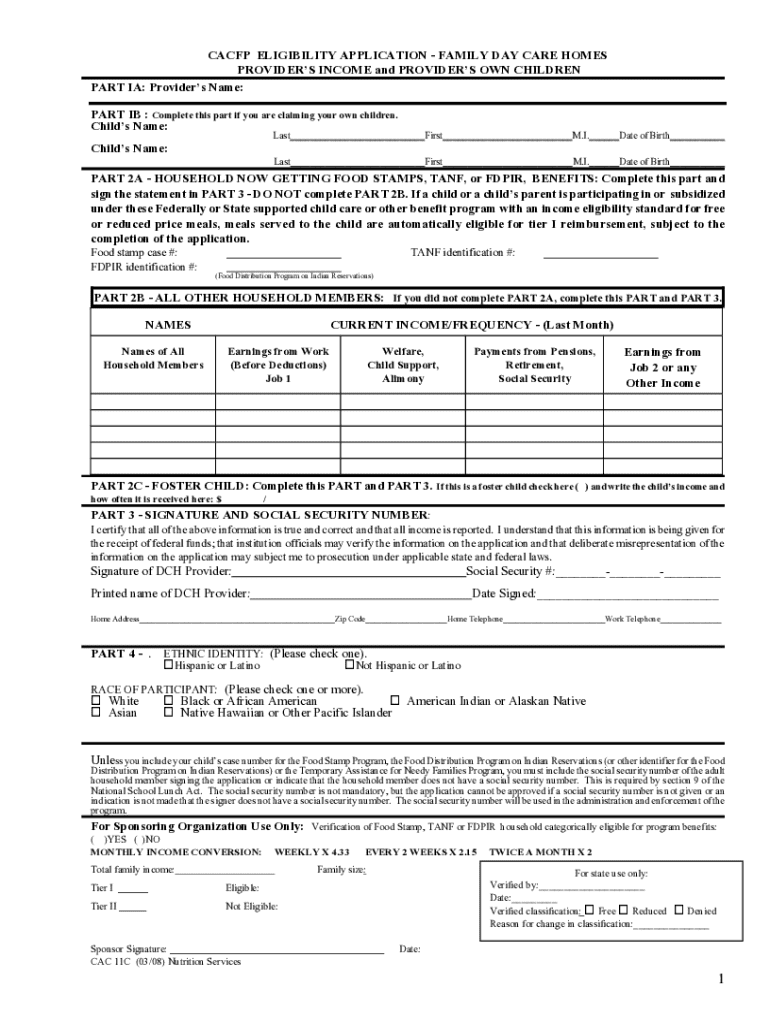

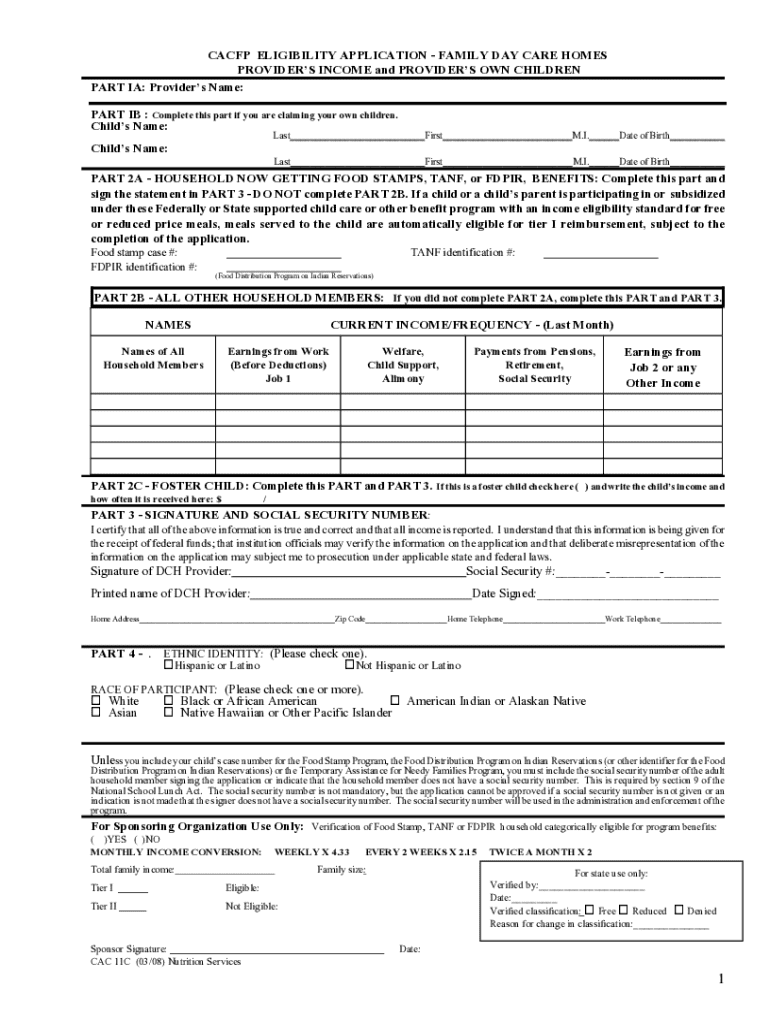

Get the free Instructions for the Income Eligibility Application for CACFP ...

Get, Create, Make and Sign instructions for form income

How to edit instructions for form income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form income

How to fill out instructions for form income

Who needs instructions for form income?

Instructions for Form Income Form

Understanding the income form

Income forms serve as essential documents for reporting earnings to tax authorities. This reporting is crucial for ensuring compliance with tax laws, allowing individuals and organizations to accurately declare their earnings and fulfill their tax obligations. Failing to correctly report income can lead to penalties and issues with the Internal Revenue Service (IRS) or respective tax agencies.

There are several types of income forms, with the most common being W-2 forms for employees and 1099 forms for freelancers and independent contractors. Each form is designed for specific scenarios; for example, the W-2 summarizes an employee's earnings and tax withholdings for a calendar year, while the 1099 reports income received from sources other than employment. Understanding the differences between these forms is vital for correct income reporting.

Preparing to fill out the income form

Before tackling your income form, it’s essential to gather all necessary documents. Essential paperwork typically includes pay stubs, bank statements, and previous tax returns. Keeping these documents organized simplifies the filling process. For instance, having all your income sources documented helps you accurately fill out the corresponding fields in your form.

Understanding key terminology is crucial when filling out income forms. Familiarize yourself with terms such as gross income, which refers to total earnings before any deductions, and taxable income, which is the income amount subject to tax after deductions. Knowing these definitions ensures you complete your forms accurately.

Step-by-step instructions for completing the income form

The first section of the income form typically requires personal information. Be sure to include your full name, current address, and social security number. Accuracy in this section is critical as any discrepancies can delay processing or lead to further inquiries from the IRS or tax agencies.

Next, you will need to report your income. Depending on the type of income you receive, different boxes will need to be filled out. Report all sources of income accurately; failure to declare any income can result in penalties. Common mistakes include misreporting amounts or omitting additional sources of income.

Deductions and adjustments can further affect your tax liability. Understanding available deductions, such as business expenses for freelancers, will help in accurately completing the form. Be sure also to report any tax credits you are eligible for, as these can significantly impact your final tax amount.

Before finalizing your income form, review it thoroughly for any errors. Common mistakes include incorrect social security numbers, miscalculated income amounts, and missed deductions. If corrections are needed, follow the guidelines provided with the form to amend your submission.

Digital tools for form completion

Utilizing digital tools, such as pdfFiller, can simplify the process of filling out and managing income forms. pdfFiller allows you to upload, edit, and fill PDF forms easily. The eSignature feature also enables you to sign your forms electronically, which can save time and streamline communications.

Cloud-based document management is another significant advantage of using pdfFiller. Accessing your forms remotely means you can manage your documents from any location without needing to download or print. Furthermore, collaborating with team members in real-time ensures accuracy and timely completion of your income reporting.

Submitting your income form

Once your form is completed and thoroughly reviewed, the next step is submission. There are generally two options for submitting income forms: e-filing and paper filing. E-filing is often faster and more secure but requires careful attention to ensure that all required information is entered correctly. In contrast, paper filing allows for more traditional processing but may take longer to be acknowledged.

Regardless of the method you choose, tracking your submission is crucial. Many e-filing services provide immediate confirmation while paper filings may require follow-up. If issues arise, such as delays or missing documents, be prepared to contact the relevant agency or a representative for assistance.

Best practices for managing your income form

Securing your information should be a priority when managing income forms. Utilize best practices for data privacy, such as password protection for digital documents and storing physical copies in secure locations. Maintaining meticulous records for future reference is also vital, as you may need to refer back to earlier forms when preparing subsequent tax returns.

Additionally, staying informed about tax changes is crucial. Tax laws can vary and change from year to year, impacting your income filing process. Utilize resources such as the IRS website or tax news bulletins to remain updated. Awareness of new regulations can help you adjust how you file and manage your tax-related documents.

Troubleshooting common issues

It's not uncommon to have questions or issues arise while completing income forms. Common inquiries often revolve around deadlines, acceptable forms of documentation, and the process of correcting submitted forms. Addressing these questions proactively can help avert potential problems.

Knowing when to seek professional help can also be crucial. If your situation involves multiple income sources, significant deductions, or if you simply feel overwhelmed, consulting a tax professional can provide clarity and guidance. The benefits of professional services can far outweigh costs, particularly if they help you maximize deductions and minimize liabilities.

User testimonials and success stories

Many users have found pdfFiller to be instrumental in their income form management processes, sharing experiences of relief and empowerment through streamlined document handling. Testimonials often highlight the ease of use, especially when it comes to eSigning and collaborating on forms with team members.

Real-life success stories showcase how pdfFiller’s tools helped individuals navigate the complexities of income reporting. Users report feeling more confident and organized, especially when deadlines approach, knowing they can edit and manage their income forms wherever they are.

Additional features of pdfFiller

Beyond essential editing and signing capabilities, pdfFiller offers advanced features that enhance overall form management. With capabilities to annotate, highlight, and even collaborate on forms in real time, users can create a more robust document workflow.

Moreover, pdfFiller integrates seamlessly with various accounting and business software, allowing for a unified interface for all document-related tasks. This integration helps users streamline their workflows even further, minimizing the need to switch between multiple applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send instructions for form income to be eSigned by others?

How can I fill out instructions for form income on an iOS device?

How do I fill out instructions for form income on an Android device?

What is instructions for form income?

Who is required to file instructions for form income?

How to fill out instructions for form income?

What is the purpose of instructions for form income?

What information must be reported on instructions for form income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.