Get the free Business & occupation tax classifications

Get, Create, Make and Sign business amp occupation tax

Editing business amp occupation tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business amp occupation tax

How to fill out business amp occupation tax

Who needs business amp occupation tax?

Understanding the Business Amp Occupation Tax Form

What is the Business Amp Occupation Tax Form?

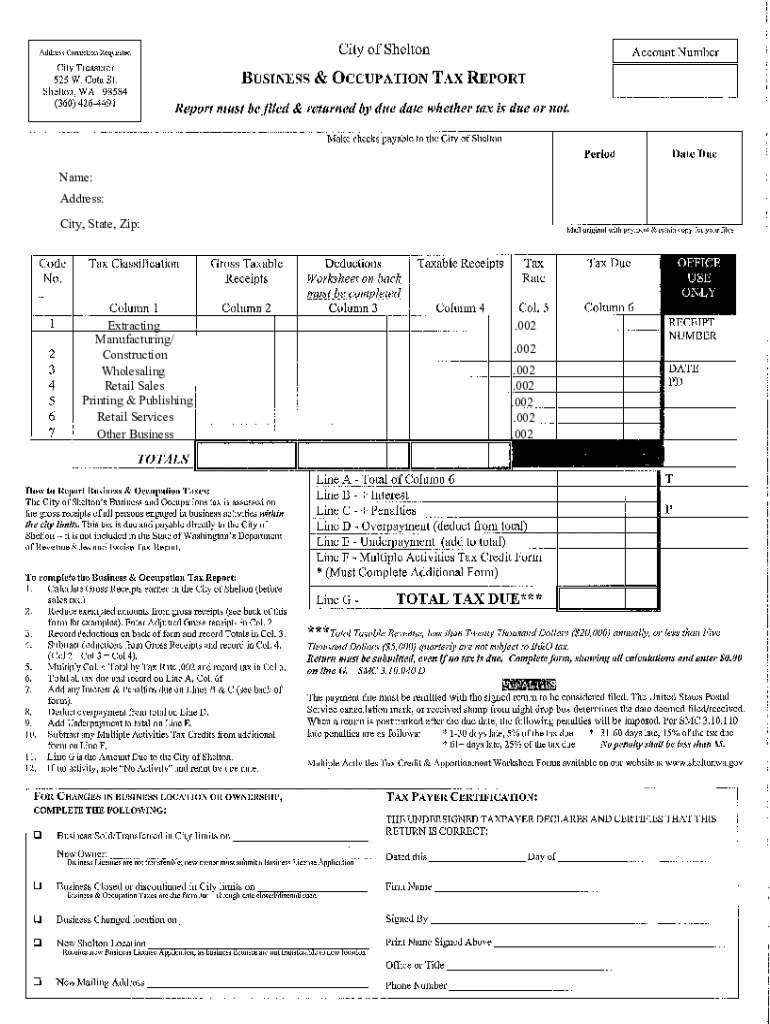

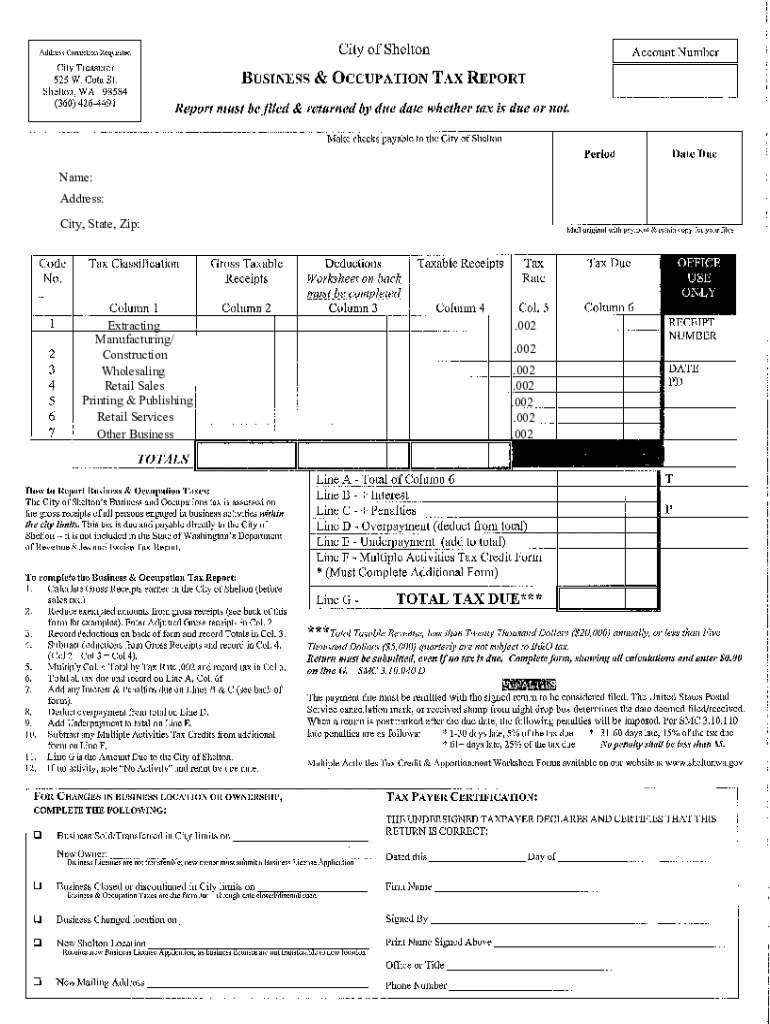

The Business Amp Occupation (B&O) tax form plays a crucial role in various business sectors, primarily in regions like Washington State where it is implemented. This tax primarily targets gross receipts from business operations instead of profits, making it essential for businesses to accurately report their earnings. Essentially, the B&O tax is imposed on the revenue generated through business activities, and the Business Amp Occupation Tax Form is the official document through which businesses declare their gross income to taxing authorities.

Understanding and accurately filling out the Business Amp Occupation Tax Form is vital not only for compliance but also for contributing to local government revenues. Collectively, the funds collected through this tax can support infrastructure, community services, and other essential governmental functions. Any business operating within the jurisdiction where the B&O tax applies must take this form seriously, as discrepancies can lead to audits or other legal ramifications.

Who is required to complete the form?

Both individuals and businesses are affected by the Business Amp Occupation Tax Form. Sole proprietors, LLCs, corporations, and non-profits operating in regions that impose a B&O tax must file the form. Understanding which specific business category you fall under is essential, as it determines the exact requirements you must adhere to. Smaller entities may face different reporting thresholds than larger companies, influencing their participation in this taxation structure.

Industry-specific requirements also vary widely. For instance, construction companies are generally taxed differently than retail businesses due to their unique revenue structures. Most businesses in the service sector will have a different calculation of gross receipts compared to manufacturers or wholesalers. Additionally, certain exemptions might apply—for instance, non-profits or businesses that generated below a certain threshold may not be required to file the form at all.

Breakdown of the Business Amp Occupation Tax Form

The Business Amp Occupation Tax Form consists of several key sections that require careful consideration and accurate reporting. The 'Identification Information' section asks for essential details like the taxpayer Identification Number (TIN), name, and contact information, which forms the basis of the tax accordingly. This information is pivotal, especially for the IRS and local tax authorities to recognize the taxpayer and establish accountability.

Following the identification information is the section requiring businesses to specify their 'Business Activity and Classification.' Here, companies must describe the nature of their operations, alongside corresponding codes that delineate the type of services or products provided. Finally, the calculation of gross income represents a crucial step in the form. Businesses must articulate their total revenue from all sources accurately, ensuring they account for all earnings, including those obtained as contractors or affiliated entities.

Step-by-step instructions to fill out the form

Before diving into the Business Amp Occupation Tax Form, it’s essential to prepare adequately. Gather all necessary documentation, including income statements, invoices, and receipts for transactions. Familiarity with your income sources can greatly simplify the reporting process. Understanding the breakdown of different income segments, such as services rendered and product sales, will streamline filling out the required sections.

Start by carefully filling out the identification section, ensuring accuracy with your name, business structure, and taxpayer identification number. Next, specify your business activities. Clearly articulate what services you provide and how your business classifies under local regulations. When calculating and reporting your gross income, ensure that all sources of income are accounted for; it’s wise to double-check figures before submission to avoid any inconsistencies that may arise during audits or assessments.

Tips for accurate submission

Submitting the Business Amp Occupation Tax Form correctly is vital for avoidance of penalties. Common mistakes include misclassifying business activities or incorrectly stating gross income. To mitigate errors, always review the form after completing it, ensuring every entry aligns with the documentation. Use clear, legible handwriting if filling the form out by hand, or consider utilizing a digital form fill out option for precision.

Best practices for filling out tax forms involve utilizing available resources and consulting guidelines from local tax authorities. Additionally, engaging with tax professionals can provide clarity, especially in complex business scenarios. Each business situation is unique; thus, tailor your approach based on the advice received from professionals to ensure optimal compliance with the B&O tax requirements.

Filing and submission process

Submitting the Business Amp Occupation Tax Form can be done in multiple ways, including online submission or traditional mail-in options. Most jurisdictions prefer electronic filing due to speed and efficiency; however, businesses should confirm the accepted methods in their specific area. Online platforms often offer functionalities that guide users through the submission process, reducing potential errors associated with manual entries. Understanding the timeline for submission and payment is critical; most jurisdictions have set deadlines commonly aligned with the close of the financial year or quarter.

After submission, businesses should receive confirmation of acceptance from tax authorities. This step ensures that proof is available for future reference, should any discrepancies arise. Make it a practice to retain confirmation notices and a copy of the submitted form for record-keeping, as records may be required during audits or future applications.

Managing your business amp occupation tax obligations

Proper management of your Business Amp Occupation Tax obligations requires meticulous record-keeping and documentation. Every business should develop a system to track income transactions, expenses, and any changes in tax laws that may affect reporting duties. Implementing software solutions or spreadsheets can help you streamline this process, ensuring that all documentation remains organized.

Staying informed about updates in tax policies will serve you well; subscribing to newsletters from relevant tax institutions or following them on social media can be beneficial. Moreover, knowing when to consult with a tax professional is crucial. If your business expands, diversifies, or encounters unique tax situations, reaching out to a tax consultant can save time and circumvent potential pitfalls, ensuring compliance with all legislative changes and expectations.

Frequently asked questions

Businesses often have questions related to the Business Amp Occupation Tax Form. One common concern is what happens if the deadline is missed. Late filings can lead to fines, so it is essential to communicate with the local tax authority for potential solutions. Another question may involve amending the form post-submission; tax authorities generally allow amendments if discrepancies are found, but proper procedures must be followed. Lastly, businesses often inquire about how the B&O tax factors into overall tax obligations—understanding how these taxes interrelate with income taxes is vital for comprehensive tax planning and financial management.

Tools and resources for better form management

For individuals and teams seeking a seamless document creation solution, platforms like pdfFiller provide interactive tools designed to simplify form filling. One of the standout features is its editing capability, which allows users to directly manipulate PDFs. This means you can easily correct any mistakes or reformat the document as needed without starting from scratch. Additionally, the eSignature capabilities streamline the process of obtaining necessary approvals electronically, a feature particularly useful in collaborative environments.

Furthermore, pdfFiller's collaboration tools enable teams to work together efficiently, making it easy to share forms and track any changes in real-time. With these tools at your disposal, managing the Business Amp Occupation Tax Form becomes a much more straightforward task. By utilizing a cloud-based solution, you can access your documents from anywhere, ensuring that your tax compliance efforts are both effective and efficient.

Conclusion: Empowering your tax management journey

Leveraging cloud-based solutions like pdfFiller for your Business Amp Occupation Tax documentation can significantly enhance your filing experience. The flexibility to access documents from various devices ensures you maintain productivity even when on the go. With comprehensive features such as easy PDF editing and collaboration tools, pdfFiller stands out as an essential resource for ensuring that your tax management journey is as efficient and effective as possible.

Ultimately, using sophisticated tools to manage your B&O tax obligations not only mitigates errors but also empowers businesses to engage more proactively with financial planning. As you navigate your tax responsibilities, remain vigilant about updates in regulations and seek out solutions that offer comprehensive support, such as pdfFiller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my business amp occupation tax directly from Gmail?

Can I create an electronic signature for the business amp occupation tax in Chrome?

How do I fill out the business amp occupation tax form on my smartphone?

What is business amp occupation tax?

Who is required to file business amp occupation tax?

How to fill out business amp occupation tax?

What is the purpose of business amp occupation tax?

What information must be reported on business amp occupation tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.