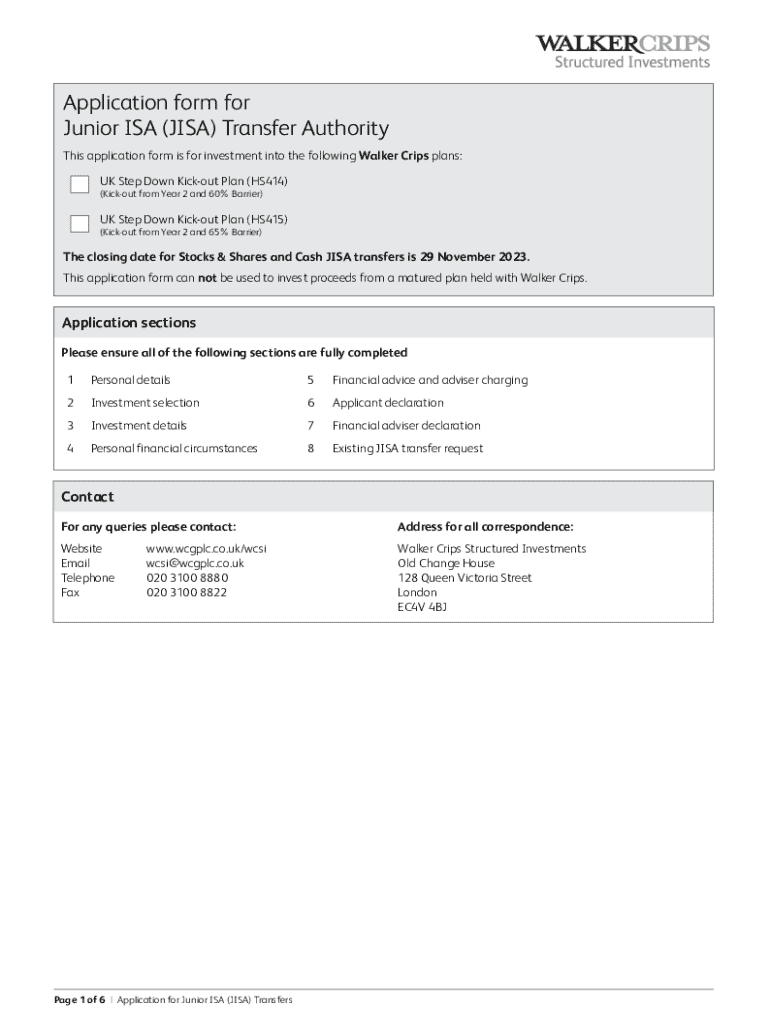

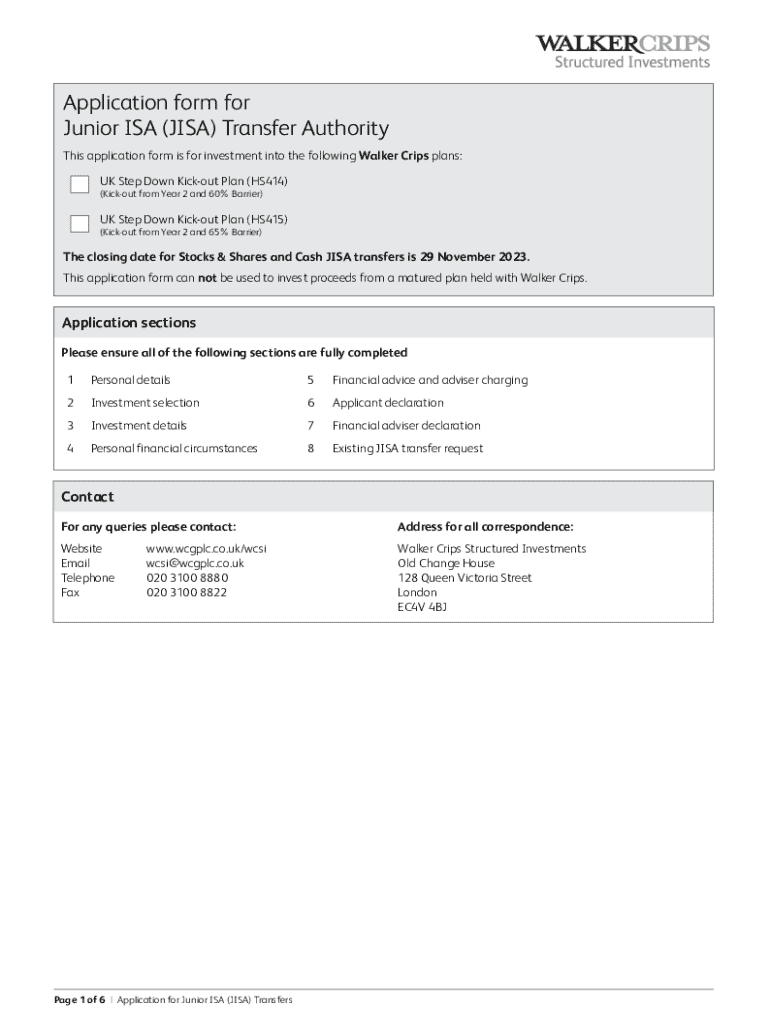

Get the free UK Step Down Kick-out Plan (HS414)

Get, Create, Make and Sign uk step down kick-out

Editing uk step down kick-out online

Uncompromising security for your PDF editing and eSignature needs

How to fill out uk step down kick-out

How to fill out uk step down kick-out

Who needs uk step down kick-out?

Understanding the UK Step Down Kick-Out Form: A Comprehensive Guide

Key information

The UK Step Down Kick-Out Form is a pivotal document in the realm of financial instruments, particularly for those engaged in structured products. This form is designed to facilitate the process of opting into a financial agreement where the investment has the potential to 'kick out' early under specific market conditions. Its primary purpose is to provide clarity and formalize the agreement between you and the financial institution, detailing eligibility, conditions, and potential benefits.

Eligibility to use the UK Step Down Kick-Out Form typically extends to both individual investors and institutional teams. Individual investors must meet specific criteria, which may include a minimum investment amount and a risk profile suitable for structured products. Teams or financial advisors representing clients must also demonstrate a thorough understanding of the product to ensure that it aligns with the clients' financial goals.

Overview of the process

Understanding how the step down kick-out options function in financial markets is crucial for effective investment strategies. Essentially, kick-out features allow investors to exit an investment earlier than the predetermined maturity date if certain conditions are met, such as the performance of an underlying asset reaching a specified threshold. This can provide matures returns more rapidly, making it an attractive option for many.

However, utilizing the UK Step Down Kick-Out Form also carries implications that should not be overlooked, including financial benefits like enhanced liquidity and the potential for higher returns. Conversely, investors may face risks, especially if market conditions do not unfold as predicted. Therefore, proper completion of this form is essential to ensure that all relevant details are accurately represented to minimize complications later on.

Important dates

When engaging with the UK Step Down Kick-Out Form, awareness of key deadlines is vital. Submission dates can vary depending on specific financial products and the institutions offering them. Standard practice dictates that the form should be submitted within a defined window, often established at the launch of the financial product, which could range from a few weeks to several months.

Additionally, once submitted, the review and processing timeline is typically within a range of 3 to 5 business days, during which investors can expect feedback regarding their application status. Understanding these timelines can significantly impact decision-making for prospective investors.

Document creation and management

Creating the UK Step Down Kick-Out Form can be seamlessly achieved using pdfFiller, a powerful tool designed for efficient document management. To get started, users can access pdfFiller to create the form from an available template or fill in a blank form directly. The intuitive interface makes navigation straightforward, allowing even those with minimal experience to create needed documents with ease.

Once the base form is created, pdfFiller offers numerous features to enhance document accessibility. Users can easily collaborate by sharing links with team members for input or review, and powerful editing options allow for customization tailored to specific financial situations. Furthermore, managing the document, tracking changes, and conducting revisions is simplified through the platform's version control features.

Detailed steps for filling out the form

Filling out the UK Step Down Kick-Out Form can be a straightforward process when following structured steps. Here’s how:

Collaboration and sharing features

Collaboration is a vital aspect of document management, especially for teams working on financial agreements. With pdfFiller, users can invite team members to contribute to the editing process by sharing access to the document. This feature enhances teamwork and ensures that all pertinent perspectives are considered, leading to a more refined final product.

In addition to effective collaboration, pdfFiller provides robust version control features. This allows users to manage all iterations of a document easily, ensuring that all changes are tracked. Users can revert to previous versions if needed, which can be particularly helpful in maintaining an accurate history of discussions and decisions made around the UK Step Down Kick-Out Form.

Common challenges and solutions

Completing the UK Step Down Kick-Out Form can present challenges, primarily if users are not familiar with the document's requirements or the financial implications involved. Common errors include inaccurate personal information, misunderstanding the financial options available, or failing to submit the document on time. Such mistakes can have significant implications for the investment process, including denied applications or unfavorable terms.

To mitigate these issues, maintaining a checklist can help guide users through the completion process. Additionally, if complications arise, pdfFiller’s help resources offer troubleshooting tips on how to resolve typical submission problems. By following these tips and being proactive, users can enhance their experience while dealing with the UK Step Down Kick-Out Form.

Frequently asked questions (FAQs)

When dealing with the UK Step Down Kick-Out Form, users may encounter various questions that require clarity. Common queries often revolve around the conditions under which kick-outs occur, the potential consequences of early opt-outs, and procedural aspects related to form submission.

Furthermore, legal aspects are frequently discussed, such as the binding nature of agreements made through this form and what recourse is available in the event of a dispute. Getting accurate answers to these questions is crucial for both individuals and teams, ensuring they are fully informed before making commitments.

User experiences and testimonials

User feedback surrounding the UK Step Down Kick-Out Form highlights the advantages of utilizing pdfFiller's services. Many users share success stories of effectively navigating the complex world of structured products and benefiting from enhanced returns through timely submissions using the kick-out option.

Moreover, users often praise pdfFiller for its user-friendly interface and collaborative tools. Testimonials frequently reflect satisfaction regarding the ease of document management, which significantly reduces the stress commonly associated with financial paperwork. Achieving success with the UK Step Down Kick-Out Form not only enhances satisfaction rates but also builds confidence in using technology to manage documents.

Additional considerations

While the UK Step Down Kick-Out Form opens doors to potentially lucrative financial opportunities, understanding associated risks is paramount. Many kick-out products involve underlying assets that can be volatile; thus, market fluctuations can directly impact the success of your financial strategy.

Recognizing future trends in document management is essential as well. As technology continues to evolve, platforms like pdfFiller are expected to incorporate more advanced features, serving to streamline the documentation process even further. Keeping an eye on these developments will empower users to adapt promptly, benefiting from technological advancements in financial documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in uk step down kick-out without leaving Chrome?

Can I create an electronic signature for signing my uk step down kick-out in Gmail?

Can I edit uk step down kick-out on an Android device?

What is uk step down kick-out?

Who is required to file uk step down kick-out?

How to fill out uk step down kick-out?

What is the purpose of uk step down kick-out?

What information must be reported on uk step down kick-out?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.