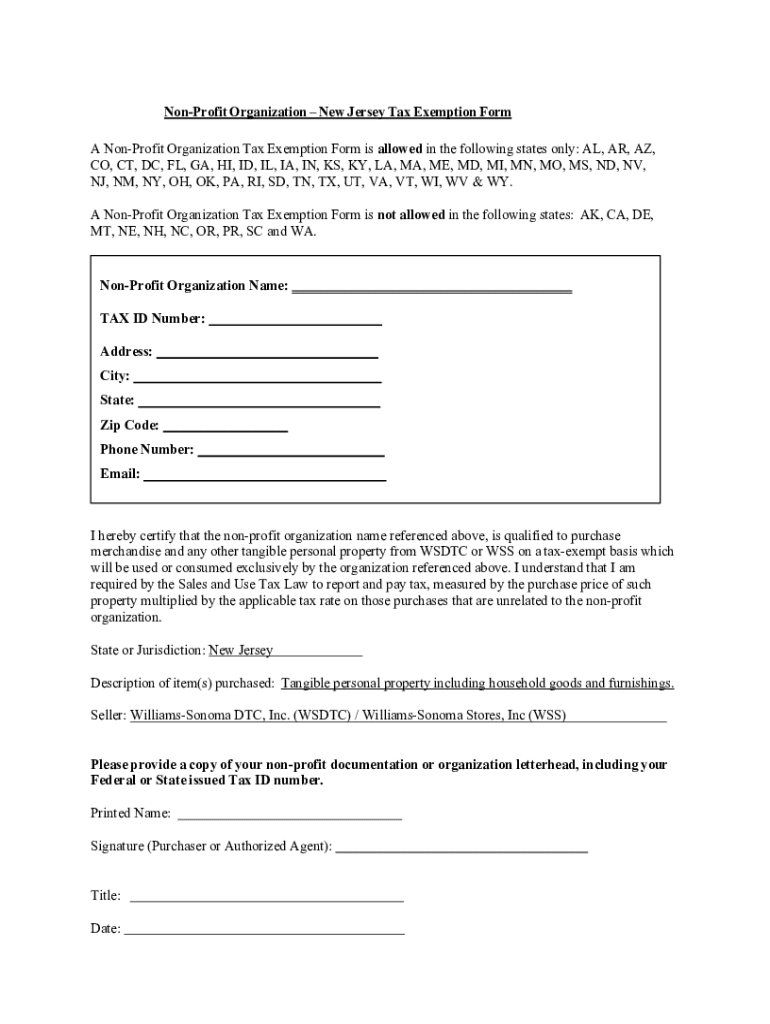

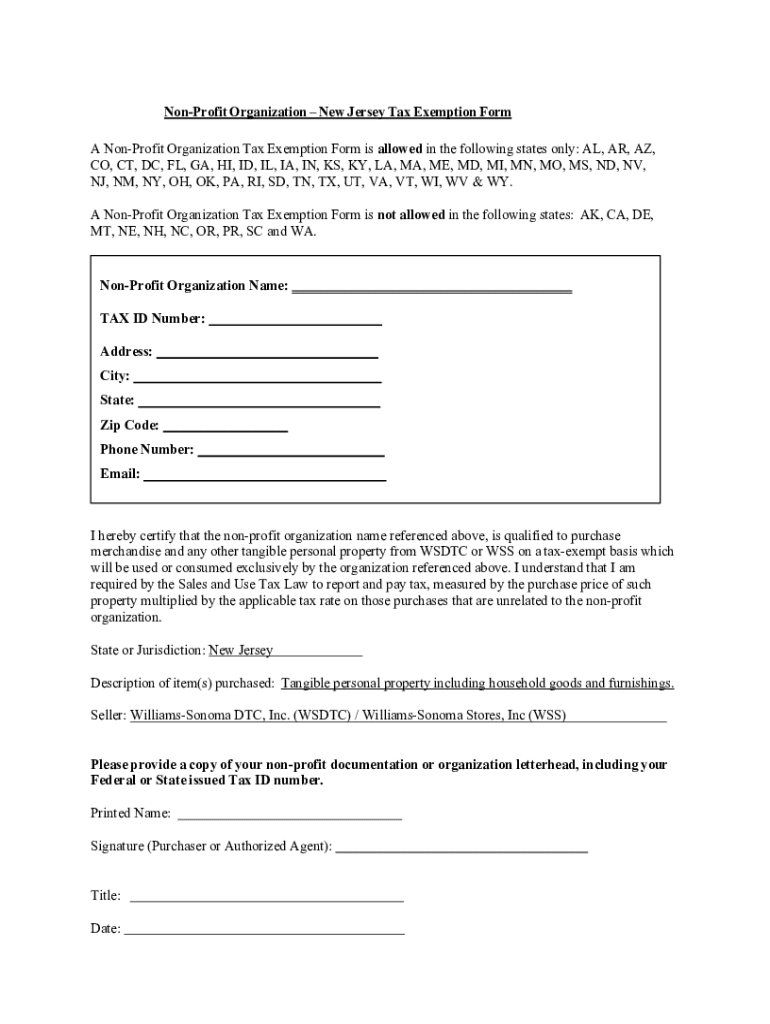

Get the free Non Profit Organization Tax Exemption Form.pdf

Get, Create, Make and Sign non profit organization tax

Editing non profit organization tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non profit organization tax

How to fill out non profit organization tax

Who needs non profit organization tax?

Understanding Nonprofit Organization Tax Forms: A Comprehensive Guide

Understanding nonprofit organizations and their tax obligations

Nonprofit organizations are entities operated for purposes other than generating profits for owners or shareholders. Their primary objective is serving the public good, which can manifest in various ways, including charitable, educational, religious, or scientific activities. Characteristics of a nonprofit include a mission-driven approach, reliance on contributions, and often, compliance with state and federal regulations. Examples include charities, educational institutions, and religious organizations.

Tax obligations for nonprofits, particularly those seeking IRS recognition as tax-exempt entities, are significant. The IRS requires that nonprofits file specific tax forms to maintain their tax-exempt status. This compliance underscores the importance of transparency and accountability, which are crucial for attracting donors and ensuring public trust in nonprofit endeavors.

Key nonprofit tax forms

One of the essential forms for nonprofits is Form 990, which serves as a public record of the organization’s activities, governance, and financials. Nonprofits earning over a certain amount must file Form 990, while those with lower revenue levels may use the simplified Form 990-EZ or the postcard version, Form 990-N. Each of these forms varies in complexity but is essential for proper reporting.

Form 990-T must be filed by nonprofits that generate unrelated business income, which could include activities outside of their tax-exempt mission. Filing this form helps establish transparency regarding revenue generation that is unrelated to the organization’s specific purpose. Other forms include Form 1023, which nonprofits must complete to apply for tax-exempt status, and various W-9 and 1099 series forms for reporting income from vendors.

Step-by-step guide to filling out nonprofit tax forms

To start the process of filing nonprofit tax forms, gather essential documentation. Key items include IRS determination letters, detailed financial statements, and data about revenue sources, program services, and functional expenses. Accurate record-keeping throughout the year can simplify tax form preparation.

When completing Form 990, the first step is to provide basic information about the organization, including its legal name, address, and EIN. Next, summarize the organization’s revenue and program accomplishments, focusing on how well resources have been utilized. This is followed by a detailed account of functional expenses and an analysis of the balance sheet. Finally, fill out the necessary statements and schedules, including Schedule A, which validates the organization’s public charity status. Careful attention to detail helps avoid common pitfalls that can arise from incomplete or inaccurate reporting.

The next step is filing Form 990. Electronic filing is often more efficient and allows for faster processing compared to paper filing. It’s important to meet deadlines, typically the 15th day of the 5th month after the end of the nonprofit’s fiscal year. Missing these deadlines can lead to penalties and loss of tax-exempt status.

Understanding tax exemptions and regulations

To maintain tax-exempt status, nonprofits must meet specific criteria outlined by the IRS, including operational tests and public support tests. These regulations ensure that a minimum percentage of the organization’s funding comes from the public, reinforcing the notion that they serve a charitable purpose. Failure to comply with these regulations can lead to penalties, including the loss of tax-exempt status.

Nonprofits can proactively rectify potential compliance issues by establishing regular audits and adhering to best practices for maintaining accurate and transparent financial records. This diligence provides peace of mind and safeguards the organization’s mission and contributions.

Tools for managing nonprofit tax forms

Utilizing a platform like pdfFiller can streamline the management of nonprofit tax forms. This cloud-based solution allows organizations to create, edit, eSign, and collaborate on crucial documents from any location. Its features include template access, automated form filling, and storage capabilities, facilitating smoother filing processes.

Interactive tools available on pdfFiller help organizations fill out forms efficiently and ensure they remain compliant with IRS requirements. Templates can significantly reduce the time spent preparing documents, allowing teams to focus on service delivery.

Best practices for nonprofits regarding taxes

To prepare for tax season, nonprofits should adopt regular record-keeping habits. Implementing structured bookkeeping practices ensures that financial data is accurate and readily available when needed. Schedule periodic reviews of financial records to catch any discrepancies early, ultimately saving time and reducing stress during tax season.

Engaging professional assistance, such as hiring a CPA or tax advisor specializing in nonprofit organizations, can provide valuable insights into navigating complex tax requirements. These experts can help ensure compliance and optimize the organization’s financial strategies. Continuous education regarding updates in tax laws and regulations is equally vital for staying informed and compliant.

Addressing FAQs about nonprofit tax forms

Many misconceptions exist regarding nonprofit tax obligations. A common question is whether all nonprofits must file Form 990. The answer is no; only those surpassing specific revenue thresholds are required to do so. Additionally, some nonprofits may worry about filing if they have earned no income. The IRS still requires non-profit entities to file, even with zero revenue, to maintain transparency and compliance.

Clarifying these aspects can help nonprofits better navigate their tax responsibilities and avoid potential pitfalls. Engaging with credible resources and professionals can provide clarity on any uncertainties within the complex world of nonprofit tax regulation.

Case studies: Success stories & lessons learned

Analyzing autonomous organizations that have successfully navigated their tax filings reveals insightful lessons. For instance, a local charity that regularly updated its records and sought expert advice was able to avoid common mistakes, maintaining compliance and successfully renewing its tax-exempt status each year. Contrastingly, an organization that delayed filing due to a lack of preparation faced penalties and an inquiry into its financial practices.

These case studies emphasize the importance of meticulous planning, ongoing education, and the role of professional guidance in ensuring that nonprofits manage their tax obligations effectively, thus safeguarding their mission and reputation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit non profit organization tax from Google Drive?

Where do I find non profit organization tax?

How do I complete non profit organization tax on an Android device?

What is non profit organization tax?

Who is required to file non profit organization tax?

How to fill out non profit organization tax?

What is the purpose of non profit organization tax?

What information must be reported on non profit organization tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.