Get the free Form PA-10169 (2017) (AM) (CT)

Get, Create, Make and Sign form pa-10169 2017 am

How to edit form pa-10169 2017 am online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form pa-10169 2017 am

How to fill out form pa-10169 2017 am

Who needs form pa-10169 2017 am?

A Comprehensive Guide to Form PA-10169: 2017 AM Form

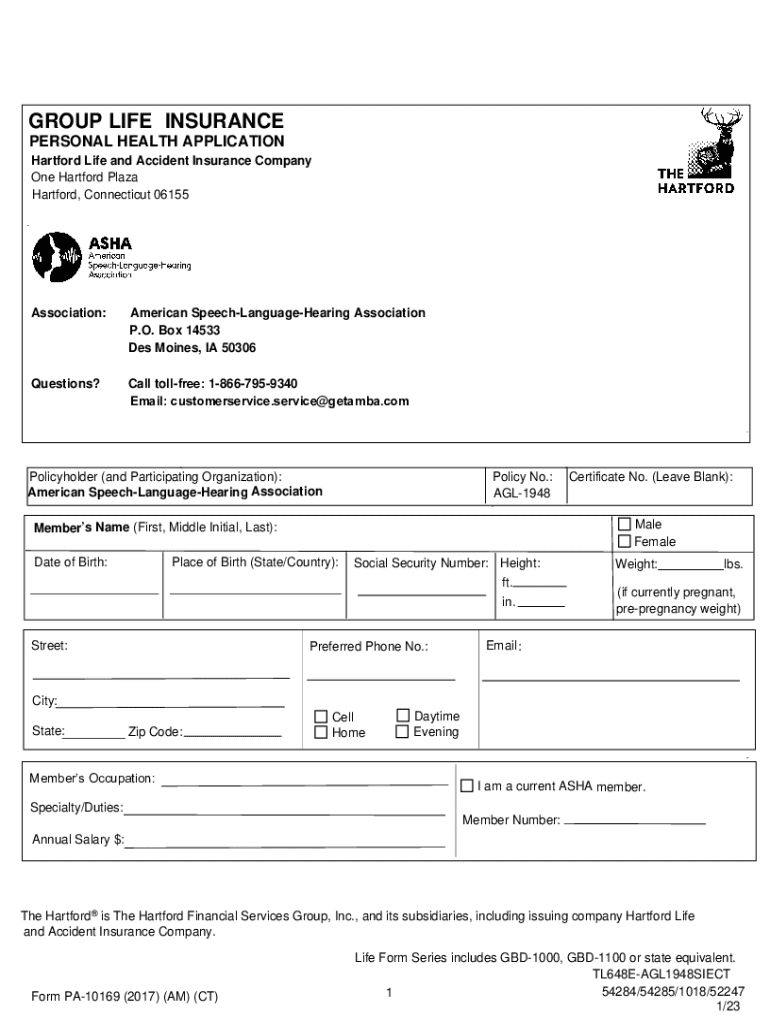

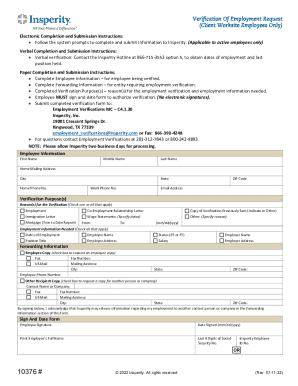

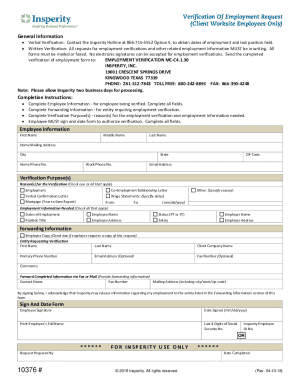

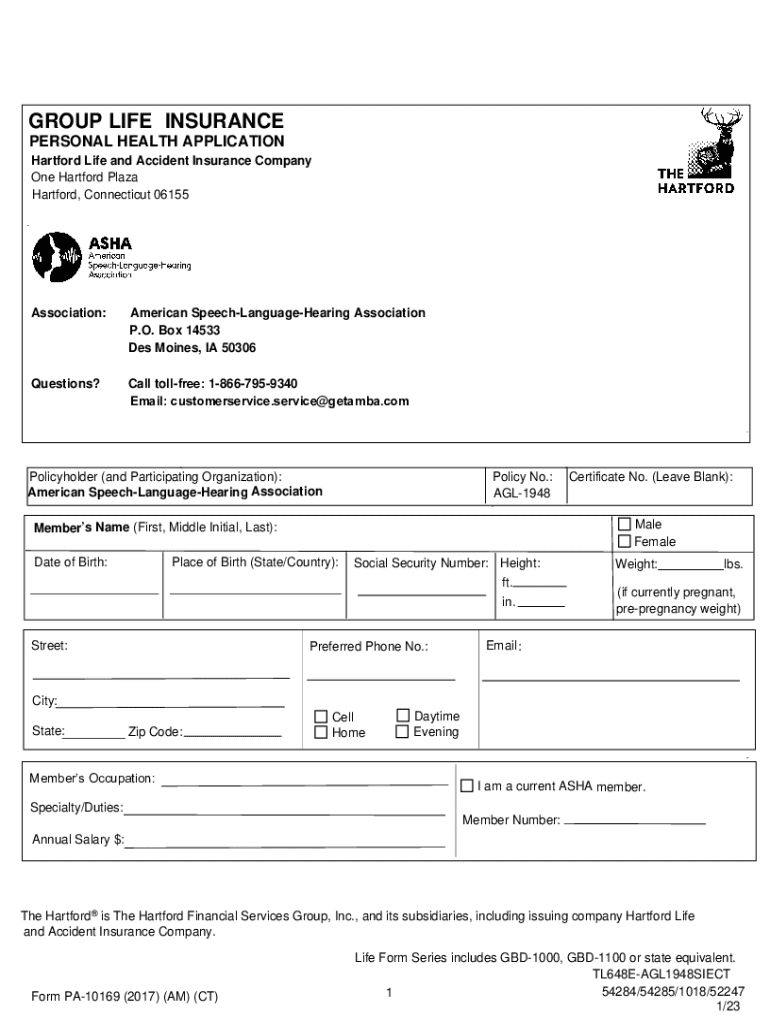

Understanding Form PA-10169

Form PA-10169 is a crucial document designed for Pennsylvania residents, primarily for those involved in tax-related processes. This form plays an essential role in maintaining compliance with state regulations and ensures proper documentation of financial activities. As a vital part of the tax filing ecosystem, it serves individuals and businesses alike, streamlining various fiscal responsibilities.

Legislative updates in 2017 have redefined certain aspects of Form PA-10169, marking the importance of understanding its requirements. This form is influenced by changing tax laws that aim to improve clarity and efficiency in tax reporting and processing. Users must stay informed of these distinctions to ensure accurate filing.

Key features of Form PA-10169

Form PA-10169 includes several key features crucial for proper tax documentation. It is divided into major sections that cater to different aspects of the filer’s information, including personal and financial data. Users should pay particular attention to these elements to avoid submission errors.

Among the essential elements of the form, you will find sections allocated for personal identification, income reporting, deductions, and signatures. Familiarity with common terms and abbreviations, like 'AGI' for Adjusted Gross Income, is also beneficial for accurate completion.

Step-by-step guide to completing Form PA-10169

Before starting, gather all necessary documents such as previous tax returns, proof of income, and any receipts for deductions. This preparation will help streamline the process of filling out the form.

Filling out Section 1 focuses on Personal Information, including your full name, address, social security number, and date of birth. Ensure accuracy as this information is used for verification.

In Section 2, Financial Details are documented. List your income sources, project any taxable income, and claim deductions. Check current regulations to maximize your eligible claims. Finally, Section 3 requires necessary Signatures and Dates to validate your submission.

Tips for accurate submission of Form PA-10169

To ensure your form is accurate, be wary of common errors. Miscalculations, illegible handwriting, and missing information are prevalent issues that can delay processing. Review your entries against your documentation before submission.

Best practices include double-checking all details, asking someone else to review the form for clarity, and noting relevant deadlines for submission, so you do not incur penalties. Ensure your submission is postmarked by the state’s due date.

Editing and managing your Form PA-10169

Editing your Form PA-10169 can be efficiently handled using pdfFiller. Start by uploading your completed form onto the platform. pdfFiller allows you to make changes directly, ensuring that any amendments are easily incorporated into the document.

To edit, simply select the text you wish to modify, change the specifics as needed, and then save your changes. Utilize pdfFiller’s interactive tools such as highlighting critical information and adding comments for future reference or collaboration.

eSigning Form PA-10169 with pdfFiller

In the current digital age, eSigning documents has become an essential component of efficient workflows. Adding an electronic signature to your Form PA-10169 is straightforward using pdfFiller. This method eliminates the need for printing and scanning, enhancing your overall productivity.

To add your signature, navigate to the eSignature section on pdfFiller, select your signature style, and place it on the designated line. Remember to consider security measures, ensuring that your electronic signature remains protected against unauthorized use.

FAQs about Form PA-10169

Users often have several queries regarding Form PA-10169. One common concern is what to do if a mistake has been made after submission. Typically, you can file an amended return; however, check specific state guidelines for your situation.

Another question often asked is how to track the status of your form after submission. Many agencies provide online portals for tracking the progress of your document submission, allowing you to ensure everything is on track.

Managing your documents on pdfFiller

pdfFiller offers excellent document management options, allowing users to store, organize, and retrieve forms effortlessly. You can categorize your documents based on type, importance, or due date, making it simple to find what you need when you need it.

The platform also offers diverse sharing options, permitting real-time collaboration with team members. Integrations with other platforms enhance your workflow, making it a central hub for document management and interaction.

Case studies and user experiences

Real-life scenarios showcase how users have effectively leveraged Form PA-10169 in their tax processes. For example, small business owners have successfully navigated their tax obligations using this form, minimizing errors through the utilization of pdfFiller.

Testimonials from satisfied users reveal how pdfFiller's platform simplifies complex documentation tasks, making compliance much easier and saving valuable time during tax season.

Additional tools and resources on pdfFiller

Explore related forms and templates on pdfFiller that can complement your filing of Form PA-10169. Recommendations may include forms for tax credits, different types of income reporting, or financial acknowledgments.

Interactive tools offered by pdfFiller, such as templates and calculators, can enhance your document management experience and provide systematic support for all your tax-related needs.

Initiating further actions after completing Form PA-10169

Once you have completed Form PA-10169, several options are available for submission. You may either send it via traditional postal mail or utilize electronic filing if applicable, as many state agencies now offer online submissions.

After submitting the form, it’s essential to engage in follow-up tasks, such as keeping copies of your documents and tracking your submission status. Adopting these practices will ensure that you maintain proper records and are prepared for any future inquiries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form pa-10169 2017 am for eSignature?

How do I complete form pa-10169 2017 am online?

How do I fill out the form pa-10169 2017 am form on my smartphone?

What is form pa-10169 2017 am?

Who is required to file form pa-10169 2017 am?

How to fill out form pa-10169 2017 am?

What is the purpose of form pa-10169 2017 am?

What information must be reported on form pa-10169 2017 am?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.