Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out sale deed deed of

Who needs sale deed deed of?

Sale deed | Deed of form

Understanding sale deeds

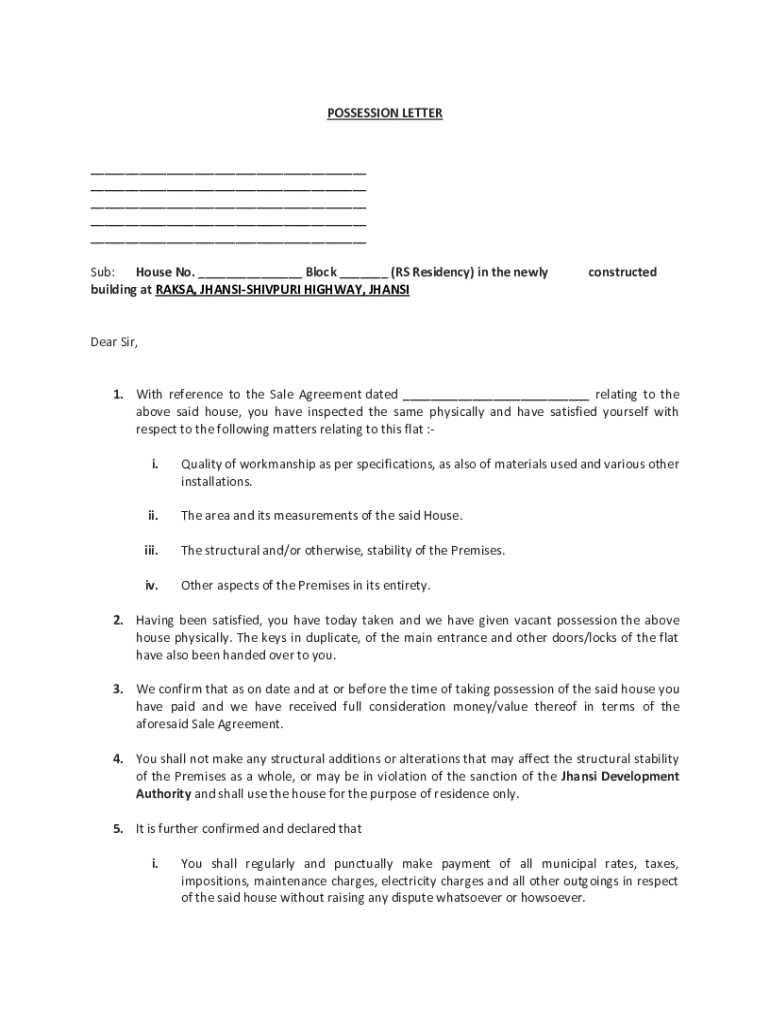

A sale deed is a formal legal document that records the transfer of property ownership from one party (the grantor) to another (the grantee). It is crucial in real estate transactions, serving not only as proof of property transfer but also as a legal instrument that outlines the details of the agreement between parties. Without a sale deed, the transaction can be considered incomplete, potentially leading to disputes over ownership.

The importance of a sale deed extends beyond mere transfer; it offers protection and clear delineation of rights for both buyers and sellers. At its core, a sale deed contains key elements such as the identities of the involved parties, a detailed property description, purchase price, and terms of payment. These elements work together to provide clarity and legal standing, ensuring that all parties are aware of their rights and obligations.

Types of sale deeds

Several types of sale deeds exist, each serving distinct purposes. Understanding these variations can assist individuals in selecting the appropriate type for their transaction needs.

Main components of a sale deed

Creating a valid sale deed requires attention to several critical elements. These components form the foundation of the transaction and must be clearly articulated to avoid disputes.

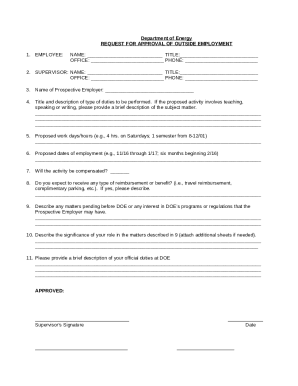

When to use a sale deed

A sale deed is typically employed in situations where real estate is being bought or sold. It's essential to distinguish when to use a sale deed versus other forms, such as a gift deed or lease deed. For instance, a gift deed serves to transfer property ownership without a financial transaction, while a lease deed outlines rental agreements.

Understanding regional differences is also critical, as various states impose unique regulations and requirements surrounding the execution of sale deeds. As a property owner, being aware of these distinctions can help streamline transactions and ensure compliance with state laws.

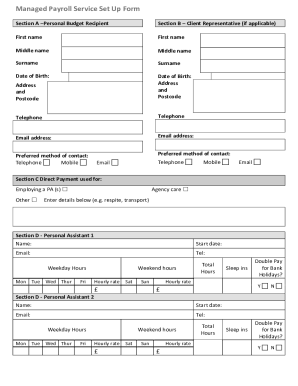

Filling out a sale deed

Completing a sale deed involves multiple essential steps to ensure it is both valid and effective. Here’s how to approach it systematically:

Common mistakes include omitting key details, failing to provide accurate property descriptions, or misunderstanding legal requirements. Customizing your sale deed to reflect the unique aspects of your transaction will also enhance its relevance.

Legal requirements for a valid sale deed

To be legally binding, a sale deed must adhere to specific statutory requirements, which can vary significantly by region. Generally, for a sale deed to be valid, it must be in writing, signed by both parties, and notarized or witnessed in some states.

Signing and executing the sale deed

Execution of a sale deed involves structured procedures which necessitate attention to detail. Necessary signatures from both the grantor and grantee are critical. They should sign in the presence of required witnesses, as stipulated by local laws.

Furthermore, the date and place of execution must be clearly stated. This aspect serves as a legal milestone to identify when the transfer took place, solidifying the agreement in the eyes of the law.

Managing your sale deed post-execution

After executing the sale deed, it's vital to manage it properly. Keep the original document in a secure location, such as a safe deposit box or a fireproof safe at home, to guarantee its safety.

Challenges and common issues

Disputes related to sale deeds can arise frequently due to misunderstandings or failures to adhere to agreement terms. It's essential to know your legal rights and options should a breach occur. Breach of the deed can lead to legal recourse, where courts may enforce specific performance or award damages.

Additionally, problems often emerge related to title and ownership claims, especially if the seller had undisclosed liens or defects in the property. Being proactive and conducting thorough diligence before executing a sale deed can mitigate these risks significantly.

Advanced topics and FAQs

Engaging with a sale deed can lead to several advanced considerations, including tax implications. Depending on the property's value and your local regulations, the sale may incur capital gains tax. Furthermore, obtaining title insurance is an invaluable step, providing protection against potential claims or defects in title.

Interactive features on pdfFiller

pdfFiller offers a range of interactive features designed to streamline the process of creating sale deeds. With fillable templates, users can easily customize their documents to fit specific needs while ensuring compliance with local regulations.

Final thoughts on using sale deeds effectively

Navigating the complexities of real estate transactions can be overwhelming. However, understanding how to utilize a sale deed effectively can empower buyers and sellers alike. Adhering to best practices, such as thorough document preparation and secure handling post-signing, can make a significant difference in the transaction's outcome.

With tools provided by pdfFiller, users have the ability to create, customize, and manage their sale deed documents from anywhere. This capability not only enhances efficiency but also empowers individuals and teams to handle essential documentation seamlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify pdffiller form without leaving Google Drive?

How can I edit pdffiller form on a smartphone?

How do I fill out pdffiller form using my mobile device?

What is sale deed deed of?

Who is required to file sale deed deed of?

How to fill out sale deed deed of?

What is the purpose of sale deed deed of?

What information must be reported on sale deed deed of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.