Get the free Fayette County PVAProperty Valuation Admin Lexington, KY

Get, Create, Make and Sign fayette county pvaproperty valuation

How to edit fayette county pvaproperty valuation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fayette county pvaproperty valuation

How to fill out fayette county pvaproperty valuation

Who needs fayette county pvaproperty valuation?

A Comprehensive Guide to the Fayette County Property Valuation Form

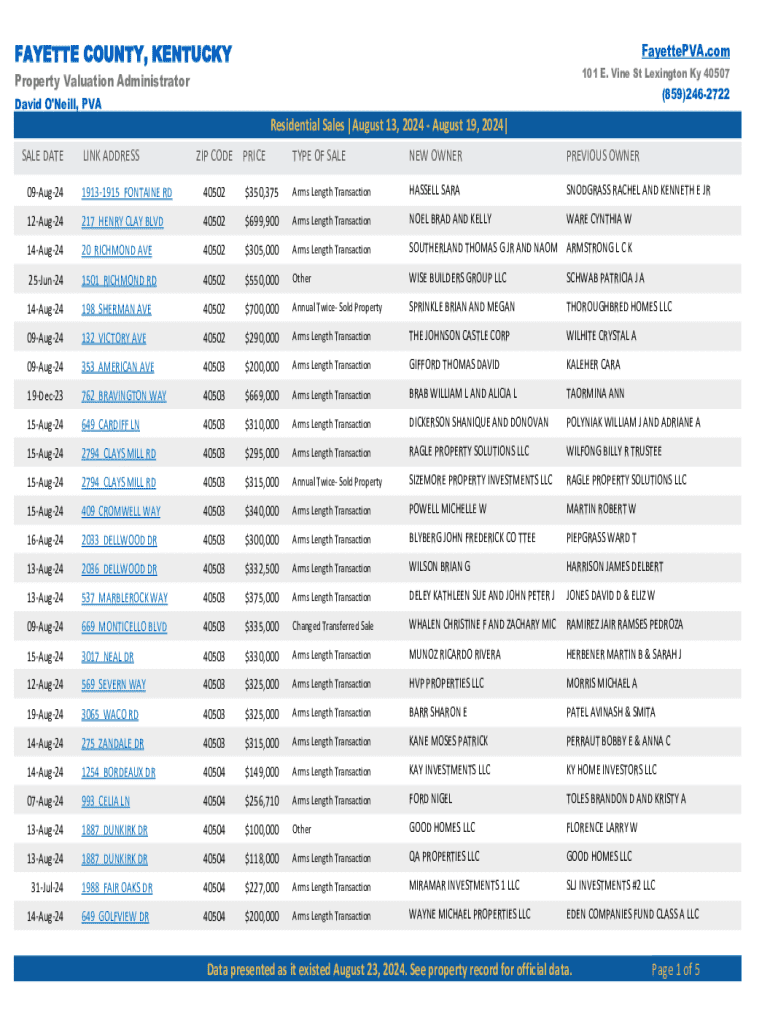

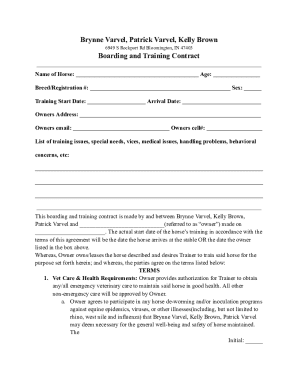

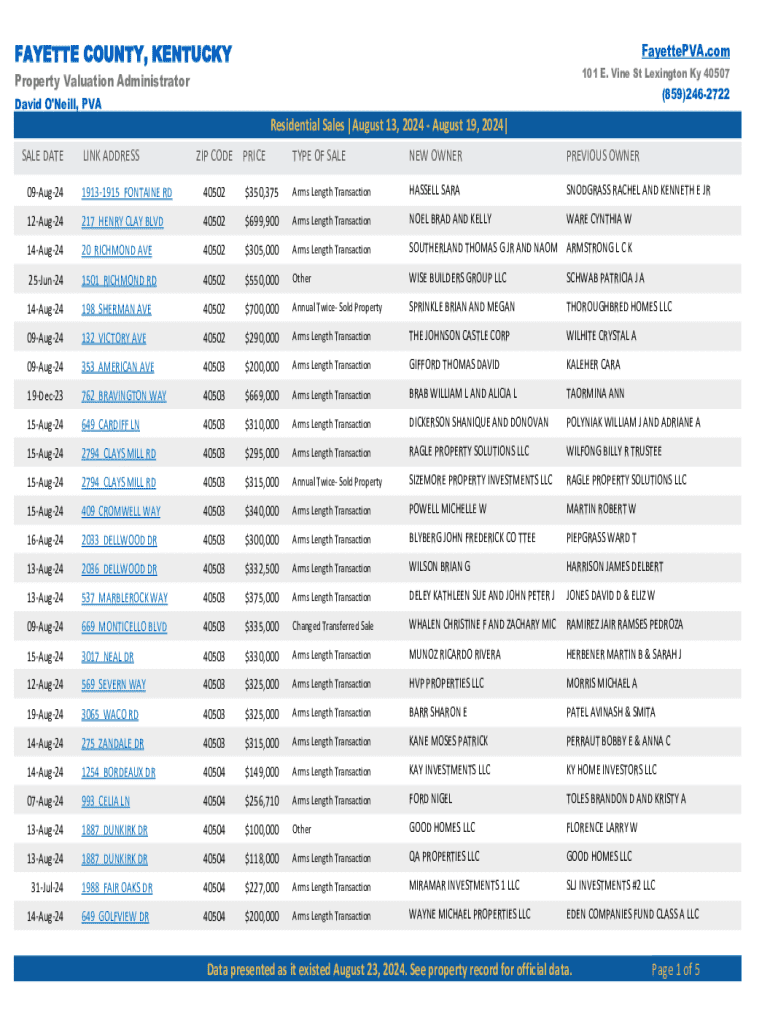

Overview of the Fayette County property valuation form

The Fayette County property valuation form plays a critical role in the local real estate landscape by serving as a foundational tool for assessing the value of properties throughout the county. This form is essential for determining property taxes and ensuring that property owners are accurately assessed according to the value of their assets. In essence, the property valuation form is designed to provide an official estimation that reflects the market conditions, property conditions, and specific characteristics of each property.

Accurate property valuations directly impact homeownership costs, funding for local services, and community development. When homeowners accurately fill out the Fayette County property valuation form, it not only ensures fair taxation but also contributes to the integrity of the entire property assessment system. Understanding this form is crucial for anyone looking to navigate property ownership in Fayette County effectively.

Key components of the Fayette County property valuation form

The Fayette County property valuation form consists of several key components that applicants must complete to ensure an accurate assessment. The primary fields include:

In addition to these essential fields, applicants are often required to submit additional documentation that supports their valuation claims. This might include comparative market analyses, recent appraisals, or other relevant financial data to substantiate their property’s worth.

Step-by-step instructions for filling out the form

Filling out the Fayette County property valuation form can be straightforward if you follow a structured approach. Here’s a detailed breakdown of the steps you should take:

Interactive tools for enhanced form management

Utilizing online platforms such as pdfFiller can significantly ease the process of managing your Fayette County property valuation form. pdfFiller provides interactive features that enhance usability, including:

Additionally, the benefits of cloud-based document storage mean that property owners can access their forms and related documents from anywhere, ensuring that managing important paperwork is always convenient.

Submission process for the Fayette County property valuation form

Once you have correctly filled out the Fayette County property valuation form, the next step is submission. Here’s how to properly submit your completed form:

Common concerns and FAQs

Navigating the property valuation process can raise questions. Here are some common concerns and how to address them:

Understanding the impact of property valuation

The implications of property valuation extend beyond mere numbers. An accurate assessment directly affects tax liabilities, impacting how much a property owner pays annually. Additionally, a well-valued property enhances the real estate market dynamics in Fayette County, influencing everything from buyer interest to community funding.

For instance, a properly valued home ensures that the local government has adequate funding for public services, including schools, emergency services, and infrastructure. Efficiency in the valuation process ultimately benefits the community as a whole, fostering sustainable growth and development.

Resources for property owners

In Fayette County, there exist various resources designed to assist property owners in understanding their property valuation and assessment processes. These include:

Best practices for managing property documents

Managing property documents effectively is crucial for any homeowner. To do this successfully, consider following these best practices:

By adopting these practices, property owners can minimize stress and ensure that they maintain accurate records essential for smooth property management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fayette county pvaproperty valuation for eSignature?

How do I execute fayette county pvaproperty valuation online?

How can I fill out fayette county pvaproperty valuation on an iOS device?

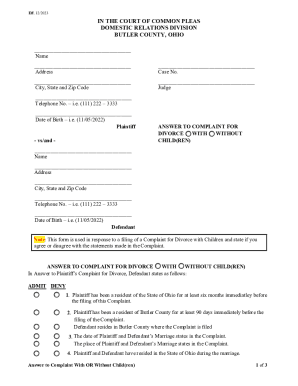

What is Fayette County PVAPROPERTY valuation?

Who is required to file Fayette County PVAPROPERTY valuation?

How to fill out Fayette County PVAPROPERTY valuation?

What is the purpose of Fayette County PVAPROPERTY valuation?

What information must be reported on Fayette County PVAPROPERTY valuation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.