Get the free Tax Forms for F1 OPT Students: W-8BEN Q&A Guide

Get, Create, Make and Sign tax forms for f1

Editing tax forms for f1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax forms for f1

How to fill out tax forms for f1

Who needs tax forms for f1?

Tax forms for F1 form: A comprehensive guide for international students

Understanding the F-1 visa and its tax implications

The F-1 visa is a non-immigrant student visa that allows international students to study in the United States. It is crucial for non-U.S. citizens pursuing academic programs in the country. For F-1 students, maintaining their visa status is contingent on full-time enrollment and compliance with U.S. laws, including tax regulations.

Tax responsibilities for F-1 visa holders vary significantly from those of U.S. citizens. Typically, F-1 students are classified as non-resident aliens for tax purposes for the first five years of their stay, which influences their filing requirements and tax liability. Understanding these distinctions is not just about compliance; it can also affect budgeting and financial planning.

Do F-1 students need to file taxes?

F-1 students must file tax returns in the U.S. even if they earned no income. This requirement stems from federal regulations designed to monitor individuals on non-immigrant visas. Students earning wages from on-campus employment, such as teaching or research assistantships, must report that income if it exceeds the filing threshold.

Non-residents for tax purposes are typically those who do not meet the Substantial Presence Test, which assesses the number of days spent in the U.S. over the current and two preceding years. F-1 students, during their initial years, usually fall under this category, thus necessitating the use of specific forms tailored for non-residents.

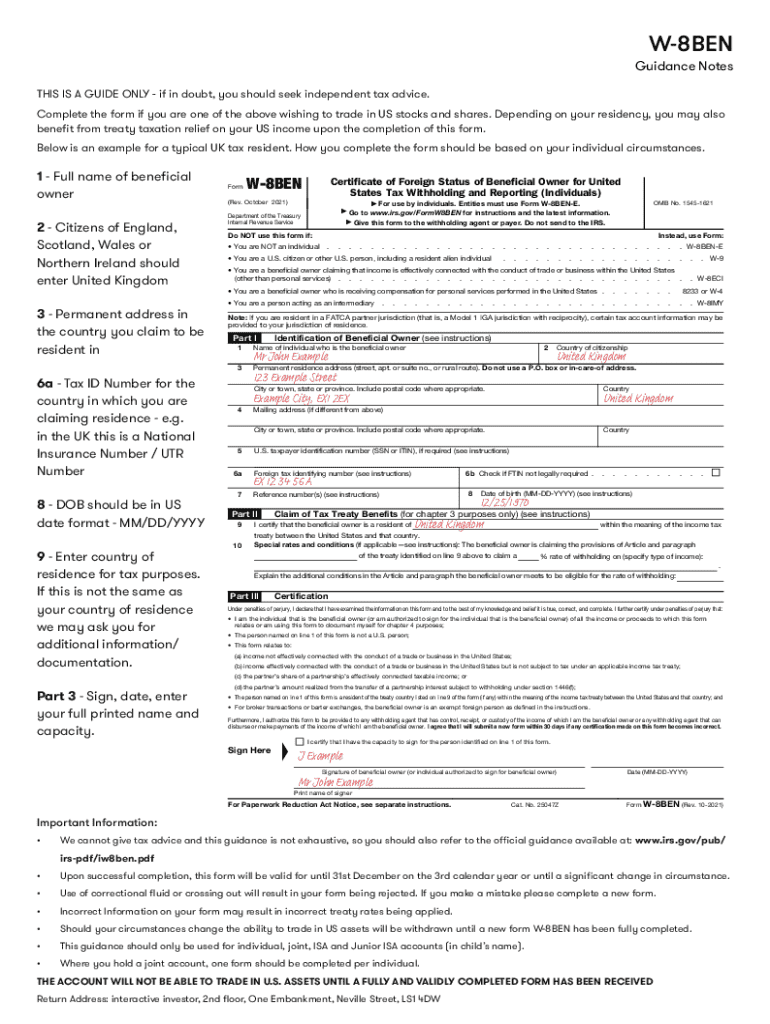

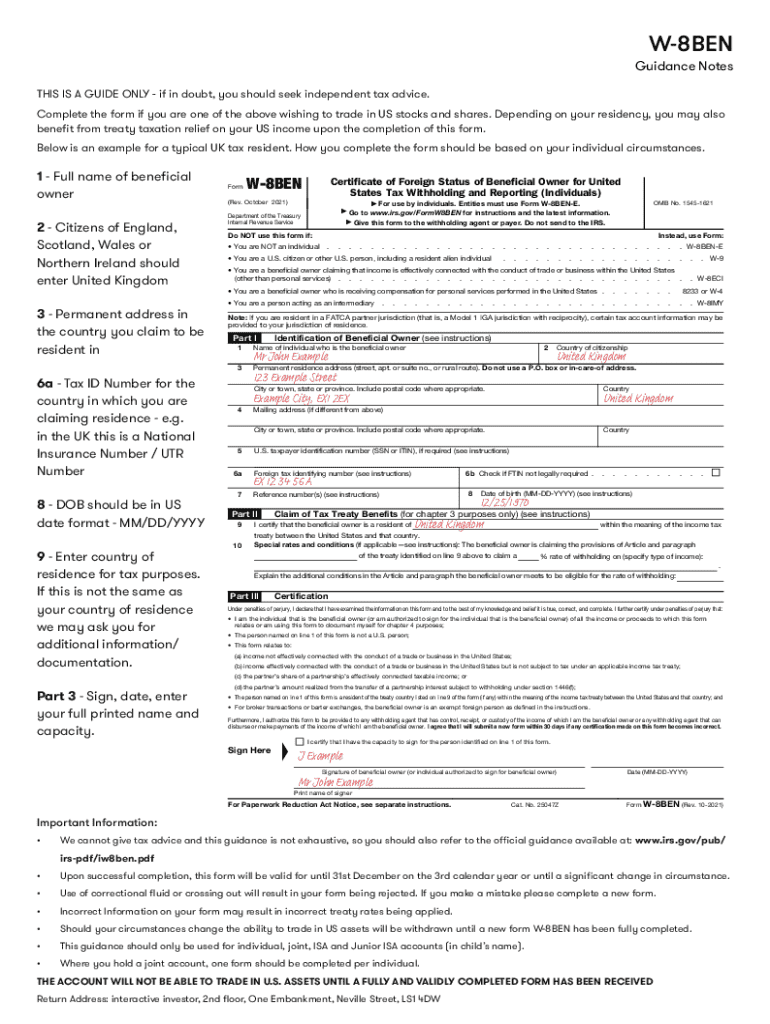

Key tax forms for F-1 students

F-1 students need to be familiar with specific tax forms. Primary among these is Form 8843, which all F-1 students must file. Designed as a declaration for exempt individuals, it is essential for maintaining tax-exempt status during studies.

Detailing each form:

Common mistakes in filing include using the wrong form, misreporting income, or not claiming eligible deductions. Understanding these intricacies ensures compliance and potentially optimizes tax refunds.

Identifying taxable income for F-1 students

Identifying what constitutes taxable income is crucial for F-1 students. This includes any earnings from on-campus jobs as well as funds received from scholarships that exceed tuition costs. While scholarships often support education-related expenses, when funds are used for living costs, they may be subject to taxation.

It is also essential for students to understand exemptions applicable to non-resident aliens. The IRS allows certain types of income to remain tax-exempt, based on required conditions, such as the duration and purpose of the stay. Keeping track of these regulations can result in significant savings.

Navigating tax filing for international students

F-1 students must adhere to specific timelines for tax filing. The U.S. tax season typically begins in January and runs until the tax deadline, usually around April 15. It's essential for students to mark their calendars to avoid potential penalties for late submissions.

To file taxes properly, students should gather necessary documents, including their Form W-2 from employers and any other income statements. Choosing the right method for tax filing is also crucial: students can opt for online filing through platforms that streamline the input process or opt for traditional paper filing, which may require more time.

Common issues and solutions for F-1 students

Missing tax deadlines can carry serious consequences, including penalties or complications with future visa applications. If an F-1 student misses the deadline, they should file as soon as possible, even if late. The IRS has guidelines for those who file late, where it's often better to incur a penalty than to go without filing.

Mistakes made during filing, such as selecting the wrong forms or misreporting information, can be corrected, but require prompt action. If an F-1 student believes they've made an error, they should review guidance on amending tax returns through various IRS resources.

Interactive tools and resources for tax filing

Utilizing pdfFiller can make tax forms management significantly easier for F-1 students. This cloud-based document solution allows students to edit, sign, and collaborate on forms directly from any location, streamlining the overall tax filing process.

With features tailored to meet the needs of students, pdfFiller enhances the efficiency of tax document management. From filling out forms to e-signing them, the platform simplifies filing returns, ensuring that students stay organized and compliant with tax regulations.

Frequently asked questions about F-1 taxes

F-1 students often encounter common questions regarding tax responsibilities. One frequent query is whether F-1 students are eligible for a tax refund. Generally, if students had taxes withheld and meet certain criteria, they may file for a tax refund upon submitting their returns.

Determining residency status for tax purposes can be complicated, but it largely depends on the days spent in the U.S. and the type of visa held. Lastly, if a student hasn’t received their Form W-2, it’s critical to follow up directly with the employer to ensure accurate tax filings are possible.

Preparing for future tax seasons

For F-1 students, record-keeping becomes imperative not just for the current tax season, but for future filing years as well. Maintaining organized financial records — including employment documents, tax returns, and Form W-2s — ensures that tax filing continues to be straightforward and accurate.

Planning ahead for next year’s taxes involves understanding potential changes in tax laws that might affect international students. Staying informed can help students adjust their financial planning proactively to align with any new regulations.

Support for F-1 students navigating U.S. taxes

Seeking professional help can be beneficial for F-1 students who feel overwhelmed by tax regulations. Consulting a tax advisor familiar with international student needs can provide specific guidance tailored to individual circumstances, maximizing compliance and potential tax benefits.

Additionally, many universities have international student offices offering resources and workshops on tax matters. Utilizing these community resources can significantly reduce the hurdles associated with tax compliance for F-1 visa holders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax forms for f1 directly from Gmail?

How can I send tax forms for f1 to be eSigned by others?

How do I fill out tax forms for f1 using my mobile device?

What is tax forms for f1?

Who is required to file tax forms for f1?

How to fill out tax forms for f1?

What is the purpose of tax forms for f1?

What information must be reported on tax forms for f1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.