Get the free POLICY-MANUAL - Lodging / Tax - personnel wv

Get, Create, Make and Sign policy-manual - lodging tax

How to edit policy-manual - lodging tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out policy-manual - lodging tax

How to fill out policy-manual - lodging tax

Who needs policy-manual - lodging tax?

Policy Manual - Lodging Tax Form: A Comprehensive Guide

Overview of the lodging tax form

The lodging tax form is a critical document used by businesses in the hospitality sector to report and remit taxes on revenues generated from short-term accommodations. This form serves the dual purpose of ensuring compliance with local tax regulations and providing a clear financial account of the business's operations. For hotels, motels, vacation rentals, and similar establishments, understanding and correctly filing this form is essential to avoid penalties and maintain good standing with regulatory authorities.

For individuals operating in the hospitality industry, the lodging tax form is not just a bureaucratic hurdle; it represents an obligation that supports local infrastructure and services. The lodging tax collected is often directed towards promoting tourism, maintaining public facilities, and funding community projects. Furthermore, awareness and adherence to regulations, such as local tax laws and compliance requirements, represent a fundamental aspect of responsible business practice.

Key components of the lodging tax form

Understanding the layout of the lodging tax form is crucial for accurate completion. The form is typically divided into several key sections, each gathering different types of information. Analyzing these components can help in preparing for submission and ensuring compliance with local regulations.

Familiarizing oneself with common terminology, such as 'occupancy tax' and 'exemptions,' can empower business owners to navigate the form more effectively and avoid mistakes.

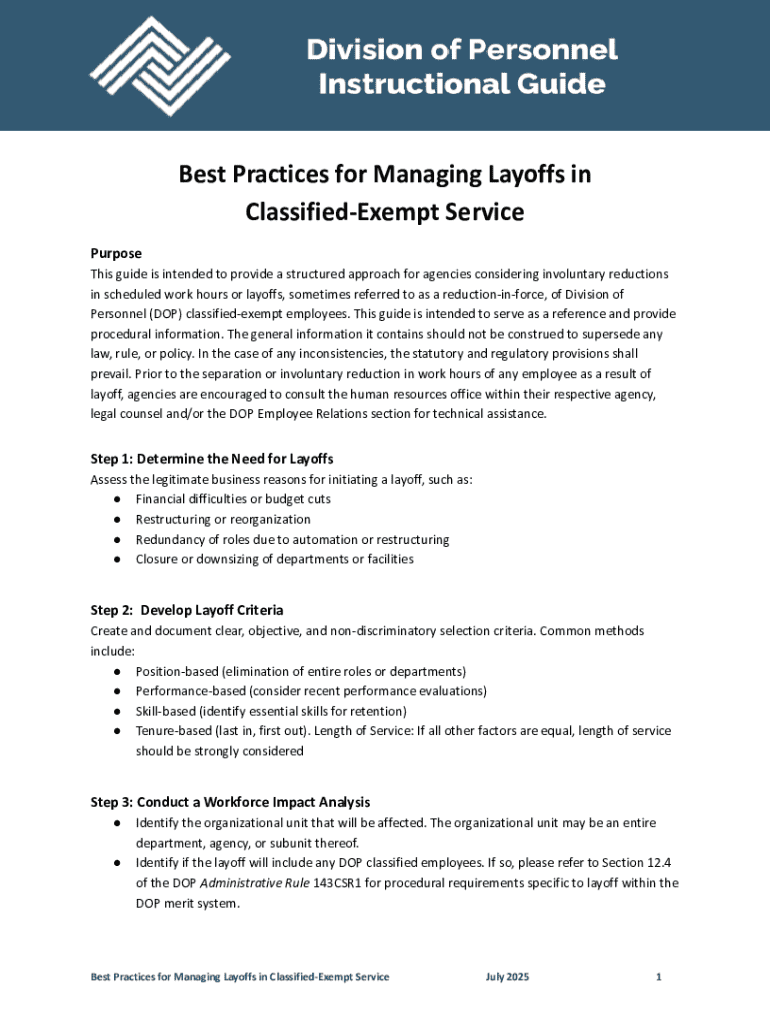

Step-by-step guide to completing the lodging tax form

Completing the lodging tax form can seem daunting, but breaking it down into manageable steps can simplify the process. Following a structured approach ensures accuracy and compliance.

Common pitfalls include overlooking minor details or neglecting to sign the form. Such mistakes can lead to delays or even financial ramifications, so a thorough review is non-negotiable.

Interactive tools for form management

In today's digital age, utilizing a cloud-based platform like pdfFiller can enhance your experience with managing the lodging tax form. From editing to e-signing, pdfFiller offers an array of features that make compliance easier and more efficient.

These features not only save time but also minimize the risk of errors that could arise when using traditional paper forms.

Submitting your lodging tax form

Submitting your lodging tax form involves selecting the appropriate method based on local regulations and personal preferences. Most jurisdictions offer several options for submission, each with its own guidelines.

Be sure to check submission deadlines specific to your area, as these can vary significantly. Late submissions can incur penalties, so establishing a reliable calendar system is crucial.

Managing and storing your lodging tax documentation

Effective document management is a key part of handling lodging tax forms. Developing best practices for storing and organizing your lodging tax documentation will serve you well in the long run.

Solid document management not only ensures compliance but also prepares you for any inquiries or audits from local tax authorities.

Troubleshooting and FAQs

Navigating the lodging tax form can occasionally lead to confusion. Addressing common issues proactively can enhance your filing experience.

Frequently asked questions often revolve around submission deadlines and tax rates. For example, if you miss a deadline, contacting local authorities to explain the situation can sometimes lead to penalties being waived, especially for first-time offenses. Understanding your local tax regulations is essential in managing lodging tax obligations effectively.

Updates and changes in lodging tax regulations

Tax regulations are dynamic and can change frequently, affecting how lodging taxes are calculated and reported. Staying informed is paramount for compliance.

Regularly attending tax training webinars or seminars about lodging regulations can also help clarify any doubts and keep you updated on best practices.

User testimonials and case studies

Real-world experiences with using pdfFiller reveal how powerful the tool can be for managing lodging tax forms effectively. Businesses that have implemented pdfFiller report significant decreases in errors and a smoother compliance process.

Such success stories highlight not only how pdfFiller empowers businesses to meet lodging tax compliance but also alleviates the stress often associated with such responsibilities.

Contact and support options

Should you encounter any obstacles while managing your lodging tax form, reaching out to the pdfFiller support team is a simple step for receiving timely assistance. The support team is dedicated to helping users navigate the platform effectively and addressing any specific issues related to form completion or submission.

By utilizing these resources, you can confidently manage your lodging tax documents and ensure compliance with local regulations efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify policy-manual - lodging tax without leaving Google Drive?

How can I send policy-manual - lodging tax to be eSigned by others?

Can I edit policy-manual - lodging tax on an iOS device?

What is policy-manual - lodging tax?

Who is required to file policy-manual - lodging tax?

How to fill out policy-manual - lodging tax?

What is the purpose of policy-manual - lodging tax?

What information must be reported on policy-manual - lodging tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.