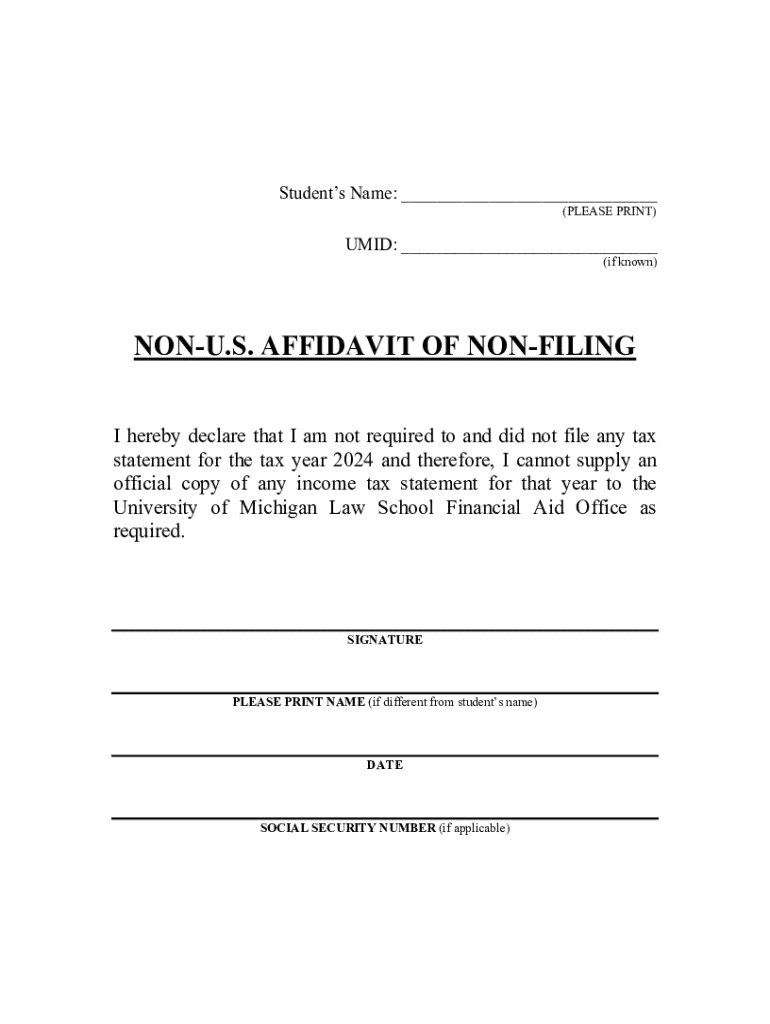

Get the free Non-U.S. Affidavit of Non-filing. Non-U.S. Affidavit of Non-filing

Get, Create, Make and Sign non-us affidavit of non-filing

How to edit non-us affidavit of non-filing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-us affidavit of non-filing

How to fill out non-us affidavit of non-filing

Who needs non-us affidavit of non-filing?

Non-US Affidavit of Non-Filing Form: A Comprehensive How-To Guide

Understanding the Non-US Affidavit of Non-Filing Form

A Non-US Affidavit of Non-Filing Form is a legal document certifying that an individual or entity did not file a tax return in the United States during a specific tax year. This form serves a critical purpose, primarily for expatriates, international students, and non-resident aliens who may require proof of their tax situation when applying for financial aid or fulfilling immigration requirements.

Certain situations necessitate filing this form. For instance, if you were a non-resident for tax purposes but needed to demonstrate your financial circumstances for educational funding or residency applications, the Non-US Affidavit of Non-Filing would be crucial.

Who needs to file a Non-US Affidavit of Non-Filing?

Individuals and entities that may be required to submit the Non-US Affidavit of Non-Filing Form include expats who have lived abroad without a US income, international students who did not file taxes, and foreign businesses operating temporarily in the US. Each of these groups faces unique situations where evidence of non-filing is necessary.

Failure to file this affidavit can lead to serious consequences. Repercussions may include fines, an inability to receive financial aid, or complications with immigration applications. Therefore, understanding your obligations related to non-filing is essential.

Preparing for the Affidavit: Necessary Documentation

Before completing the Non-US Affidavit of Non-Filing Form, individuals should gather essential documentation. Identification documents, such as passports or National ID cards, are critical for verifying identity. Additionally, any previous income records will help substantiate your status as a non-filer for the relevant tax year.

Organizing your documents effectively is crucial. Ensure that all identification and supporting documents are current and clearly legible. When possible, digital copies should be stored in accessible formats, as this facilitates easy editing and transmission when needed.

Step-by-step guide to completing the Non-US Affidavit of Non-Filing

Completing the Non-US Affidavit of Non-Filing Form can be straightforward if you follow a structured approach. The first step involves providing personal information, such as your full name, address, and contact details. Be meticulous; accuracy is essential to avoid complications during processing.

Next, you will encounter sections for financial information. Here, it's important to clearly report any income you might have received from US sources. Additionally, if you had zero income, indicate this clearly to avoid confusion. Common errors in this section can lead to unnecessary delays, so double-check your entries.

eSigning and submitting the Non-US Affidavit

Once you have completed the Non-US Affidavit of Non-Filing Form, the next step is to electronically sign the document. This can easily be done using pdfFiller. Simply upload your completed affidavit to the pdfFiller platform, where you can add an eSignature in a few simple steps, ensuring your document is legally binding.

Submit your affidavit by choosing between mailing it to the appropriate office or electronically submitting it via designated online platforms. Each option has its advantages; for electronic submissions, you could track your status more easily, while mailing provides a physical copy of submission.

Frequently asked questions about the Non-US Affidavit of Non-Filing

Completing the Non-US Affidavit of Non-Filing Form often raises common questions. Many individuals wonder if they need to provide additional documentation along with the affidavit. Typically, the affidavit itself suffices, but some institutions may request supplementary documentation such as proof of residency or identity verification.

Another common concern is how this affidavit impacts financial aid applications. Generally, failure to submit this document can hinder eligibility for aid, so it’s advised to consult with financial aid advisors for specific requisites.

Troubleshooting common issues with the Non-Filing Affidavit

If your submission of the Non-US Affidavit of Non-Filing is rejected, don’t panic. It's essential first to understand the reason for the rejection. Often, rejections stem from incomplete or inaccurate information. Contacting the appropriate office can clarify the necessary corrections.

If you need to amend a submitted affidavit, follow the specified procedures for corrections. This might involve submitting a corrected affidavit along with a cover letter explaining the amendments. Ensure to adhere to any timelines provided by the overseeing agency.

Contacting support for questions or clarifications

Should you have questions or seek clarifications about the Non-US Affidavit of Non-Filing Form, contacting support can provide valuable assistance. At pdfFiller, there are multiple ways to reach out, including phone support, email inquiries, or live chat for immediate assistance.

Expect reasonable response times, and remember that customer service representatives are trained to assist with specific issues related to document submission and management, ensuring you get the help needed.

Preparing for future filings and document management

Maintaining effective records is crucial for future non-filing affidavits. Implementing best practices, such as keeping a dedicated folder for tax documents and using cloud-based storage solutions like pdfFiller, can streamline the process for future submissions. Consistently organizing documents allows you to respond promptly to requests for financial or tax information.

pdfFiller offers features that enhance document management, including templates for quick access to necessary forms in the future. Effortlessly navigate the cloud-based platform, ensuring your documents are always ready when needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in non-us affidavit of non-filing?

How do I complete non-us affidavit of non-filing on an iOS device?

How do I complete non-us affidavit of non-filing on an Android device?

What is non-us affidavit of non-filing?

Who is required to file non-us affidavit of non-filing?

How to fill out non-us affidavit of non-filing?

What is the purpose of non-us affidavit of non-filing?

What information must be reported on non-us affidavit of non-filing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.