Get the free OC Treasurer-Tax Collector Shari Freidenrich Rolls Out ...

Get, Create, Make and Sign oc treasurer-tax collector shari

How to edit oc treasurer-tax collector shari online

Uncompromising security for your PDF editing and eSignature needs

How to fill out oc treasurer-tax collector shari

How to fill out oc treasurer-tax collector shari

Who needs oc treasurer-tax collector shari?

A comprehensive guide to the OC Treasurer-Tax Collector Shari Form

Overview of the OC Treasurer-Tax Collector Shari Form

The OC Treasurer-Tax Collector Shari Form is a crucial document in the realm of property tax management, enabling residents of Orange County to handle tax obligations and submissions effectively. This form is designed to simplify the tax process, providing essential information to both taxpayers and the county's tax authorities.

The importance of the Shari Form cannot be overstated, as it ensures compliance with local tax regulations while also facilitating transparent communication between taxpayers and the Treasurer-Tax Collector's office. It is particularly vital during tax season when timely submissions can directly impact property tax assessments and payments.

Individuals who own property in Orange County are the primary audience for the Shari Form. This includes homeowners, landlords, and other property managers who need to report financial details associated with their tax liabilities.

Key features of the Shari Form

The Shari Form stands out in the realm of tax documentation thanks to its various interactive tools. These features facilitate not only the completion of the form but also enhance the overall user experience. One major highlight is its compatibility with pdfFiller, a versatile platform that provides numerous functionalities tailored for document management.

One of the standout attributes of the Shari Form is its cloud-based document management capabilities. This allows users to access their forms from anywhere, eliminating the stress of being tied down to a single location for tax-related tasks. Additionally, the integration of e-signature options speeds up the processing times, making it easier for taxpayers to submit forms quickly.

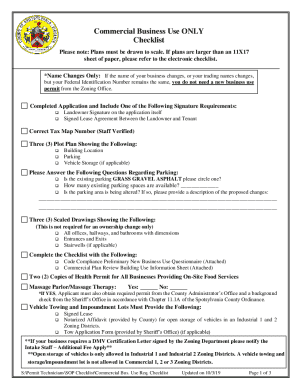

Step-by-step instructions for completing the Shari Form

Completing the OC Treasurer-Tax Collector Shari Form can be straightforward if approached systematically. Following a structured format will help ensure that you do not overlook any crucial information.

Editing and modifying the Shari Form

One of the convenient features of using pdfFiller for the Shari Form is the array of editing tools available. Users can make necessary corrections or adjustments before finalizing their forms. This includes correcting any typos or providing clarifications to ensure complete accuracy.

To add notes or annotations, utilize the comment features within pdfFiller. This is particularly beneficial for those collaborating with others on form completion, as it allows for real-time discussions on needed changes or clarifications.

Collaboration features for teams

For teams working on the OC Treasurer-Tax Collector Shari Form, pdfFiller offers robust collaboration features. For instance, users can invite team members to edit or review the form by simply sharing access via email or a direct link.

Moreover, pdfFiller allows for tracking changes and comments, greatly enhancing team dynamics. This eliminates the hassle of email chains and aligns everyone involved towards a single document, ensuring input from all relevant parties is considered.

Signing and submitting the Shari Form

The process of signing the Shari Form has been streamlined to facilitate faster submission. Users can choose from various e-signature options—typing their name, drawing a signature, or uploading an image of their written signature.

After signing, it’s essential to review the final form carefully. A checklist can help verify that all sections are correctly filled out and that supporting documents have been included. Once verified, submission of the form can be performed electronically through pdfFiller, which simplifies the filing process.

Frequently asked questions (FAQ) about the Shari Form

Navigating the OC Treasurer-Tax Collector Shari Form might bring up some common questions among users. It's important to provide clear answers to these inquiries to enhance user experience.

Additional features of pdfFiller relevant to the Shari Form

Users of the Shari Form can additionally enjoy mobile access through pdfFiller’s platform. This enables individuals to manage their documents on-the-go, allowing for quick edits or submissions from their mobile devices.

Furthermore, pdfFiller offers document storage options that allow users to track and manage submitted forms seamlessly. Coupled with top-notch security features, users can feel confident that their sensitive information is protected throughout the entire process.

Case studies: Successful use of the Shari Form

Several individuals and teams have reported significant improvements in their property tax management thanks to the efficient use of the OC Treasurer-Tax Collector Shari Form. For instance, a local property management company was able to streamline its tax submission process, resulting in a notable reduction in late filings.

Testimonials from users emphasize the convenience and efficiency that pdfFiller brings to the process, reinforcing the benefits of a collaborative and interactive approach to document handling.

Final thoughts on the OC Treasurer-Tax Collector Shari Form

In summary, the OC Treasurer-Tax Collector Shari Form serves as a vital resource for property owners in Orange County navigating their tax obligations. Leveraging the powerful capabilities of pdfFiller can significantly enhance how users interact with this form, ensuring a smoother experience from beginning to end.

The combined features of the Shari Form and pdfFiller empower users to submit their property tax documents with confidence. Engaging these tools can lead to increased efficiency and reduced stress when meeting tax duties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get oc treasurer-tax collector shari?

Can I create an electronic signature for signing my oc treasurer-tax collector shari in Gmail?

How do I complete oc treasurer-tax collector shari on an iOS device?

What is oc treasurer-tax collector shari?

Who is required to file oc treasurer-tax collector shari?

How to fill out oc treasurer-tax collector shari?

What is the purpose of oc treasurer-tax collector shari?

What information must be reported on oc treasurer-tax collector shari?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.