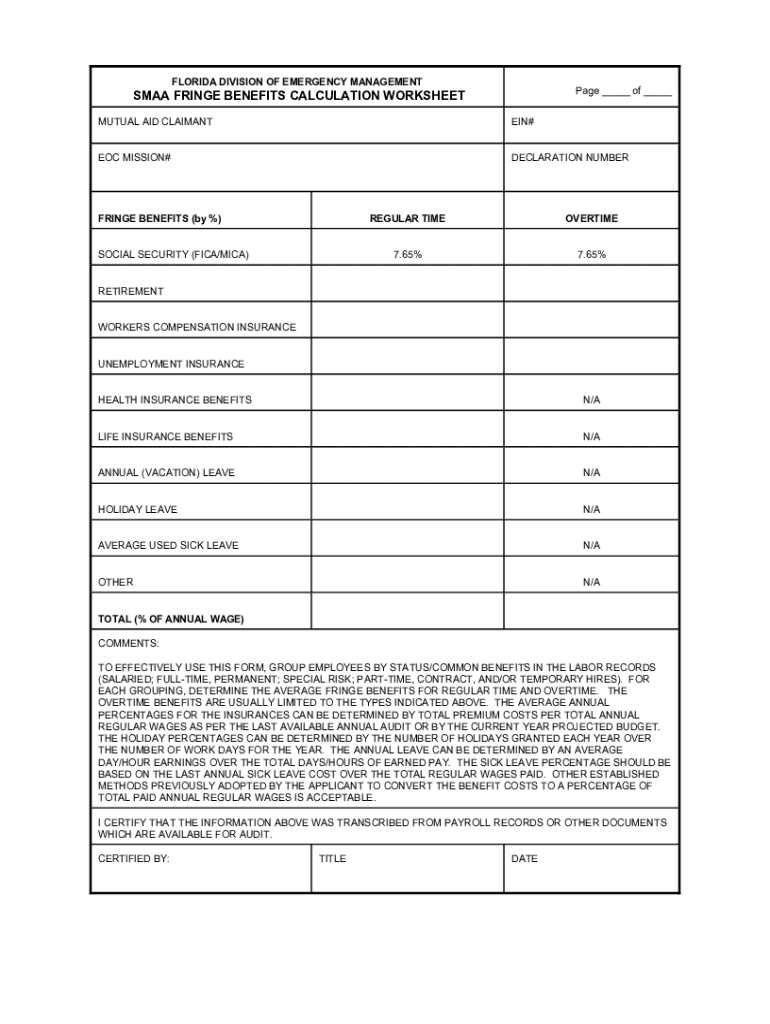

Get the free SMAA FRINGE BENEFITS CALCULATION WORKSHEET

Get, Create, Make and Sign smaa fringe benefits calculation

How to edit smaa fringe benefits calculation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out smaa fringe benefits calculation

How to fill out smaa fringe benefits calculation

Who needs smaa fringe benefits calculation?

SMAA Fringe Benefits Calculation Form: A Complete Guide

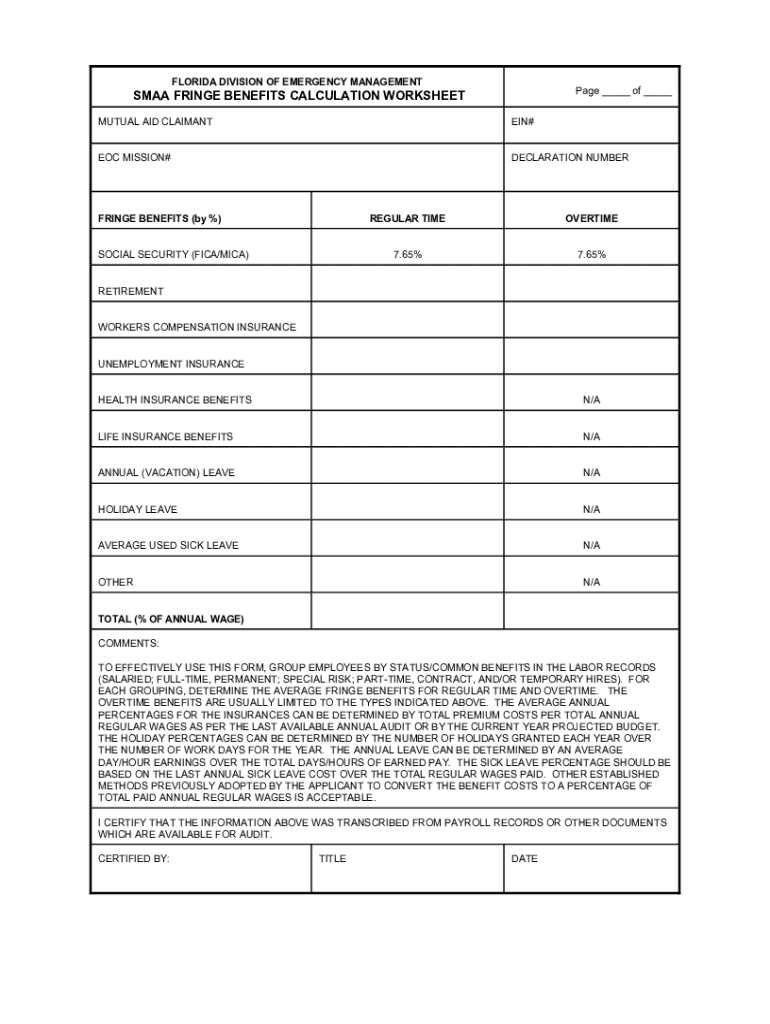

Understanding SMAA fringe benefits

SMAA fringe benefits refer to additional perks and incentives provided by employers beyond regular wages or salaries. These benefits can include health insurance, retirement plans, paid time off, and various employee assistance programs. Their significance lies in not only attracting potential employees but also in retaining existing staff and improving overall workplace morale. Different types of SMAA fringe benefits can cater to diverse employee needs, including financial support, wellness programs, and flexible working arrangements.

Calculating SMAA fringe benefits accurately is crucial for compliance with legal standards and ensuring fair treatment of employees. errors in this calculation could lead to legal repercussions, such as tax penalties or disputes. Moreover, correctly managed benefits contribute to employee satisfaction and retention, as they reflect the employer's commitment to supporting their workforce.

Overview of the SMAA fringe benefits calculation form

The SMAA fringe benefits calculation form serves as a vital tool for employers and HR professionals to estimate the total value of benefits provided to employees. This standardized form simplifies the process of collecting and processing benefit data, ensuring consistency and accuracy. It is designed for use by HR departments, payroll specialists, and financial officers who are responsible for managing employee compensation packages.

Key features of the pdfFiller platform enhance the management of these forms, allowing for easy editing, electronic signatures, and collaborative features that streamline the entire documentation process. With pdfFiller, users can create, fill out, and store forms securely from anywhere, making the management of SMAA fringe benefits straightforward and efficient.

Step-by-step guide to filling out the SMAA fringe benefits calculation form

Before filling out the SMAA fringe benefits calculation form, it is essential to gather all necessary information and documentation. This includes employee data such as names, job titles, and employment dates, as well as details on the types of benefits offered such as health insurance plans, educational reimbursements, and retirement contributions.

Detailed instructions for each section of the form include:

For precise calculations, consider utilizing examples from previous forms to guide entries.

Common mistakes to avoid in the calculation process

When filling out the SMAA fringe benefits calculation form, several common mistakes can lead to significant errors. These include inaccurate classification of employees, misreporting fringe benefit values, and overlooking eligible benefits. Such errors can create discrepancies that impact benefits reporting and employee satisfaction.

To mitigate these issues, strategies should include double-checking employee classifications, consulting with all benefits providers for accuracy, and maintaining clear records of all offers and agreements related to benefits. Regular training on compliance and accuracy in calculating fringe benefits can further reduce mistakes in the process.

Interactive tools available through pdfFiller

pdfFiller provides a suite of interactive tools to facilitate efficient calculations and data entry for the SMAA fringe benefits calculation form. Features like electronic signatures not only expedite approvals but also enhance the security and validity of the documents being managed. This streamlines workflows and reduces turnaround times.

Moreover, collaboration options enable teams to work together on a single document in real-time, making it easy for HR departments to gather input and adjustments from various stakeholders. This collaborative approach ensures that all voices are included and that the final calculations are comprehensive.

Managing SMAA fringe benefits documentation

Effective organization and storage of completed SMAA fringe benefits forms assist businesses in maintaining compliance and readiness for audits. Establishing a systematic filing system, whether digital or physical, helps manage documentation efficiently. Digital platforms like pdfFiller not only serve to store forms but also provide features for easy retrieval.

Best practices for document security and compliance include implementing access controls to sensitive documents and establishing regular review cycles to ensure that all forms are up-to-date. Keeping detailed records helps in mitigating legal risks and prepares you for audits, allowing for seamless checks on the benefits provided.

Advanced considerations in SMAA fringe benefits

Understanding the nuances of employee classification under SMAA regulations is key for accurate benefits administration. Special rules may apply to part-time and temporary employees that differ from those in full-time roles, impacting their benefits eligibility or calculations.

Additionally, stay updated on changes in benefits packages over time, as adjustments might be necessary to ensure compliance with evolving regulations. Regular training and updates for HR personnel on these advanced considerations will improve overall benefits management and ensure that the employer provides equitable and lawful benefits.

Navigating legal and compliance aspects

Federal regulations surrounding SMAA fringe benefits are complex, necessitating comprehensive awareness from compliance teams. This includes understanding the Internal Revenue Service (IRS) guidelines as well as any relevant state laws pertaining to employee benefits. Staying informed about these regulations is essential for minimizing legal risks.

Regular engagement with industry resources and legal updates ensures that businesses can quickly adapt to regulatory changes. These practices foster a company culture that prioritizes compliance and demonstrates to employees a commitment to ethical management of their benefits.

User success stories with pdfFiller’s SMAA calculation form

Many organizations have experienced enhanced efficiency and accuracy in their benefits management through the use of pdfFiller’s SMAA fringe benefits calculation form. Case studies illustrate how businesses reduced errors and streamlined their documentation processes significantly.

Testimonials highlight user satisfaction with the form’s straightforward design, noting that it has clarified the benefits calculation process and contributed to better employee relationships. These success stories underscore the practical advantages of utilizing pdfFiller's tools in real-world applications.

Utilizing pdfFiller for ongoing benefits management

pdfFiller offers various subscription options, ensuring continuous access to templates and forms necessary for managing SMAA fringe benefits effectively. The cloud-based nature of pdfFiller allows for real-time updates and access from any location, an essential feature for modern HR teams.

Furthermore, the platform fosters collaboration among teams, significantly enhancing the efficiency of benefits management processes. By establishing clear communication channels through pdfFiller, organizations can better coordinate benefits tasks and maintain updated documentation, reflecting the changing landscape of employee needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get smaa fringe benefits calculation?

Can I create an eSignature for the smaa fringe benefits calculation in Gmail?

How do I fill out the smaa fringe benefits calculation form on my smartphone?

What is smaa fringe benefits calculation?

Who is required to file smaa fringe benefits calculation?

How to fill out smaa fringe benefits calculation?

What is the purpose of smaa fringe benefits calculation?

What information must be reported on smaa fringe benefits calculation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.