Sample adverse action letter form: A comprehensive guide

Understanding adverse action letters

An adverse action letter is a formal notification sent to individuals when a negative decision is made based on information obtained from a consumer report. This could involve actions like denying credit applications, failing to hire a candidate, or increasing insurance rates. The primary purpose of this letter is to inform the affected individual of the decision, its basis, and their rights regarding the matter.

Notifying individuals of adverse actions is crucial not only for transparency but also for compliance with legal standards. This promotes trust and ensures individuals understand their rights within financial or employment processes.

Legal requirements

Adverse action letters must comply with several legal requirements, particularly under the Fair Credit Reporting Act (FCRA). The FCRA mandates that individuals must receive a written notice if an adverse action is taken based on their credit report. Additionally, regulations require organizations to provide a summary of the report that influenced the decision and information about how the person can obtain a copy of their report.

Key compliance considerations include ensuring that the letter contains specific language regarding the recipient's right to dispute the information used in the decision-making process.

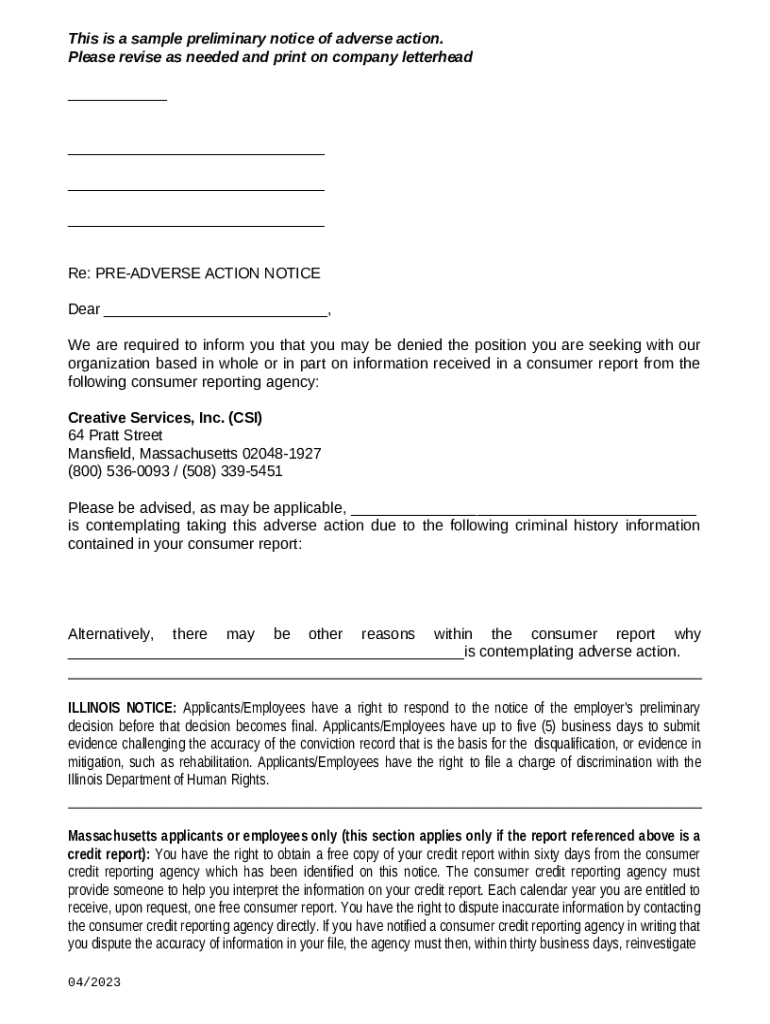

Components of a sample adverse action letter

A well-structured adverse action letter contains several essential elements. Firstly, it should clearly identify the sender, which typically is the company or individual who made the adverse decision, and the recipient, who is the affected individual. Following this, the letter should include a summary of the adverse action taken, such as a credit denial or employment rejection, ensuring the purpose is clear from the outset.

Clarifying the reason(s) for the adverse action is another critical element. This may include low credit scores, negative reports, or unsatisfactory background checks. Moreover, the letter needs to incorporate specific statements required by law, such as notifying the recipient of their right to dispute the information and providing details about the consumer reporting agency used, particularly if the decision stems from a credit report.

Customizing your adverse action letter

While a sample adverse action letter form provides a solid foundation, personalizing the template is essential for your specific circumstances. This may involve adjusting the wording to match the tone and style of your organization, as well as adding unique reasons for the adverse action that apply directly to the recipient.

For better clarity and understanding, keep the language straightforward. Avoid legal jargon that might confuse the recipient. Furthermore, using interactive editing tools like pdfFiller allows for seamless updates to your letter. With pdfFiller, you can easily modify templates to fit your needs, ensuring compliance and clarity.

Interactive editing tools

pdfFiller offers user-friendly features for editing documents, allowing users to customize their adverse action letters efficiently. Utilizing pdfFiller’s platform, you can access a range of templates, fill in details, and even save versions for future reference. A step-by-step guide on engaging with pdfFiller’s tools can help you navigate through the editing process with ease.

Filling out the sample adverse action letter form

When it comes to filling out the sample adverse action letter form, adherence to a well-structured approach is vital. Begin by clearly inserting the date at the top of the form, followed by the sender’s details including name, address, and contact information. Next, accurately enter the recipient’s information, ensuring that names and addresses are correctly spelled for professional integrity.

Then, articulate the summary of the adverse action taken, coupled with the rationale behind it. Where appropriate, cite any relevant data or reports that contributed to the decision. Lastly, incorporate the legally mandated statements regarding the right to dispute the information and the requisite details about the consumer reporting agency, making sure this information is prominently displayed.

Sender's information (name, address, contact).

Recipient's information (name, address).

Summary of the adverse action taken.

Reason(s) for the adverse action.

Legal statements on the right to dispute.

Details of the consumer reporting agency, if applicable.

Signing and sending the letter

After filling out the adverse action letter form appropriately, the next step is to sign it. pdfFiller provides a secure platform for electronically signing documents, ensuring that your eSignature is valid and recognized under the law. This can save time while maintaining professional authenticity.

Special attention should also be given to how the letter is delivered. The options typically include email or postal mail. Email provides immediacy, but sending via postal mail might be safer in terms of providing a formal record. Utilizing tracking methods can also confirm delivery, providing additional security for both parties involved.

Managing responses after sending the letter

Post-delivery, it’s crucial to maintain an organized approach should you receive a response or dispute from the individual. This involves documenting responses carefully and following a consistent procedure for addressing disputes. Proper record-keeping can protect your organization in the event of future inquiries regarding the decisions made.

By leveraging pdfFiller for document management, you can conveniently store and organize copies of all sent letters. Cloud-based document access offers teams the flexibility to retrieve these letters anytime, from anywhere — a critical advantage in managing compliance and enhancing collaboration on team-related issues.

Additional considerations

The impact of sending an adverse action letter can vary greatly; it can influence an individual's employment opportunities or credit status. Moreover, understanding the long-term implications of your decisions and reporting practices is essential. Ensuring clarity and transparency fosters a better relationship with clients and employees alike.

Best practices for compliance and communication include maintaining updated information, training teams in proper procedures, and using resources like pdfFiller to keep letter templates compliant with current laws. Regular audits of your documentation processes can ensure you remain aligned with regulations, thereby protecting your organization from potential penalties.

Conclusion

In conclusion, understanding and utilizing a sample adverse action letter form is crucial for maintaining professionalism and regulatory compliance in your organization. By integrating pdfFiller into your documentation process, you can streamline the creation and management of these important letters, enhancing efficiency and legal robustness. Continual adaptation to legal changes and best practices ensures that you are empowered to handle adverse actions transparently and compassionately.