Get the free Junior ISAs for ISA managers

Get, Create, Make and Sign junior isas for isa

Editing junior isas for isa online

Uncompromising security for your PDF editing and eSignature needs

How to fill out junior isas for isa

How to fill out junior isas for isa

Who needs junior isas for isa?

Junior ISAs for ISA Form: A Comprehensive Guide

Understanding Junior ISAs

Junior ISAs (Individual Savings Accounts) were introduced in 2011 as a tax-efficient savings option specifically designed for children under 18. The purpose of a Junior ISA is to encourage parents and guardians to save for their child’s future, allowing funds to grow tax-free until the child reaches adulthood. By setting up a Junior ISA, you can instill good saving habits early on, helping your child build a substantial financial foundation.

One of the key benefits of opening a Junior ISA is the freedom from income tax and capital gains tax on the savings, which means every penny your child earns in interest or investment growth is theirs to keep. Additionally, Junior ISAs have the potential for long-term investment growth, making them a powerful tool for accumulating savings that can help pay for education, a first car, or a deposit on their first home.

Comparing Junior ISAs with regular savings accounts reveals significant advantages. Although regular savings accounts can offer some interest benefits, they generally come with lower interest rates and taxable earnings. Junior ISAs, on the other hand, have a much higher annual contribution limit, allowing substantial investment opportunities.

Steps to open a Junior ISA

Before you begin the application process, it's crucial to understand the eligibility requirements for opening a Junior ISA. Generally, only parents or legal guardians can open a Junior ISA on behalf of a child. The child must be under the age of 18 and be a resident in the UK. Age restrictions apply, meaning that Junior ISAs can be opened until the child turns 18 but are available for them to control only upon reaching adulthood.

To start, you’ll need specific documents to verify your identity as the guardian and provide essential information about your child. Non-UK residents may face additional requirements. Ensure you have identification, such as a passport or driver’s license, and if applicable, your child's National Insurance number, which can accelerate the opening process.

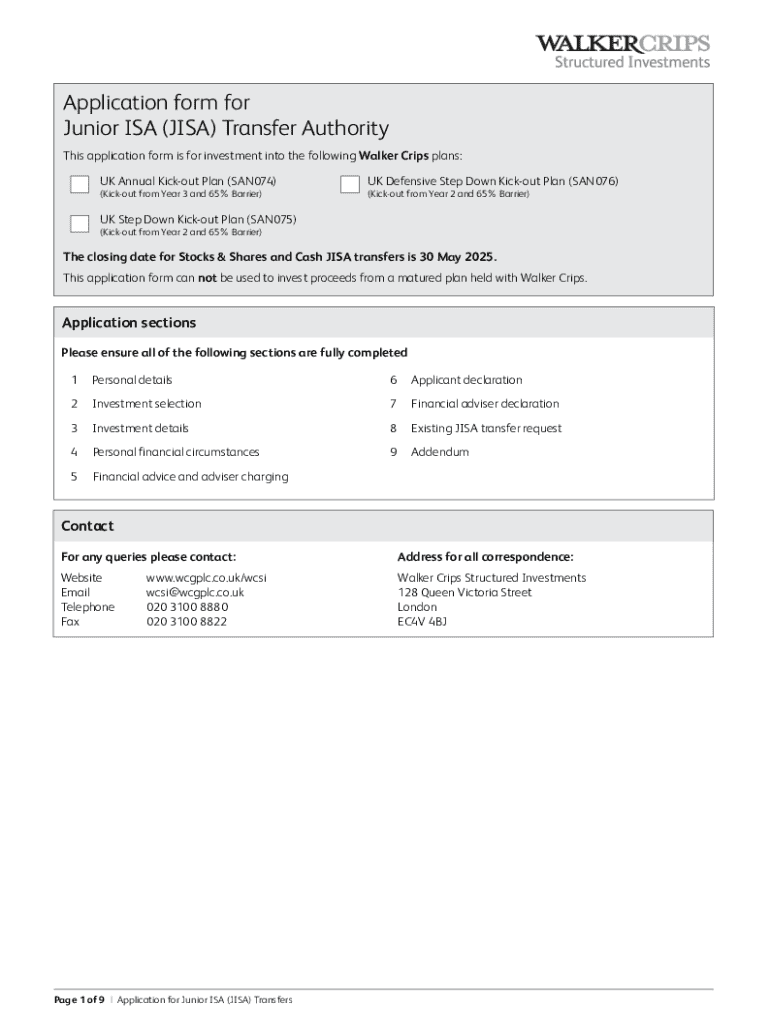

How to complete the Junior ISA application form

Completing the Junior ISA application form is a straightforward process. When filling out the form, start with the personal information section, where you'll provide details for both the child and the guardian. This includes names, addresses, and any identification numbers required to verify your identity.

Next, you will need to choose the type of Junior ISA account. You can opt for a cash Junior ISA, which operates like a typical savings account, or a stocks and shares Junior ISA, which offers investment opportunities that can potentially yield higher returns. It's essential to consider your investment strategy carefully at this stage.

You'll also have to declare your investment choices within the form. The annual contribution limit for Junior ISAs as of the current fiscal year stands at £9,000, which can be spread across cash and stocks and shares ISAs. Make sure your choices align with the permitted investment types specified by your chosen ISA provider.

Opening a Junior ISA by different methods

There are various ways to open a Junior ISA, giving you flexibility based on your personal preference. The online application process is now the most common method. Simply visit your chosen ISA provider’s website, fill out the digital form, and submit it. Remember to double-check all entries for accuracy to avoid processing delays.

If you prefer a more personal touch, you can initiate the application by phone. It’s best to gather all necessary information and documents ahead of time to streamline the call. You can ask your representative any questions you might have about the process or specific investment choices.

Alternatively, if you’re more comfortable with paper forms, you can apply by post. Request a Junior ISA application form from your provider, fill it out carefully, and ensure you understand the mailing instructions. Send your application to the designated address and check for confirmation once it’s received.

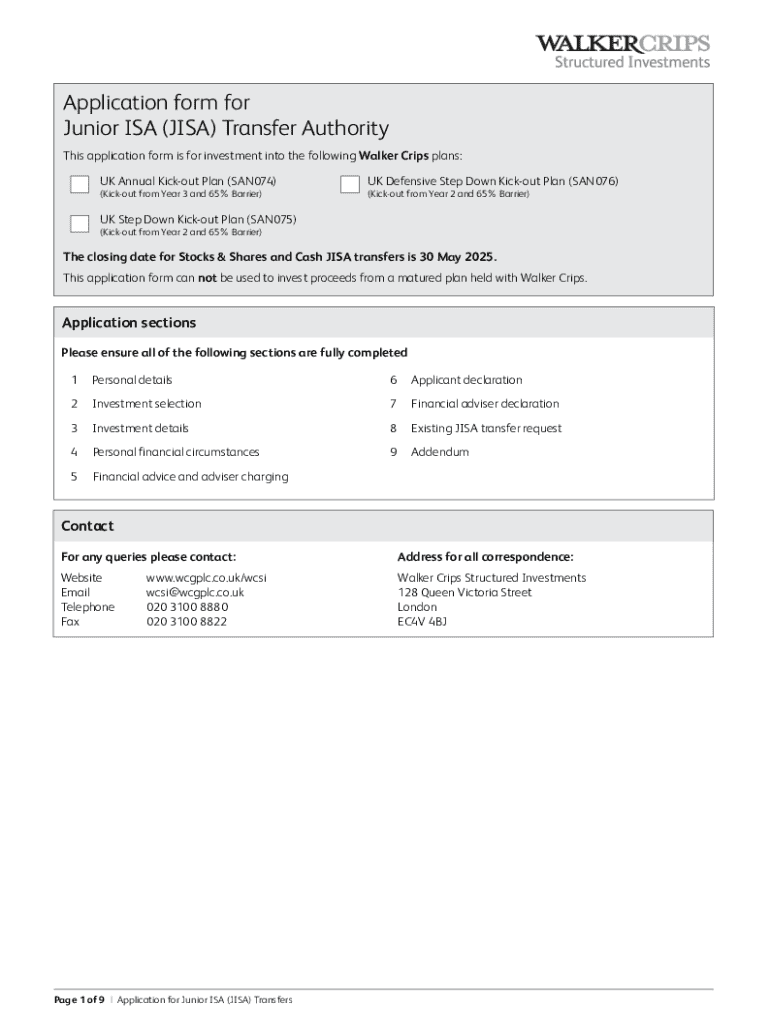

Transferring existing savings to a Junior ISA

If you have existing savings in a regular account, transferring them to a Junior ISA can be a wise decision. Consolidating your child’s savings into a single, tax-efficient ISA not only simplifies management but also optimizes potential growth through tax benefits.

To initiate the transfer process, start by contacting your current savings provider. They will guide you through the necessary paperwork and timelines. It’s important to check that the funds can be transferred without penalties, as some accounts may impose early withdrawal charges.

Investing within the Junior ISA

Understanding the available investment options within a Junior ISA is crucial for maximizing growth potential. Parents can typically choose between cash savings and stocks and shares. Cash ISAs offer security but with lower growth potential, while stocks and shares ISAs present opportunities for higher returns — albeit with increased risk.

When investing, consider strategies like Dollar Cost Averaging (DCA), which reduces the impact of volatility by investing fixed amounts regularly. Diversification of your investment portfolios is also fundamental; mix various asset classes to spread risk and increase the likelihood of positive returns over time.

Managing your Junior ISA account

Once the Junior ISA is established, ongoing management is vital for ensuring that the account performs well. Monitoring the account's performance regularly allows you to make informed decisions about whether to adjust contributions or change investment strategies.

Making additional contributions is straightforward as well; just keep the annual contribution limit in mind. Remember, funds deposited into a Junior ISA cannot be accessed until the child turns 18, so plan future withdrawals accordingly to ensure financial goals are met without unwarranted penalties.

Common FAQs about Junior ISAs

As you navigate Junior ISAs, several common questions may arise. For instance, parents often wonder if they can change the Junior ISA provider. Yes, families can transfer the ISA to a new provider and benefit from potentially better interest rates or investment options. Additionally, what happens when the child turns 18? The funds automatically become the child's account, and they gain full control of the assets.

Another common inquiry focuses on fund access – can parents control the funds until a certain age? The legal guardian manages the Junior ISA until the child reaches 18, ensuring that the funds are utilized for the child's benefit, like education or living expenses.

Benefits of using pdfFiller for Junior ISA forms

Using pdfFiller for managing Junior ISA forms streamlines the entire process of document management. The platform allows users to seamlessly edit and customize forms, making the application process far more manageable than traditional methods. You can add necessary information without the hassle of manual paperwork.

Additionally, pdfFiller offers eSigning options for quick approvals, ensuring that your forms are processed promptly. Its collaborative tools allow guardians and relevant advisors to engage effectively on the necessary documents, enabling everyone involved to keep track of particular investment declarations and authorisation without confusion.

Furthermore, being a cloud-based platform, pdfFiller enables access from anywhere. This is extremely beneficial for individuals and teams seeking efficient management solutions for Junior ISA forms. You can easily access information and documents via browser, offering peace of mind and confidence in handling such essential financial decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find junior isas for isa?

Can I create an electronic signature for signing my junior isas for isa in Gmail?

How do I complete junior isas for isa on an Android device?

What is junior isas for isa?

Who is required to file junior isas for isa?

How to fill out junior isas for isa?

What is the purpose of junior isas for isa?

What information must be reported on junior isas for isa?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.