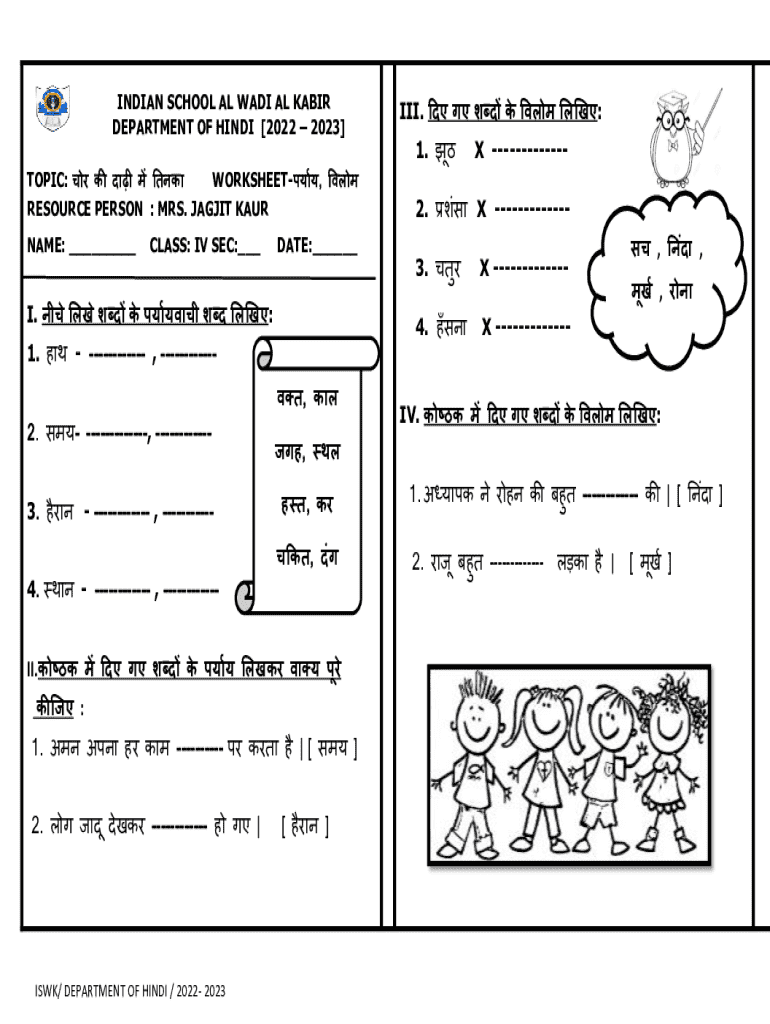

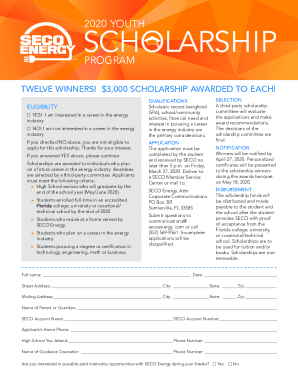

Get the free Worksheet - IV 2025-2026 Hindi

Get, Create, Make and Sign worksheet - iv 2025-2026

Editing worksheet - iv 2025-2026 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out worksheet - iv 2025-2026

How to fill out worksheet - iv 2025-2026

Who needs worksheet - iv 2025-2026?

Complete Guide to the Worksheet - 2 Form

Overview of the Worksheet - 2 Form

The Worksheet - IV 2 Form serves as a vital document in the financial aid process for students seeking assistance for higher education. This form helps institutions assess a student's financial situation and determines eligibility for various federal and state aid programs. Understanding the importance of the two academic years it covers is essential for accurate completion and timely submission.

This form is particularly important for students and families as it enables them to report their financial status honestly and transparently. It encompasses a range of financial variables, including income taxes and other relevant data, which help calculate the student's expected family contribution (EFC). This calculation is crucial in defining the level of aid a student may receive.

This form should be used by students at the undergraduate and graduate levels, along with their families. It is particularly relevant for those applying for need-based financial aid, including grants, scholarships, and work-study opportunities.

Detailed instructions for completing the Worksheet - Form

Filling out the Worksheet - IV 2 Form accurately is paramount to ensure your financial aid application progresses smoothly. Below is a detailed guide on how to complete the form effectively.

Step-by-Step Guide to Filling Out the Form

Section A: Personal Information

The first section requires personal information including the student’s full name, date of birth, and Social Security number. Make sure to double-check the spelling of names and accuracy of numbers as discrepancies can delay processing times.

Section B: Financial Information

The financial section is critical for assessing your family’s financial capacity. This section requires income details from your latest income tax returns. Common pitfalls include omitting specific forms of income or reporting outdated figures. Gather necessary documents like W-2 forms and 1099s to substantiate your claims.

Section : Dependency Status

Your dependency status will determine the type of information required. You will need to answer specific questions that will help clarify whether you are considered a dependent or independent student. Collect documentation like parental tax returns if you are deemed dependent, as this information will be reviewed closely.

Section : Certifications and Signatures

The final section emphasizes the importance of certifying that the information provided is accurate. Digital signatures can simplify this process, allowing for timely submissions. Utilizing eSignatures through pdfFiller not only expedites the process but also ensures security.

Interactive tools for enhanced document creation

pdfFiller provides a suite of editing tools that streamline the document preparation process. Users can easily modify text or add necessary fields to their PDF documents. This makes the Worksheet - IV 2 Form both user-friendly and adaptable to meet varying needs.

Collaboration is key when dealing with financial aid forms, especially for families. pdfFiller allows team input, where multiple users can access and edit the document in real-time, ensuring that all contributions are captured efficiently.

Features for signing and managing documents

The eSigning process within pdfFiller is intuitive and secure. Users can sign digitally, which maintains the document's integrity while reducing paper clutter. Additionally, pdfFiller tracks document status and maintains a history of changes, allowing for easy review.

Common challenges and solutions related to the Worksheet - Form

Filling out the Worksheet - IV 2 Form can present several challenges, especially regarding accuracy and completeness. Students may overlook key details, such as income sources or missing necessary signatures. Understanding common errors can greatly assist in successful submission.

Frequent errors and how to correct them

Common pitfalls include incorrect amounts on income reporting, failing to include parental information when applicable, and not certifying the document properly. To mitigate these issues, always cross-reference the details provided with your tax documents. Moreover, utilize checklists to ensure all fields are filled and signatures are acquired.

Resource checklist for document submission

An effective submission relies on adequate preparation. Gather the necessary documents and create a checklist to streamline your process. This checklist should include:

Understanding financial aid policies related to the Worksheet - Form

Familiarizing yourself with financial aid policies is imperative when completing the Worksheet - IV 2 Form. Verification processes can significantly affect financial aid eligibility, and understanding what to expect can alleviate concerns.

Overview of financial aid verification processes

During the financial aid verification process, the school may require additional documentation to confirm your reported income and circumstances. It’s crucial to respond to these requests promptly to avoid delays in your aid package. Discrepancies found during verification can alter your EFC and potentially impact the amount and type of aid awarded.

Financial assistance programs relevant to 2

Different financial assistance programs available for academic year 2 include both subsidized and unsubsidized loans. Understanding the key differences between these programs is essential for making informed decisions regarding financial aid.

Special circumstances and exceptional student need

In cases of special circumstances such as job loss or significant medical expenses, students may need to apply for professional judgment (PJ) reviews. This process allows schools to reassess financial situations beyond the provided documentation and extend additional support, ensuring that help is tailored to individual needs.

Document management strategies using pdfFiller

Managing multiple documents related to the Worksheet - IV 2 Form can be cumbersome, but pdfFiller offers best practices to simplify the process. Organizing documents in folders and applying tags effectively categorizes your files, ensuring quick access whenever you need them.

Security is another critical aspect of document management. Utilizing pdfFiller's encrypted storage features guarantees that sensitive information remains confidential. Understanding user permissions allows document owners to control access and editing rights, ensuring that only authorized personnel can alter critical financial documents.

Frequently asked questions (FAQs)

Providing clarity on common concerns related to the Worksheet - IV 2 Form helps demystify the process for students and families. Here, we address some frequently asked questions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the worksheet - iv 2025-2026 in Chrome?

Can I create an electronic signature for signing my worksheet - iv 2025-2026 in Gmail?

How do I fill out the worksheet - iv 2025-2026 form on my smartphone?

What is worksheet - iv 2025-2026?

Who is required to file worksheet - iv 2025-2026?

How to fill out worksheet - iv 2025-2026?

What is the purpose of worksheet - iv 2025-2026?

What information must be reported on worksheet - iv 2025-2026?

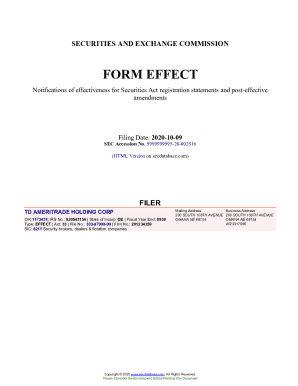

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.